Aterian, Inc. (Nasdaq: ATER) (“Aterian” or the

“Company”), a technology-enabled consumer products

company, today issued the following letter to shareholders from

Arturo Rodriguez, Chief Executive Officer, and the Company’s Board

of Directors.

Dear Fellow Shareholders:

While this is our first time writing to you

directly, you are always at the forefront of our minds.

Over the past 18 months, our team has undertaken

a comprehensive reassessment of nearly every facet of Aterian’s

business model as part of our turnaround strategy. This deep

evaluation of our brand portfolio, marketing strategies, inventory

management, marketplace operations, supply chain, and overall fixed

costs laid the foundation for the strategic initiatives we have

implemented. By successfully executing these changes, we have

focused, simplified, and stabilized the Company, positioning

Aterian to drive long-term shareholder value.

Although there is still work to be done, we

believe that 2025 marks the start of a new and promising chapter

for Aterian as we pivot from stabilizing our operations towards

sustainable growth.

2024: A Year of Achievement

2024 was a year of achievement as we delivered

on many of our key objectives which we announced in late 2023. We

streamlined our product portfolio to six highly regarded

foundational brands—Squatty Potty, hOmeLabs, PurSteam, Mueller

Living, Photo Paper Direct, and Healing Solutions—that deliver

quality, affordable products to consumers. We also simplified our

go-to-market and marketing strategies, improved efficiencies in our

marketplace account structures and our supply chain and

transitioned from an internally developed tech platform to a

best-in-class third-party model, thereby increasing our efficiency,

nimbleness, and cost savings. Additionally, we improved our working

capital profile by completing our inventory rightsizing and

renegotiating and extending our credit facility.

In late 2024, we launched several new products

under our PurSteam and Mueller Living brands, marking an exciting

return to our product development efforts. Organic product launches

remain an important component of our growth strategy, and we expect

to continue these efforts throughout 2025, with a focus on the

second half of the year.

We also continue to deliver on our commitment to

implementing an omnichannel sales approach to reach new consumers

and remain competitive in the ever-evolving e-commerce landscape.

In the fourth quarter of 2024, we began selling products from our

hOmeLabs, PurSteam, and Mueller Living brands on Target+, the

invitation-only online marketplace of Target Corporation, while

expanding product offerings of Squatty Potty on Target+. This

complements our established marketplace strength on Amazon.com,

Walmart.com, and Mercado Libre in Mexico, as well as our

direct-to-consumer websites. We also recently refreshed our

PurSteam and Mueller Living websites, modernizing them to match the

recent updates of those brands.

Our Efforts are Yielding Tangible

Results

Our progress was evident in our third quarter

2024 year to date financial results. When compared to the same

nine-month period in 2023, we generated significant improvements in

gross margin and contribution margin, and narrowed our net loss by

$56.3 million, or 84%.

We also reported positive adjusted EBITDA for

both the second and third quarters of 2024.

At September 30, 2024, our cash flow from

operations was $2.2 million, a $10.6 million improvement from the

same period in 2023, our credit facility balance declined by $4.4

million from December 31, 2023, and we had cash on hand of $16.1

million.

Fourth Quarter 2024 Preliminary

Results

This momentum carried into the final quarter of

the year. For the fourth quarter of 2024, we now expect to report

net revenue between $24.2 million and $25.0 million which is at the

higher end of our previous guidance of $22.5 million to $25.5

million. As previously disclosed, we continue to expect that this

level of revenue will produce approximately breakeven adjusted

EBITDA.

We expect that our cash position at December 31,

2024 will improve to approximately $18 million from $16.1 million

at September 30, 2024, while our credit facility balance is

expected to increase slightly from $6.7 million at September 30,

2024 to approximately $6.9 million at December 31, 2024.

Full Year 2025: From Stability to

Growth

Looking ahead to 2025, we are confident that

Aterian will evolve into a growth company, driven by our

omnichannel expansion initiatives, organic product launches, and a

commitment to prudent capital allocation strategies. In comparison

to 2024, we expect to produce higher revenue, along with continuing

improvements in operating efficiencies and adjusted EBITDA. More

importantly, we believe that our efforts to date have placed us

firmly on the path to producing these results on a sustainable

basis.

We believe we have taken a conservative approach

in our expectations for 2025 by considering both the potential

impact of increased tariffs on Chinese imports, and to a lesser

extent, those from Canada, as well as the proactive measures we

would implement to mitigate their effects. Our primary strategy to

offset these tariffs would be price adjustments on select products,

supplemented by additional cost-management initiatives, if deemed

necessary. As trade policies evolve, we will continue to monitor

developments and adjust our responses, as needed.

