Filed pursuant to General Instruction II.L of Form

F-10;

File No. 333-254096

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED MARCH 29, 2021

|

|

|

| New Issue |

|

November 25, 2022 |

AURORA CANNABIS INC.

6,600,000 Common Shares

This Prospectus

Supplement relates to: (i) up to 6,600,000 common shares (the “Warrant Shares”) of Aurora Cannabis Inc. (“we”, “our”, “Aurora” or the “Company”), issuable from

time to time upon the exercise of 6,600,000 common share purchase warrants (the “Warrants”) issued by the Company pursuant to the Unit Offering (defined below); and (ii) such indeterminate number of additional Warrant Shares

that may be issuable by reason of the anti-dilution provisions contained in the Warrant Indenture (as defined herein) (the “Offering”). See “Plan of Distribution”.

The Company previously filed a prospectus supplement (the “Original Warrant Share Prospectus Supplement”) dated January 25, 2021 to its

base shelf prospectus dated October 28, 2020 (the “Original Base Prospectus”) with the securities commission or similar regulatory authority in each of the provinces of Canada, except Québec, and, in connection

therewith, filed a prospectus supplement dated January 25, 2021 to its registration statement on Form F-10 with the United States Securities and Exchange Commission (the “SEC”) relating

to the Warrant Shares.

In accordance with Canadian shelf prospectus rules under National Instrument 44-102 Shelf

Distributions (“NI 44-102”), the Original Base Prospectus will cease to be effective as of November 28, 2022. This Prospectus Supplement replaces the Original Warrant Share Prospectus

Supplement in order to maintain the registration of the offering of the Warrant Shares under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), beyond the expiry date of the Original Base Prospectus.

The Warrants were qualified for distribution by a prospectus supplement dated January 22, 2021 to the Original Base Prospectus filed with the

securities commission or similar regulatory authority in each of the provinces of Canada, except Québec, and, in connection therewith, a prospectus supplement dated January 22, 2021 to its registration statement on Form F-10 with the SEC relating to the offering (the “Unit Offering”) by the Company to the public in Canada and the United States of units (“Units”), each Unit consisting of one common

share of the Company (a “Common Share”) and one-half of one Warrant.

Each Warrant entitles the

holder thereof to purchase one Warrant Share at an exercise price of U.S.$12.60 per Warrant Share at any time until 5:00 p.m. (Toronto time) on January 26, 2024 (the “Expiry Date”), being the date that is 36 months from the

closing of the Unit Offering, subject to adjustment in accordance with the terms of the Warrant Indenture. The exercise price of the Warrants was determined by negotiation between the Company and a syndicate of underwriters for the Unit Offering

(the “Underwriters”).

S-i

The Common Shares are listed on the Toronto Stock Exchange (the “TSX”) and on the Nasdaq

Global Select Market (the “Nasdaq”) under the symbol “ACB” and on the Frankfurt Stock Exchange (the “FSE”) under the symbol “21P”. The TSX has approved the listing of the Warrant

Shares issuable on exercise of the Warrants on the TSX.

This Prospectus Supplement is filed pursuant to (i) the Base Prospectus filed in all of the

provinces of Canada except Québec, and (ii) a base shelf prospectus filed as part of a registration statement on Form F-10 under the U.S. Securities Act, which became effective on March 30,

2021 upon filing with the SEC (the “Registration Statement”).

This Prospectus Supplement should be read in conjunction with, and may not

be delivered or utilized without, the Base Prospectus.

No Underwriter has been involved in the preparation of, or has performed any review of, this

Prospectus Supplement or the accompanying Base Prospectus.

An investment in the Warrant Shares involves significant risks. You should carefully read

the “Risk Factors” section of this Prospectus Supplement beginning on page S-15, the “Risk Factors” section in the Base Prospectus

beginning on page 35 and in the documents incorporated by reference herein and therein.

You should rely only on the information contained in or

incorporated by reference into this Prospectus Supplement. The Company has not authorized anyone to provide you with different information. The Company is not making an offer of these securities in any jurisdiction where the offer is not permitted.

You should not assume that the information contained in or incorporated by reference in this Prospectus Supplement is accurate as of any date other than the date on the front of this Prospectus Supplement or the date of such documents incorporated

by reference herein, as applicable.

This Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system

(the “MJDS”) adopted by the United States and Canada, to prepare this Prospectus Supplement in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the

United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board

(“IASB”) and may not be comparable to financial statements of United States companies. Our financial statements are audited in accordance with the standards of the Public Company Accounting Oversight Board (United States).

Prospective investors should be aware that the exercise of the Warrants and acquisition of the Warrant Shares described herein may have tax consequences

both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein. You should read the tax discussion in this Prospectus Supplement and the accompanying

Base Prospectus fully and consult with your own tax advisers. See “Certain Canadian Federal Income Tax Considerations”, “Material U.S. Federal Income Tax Considerations” and “Risk Factors”.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that we are

incorporated under the laws of British Columbia, Canada, that the majority of our officers and directors are not residents of the United States, that the majority of the experts named in the Registration Statement are not residents of the United

States and that a substantial portion of the assets of these persons are located outside the United States.

THESE SECURITIES HAVE NOT BEEN

APPROVED OR DISAPPROVED BY THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION NOR HAS ANY SUCH SECURITIES REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

S-ii

All references in this Prospectus Supplement and the Base Prospectus to “dollars” or

“C$” are to Canadian dollars and all references to “U.S.$” are to United States dollars.

Miguel Martin, the Chief Executive

Officer and a director of the Company, and Margaret Shan Atkins and Lance Friedmann, directors of the Company, reside outside of Canada. Each of Miguel Martin, Margaret Shan Atkins and Lance Friedmann has appointed the Company, at its head office

located at 500 – 10355 Jasper Avenue, Edmonton, Alberta, Canada, T5J 1Y6 as their agent for service of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any such

person, even though they have each appointed an agent for service of process.

The corporate head office of the Company is located at 500 – 10355

Jasper Avenue, Edmonton, Alberta, Canada, T5J 1Y6. The registered office of the Company is located at Suite 1700, 666 Burrard Street, Vancouver, British Columbia, V6C 2X8.

S-iii

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

S-iv

TABLE OF CONTENTS

BASE SHELF PROSPECTUS

S-v

IMPORTANT NOTICE

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the securities being offered and also adds

to and updates information contained in the Base Prospectus and the documents that are incorporated by reference into this Prospectus Supplement and the Base Prospectus. The second part is the Base Prospectus which provides more general information.

This Prospectus Supplement is deemed to be incorporated by reference into the Base Prospectus solely for the purposes of the Offering. Other documents are also incorporated or deemed to be incorporated by reference into this Prospectus Supplement

and into the Base Prospectus. See “Documents Incorporated by Reference”.

The Company filed the Base Prospectus with the securities

commissions in all Canadian provinces other than Québec (the “Canadian Qualifying Jurisdictions”) in order to qualify the offering of the securities described in the Base Prospectus in accordance with NI 44-102. The Alberta Securities Commission issued a receipt dated March 30, 2021 in respect of the final Base Prospectus as the principal regulatory authority under Multilateral Instrument 11-102 Passport System, and each of the other commissions in the Canadian Qualifying Jurisdictions is deemed to have issued a receipt under National Policy 11-202 Process for

Prospectus Review in Multiple Jurisdictions.

