AST SpaceMobile, Inc. (“AST SpaceMobile”) (NASDAQ: ASTS), the

company building the first and only space-based cellular broadband

network accessible directly by standard mobile phones, is providing

its business update for the three months and fiscal year ended

December 31, 2022.

“The testing to date for BlueWalker 3 continues to validate the

design roadmap for our BlueBird commercial satellites,” said Abel

Avellan, Chairman and Chief Executive Officer of AST SpaceMobile.

“As we plan for the commercialization of our service, we are

ramping the manufacturing of our Block 1 satellites and making key

investments for Block 2 satellites.”

Business Update

Update on BlueWalker 3

Activities

- Deployed the largest-ever commercial communications array in

low Earth orbit

- Proven ability to fly and control the fully deployed

communications array measuring 693 sq ft

- Testing has validated our architecture’s patented doppler and

delay compensation

- Initial test results indicate downlink signal strength

necessary to reach 5G cellular broadband speeds

Update on Block 1 BlueBird

Program

- Plan to launch five Block 1 BlueBird satellites in Q1 2024,

expected to provide initial, non-continuous space-based cellular

broadband services in select markets using low-band

frequencies

- Took significant steps to further industrialize our technology,

with in-house manufacturing of key components and electronics

- Secured launch services agreement for five Block 1 BlueBird

satellites on a Falcon 9 and in active discussions for subsequent

launches for Block 2 BlueBird satellites with various

providers

Commercialization and Regulatory

Progress

- Signed new MOUs (memoranda of understanding) with seven leading

mobile network operators since November 14, 2022, including Zain

KSA, Saudi Telecom, and others

- Announced plans to explore potential opportunities to jointly

market services and technologies to military and law enforcement

agencies with Fairwinds Technologies, a leading integrator for

defense and civilian agencies around the world

- Participated in initial FCC rulemaking related to Supplemental

Coverage from Space, which would allow satellite operators to

collaborate with terrestrial service providers to expand coverage

to terrestrial licensee subscribers

- Formalized the commitment with NASA to share information to

help safeguard low Earth Orbit, with the signing of a Space Act

Agreement

Fourth Quarter 2022 and Full Year 2022 Financial

Highlights

- Ended the fourth quarter with cash, cash equivalents, and

restricted cash of $239.3 million

- Total operating expenses increased by $0.5 million to $42.6

million for the fourth quarter of 2022, as compared to $42.1

million in the third quarter of 2022, due to a $1.1 million

increase in research and development costs and $1.5 million

increase in engineering services, offset by a $2.1 million decrease

in general and administrative costs

- Total operating expenses increased by $61.3 million to $152.9

million for the year ended December 31, 2022, as compared to $91.6

million for the year ended December 31, 2021

- As of December 31, 2022, the Company incurred $92.1 million of

capitalized costs (including launch costs and non-recurring

engineering costs) related to the assembly, testing and deployment

of the BlueWalker 3 test satellite

- As of December 31, 2022, the Company incurred approximately

$53.9 million of capitalized property and equipment costs related

to development of assembly, integration, and test facilities in

Texas, and purchase of satellite assembly equipment, satellite

direct materials and satellite antennas

- Completed the sale of 51% interest in NanoAvionika UAB ("Nano")

for net proceeds of $26.6 million in September 2022

- Issued shares of Class A common stock under various equity

programs and offerings for net proceeds of $102.0 million during

the year ended December 31, 2022

Conference Call Information

AST SpaceMobile will hold a quarterly business update conference

call at 8:00 a.m. (Eastern Time) on Friday, March 31, 2023. The

call will be accessible via a live webcast on the Events page of

AST SpaceMobile’s Investor Relations website at

https://ast-science.com/investors/. An archive of the webcast will

be available shortly after the call.

About AST SpaceMobile

AST SpaceMobile is building the first and only global cellular

broadband network in space to operate directly with standard,

unmodified mobile devices based on our extensive IP and patent

portfolio. Our engineers and space scientists are on a mission to

eliminate the connectivity gaps faced by today’s five billion

mobile subscribers and finally bring broadband to the billions who

remain unconnected. For more information, follow AST SpaceMobile on

YouTube, Twitter, LinkedIn and Facebook. Watch this video for an

overview of the SpaceMobile mission.