We are continuing our efforts to identify

product sourcing alternatives outside of China, wherever possible,

in response to the current uncertainty of U.S. trade policies. As

we navigate these challenges, we are fortunate to be supported by a

strong balance sheet that provides us with the flexibility to adapt

as needed while remaining focused on long-term growth and

profitability.

We look forward to providing additional clarity

on our plans and outlook for 2025 in connection with our fourth

quarter and full year financial results conference call scheduled

for mid-March, and keeping you apprised of material

developments.

Looking ahead, the strength of our brands, the

influence and accessibility provided by our marketplace

relationships, and our passionate, talented and tenacious people

will allow us to deliver on our mission to position Aterian to

deliver sustainable, long-term shareholder value. We remain

grateful for the continuing support of our shareholders. We hope

this is the beginning of more frequent communications as we share

in the excitement of Aterian's bright future.

Best regards,

Arturo RodriguezChief Executive Officer

About Aterian, Inc.Aterian,

Inc. (Nasdaq: ATER) is a technology-enabled consumer products

company that builds and acquires leading e-commerce brands with top

selling consumer products, in multiple categories, including home

and kitchen appliances, health and wellness and air quality

devices. The Company sells across the world's largest online

marketplaces with a focus on Amazon,Walmart and Target in the U.S.

and on its own direct to consumer websites. Our primary brands

include Squatty Potty, hOmeLabs, Mueller Living, PurSteam, Healing

Solutions and Photo Paper Direct. To learn more about Aterian and

its brands, visit aterian.io

Forward Looking StatementsAll

statements other than statements of historical facts included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future are forward-looking statements including, in particular,

regarding our expectations for growth in 2025, including our

omnichannel expansion initiatives, organic product launches and our

capital allocation strategies. These forward-looking statements are

based on management’s current expectations and beliefs and are

subject to a number of risks and uncertainties and other factors,

all of which are difficult to predict and many of which are beyond

our control and could cause actual results to differ materially and

adversely from those described in the forward-looking statements.

These risks include, but are not limited to, those related to our

ability to continue as a going concern, our ability to meet

financial covenants with our lenders, our ability to maintain and

to grow market share in existing and new product categories; our

ability to continue to profitably sell the SKUs we operate; our

ability to create operating leverage and efficiency when

integrating companies that we acquire, including through the use of

our team’s expertise, the economies of scale of our supply chain

and automation driven by our platform; those related to our ability

to grow internationally and through the launch of products under

our brands and the acquisition of additional brands; those related

to consumer demand, our cash flows, financial condition,

forecasting and revenue growth rate; our supply chain including

sourcing, manufacturing, warehousing and fulfillment; our ability

to manage expenses, working capital and capital expenditures

efficiently; our business model and our technology platform; our

ability to disrupt the consumer products industry; our ability to

generate profitability and stockholder value; international tariffs

and trade measures; inventory management, product liability claims,

recalls or other safety and regulatory concerns; reliance on third

party online marketplaces; seasonal and quarterly variations in our

revenue; acquisitions of other companies and technologies and our

ability to integrate such companies and technologies with our

business; our ability to continue to access debt and equity capital

(including on terms advantageous to the Company) and the extent of

our leverage; and other factors discussed in the “Risk Factors”

section of our most recent periodic reports filed with the

Securities and Exchange Commission (“SEC”), all of which you may

obtain for free on the SEC’s website at www.sec.gov.

Although we believe that the expectations

reflected in our forward-looking statements are reasonable, we do

not know whether our expectations will prove correct. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof, even if

subsequently made available by us on our website or otherwise. We

do not undertake any obligation to update, amend or clarify these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Contact: The Equity

Group

Devin SullivanManaging

Directordsullivan@equityny.com

Conor RodriguezAssociatecrodriguez@equityny.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/fac8af25-1eb0-4a9b-b114-ed58c424cb02

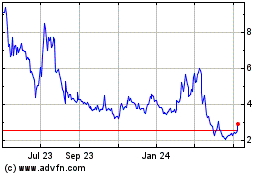

Aterian (NASDAQ:ATER)

Historical Stock Chart

From Feb 2025 to Mar 2025

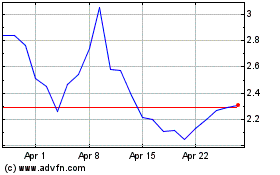

Aterian (NASDAQ:ATER)

Historical Stock Chart

From Mar 2024 to Mar 2025