The Base Prospectus also forms part of the Registration Statement that we filed with the SEC under the U.S.

Securities Act utilizing the MJDS. The Registration Statement became effective upon filing under the U.S. Securities Act on March 30, 2021. The Registration Statement incorporates the Base Prospectus with certain modifications and deletions

permitted by Form F-10. This Prospectus Supplement is being filed by the Company with the SEC in accordance with the instructions to Form F-10.

You should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Base Prospectus. If the description of

the Warrant Shares varies between this Prospectus Supplement and the Base Prospectus, you should rely on the information in this Prospectus Supplement. To the extent that any statement made in this Prospectus Supplement differs from those in the

Base Prospectus, the statements made in the Base Prospectus and the information incorporated by reference therein are deemed modified or superseded by the statements made in this Prospectus Supplement and the information incorporated by reference

herein. The Company has not authorized any other person to provide investors with additional or different information. If anyone provides you with any additional, different or inconsistent information, you should not rely on it.

You should not assume that the information contained in or incorporated by reference in this Prospectus Supplement or the Base Prospectus is accurate as of

any date other than the date of the document in which such information appears. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this Prospectus Supplement updates and modifies

the information in the Base Prospectus and information incorporated by reference herein and therein.

The Company is not making any offer of the Warrant

Shares in any jurisdiction where the offer is not permitted by law.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (“documents incorporated by reference” or “documents incorporated herein by reference”) filed by the

Company with the securities regulatory authorities in the jurisdictions in Canada in which the Company is a reporting issuer and filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of,

this Prospectus Supplement:

| |

• |

|

the annual

information form of the Company for the year ended June 30, 2022, dated and filed on SEDAR on September 20, 2022 (our “2022 AIF”); |

| |

• |

|

the audited

consolidated financial statements of the Company, and the notes thereto for the years ended June 30, 2022 and 2021, together with the reports of independent registered public accounting firm thereon, filed on SEDAR on September

20, 2022; |

S-1

| |

• |

|

the management’s

discussion and analysis of financial condition and results of operations for the year ended June 30, 2022, filed on SEDAR on September 20, 2022 (our “2022 Annual MD&A”); |

| |

• |

|

the management’s discussion

and analysis of financial condition and results of operations for the three months ended September 30, 2022, filed on SEDAR on November 10, 2022 (our “Interim MD&A”); |

| |

• |

|

the material change

report regarding the Company’s acquisition of a controlling interest in Bevo Agtech Inc., dated and filed on SEDAR on August 25, 2022; and |

| |

• |

|

the management information circular

of the Company dated September 30, 2022, distributed in connection with the Company’s annual general and special meeting of shareholders held on November 14, 2022, filed on SEDAR on October 3, 2022. |

Any document of the type referred to in section 11.1 of Form 44-101F1 of National Instrument 44-101 – Short Form Prospectus Distributions filed by us with the securities commissions or similar regulatory authorities in the jurisdictions in Canada in which the Company is a reporting issuer after

the date of this Prospectus Supplement and prior to the termination of the Offering shall be deemed to be incorporated by reference into this Prospectus Supplement.

When new documents of the type referred to in the paragraph above are filed by the Company with the commissions or similar regulatory authorities in the

jurisdictions in Canada in which the Company is a reporting issuer during the currency of this Prospectus Supplement, such documents will be deemed to be incorporated by reference in this Prospectus Supplement and the previous documents of the type

referred to in the paragraph above will no longer be deemed to be incorporated by reference in this Prospectus Supplement.

To the extent that any

document or information incorporated by reference into this Prospectus Supplement is included in any report on Form 6-K, Form 40-F, Form 20-F, Form 10-K, Form 10-Q or Form 8-K (or any respective successor

form) that is filed with or furnished to the SEC after the date of this Prospectus Supplement, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus

Supplement forms a part. In addition, the Company may incorporate by reference into this Prospectus Supplement, or the Registration Statement, other information from documents that the Company files with or furnishes to the SEC pursuant to

Section 13(a) or 15(d) of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), if and to the extent expressly provided therein.

Any statement contained in this Prospectus Supplement, the Base Prospectus or in a document incorporated or deemed to be incorporated by reference herein

or therein, will be deemed to be modified or superseded, for the purposes of this Prospectus Supplement, to the extent that a statement contained in this Prospectus Supplement or in any other subsequently filed document that is also incorporated or

is deemed to be incorporated by reference in this Prospectus Supplement modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other

information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement will not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a

misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement

so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement.

Information

contained on the Company’s website, www.auroramj.com, is not part of this Prospectus Supplement or the Base Prospectus and is not incorporated herein by reference and may not be relied upon by you in connection with an investment in the

Warrant Shares.

S-2

Copies of the documents incorporated herein by reference may be obtained from us upon request without charge

from Aurora Cannabis Inc., 500 – 10355 Jasper Avenue, Edmonton, Alberta, Canada, T5J 1Y6 (Telephone: 1-855-279-4652) Attn:

Corporate Secretary. These documents are also available electronically from the website of Canadian Securities Administrators at www.sedar.com (“SEDAR”) and from the EDGAR filing website of the United States Securities and Exchange

Commission at www.sec.gov (“EDGAR”). The Company’s filings through SEDAR and EDGAR are not incorporated by reference in the Prospectus except as specifically set out herein.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement, the accompanying Base Prospectus and the documents incorporated by reference herein and therein, contain forward-looking

statements and forward-looking information (collectively, “forward-looking statements”) which may not be based on historical fact. These forward-looking statements are made as of the date of this Prospectus Supplement, the accompanying

Base Prospectus or the applicable document incorporated by reference herein or therein, and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities

legislation. Forward-looking statements relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events. In certain cases, forward-looking statements can be identified by the use of

words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be

taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including “may”, “future”,

“expected”, “intends” and “estimates”. By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of

the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The Company provides no assurance that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements in this Prospectus Supplement and the

documents incorporated by reference include, but are not limited to, statements with respect to:

| |

• |

|

pro forma measures including revenue, cash flow, adjusted gross margin before fair value adjustments, expected

SG&A run-rates and grams produced; |

| |

• |

|

the Company’s ability to fund operating activities and cash commitments for investments for investing and

financing activities for the foreseeable future; |

| |

• |

|

the Company’s expectation of achieving positive cash flow from operating activities in future periods;

|

| |

• |

|

expectations regarding production capacity, costs and yields; |

| |

• |

|

statements made under the heading “Our Strategy” in the documents incorporated by reference, where

applicable; |

| |

• |

|

statements made with respect to the anticipated disposition of legal claims; |

| |

• |

|

the Company’s ability to execute on its business transformation plan and path to Adjusted EBITDA

profitability including, but not limited to, anticipated cost savings and planned cost efficiencies; |

| |

• |

|

growth opportunities including the expansion into additional international markets; |

| |

• |

|

expectations related to increased legalization of consumer markets, including the United States;

|

| |

• |

|

the recovery of the Company’s domestic consumer segment; |

| |

• |

|

the acquisition of Thrive, including the anticipated impact on the consumer business and the Company’s path

to Adjusted EBITDA profitability; |

| |

• |

|

competitive advantages and strengths in medical, scientific leadership, multi-jurisdictional regulatory

expertise, compliance, testing and product quality; |

| |

• |

|

product portfolio and innovation, and associated revenue growth; |

| |

• |

|

licensing of genetic innovations to other Licensed Producers and associated revenue growth;

|

| |

• |

|

expectations regarding biosynthetic production and associated intellectual property; |

| |

• |

|

the use of proceeds generated from the ATM Program; |

| |

• |

|

future strategic plans; |

| |

• |

|

the impact of the COVID-19 pandemic on the Company’s business operations, capital resources and/or financial

results; and |

| |

• |

|

other risks detailed from time to time in the documents incorporated herein by reference, and those risks which

are discussed under the heading “Risk Factors” in this Prospectus Supplement and the Base Prospectus. |

