UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

BASSETT FURNITURE INDUSTRIES, INCORPORATED

(Name of Issuer)

Common Stock, par value $5.00 per share

(Title of Class of Securities)

070203104

(CUSIP Number)

Bradley L. Hasselwander

Chief Executive Officer

Auto Services Company, Inc.

1793 HWY 201 N

Mountain Home, AR 72653

(870) 425-8330

Pierce G. Hunter

Kutak Rock LLP

124 West Capitol Avenue, Suite 2000

Little Rock, Arkansas 72201

(501) 975-3000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 11, 2024

(Date of Event which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

1

|

|

NAMES OF REPORTING PERSONS

Auto Services Company, Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

|

| |

WC

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

Arkansas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

7

|

|

SOLE VOTING POWER

|

| |

0

|

|

8

|

|

SHARED VOTING POWER

|

| |

627,572(1)

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

| |

0

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

| |

627,572(1)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

627,572(1)

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

7.11%(2)

|

|

14

|

|

TYPE OF REPORTING PERSON

|

| |

CO

|

(1) Includes beneficial ownership of 627,572 shares of Common Stock, par value $5.00 per share (“Common Stock”).

(2) The ownership percentage set forth herein is calculated assuming a total of 8,828,751 shares of Common Stock of Bassett Furniture Industries, Incorporated (the “Issuer”) are issued and outstanding, as set forth in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on April 3, 2024.

|

1

|

|

NAME OF REPORTING PERSONS

ASC Holding Company, Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

|

| |

Not applicable.

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

Arkansas

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

7

|

|

SOLE VOTING POWER

|

| |

0

|

|

8

|

|

SHARED VOTING POWER

|

| |

627,572(1)

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

| |

0

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

| |

627,572(1)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

627,572(1)

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

7.11%(2)

|

|

14

|

|

TYPE OF REPORTING PERSON

|

| |

CO

|

(1) Includes beneficial ownership of 627,572 shares of Common Stock.

(2) The ownership percentage set forth herein is calculated assuming a total of 8,828,751 shares of Common Stock of the Issuer are issued and outstanding, as set forth in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on April 3, 2024.

|

1

|

|

NAME OF REPORTING PERSONS

Bradley L. Hasselwander

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

|

| |

Not applicable.

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

7

|

|

SOLE VOTING POWER

|

| |

0

|

|

8

|

|

SHARED VOTING POWER

|

| |

627,572(1)

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

| |

0

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

| |

627,572(1)

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

627,572(1)

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

7.11%(2)

|

|

14

|

|

TYPE OF REPORTING PERSON

|

| |

IN

|

(1) Includes beneficial ownership of 627,572 shares of Common Stock.

(2) The ownership percentage set forth herein is calculated assuming a total of 8,828,751 shares of Common Stock of the Issuer are issued and outstanding, as set forth in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on April 3, 2024.

SCHEDULE 13D

This Amendment No. 1 to Schedule 13D (this “Amendment”) supplements and amends the Schedule 13D filed with the Securities and Exchange Commission on May 6, 2024 (the “Schedule 13D”) filed by Auto Services Company, Inc., an Arkansas corporation (“ASC”), ASC Holding Company, Inc. (“ASC Holding”), an Arkansas corporation, and Bradley L. Hasselwander (“Hasselwander”), an individual. Each of the foregoing is referred to herein as a “Reporting Person” and collectively as the “Reporting Persons.” This Amendment relates to the Common Stock, par value $5.00 per share (the “Common Stock”) of Bassett Furniture Industries, Incorporated, a Virginia corporation (the “Issuer”). The principal executive offices of the Issuer are located at 3525 Fairystone Park Highway, Bassett, Virginia 24055.

All capitalized terms used herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D. Except as amended and supplemented by this Amendment, the Schedule 13D is unmodified.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER.

(a) and (b) The information relating to the beneficial ownership of Common Stock by the Reporting Persons set forth in Rows 7 through 13 of each cover page hereto is incorporated by reference. ASC is the beneficial owner of 627,572 shares of Common Stock, constituting approximately 7.11% of outstanding Common Stock. Because it is the parent holding company of ASC, ASC Holding may be deemed to have the shared power to vote or direct the vote, and the shared power to dispose or direct the disposition, of all shares beneficially owned by ASC. Because he is the controlling stockholder of ASC Holdings, Bradley L. Hasselwander may be deemed to have the shared power to vote or direct the vote, and the shared power to dispose or direct the disposition, of all shares beneficially owned by ASC. The foregoing ownership percentage is calculated assuming a total of 8,828,751 shares of Common Stock of the Issuer are issued and outstanding, as set forth in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on April 3, 2024.

None of the Reporting Persons or, to the knowledge of the Reporting Persons, any of the other persons listed in Item 2(a)-(c) hereto beneficially owns any other securities of the Issuer.

