Avenue Therapeutics Enters into Warrant Exercise Transactions for $5.0 Million in Proceeds

January 05 2024 - 9:15AM

Avenue Therapeutics, Inc. (Nasdaq: ATXI) (“Avenue” or the

“Company”), a specialty pharmaceutical company focused on the

development and commercialization of therapies for the treatment of

neurologic diseases, today announced the entry into warrant

exercise agreements with existing accredited investors for the

immediate exercise of certain outstanding warrants to purchase an

aggregate of 16.5 million shares of the Company’s common stock.

These warrants for immediate exercise include: (i) November 2023

Series B warrants to purchase an aggregate of 14.6 million shares

of common stock issued by Avenue on November 2, 2023, each having

an exercise price of $0.3006 per share, and (ii) January 2023

warrants to purchase an aggregate of 1.9 million shares of common

stock issued by Avenue on January 31, 2023, each having an exercise

price of $1.55 per share, at a reduced exercise price of $0.3006

per share as agreed upon by the Company. The gross proceeds to

Avenue from the exercise of the warrants are expected to be

approximately $5.0 million, prior to deducting placement agent fees

and estimated offering expenses. The closing of the warrant

exercise transactions is expected to occur on or about January 9,

2024, subject to satisfaction of customary closing conditions.

Maxim Group LLC is acting as the exclusive

financial advisor and warrant solicitation agent for the

transaction.

In consideration for the immediate exercise of

the existing warrants for cash, the Company will issue new

unregistered Series A warrants to purchase up to 16.5 million

shares of common stock and new unregistered Series B warrants to

purchase up to 16.5 million shares of common stock. The new Series

A and Series B warrants will both have an exercise price of $0.3006

per underlying share. The new Series A warrants and Series B

warrants will not be exercisable until the Company receives

stockholder approval to increase its authorized shares of common

stock and to comply with certain Nasdaq rules. Upon receipt of

stockholder approval, the new Series A warrants will be exercisable

for a period of five years thereafter and the Series B warrants

will be exercisable for a period of eighteen months thereafter.

Subject to the aforementioned stockholder approval, Avenue has

agreed to file a registration statement with the Securities and

Exchange Commission (“SEC”) covering the resale of the shares of

common stock issuable upon exercise of the new warrants. This press

release shall not constitute an offer to sell or a solicitation of

an offer to buy any of the securities described herein, nor shall

there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Avenue Therapeutics

Avenue Therapeutics, Inc. (Nasdaq: ATXI) is a

specialty pharmaceutical Company focused on the development and

commercialization of therapies for the treatment of neurologic

diseases. It is currently developing three assets including AJ201,

a first-in-class asset for spinal and bulbar muscular atrophy,

BAER-101, an oral small molecule selective GABAA α2/3 receptor

positive allosteric modulator for CNS diseases, and IV tramadol,

which is in Phase 3 clinical development for the management of

acute postoperative pain in adults in a medically supervised

healthcare setting. Avenue is headquartered in Miami, FL and was

founded by Fortress Biotech, Inc. (Nasdaq: FBIO). For more

information, visit www.avenuetx.com.

Forward-Looking Statements

This press release contains predictive or

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of current or historical fact contained in this press

release, including statements that express our intentions, plans,

objectives, beliefs, expectations, strategies, predictions or any

other statements relating to our future activities or other future

events or conditions are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “will,” “should,”

“would” and similar expressions are intended to identify

forward-looking statements. These statements are based on current

expectations, estimates and projections made by management about

our business, our industry and other conditions affecting our

financial condition, results of operations or business prospects.

These statements are not guarantees of future performance and

involve risks, uncertainties and assumptions that are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in, or implied by,

the forward-looking statements due to numerous risks and

uncertainties. Factors that could cause such outcomes and results

to differ include, but are not limited to, risks and uncertainties

arising from: the ability to satisfy the closing conditions related

to the transaction and the overall timing and completion of such

closing; expectations for increases or decreases in expenses;

expectations for the clinical and pre-clinical development,

manufacturing, regulatory approval, and commercialization of our

pharmaceutical product candidate or any other products we may

acquire or in-license; our use of clinical research centers and

other contractors; expectations for incurring capital expenditures

to expand our research and development and manufacturing

capabilities; expectations for generating revenue or becoming

profitable on a sustained basis; expectations or ability to enter

into marketing and other partnership agreements; expectations or

ability to enter into product acquisition and in-licensing

transactions; expectations or ability to build our own commercial

infrastructure to manufacture, market and sell our product

candidates; acceptance of our products by doctors, patients or

payors; our ability to compete against other companies and research

institutions; our ability to secure adequate protection for our

intellectual property; our ability to attract and retain key

personnel; availability of reimbursement for our products;

estimates of the sufficiency of our existing cash and cash

equivalents and investments to finance our operating requirements,

including expectations regarding the value and liquidity of our

investments; the volatility of our stock price; expected losses;

expectations for future capital requirements; and those risks

discussed in our filings which we make with the SEC. Any

forward-looking statements speak only as of the date on which they

are made, and we undertake no obligation to publicly update or

revise any forward-looking statements to reflect events or

circumstances that may arise after the date of this press release,

except as required by applicable law. Investors should evaluate any

statements made by us in light of these important factors.

Contact:

Jaclyn JaffeAvenue Therapeutics, Inc.(781)

652-4500ir@avenuetx.com

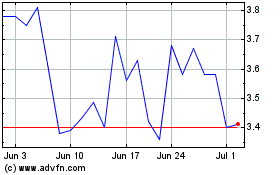

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Jan 2024 to Jan 2025