S-3

The above and other aspects of the Company’s anticipated future operations are forward-looking in

nature and, as a result, are subject to certain risks and uncertainties. Such forward-looking statements are estimates reflecting the Company’s best judgment based upon current information and involve a number of risks and uncertainties, and

there can be no assurance that other factors will not affect the accuracy of such forward-looking statements. These risks include, but are not limited to: the Company has a limited operating history and there is no assurance the Company will be able

to achieve or maintain profitability; the Company operates in a highly regulated business and any failure or significant delay in obtaining applicable regulatory approvals could adversely affect its ability to conduct its business; the

Company’s Canadian licenses are reliant on its established sites; the failure to maintain its licenses and remain in compliance with regulations could adversely affect the Company’s ability to conduct business; a change in the laws,

regulations, and guidelines that impact the business may cause adverse effects on the Company’s operations; the Company competes for market share with a number of competitors and expects even more competitors to enter our market, and many of

the Company’s current and future competitors may have longer operating histories, more financial resources, and lower costs than the Company; management’s estimates of consumer demand in Canada and in jurisdictions where the Company

exports are accurate; expectations of future results and expenses; management’s estimation that the Company will be able to maintain current SG&A expenditure levels and the SG&A will grow only in proportion to revenue growth, the yield

from cannabis growing operations, product demand, changes in prices of required commodities; the selling prices and the cost of cannabis production may vary based on a number of factors outside of the Company’s control; the Company may not be

able to realize our growth targets or successfully manage our growth; the continuance of our contractual relations with provincial and territorial governments upon which much of the Company’s business depends cannot be guaranteed; the

Company’s continued growth and ongoing operations may require additional financing, which may not be available on acceptable terms or at all; any default under the Company’s existing debt that is not waived by the applicable lenders could

materially adversely impact the Company’s results of operations and financial results and may have a material adverse effect on the trading price of the Company’s Common Shares; the Company is subject to credit risk; the Company may not be

able to successfully develop new products or find a market for their sale; the Company may not have supply continuity given the Company’s asset rationalization initiative; as the cannabis market continues to mature, the Company’s products

may become obsolete, less competitive, or less marketable; restrictions on branding and advertising may negatively impact the Company’s ability to attract and retain customers; the cannabis business may be subject to unfavorable publicity or

consumer perception, which may adversely affect the market for cannabis products generally and the Company’s products specifically; third parties with whom the Company does business may perceive themselves as being exposed to reputational risk

by virtue of their relationship with the Company and may ultimately elect to discontinue their relationships with the Company; there may be unknown health impacts associated with the use of cannabis and cannabis derivative products; the Company may

enter into strategic alliances or expand the scope of currently existing relationships with third parties and there are risks associated with such activities; the Company’s success will depend on attracting and retaining key personnel; the

Company is dependent on its senior management; future expansion efforts may not be successful; the Company has expanded and intends to further expand our business and operations into jurisdictions outside of Canada, and there are risks associated

with doing so; the Company may have challenges in accessing banks and/or financial institutions in jurisdictions where cannabis is not yet federally regulated, which may adversely affect the Company’s growth plans; the business may be affected

by political and economic instability and a period of sustained inflation across the markets in which it operates; failure to comply with the Corruption of Foreign Public Officials Act (Canada) and the Foreign Corrupt Practices Act (United States),

as well as the anti-bribery laws of the other nations in which the Company conducts business, could subject the Company to penalties and other adverse consequences; the Company’s employees, independent contractors and consultants may engage in

fraudulent or other illegal activities; the Company may be subject to uninsured or uninsurable risk; the Company may be subject to product liability claims; the Company’s cannabis products may be subject to recalls for a variety of reasons; the

Company is and may become party to litigation, mediation, and/or arbitration from time to time; the transportation of the Company’s products is subject to security risks and disruptions; the Company’s business is subject to the risks

inherent in agricultural operations; the Company has in the past, and may in the future, record significant write-downs of its assets; the Company’s operations are subject to various environmental and employee health and safety regulations,

compliance with which may affect the Company’s cost of operations; the Company may not be able to protect our intellectual property; the Company may experience breaches of security at our facilities or in respect of electronic documents and

data storage and may face risks related to breaches of applicable privacy laws; the Company may be subject to

S-4

risks related to our information technology systems, including cyber-attacks; the Company may not be able to successfully identify and execute future acquisitions or dispositions, or to

successfully manage the impacts of such transactions on its operations; as a holding company, Aurora Cannabis Inc. is dependent on its operating subsidiaries to pay dividends and other obligations; management will have substantial discretion

concerning the use of proceeds from future share sales and financing transactions; there is no assurance the Company will continue to meet the listing standards of the Nasdaq and the TSX; the financial reporting obligations of being a public company

and maintaining a dual listing on the TSX and on Nasdaq requires significant company resources and management attention; the Company does not anticipate paying any dividends to the holders of Common Shares in the foreseeable future; the

Company’s business has and may continue to be subject to disruptions as a result of the COVID-19 pandemic; Reliva, LLC’s (“Reliva”) operations in the United States may be impacted by

regulatory action and approvals from the Food and Drug Administration; and other risks detailed from time to time in our annual information forms, annual financial statements, MD&A, interim financial statements and material change reports filed

with and furnished to securities regulators, and those risks which are discussed under the heading “Risk Factors”.

Readers are cautioned

that the foregoing list of risk factors is not exhaustive, and it is recommended that prospective investors consult the more complete discussion of risks and uncertainties facing the Company included in this Prospectus Supplement and the

accompanying Base Prospectus under the heading “Risk Factors”, as well as those set out in our 2022 AIF under the heading “Risk Factors” and in our 2022 Annual MD&A and Interim MD&A, each of which documents are

incorporated by reference into this Prospectus Supplement. Readers are urged to consider the risks, uncertainties and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such

information.

Should one or more of these risks or uncertainties materialize, or should underlying factors or assumptions prove incorrect, actual results

may vary materially from those described in forward looking statements. Material factors or assumptions involved in developing forward-looking statements include, without limitation, publicly available information from governmental sources as well

as from market research and industry analysis and on assumptions based on data and knowledge of the cannabis industry which the Company believes to be reasonable.

Although the Company believes that the expectations conveyed by the forward-looking statements are reasonable based on the information available to the

Company on the date hereof, no assurance can be given as to future results, approvals or achievements. Forward-looking statements contained in this Prospectus Supplement, the accompanying Base Prospectus and in the documents incorporated by

reference herein and therein are expressly qualified by this cautionary statement. The Company disclaims any duty to update any of the forward-looking statements after the date of this Prospectus Supplement except as otherwise required by applicable

law.