(c) Transactions by the Reporting Persons in shares of Common Stock of the Issuer since the filing of the Schedule 13D are as follows, all of which were effected and held by ASC through open market purchases:

|

Date

Acquired

|

Amount of Shares

Purchased

|

Class of Securities

|

Per Share Price

|

|

2024-06-17

|

174

|

Common Stock

|

$13.44

|

|

2024-06-17

|

1,300

|

Common Stock

|

$13.45

|

|

2024-06-17

|

1,233

|

Common Stock

|

$13.55

|

|

2024-06-17

|

1

|

Common Stock

|

$13.97

|

|

2024-06-17

|

500

|

Common Stock

|

$13.94

|

|

2024-06-17

|

61

|

Common Stock

|

$13.94

|

|

2024-06-17

|

100

|

Common Stock

|

$13.94

|

|

2024-06-17

|

300

|

Common Stock

|

$13.94

|

|

2024-06-17

|

199

|

Common Stock

|

$13.96

|

|

2024-06-17

|

102

|

Common Stock

|

$13.68

|

|

2024-06-17

|

700

|

Common Stock

|

$13.83

|

|

2024-06-17

|

100

|

Common Stock

|

$13.69

|

|

2024-06-17

|

445

|

Common Stock

|

$13.92

|

|

2024-06-17

|

100

|

Common Stock

|

$13.72

|

|

2024-06-17

|

100

|

Common Stock

|

$13.95

|

|

2024-06-17

|

15

|

Common Stock

|

$13.95

|

|

2024-06-17

|

643

|

Common Stock

|

$13.70

|

|

2024-06-17

|

100

|

Common Stock

|

$13.71

|

|

2024-06-17

|

363

|

Common Stock

|

$13.92

|

|

2024-06-17

|

223

|

Common Stock

|

$13.97

|

|

2024-06-17

|

700

|

Common Stock

|

$13.84

|

|

2024-06-17

|

284

|

Common Stock

|

$13.67

|

|

2024-06-17

|

41

|

Common Stock

|

$13.83

|

|

2024-06-17

|

9

|

Common Stock

|

$13.80

|

|

2024-06-17

|

9

|

Common Stock

|

$13.77

|

|

2024-06-17

|

2

|

Common Stock

|

$13.70

|

|

2024-06-17

|

50

|

Common Stock

|

$13.72

|

|

2024-06-17

|

945

|

Common Stock

|

$13.81

|

|

2024-06-17

|

300

|

Common Stock

|

$13.75

|

|

2024-06-17

|

600

|

Common Stock

|

$13.70

|

|

2024-06-17

|

100

|

Common Stock

|

$13.66

|

|

2024-06-17

|

4

|

Common Stock

|

$13.66

|

|

2024-06-17

|

231

|

Common Stock

|

$13.68

|

|

2024-06-17

|

100

|

Common Stock

|

$13.69

|

|

2024-06-17

|

4,767

|

Common Stock

|

$13.72

|

|

2024-06-17

|

200

|

Common Stock

|

$13.65

|

|

2024-06-17

|

1,120

|

Common Stock

|

$13.66

|

|

2024-06-17

|

100

|

Common Stock

|

$13.51

|

|

2024-06-17

|

100

|

Common Stock

|

$13.58

|

|

2024-06-17

|

13

|

Common Stock

|

$13.67

|

|

2024-06-17

|

100

|

Common Stock

|

$13.65

|

|

2024-06-17

|

1,200

|

Common Stock

|

$13.67

|

|

2024-06-17

|

6,091

|

Common Stock

|

$13.72

|

|

2024-06-17

|

900

|

Common Stock

|

$13.72

|

|

2024-06-17

|

500

|

Common Stock

|

$13.71

|

|

2024-06-17

|

500

|

Common Stock

|

$13.72

|

|

2024-06-17

|

9

|

Common Stock

|

$13.69

|

|

2024-06-14

|

47,934

|

Common Stock

|

$13.99

|

|

2024-06-13

|

998

|

Common Stock

|

$13.99

|

|

2024-06-12

|

37

|

Common Stock

|

$13.99

|

|

2024-06-11

|

671

|

Common Stock

|

$13.99

|

|

2024-06-11

|

360

|

Common Stock

|

$13.99

|

|

2024-05-28

|

1,200

|

Common Stock

|

$14.14

|

|

2024-05-28

|

343

|

Common Stock

|

$14.48

|

|

2024-05-28

|

600

|

Common Stock

|

$14.12

|

|

2024-05-28

|

1,346

|

Common Stock

|

$14.15

|

|

2024-05-28

|

10,741

|

Common Stock

|

$14.22

|

|

2024-05-28

|

1,513

|

Common Stock

|

$14.49

|

|

2024-05-28

|

400

|

Common Stock

|

$14.21

|

|

2024-05-28

|

300

|

Common Stock

|

$14.05

|

|

2024-05-28

|

34

|

Common Stock

|

$14.18

|

|

2024-05-28

|

500

|

Common Stock

|

$14.06

|

|

2024-05-28

|

800

|

Common Stock

|

$14.14

|

|

2024-05-28

|

23,600

|

Common Stock

|

$14.16

|

|

2024-05-28

|

198

|

Common Stock

|

$14.47

|

|

2024-05-28

|

100

|

Common Stock

|

$14.30

|

|

2024-05-28

|

100

|

Common Stock

|

$14.12

|

|

2024-05-28

|

100

|

Common Stock

|

$14.07

|

|

2024-05-28

|

68

|

Common Stock

|

$14.16

|

|

2024-05-28

|

81

|

Common Stock

|

$14.15

