0001633070

false

0001633070

2023-09-14

2023-09-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 14, 2023

AXCELLA

HEALTH INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38901 |

|

26-3321056 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

P.O. Box 1270

Littleton,

Massachusetts |

01460 |

| (Address

of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: (857) 320-2200

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock, $0.001 Par Value |

|

AXLA |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Attached to this report on Form 8-K as Exhibit 99.1

is a copy of the press release dated September 14, 2023 titled “Axcella Announces Reverse Stock Split” whereby Axcella

Health Inc. (the “Company”) announced that its Board of Directors has approved a 1-for-25 reverse stock split (the “Reverse

Stock Split”) of the Company’s common stock. The Reverse Stock Split will become effective at 5:00 p.m. Eastern Time

on September 18, 2023, after close of trading on The Nasdaq Global Market. The Company’s common stock is expected to commence

trading on a split-adjusted basis when the markets open on September 19, 2023 under the existing trading symbol “AXLA.”

Forward Looking Statements

This Current Report on

Form 8-K contains forward-looking statements, including within the meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered

forward-looking statements, including, without limitation, statements regarding the Reverse Stock Split and related timing. These forward-looking

statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but

not limited to, the important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, Quarterly Report on Form 10-Q for the three months ended June 30, 2023, and our

other reports filed with the U.S. Securities and Exchange Commission. Any such forward-looking statements represent management’s

estimates as of the date of this Current Report on Form 8-K. While we may elect to update such forward-looking statements at some

point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change.

These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this Current

Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

Axcella Health Inc. |

| |

|

|

| Date: September 14, 2023 |

By: |

/s/ William R. Hinshaw, Jr. |

| |

Name: |

/s/ William R. Hinshaw, Jr. |

| |

Title: |

President, Chief Executive Officer and Director |

Exhibit 99.1

Axcella Announces Reverse Stock Split Effective September 19,

2023

– AXLA common stock expected to begin trading

on a split-adjusted basis on September 19, 2023 –

CAMBRIDGE, Mass.--(BUSINESS WIRE)--Sep. 14, 2023-- Axcella Therapeutics

(Nasdaq: AXLA), a clinical-stage biotechnology company focused on pioneering a new approach to address the biology of complex diseases

using compositions of endogenous metabolic modulators (EMMs), today announced that its Board of Directors has approved a 1-for-25

reverse stock split of the Company’s common stock. The reverse stock split will become effective at 5:00 p.m. Eastern Time

on September 18, 2023, after close of trading on The Nasdaq Global Market. The Company’s common stock is expected to commence

trading on a split-adjusted basis when the markets open on September 19, 2023 under the existing trading symbol “AXLA.”

The new CUSIP number for the Company’s common stock following the reverse stock split will be 05454B204.

The primary goal of the reverse stock split is to increase the per

share market price of the Company’s common stock to meet the minimum per share bid price requirement for continued listing on The

Nasdaq Global Market. The reverse stock split was approved by the Company’s stockholders at its annual meeting of stockholders held

on September 11, 2023. On September 11, 2023, following the annual meeting, the Company’s Board of Directors approved

the reverse stock split at the ratio of 1-for-25. As a result of the reverse stock split, every twenty-five shares of the Company’s

common stock issued and outstanding will be automatically reclassified into one new share of the Company’s common stock. Proportionate

adjustments will be made to the exercise prices and the number of shares underlying the Company’s outstanding equity awards, as

applicable. The common stock issued pursuant to the reverse stock split will remain fully paid and non-assessable. The reverse stock split

will not affect the number of authorized shares of common stock or the par value of the common stock. No fractional shares will be issued

in connection with the reverse stock split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the

reverse stock split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would

otherwise be entitled multiplied by the closing sales price per share of the common stock (as adjusted to give effect to the reverse stock

split) on The Nasdaq Global Market on September 18, 2023, the last trading day immediately preceding the effective time of the reverse

stock split.

Computershare Trust Company, N.A. (“Computershare”), the

Company’s transfer agent, is acting as the exchange agent for the reverse stock split. Stockholders with book-entry shares or who

hold their shares through a bank, broker or other nominee will not need to take any action. Additional information about the reverse stock

split can be found in the Company’s definitive proxy statement (the “Proxy Statement”) filed with the Securities and

Exchange Commission (the “SEC”) on August 18, 2023, which is available free of charge at the SEC’s website, www.sec.gov,

and on the Company’s website at https://axcellatx.com/.

Internet Posting of Information

Axcella uses the “Investors and News” section of its website, www.axcellatx.com,

as a means of disclosing material nonpublic information, to communicate with investors and the public, and for complying with its disclosure

obligations under Regulation FD. Such disclosures include, but may not be limited to, investor presentations and FAQs, Securities

and Exchange Commission filings, press releases, and public conference calls and webcasts. The information that we post on our website

could be deemed to be material information. As a result, we encourage investors, the media and others interested to review the information

that we post there on a regular basis. The contents of our website shall not be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended.

About Axcella Therapeutics (Nasdaq: AXLA)

Axcella is a clinical-stage biotechnology company focused on pioneering

a new approach to address the biology of complex diseases using compositions of endogenous metabolic modulators (EMMs). The company’s

unique model allows for the evaluation of its EMM compositions through non-IND clinical studies or IND clinical trials. For more information,

please visit www.axcellatx.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, statements concerning the expected

timing of the reverse stock split, the impact of the reverse stock split on the Company’s share price, and the Company’s ability

to meet the minimum per share bid price requirement for continued listing on The Nasdaq Global Market.

These forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the potential volatility

of our common stock; and the potential delisting of our common stock from The Nasdaq Global Market. These and other important factors

discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022,

our Quarterly Report on Form 10-Q for the three months ended June 30, 2023, and our other reports filed with the U.S. Securities

and Exchange Commission, could cause actual results to differ materially from those indicated by the forward-looking statements made in

this press release. Any such forward-looking statements represent management's estimates as of the date of this press release. While we

may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation

to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing

our views as of any date subsequent to the date of this press release.

Company Contact

ir@axcellatx.com

(857) 320-2200

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

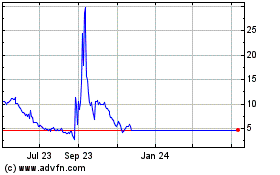

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Dec 2023 to Dec 2024