NOTE TO UNITED STATES READERS REGARDING DIFFERENCES

BETWEEN UNITED STATES AND CANADIAN FINANCIAL REPORTING PRACTICES

We prepare our financial statements in accordance with IFRS, as issued by the IASB, which differs from U.S. generally accepted accounting principles

(“U.S. GAAP”). Accordingly, our financial statements and other financial information included or incorporated by reference in this Prospectus Supplement and the accompanying Base Prospectus may not be comparable to financial

statements of United States companies prepared in accordance with U.S. GAAP.

NON-IFRS MEASURES

The information presented in this Prospectus Supplement and the accompanying Base Prospectus,

including certain documents incorporated by reference herein and therein, may include non-IFRS measures that are used by us as indicators of financial performance. These financial measures do not have

standardized meanings prescribed under IFRS and our computation may differ from similarly-named computations as reported by other entities and, accordingly, may not be comparable. These financial measures should not be considered as an alternative

to, or more meaningful than, measures of financial performance as determined in accordance with IFRS as an indicator of performance. The Company believes these measures may be useful supplemental information to assist investors in assessing our

operational performance and our ability to generate cash through operations. The non-IFRS measures also provide investors with insight into our decision making as we use these

non-IFRS measures to make financial, strategic and operating decisions.

S-5

Because non-IFRS measures do not have a standardized meaning and may

differ from similarly-named computations as reported by other entities, securities regulations require that non-IFRS measures be clearly defined and qualified, reconciled with their nearest IFRS measure and

given no more prominence than the closest IFRS measure. If non-IFRS measures are included in documents incorporated by reference herein, information regarding these

non-IFRS measures are presented in the sections dealing with these financial measures in such documents.

Non-IFRS measures are not audited. These non-IFRS measures have important limitations as analytical tools and investors are cautioned not to consider them in isolation or

place undue reliance on ratios or percentages calculated using these non-IFRS measures.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise requires, all references to dollar

amounts in this Prospectus Supplement are references to Canadian dollars. References to “C$” are to Canadian dollars and references to “U.S. dollars” or “U.S.$” are to United States dollars.

Except as otherwise noted in our 2022 AIF and the Company’s financial statements and related management’s discussion and analysis of financial

condition and results of operations of the Company that are incorporated by reference into this Prospectus Supplement, the financial information contained in such documents is expressed in Canadian dollars.

The high, low, average and closing daily exchange rates for the United States dollar in terms of Canadian dollars for each of the financial periods of the

Company ended September 30, 2022, June 30, 2022 and June 30, 2021, as quoted by the Bank of Canada, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

September 30, 2022 |

|

|

Year ended

June 30, 2022 |

|

|

Year ended

June 30, 2021 |

|

| |

|

(expressed in Canadian dollars) |

|

| High |

|

|

1.3726 |

|

|

|

1.3039 |

|

|

|

1.3682 |

|

| Low |

|

|

1.2753 |

|

|

|

1.2329 |

|

|

|

1.2040 |

|

| Average |

|

|

1.3056 |

|

|

|

1.2659 |

|

|

|

1.2882 |

|

| Closing |

|

|

1.3707 |

|

|

|

1.2886 |

|

|

|

1.2394 |

|

On November 24, 2022, the daily exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the

Bank of Canada, was U.S.$1.00 = C$1.3338.

OUR BUSINESS

This summary does not contain all the information about the Company that may be important to you. You should read the more detailed information, public

filings and financial statements and related notes that are incorporated by reference into and are considered to be a part of this Prospectus Supplement and the accompanying Base Prospectus.

S-6

Aurora is a Canadian-headquartered cannabis company serving both the medical and consumer markets. Aurora is

a pioneer in global cannabis, dedicated to helping people improve their lives. The Company’s adult-use brand portfolio includes Aurora Drift, San Rafael ‘71, Daily Special, Whistler, Being and Greybeard, as well as CBD brands, Reliva

and KG7. Medical cannabis brands include MedReleaf, CanniMed, Aurora and Whistler Medical Marijuana Co. Aurora also has a controlling interest in Bevo Farms, North America’s leading supplier of propagated agricultural plants. Driven by science

and innovation, and with a focus on high-quality cannabis products, Aurora’s brands continue to break through as industry leaders in the medical, performance, wellness and adult recreational markets wherever they are launched.

USE OF PROCEEDS

We will receive all proceeds of the full issue price of U.S.$12.60 per Warrant Share upon issuance of the Warrant Shares upon any exercise of the Warrants

from time to time. Assuming that all of the Warrants are exercised prior to 5:00 p.m. (Toronto time) on the Expiry Date for cash and that no adjustment based on anti-dilution provisions contained in the Warrant Indenture has taken place, the

proceeds to the Company will be U.S.$83,160,000. There is no assurance as to how many Warrants will be exercised, if any. Accordingly, there is no assurance as to how many Warrant Shares will be issued pursuant to this Prospectus Supplement, if any,

or the proceeds of such offering.

It is currently anticipated that the Company will use any proceeds from the Offering for general corporate purposes.

Although we intend to use the proceeds from the Offering as set forth above, the actual allocation of the net proceeds may vary depending on future

developments, at the discretion of our board of directors and management. See “Risk Factors – The Company has discretion with respect to the use of proceeds from this Offering”.

S-7

During the fiscal year ended June 30, 2022 and the first quarter ended September 30, 2022, the

Company had negative cash flow from operating activities. Although the Company anticipates it will be able to generate positive cash flow from operating activities in the future, the Company cannot guarantee it will have positive cash flow from

operating activities in any future period. To the extent that the Company has negative operating cash flow in any future period, current working capital and certain of the proceeds from the Offering may be used to fund such negative cash flow from

operating activities. See “Risk Factors – Negative Cash Flow from Operations”.

CONSOLIDATED CAPITALIZATION

As of September 30, 2022, the Company had 300,437,433 Common Shares issued and outstanding. Except as described below, there have been no material

changes in our share and debt capital, on a consolidated basis, since September 30, 2022, being the date of the Interim Financial Statements incorporated by reference in this Prospectus, other than:

| |

• |

|

the issuance of a total of 186,497 Common Shares related to Aurora’s RSU share based compensation program;

and |

| |

• |

|

the issuance of an aggregate of 24,958,371 Common Shares pursuant to the Company’s at-the-market offering program (the “ATM Program”) for gross proceeds of approximately U.S.$31,216,903, |

each as described further below under “Prior Sales”.