|

|

2024-05-28

|

100

|

Common Stock

|

$14.15

|

|

2024-05-28

|

100

|

Common Stock

|

$14.20

|

|

2024-05-28

|

100

|

Common Stock

|

$14.21

|

|

2024-05-28

|

334

|

Common Stock

|

$14.15

|

|

2024-05-24

|

224

|

Common Stock

|

$14.15

|

|

2024-05-24

|

1,905

|

Common Stock

|

$14.15

|

|

2024-05-23

|

300

|

Common Stock

|

$14.08

|

|

2024-05-23

|

129

|

Common Stock

|

$14.07

|

|

2024-05-23

|

1,005

|

Common Stock

|

$14.09

|

|

2024-05-23

|

100

|

Common Stock

|

$14.15

|

|

2024-05-23

|

1,564

|

Common Stock

|

$14.14

|

|

2024-05-23

|

201

|

Common Stock

|

$14.10

|

|

2024-05-23

|

409

|

Common Stock

|

$14.01

|

|

2024-05-23

|

100

|

Common Stock

|

$14.14

|

|

2024-05-23

|

1

|

Common Stock

|

$14.11

|

|

2024-05-23

|

100

|

Common Stock

|

$14.07

|

|

2024-05-22

|

356

|

Common Stock

|

$14.01

|

|

2024-05-22

|

19

|

Common Stock

|

$14.07

|

|

2024-05-21

|

328

|

Common Stock

|

$14.07

|

|

2024-05-21

|

990

|

Common Stock

|

$14.11

|

|

2024-05-21

|

266

|

Common Stock

|

$14.10

|

|

2024-05-21

|

160

|

Common Stock

|

$14.11

|

|

2024-05-21

|

10,497

|

Common Stock

|

$14.10

|

|

2024-05-21

|

34

|

Common Stock

|

$14.06

|

|

2024-05-21

|

100

|

Common Stock

|

$14.09

|

|

2024-05-20

|

398

|

Common Stock

|

$14.07

|

|

2024-05-20

|

1,146

|

Common Stock

|

$14.07

|

|

2024-05-20

|

9,525

|

Common Stock

|

$14.12

|

|

2024-05-16

|

14,503

|

Common Stock

|

$14.00

|

|

2024-05-14

|

271

|

Common Stock

|

$14.00

|

|

2024-05-08

|

80

|

Common Stock

|

$14.06

|

(d) No other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds of sale of, any of the Common Stock beneficially owned by the Reporting Persons.

(e) Not applicable.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS.

This filing includes the following exhibit:

Exhibit 1: Joint Filing Agreement.

SIGNATURE

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: June 18, 2024

| |

AUTO SERVICES COMPANY, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Bradley L. Hasselwander

|

|

| |

Name:

|

Bradley L. Hasselwander

|

|

| |

Title:

|

President and CEO

|

|

| |

ASC HOLDING COMPANY, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Bradley L. Hasselwander

|

|

| |

Name:

|

Bradley L. Hasselwander

|

|

| |

Title:

|

President and CEO

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

/s/ Bradley L. Hasselwander

|

|

| |

Bradley L. Hasselwander

|

|

Exhibit 1

AGREEMENT AS TO JOINT FILING

In accordance with Rule 13d-1(k) under the Securities and Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing on behalf of each of them of a statement on Schedule 13D, and any amendments thereto, with respect to the Common Stock, par value $5.00 per share of Bassett Furniture Industries, Incorporated, and that this agreement be included as an exhibit to such filing and any amendment thereof.

This agreement may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which together shall be deemed to constitute one and the same agreement.

IN WITNESS WHEREOF, each of the undersigned hereby executes this agreement as of June 18, 2024.

| |

AUTO SERVICES COMPANY, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Bradley L. Hasselwander

|

|

| |

Name:

|

Bradley L. Hasselwander

|

|

| |

Title:

|

President and CEO

|

|

| |

|

|

|

| |

|

|

|

| |

ASC HOLDING COMPANY, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Bradley L. Hasselwander

|

|

| |

Name:

|

Bradley L. Hasselwander

|

|

| |

Title:

|

President and CEO

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

/s/ Bradley L. Hasselwander

|

|

| |

Bradley L. Hasselwander

|

|

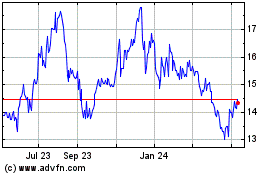

Bassett Furniture Indust... (NASDAQ:BSET)

Historical Stock Chart

From May 2024 to Jun 2024

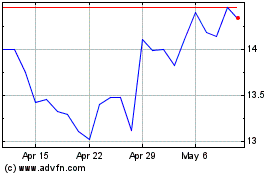

Bassett Furniture Indust... (NASDAQ:BSET)

Historical Stock Chart

From Jun 2023 to Jun 2024