The following table shows the effect of the Warrants and Warrant Shares (assuming all Warrants are exercised prior to the Expiry Date) on the issued share

capital of the Company. This table should be read in conjunction with the consolidated financial statements of the Company and the related notes and management’s discussion and analysis of financial condition and results of operations in

respect of those statements that are incorporated by reference in the Prospectus.

|

|

|

|

|

|

|

|

|

|

Description(1) |

|

As at September 30, 2022,

before giving effect

to the exercise of the

Warrants |

|

|

As at September 30, 2022,

after giving effect

to the exercise of

the Warrants(2) |

|

| Common Shares |

|

|

300,437,433

|

|

|

|

307,037,433

|

|

| Share Capital (in thousands of $) |

|

C$ |

6,764,621 |

|

|

C$ |

6,878,500 |

|

| Warrants |

|

|

89,124,788 |

|

|

|

82,524,788 |

|

| (1) |

This table does not give effect to issuances of Common Shares that occurred after September 30, 2022.

|

| (2) |

Assuming a currency exchange rate equivalent to the daily exchange rate for the United States dollar in terms

of Canadian dollars on September 30, 2022, as quoted by the Bank of Canada, being U.S.$1.00 = C$1.3707. |

S-8

PRIOR SALES

The following table sets out details of all Common Shares issued by the Company since the year ended June 30, 2022. For details of all Common Shares

issued during the year ended June 30, 2022, see the Company’s 2022 AIF.

|

|

|

|

|

|

|

|

|

|

|

| Date of Issuance |

|

Reason for Issuance |

|

Number of

Securities

Issued |

|

|

Issue/Exercise Price

per Security |

|

| July 4, 2022 |

|

PSU Release |

|

|

54 |

|

|

C$ |

8.22 |

|

| July 4, 2022 |

|

RSU Release |

|

|

250 |

|

|

C$ |

8.22 |

|

| July 7, 2022 |

|

Shares issued for business combinations & asset acquisitions |

|

|

2,614,995 |

|

|

C$ |

3.70 |

|

| July 26, 2022 |

|

RSU Release |

|

|

334 |

|

|

C$ |

12.61 |

|

| July 26, 2022 |

|

RSU Release |

|

|

820 |

|

|

C$ |

8.22 |

|

| July 26, 2022 |

|

RSU Release |

|

|

328 |

|

|

C$ |

10.09 |

|

| July 26, 2022 |

|

RSU Release |

|

|

489 |

|

|

C$ |

8.22 |

|

| July 26, 2022 |

|

RSU Release |

|

|

251 |

|

|

C$ |

12.61 |

|

| July 26, 2022 |

|

RSU Release |

|

|

606 |

|

|

C$ |

8.22 |

|

| July 26, 2022 |

|

RSU Release |

|

|

368 |

|

|

C$ |

8.22 |

|

| August 31, 2022 |

|

RSU Release |

|

|

1,061 |

|

|

C$ |

8.22 |

|

| August 22, 2022 |

|

RSU Release |

|

|

247 |

|

|

C$ |

10.09 |

|

| August 22, 2022 |

|

RSU Release |

|

|

343 |

|

|

C$ |

12.61 |

|

| August 22, 2022 |

|

PSU Release |

|

|

167 |

|

|

C$ |

8.22 |

|

| August 22, 2022 |

|

RSU Release |

|

|

363 |

|

|

C$ |

8.22 |

|

| August 22, 2022 |

|

RSU Release |

|

|

417 |

|

|

C$ |

113.16 |

|

| September 7, 2022 |

|

RSU Release |

|

|

652 |

|

|

C$ |

94.92 |

|

| September 7, 2022 |

|

RSU Release |

|

|

12,622 |

|

|

C$ |

10.09 |

|

| September 7, 2022 |

|

RSU Release |

|

|

5,755 |

|

|

C$ |

17.84 |

|

| September 7, 2022 |

|

RSU Release |

|

|

22,582 |

|

|

C$ |

8.22 |

|

| September 7, 2022 |

|

RSU Release |

|

|

53 |

|

|

C$ |

33.48 |

|

| September 7, 2022 |

|

RSU Release |

|

|

1,140 |

|

|

C$ |

17.84 |

|

| September 7, 2022 |

|

RSU Release |

|

|

1,298 |

|

|

C$ |

8.22 |

|

| October 3, 2022 |

|

ATM Program |

|

|

835,824 |

|

|

U.S.$ |

1.27 |

|

| October 3, 2022 |

|

RSU Release |

|

|

1,052 |

|

|

C$ |

2.08 |

|

| October 3, 2022 |

|

RSU Release |

|

|

7,454 |

|

|

C$ |

7.91 |

|

| October 3, 2022 |

|

RSU Release |

|

|

2,917 |

|

|

C$ |

8.22 |

|

| October 3, 2022 |

|

RSU Release |

|

|

41,364 |

|

|

C$ |

10.09 |

|

| October 3, 2022 |

|

RSU Release |

|

|

594 |

|

|

C$ |

12.61 |

|

| October 3, 2022 |

|

RSU Release |

|

|

1,023 |

|

|

C$ |

17.84 |

|

| October 3, 2022 |

|

ATM Program |

|

|

525,000 |

|

|

U.S.$ |

1.24 |

|

| October 4, 2022 |

|

ATM Program |

|

|

3,500,000 |

|

|

U.S.$ |

1.27 |

|

| October 6, 2022 |

|

ATM Program |

|

|

11,000,883 |

|

|

U.S.$ |

1.31 |

|

| October 7, 2022 |

|

ATM Program |

|

|

951,900 |

|

|

U.S.$ |

1.22 |

|

| October 12, 2022 |

|

ATM Program |

|

|

278,736 |

|

|

U.S.$ |

1.07 |

|

| October 13, 2022 |

|

ATM Program |

|

|

1,000,000 |

|

|

U.S.$ |

1.10 |

|

| October 14, 2022 |

|

ATM Program |

|

|

166,094 |

|

|

U.S.$ |

1.11 |

|

| October 17, 2022 |

|

ATM Program |

|

|

2,548,929 |

|

|

U.S.$ |

1.12 |

|

S-9

|

|

|

|

|

|

|

|

|

|

|

| Date of Issuance |

|

Reason for Issuance |

|

Number of

Securities

Issued |

|

|

Issue/Exercise Price

per Security |

|

| October 18, 2022 |

|

ATM Program |

|

|

1,155,047 |

|

|

U.S.$ |

1.13 |

|

| October 19, 2022 |

|

ATM Program |

|

|

197,481 |

|

|

U.S.$ |

1.11 |

|

| October 20, 2022 |

|

ATM Program |

|

|

596,498 |

|

|

U.S.$ |

1.11 |

|

| October 21, 2022 |

|

ATM Program |

|

|

952,261 |

|

|

U.S.$ |

1.10 |

|

| October 4, 2022 |

|

RSU Release |

|

|

61,766 |

|

|

C$ |

8.22 |

|

| October 27, 2022 |

|

RSU Release |

|

|

1,574 |

|

|

C$ |

12.61 |

|

| October 27, 2022 |

|

RSU Release |

|

|

2,253 |

|

|

C$ |

8.22 |

|

| October 27, 2022 |

|

RSU Release |

|

|

157 |

|

|

C$ |

10.09 |

|

| October 27, 2022 |

|

RSU Release |

|

|

36,128 |

|

|

C$ |

10.09 |

|

| October 27, 2022 |

|

RSU Release |

|

|

29,032 |

|

|

C$ |

8.22 |

|

| November 3, 2022 |

|

RSU Release |

|

|

136 |

|

|

C$ |

7.91 |

|

| November 3, 2022 |

|

RSU Release |

|

|

1,047 |

|

|

C$ |

8.22 |

|

| November 17, 2022 |

|

ATM Program |

|

|

1,004,058 |

|

|

U.S.$ |

1.43 |

|

| November 18, 2022 |

|

ATM Program |

|

|

131,538 |

|

|

U.S.$ |

1.37 |

|

| November 21, 2022 |

|

ATM Program |

|

|

114,122 |

|

|

U.S.$ |

1.35 |

|

The following table sets out details of all securities convertible or exercisable into Common Shares that were issued or

granted by the Company following the year ended June 30, 2022. For details of all securities convertible or exercisable into Common Shares that were issued or granted during the year ended June 30, 2022, see the Company’s 2022 AIF.

|

|

|

|

|

|

|

|

|

|

|

| Date of Issuance |

|

Type of Security

Issued |

|

Number of Common Shares

Issuable Upon Exercise or

Conversion |

|

|

Exercise or Conversion Price

Per Common Share |

|

| September 23, 2022 |

|

Options |

|

|

3,168,334 |

|

|

C$ |

1.87 |

|

| September 23, 2022 |

|

PSU |

|

|

1,725,010 |

|

|

|

N/A |

|

| September 30, 2022 |

|

Options |

|

|

216,664 |

|

|

C$ |

1.67 |

|

| September 30, 2022 |

|

DSU |

|

|

62,872 |

|

|

|

N/A |

|

| September 30, 2022 |

|

DSU |

|

|

52,395 |

|

|

|

N/A |

|

| November 15, 2022 |

|

PSU |

|

|

9,736 |

|

|

|

N/A |

|

| November 15, 2022 |

|

RSU |

|

|

22,716 |

|

|

|

N/A |

|

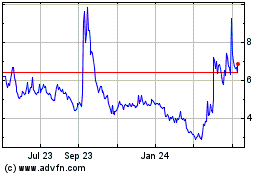

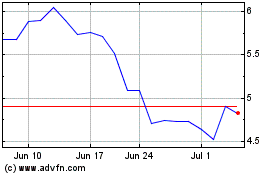

TRADING PRICE AND VOLUME

Our Common Shares are listed on the TSX and Nasdaq under the trading symbol “ACB”. The following tables set forth the reported high and low closing

prices and the aggregate trading volume of our Common Shares on the TSX and the Nasdaq for each of the months (or, if applicable, partial months) indicated during the 12-month period prior to the date of this

Prospectus Supplement.

S-10

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month |

|

TSX Price Range |

|

|

Total Volume |

|

| |

High (C$) |

|

|

Low (C$) |

|

| November 2021 |

|

|

10.87 |

|

|

|

7.82 |

|

|

|

37,218,206 |

|

| December 2021 |

|

|

8.52 |

|

|

|

6.82 |

|

|

|

27,760,176 |

|

| January 2022 |

|

|

7.61 |

|

|

|

4.74 |

|

|

|

34,879,925 |

|

| February 2022 |

|

|

6.22 |

|

|

|

4.46 |

|

|

|

33,793,195 |

|

| March 2022 |

|

|

5.70 |

|

|

|

3.70 |

|

|

|

46,742,887 |

|

| April 2022 |

|

|

5.27 |

|

|

|

3.58 |

|

|

|

31,228,245 |

|

| May 2022 |

|

|

4.09 |

|

|

|

2.13 |

|

|

|

58.935,771 |

|

| June 2022 |

|

|

2.03 |

|

|

|

1.58 |

|

|

|

60,410,007 |

|

| July 2022 |

|

|

2.12 |

|

|

|

1.63 |

|

|

|

35,831,695 |

|

| August 2022 |

|

|

2.43 |

|

|

|

1.84 |

|

|

|

52,673,201 |

|

| September 2022 |

|

|

2.11 |

|

|

|

1.59 |

|

|

|

62,684,576 |

|

| October 2022 |

|

|

1.96 |

|

|

|

1.43 |

|

|

|

58,502,905 |

|

| November 1—24, 2022 |

|

|

2.05 |

|

|

|

1.65 |

|

|

|

55,394,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month |

|

Nasdaq Price Range |

|

|

Total Volume |

|

| |

High (U.S.$) |

|

|

Low (U.S.$) |

|

| November 2021 |

|

|

8.69 |

|

|

|

6.10 |

|

|

|

144,607,688 |

|

| December 2021 |

|

|

6.74 |

|

|

|

5.39 |

|

|

|

102,100,806 |

|

| January 2022 |

|

|

6.0499 |

|

|

|

3.71 |

|

|

|

135,122,353 |

|

| February 2022 |

|

|

4.90 |

|

|

|

3.47 |

|

|

|

107,807,976 |

|

| March 2022 |

|

|

4.56 |

|

|

|

2.89 |

|

|

|

207,854,075 |

|

| April 2022 |

|

|

4.215 |

|

|

|

2.79 |

|

|

|

123,460,666 |

|

| May 2022 |

|

|

3.19 |

|

|

|

1.66 |

|

|

|

266,659,678 |

|

| June 2022 |

|

|

1.62 |

|

|

|

1.23 |

|

|

|

235,834,334 |

|

| July 2022 |

|

|

1.65 |

|

|

|

1.26 |

|

|

|

177,785,725 |

|

| August 2022 |

|

|

1.89 |

|

|

|

1.37 |

|

|

|

262,879,542 |

|

| September 2022 |

|

|

1.61 |

|

|

|

1.16 |

|

|

|

177,050,937 |

|

| October 2022 |

|

|

1.43 |

|

|

|

1.04 |

|

|

|

309,461,793 |

|

| November 1—24, 2022 |

|

|

1.54 |

|

|

|

1.21 |

|

|

|

231,709,939 |

|

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

Common Shares

The Company is authorized to issue an

unlimited number of Common Shares without par value. For a description of the terms and provisions of the Common Shares, see “Description of Securities Being Distributed – Common Shares” in the Base Prospectus. As of

September 30, 2022, there were 300,437,433 Common Shares outstanding. If all of the Warrants are exercised, there will be 307,037,433 Common Shares outstanding.

S-11

PLAN OF DISTRIBUTION

This Prospectus Supplement relates to: (i) up to 6,600,000 Warrant Shares issuable from time to time on exercise of 6,600,000 Warrants issued by the

Company pursuant to the Unit Offering; and (ii) such indeterminate number of additional Warrant Shares that may be issuable by reason of the anti-dilution provisions contained in the indenture governing the Warrants (the “Warrant

Indenture”) entered into between the Company and Computershare Trust Company of Canada, as warrant agent (the “Warrant Agent”).

Each Warrant entitles the holder to purchase one Warrant Share from the treasury of the Company at the price of U.S.$12.60 per Warrant Share at any time until

5:00 p.m. (Toronto time) on the Expiry Date, subject to adjustment and in accordance with the terms and conditions set out in the Warrant Indenture, after which the Warrants will become null and void.

The following summary of certain provisions of the Warrant Indenture does not purport to be complete and is qualified in its entirety by reference to the

detailed provisions of the Warrant Indenture. Reference is made to the Warrant Indenture for the full text of the attributes of the Warrants, which is filed on SEDAR under the issuer profile of the Company at www.sedar.com and with the SEC at

www.sec.gov. A register of holders of Warrants is maintained at the principal offices of the Warrant Agent in Vancouver, British Columbia. The holders of Warrants do not, as such, have any voting right or other right attached to the Warrant Shares

until and unless the Warrants are duly exercised as provided for in the Warrant Indenture.

The Warrant Indenture provides that the number of Warrant

Shares which may be acquired by a holder of Warrants upon the exercise thereof will be subject to anti-dilution provisions governed by the Warrant Indenture, including provisions for the appropriate adjustment of the class, number and price of the

securities issuable under the Warrant Indenture upon the occurrence of certain events, including:

| |

(a) |

the issuance of Common Shares or securities exchangeable for or convertible into Common Shares to all or

substantially all of the holders of Common Shares by way of a stock dividend or other distribution (other than a distribution of Common Shares upon the exercise of any outstanding warrants, options or other convertible securities);

|

| |

(b) |

the subdivision, redivision or change of the Common Shares into a greater number of shares;

|

| |

(c) |

the consolidation, reduction or combination of the Common Shares into a lesser number of shares;

|

| |

(d) |

the issuance to all or substantially all of the holders of Common Shares of rights, options or warrants under

which such holders are entitled, during a period expiring not more than 45 days after the record date for such issuance, to subscribe for or purchase Common Shares, or securities exchangeable for or convertible into Common Shares, at a price per

Common Share to the holder (or at an exchange or conversion price per share) of less than 95% of the “current market price” (as defined in the Warrant Indenture) of Common Shares on such record date; and |

| |

(e) |

the issuance or distribution to all or substantially all of the holders of Common Shares of

(i) securities, including rights, options or warrants to acquire shares of any class or securities exchangeable or convertible into any such shares or property or assets or (ii) any property or assets, including evidences of indebtedness.

|

The Warrant Indenture also includes provisions for the appropriate adjustment of the class, number and price of the securities issuable

under the Warrant Indenture upon the occurrence of the following additional events:

| |

(a) |

the reclassification of the Common Shares or exchange or change of the Common Shares into other shares;

|

S-12

| |

(b) |

the amalgamation, arrangement or merger with or into any other corporation or other entity (other than an

amalgamation, arrangement or merger which does not result in any reclassification of the Company’s outstanding Common Shares or an exchange or change of the Common Shares into other shares); and |

| |

(c) |

the transfer of the Company’s undertakings or assets as an entirety or substantially as an entirety to

another corporation or other entity. |

The Warrant Indenture provides that: (i) no adjustment to the exercise price for the Warrants

will be required to be made unless such adjustment would result in a change of at least 1% in the exercise price for the Warrants; and (ii) no adjustment to the number of Warrant Shares issuable upon exercise of the Warrants will be required to

be made unless such adjustment would result in a change of at least one one-hundredth of a Warrant Share.

The Company has covenanted in the Warrant

Indenture, during the period in which the Warrants are exercisable, to give notice to holders of Warrants of certain stated events, including events that would result in an adjustment to the exercise price for the Warrants or the number of Warrant

Shares issuable upon exercise of the Warrants, a prescribed number of days prior to the record date or effective date, as the case may be, of such event.

The Warrant Indenture provides that, from time to time, the Warrant Agent and the Company, without the consent of the holders of Warrants, is able to amend or

supplement the Warrant Indenture for certain purposes, including rectifying any ambiguities, defective provisions, clerical omissions or mistakes, or other errors contained in the Warrant Indenture or in any deed or indenture supplemental or

ancillary to the Warrant Indenture, provided that, in the opinion of the Warrant Agent, relying on legal counsel, the rights of the holders of Warrants, as a group, are not prejudiced thereby. Subject to the voting rights set forth in the Warrant

Indenture, the rights of holders of the Warrants may, in certain circumstances, be modified by way of an extraordinary resolution passed by the affirmative vote of the holders of not less than 662⁄3% of the aggregate number of all the then outstanding Warrants at a meeting duly called and held in accordance with the terms of the Warrant Indenture at which there are present in person or by proxy at least two

holders representing at least 20% of the aggregate number of all the then outstanding Warrants.

The Warrant Indenture also provides that in the event of

an extraordinary transaction, as described in the Warrant Indenture and generally including any merger, arrangement or amalgamation of the Company with or into another entity, sale of all or substantially all of the Company’s assets, tender

offer or exchange offer, or reclassification of the Common Shares, the holders of the Warrants will generally be entitled to receive upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders would have

received had they exercised the Warrants immediately prior to such extraordinary transaction.

The Warrant Indenture includes certain beneficial ownership

limitations under which Warrants are not exercisable to the extent that, after giving effect to the issuance of the Warrant Shares issuable upon such exercise of the Warrants, the holder, together with its affiliates and other persons acting as a

group with the holder or any of its affiliates, would beneficially own in excess of 4.99% of the number of Common Shares outstanding immediately after giving effect to such issuance. Such beneficial ownership limitation may be increased or decreased

by the holder upon notice to the Company, to a maximum of 9.99%. Except as provided in the Warrant Indenture, beneficial ownership will be calculated in accordance with Section 13(d) of the U.S. Exchange Act and the rules and regulations

promulgated thereunder. To the extent the beneficial ownership limitations apply, the determination of whether a Warrant is exercisable and of which portion of a Warrant is exercisable shall be in the sole discretion and at the sole responsibility

of the holder, and the submission of an exercise notice in respect of any Warrants shall be deemed to be the holder’s determination of whether the Warrants are exercisable, and neither the Warrant Agent nor the Company will have any obligation

to verify or confirm the accuracy of such determination.

The Company will use commercially reasonable best efforts to maintain a registration statement

effective until the earlier of the Expiry Date or such time as no Warrants remain outstanding (provided, however, that nothing shall prevent the Company’s amalgamation, arrangement, merger or sale, including any take-over bid, and any

associated delisting or deregistration or ceasing to be a reporting issuer, provided that, so long as the Warrants are

S-13

still outstanding and represent a right to acquire securities of the acquiring company, the acquiring company shall assume the Company’s obligations under the Warrant Indenture), which could

require the additional filing of a new registration statement and/or base shelf prospectus and prospectus supplement if the current Prospectus is no longer usable. If, at any time prior to the Expiry Date, the Company determines that no registration

statement filed with the SEC is effective, or that its use is suspended, no holder of Warrants will be permitted to exercise Warrants unless an exemption from the registration requirements of the U.S. Securities Act and applicable state securities

laws is available, and the holders of Warrants will receive a notice of this determination, together with written confirmation that the Warrants may, until the earlier of (x) a registration statement becoming effective or ceasing to be

suspended and any prospectus supplement necessary in relation thereto having been filed and (y) the Expiry Date, if the Current Market Price (as defined in the Warrant Indenture) of the Common Shares exceeds the exercise price for the Warrants,

also be exercised by means of a “cashless exercise” in which the holder of Warrants will be entitled to receive a certificate for a number of Warrant Shares determined on the basis of the excess of the current market price over the

exercise price for the Warrants.

The principal transfer office of the Warrant Agent in Vancouver, British Columbia is the location at which Warrants may

be surrendered for exercise or transfer.

The Company previously filed the Original Warrant Share Prospectus Supplement to the Original Base Prospectus on

January 25, 2021 with the securities commission or similar regulatory authority in each of the provinces of Canada, except Québec, and, in connection therewith, filed a prospectus supplement dated January 25, 2021 to its

registration statement on Form F-10 with the SEC relating to the Warrant Shares.

In accordance with Canadian

shelf prospectus rules under NI 44-102, the Original Base Prospectus will cease to be effective as of November 28, 2022. This Prospectus Supplement replaces the Original Warrant Share Prospectus

Supplement in order to maintain the registration of the offering of the Warrant Shares under the U.S. Securities Act, beyond the expiry date of the Original Base Prospectus.

The Warrants were qualified for distribution by a prospectus supplement dated January 22, 2021 to the Original Base Prospectus filed with the securities

commission or similar regulatory authority in each of the provinces of Canada, except Québec, and, in connection therewith, a prospectus supplement dated January 22, 2021 to its registration statement on Form F-10 with the SEC relating to the Unit Offering, pursuant to which the Company qualified the distribution by the Company of 13,200,000 Units at a price of U.S.$10.45 per Unit pursuant to the terms of the

underwriting agreement entered into between the Company and the Underwriters on January 22, 2021 (the “Underwriting Agreement”). The Unit Offering was completed on January 26, 2021. The exercise price of the Warrants was

determined by negotiation between the Company and the Underwriters.

This Prospectus Supplement registers the offering of the securities to which it

relates under the U.S. Securities Act in accordance with the MJDS. This Prospectus Supplement does not qualify in any of the provinces or territories of Canada the distribution of the Warrant Shares to which it relates.

The Warrant Shares to which this Prospectus Supplement relates will be sold directly by the Company to holders of Warrants upon any exercise of such Warrants.

No underwriters, dealers or agents will be involved in these sales.

The Common Shares are listed on the TSX and on the Nasdaq under the symbol

“ACB” and on the FSE under the symbol “21P”. The TSX has approved the listing of the Warrant Shares issuable on exercise of the Warrants on the TSX.

There is no assurance as to how many of the Warrants will be exercised, and accordingly, there is no assurance as to how many Warrant Shares will be issued

pursuant to this Prospectus Supplement, if any. No party has any obligation to purchase any Warrant Shares qualified by this Prospectus Supplement.

No

fractional Common Shares will be issuable upon the exercise of any Warrants, and no cash or other consideration will be paid in lieu of fractional Common Shares.

S-14

RISK FACTORS

An investment in the Warrant Shares is highly speculative and subject to a number of known and unknown risks. Only those persons who can bear the risk of

loss of their investment should purchase the Warrant Shares. Investors should consider carefully the risk factors set out herein and contained in and incorporated by reference in the Base Prospectus. Discussions of certain risks affecting us in

connection with our business are set out under the heading “Risk Factors” in the accompanying Base Prospectus as well as in the documents incorporated by reference therein and herein, including, specifically, under the heading “Risk

Factors” in the 2022 AIF. Any of the matters highlighted in these risk factors could have a material adverse effect on our business, results of operations and financial conditions, causing an investor to lose all, or part of, its, his or her

investment.

The Company has discretion with respect to the use of proceeds from this Offering.

Management will have broad discretion with respect to the use of the proceeds from this Offering, if any, and investors will be relying on the judgment of

management regarding the application of these proceeds. At the date of this Prospectus Supplement, the Company intends to use the proceeds from this Offering as described under the heading “Use of Proceeds”. However, the

Company’s needs may change as its business and the industry the Company addresses evolve. As a result, the proceeds to be received in this Offering may be used in a manner significantly different from the Company’s current expectations.

The failure by management to apply these funds effectively could have a material adverse effect on the Company’s business.

Negative Cash Flow

from Operations

The Company had negative operating cash flows for the fiscal year ended June 30, 2022 and the first quarter ended

September 30, 2022. Although the Company anticipates it will be able to generate positive cash flow from operating activities in the future, the Company cannot guarantee it will have positive cash flow from operating activities in any future

period. To the extent that the Company has negative operating cash flow in any future period, certain of the proceeds from the Offering may be used to fund such negative cash flow from operating activities. See “Use of Proceeds”.

Future sales or issuances of Common Shares could decrease the value of any existing Common Shares or Warrants, dilute voting power of holders of

Common Shares and reduce the Company’s earnings per share.

Future issuances of equity securities by the Company could decrease the value of

any existing Common Shares and Warrants, dilute voting power of holders of Common Shares, reduce the Company’s earnings per share and make future sales of the Company’s equity securities more difficult. With any additional sale or issuance

of equity securities, holders of Common Shares will suffer dilution of their voting power and may experience dilution in the Company’s earnings per share. Sales of Common Shares by shareholders might also make it more difficult for the Company

to sell equity securities at a time and price that it deems appropriate.

The Company may issue additional equity securities (including through the sale

of securities convertible into, or exchangeable for, Common Shares) under the Company’s current equity incentive plans. In addition, the Company may issue Common Shares to finance its operations or future acquisitions. The Company cannot

predict the size of future sales and issuances of debt or equity securities or the effect, if any, that future sales and issuances of equity securities will have on the market price of the Common Shares and Warrants.

Sales or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing market prices

for the Common Shares and the Warrants.

S-15

The Common Share price has experienced volatility and may be subject to fluctuation in the future

based on market conditions, which could also affect the market price of the Warrants.

The market prices for the securities of cannabis companies,

including the Company, have historically been, and may in the future be, subject to large fluctuations. The market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of any

particular company. In addition, because of the nature of the Company’s business, certain factors such as announcements and the public’s reaction, the Company’s operating performance and the performance of competitors and other

similar companies, government regulations, changes in earnings estimates or recommendations by research analysts who track the Company’s securities or securities of other companies in the cannabis industry, general market conditions,

announcements relating to litigation, the arrival or departure of key personnel and the factors listed under the heading “Cautionary Note Regarding Forward-Looking Statements” can have an adverse impact on the market price of the

Common Shares and Warrants.

Any negative change in the public’s perception of the Company’s prospects could cause the price of the

Company’s securities, including the price of the Common Shares and Warrants, to decrease dramatically. Furthermore, any negative change in the public’s perception of the prospects of cannabis companies in general could depress the price of

the Company’s securities, including the price of the Common Shares and Warrants, regardless of the Company’s results. Following declines in the market price of a corporation’s securities, securities class-action litigation could be

instituted. Litigation of this type, if instituted, could result in substantial costs and a diversion of management’s attention and resources.

No public market for Warrants

There is currently

no market through which the Warrants may be sold and holders may not be able to resell the Warrants. There can be no assurance that a secondary market for trading in the Warrants will develop or that any secondary market which does develop will

continue and if it does develop, that it will be active. This may affect the pricing of the Warrants in the secondary market and the transparency and availability of tracing prices. Without an active market, the liquidity of the Warrants will be

limited and you may be unable to sell the Warrants at the prices desired or at all. The Warrants have an exercise price of U.S.$12.60 per Warrant Share (subject to adjustment in certain circumstances) and can be exercised at any time prior to the

Expiry Date. In the event the market price of the Common Shares does not exceed the exercise price of the Warrants during the period when the Warrants are exercisable, the Warrants may not have any value. Holders of the Warrants have no rights as

shareholders of the Company until they exercise the Warrants in accordance with their terms. Upon exercise of the Warrants, holders of the Warrant Shares deliverable on the exercise of such Warrants will be entitled to exercise the rights of a