Forward-Looking Statements

This communication contains “forward-looking statements” that

are not historical facts, and involve risks and uncertainties that

could cause actual results of AST SpaceMobile to differ materially

from those expected and projected. These forward-looking statements

can be identified by the use of forward-looking terminology,

including the words “believes,” “estimates,” “anticipates,”

“expects,” “intends,” “plans,” “may,” “will,” “would,” “potential,”

“projects,” “predicts,” “continue,” or “should,” or, in each case,

their negative or other variations or comparable terminology.

These forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside AST SpaceMobile’s control and are difficult to predict.

Factors that may cause such differences include, but are not

limited to: (i) expectations regarding AST SpaceMobile’s strategies

and future financial performance, including AST’s future business

plans or objectives, expected functionality of the SpaceMobile

Service, anticipated timing and level of deployment of satellites,

anticipated demand and acceptance of mobile satellite services,

prospective performance and commercial opportunities and

competitors, the timing of obtaining regulatory approvals, ability

to finance its research and development activities, commercial

partnership acquisition and retention, products and services,

pricing, marketing plans, operating expenses, market trends,

revenues, liquidity, cash flows and uses of cash, capital

expenditures, and AST’s ability to invest in growth initiatives;

(ii) the negotiation of definitive agreements with mobile network

operators relating to the SpaceMobile service that would supersede

preliminary agreements and memoranda of understanding; (iii) the

ability of AST SpaceMobile to grow and manage growth profitably and

retain its key employees and AST SpaceMobile’s responses to actions

of its competitors and its ability to effectively compete; (iv)

changes in applicable laws or regulations; (v) the possibility that

AST SpaceMobile may be adversely affected by other economic,

business, and/or competitive factors; (vi) the outcome of any legal

proceedings that may be instituted against AST SpaceMobile; and

(vii) other risks and uncertainties indicated in the Company’s

filings with the SEC, including those in the Risk Factors section

of AST SpaceMobile’s Form 10-K filed with the SEC on March 31,

2023.

The planned testing of the BW3 test satellite may not be

completed due to a variety of factors, which could include loss of

satellite connectivity, destruction of the satellite, or other

communication failures, and even if completed as planned, the BW3

testing may indicate adjustments that are needed or modifications

that must be made, any of which could result in additional costs,

which could be material, and delays in commercializing our service.

If there are delays or issues with our testing, it may become more

costly to raise capital, if we are able to do so at all.

AST SpaceMobile cautions that the foregoing list of factors is

not exclusive. AST SpaceMobile cautions readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. For information identifying important factors

that could cause actual results to differ materially from those

anticipated in the forward-looking statements, please refer to the

Risk Factors incorporated by reference into AST SpaceMobile’s Form

10-K filed with the SEC on March 31, 2023. AST SpaceMobile’s

securities filings can be accessed on the EDGAR section of the

SEC’s website at www.sec.gov. Except as expressly required by

applicable securities law, AST SpaceMobile disclaims any intention

or obligation to update or revise any forward-looking statements

whether as a result of new information, future events or

otherwise.

Fourth Quarter and Fiscal Year 2022 Financial Results

AST SPACEMOBILE, INC.

CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except

share data)

December 31,

2022

2021

ASSETS

Current assets:

Cash and cash equivalents

$

238,588

$

321,787

Restricted cash

668

2,750

Accounts receivable

-

2,173

Inventories

-

1,412

Prepaid expenses

4,100

2,831

Other current assets

24,954

4,850

Total current assets

268,310

335,803

Property and equipment:

BlueWalker 3 satellite - construction in

progress

92,077

67,615

Property and equipment, net

53,912

28,327

Total property and equipment,

net

145,989

95,942

Other non-current assets:

Operating lease right-of-use assets,

net

7,671

7,991

Goodwill

-

3,641

Other non-current assets

16,402

559

Total other non-current assets

24,073

12,191

TOTAL ASSETS

$

438,372

$

443,936

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

13,929

$

6,638

Accrued expenses and other current

liabilities

13,145

7,469

Deferred revenue

-

6,636

Current operating lease liabilities

722

634

Total current liabilities

27,796

21,377

Warrant liabilities

38,946

58,062

Non-current operating lease

liabilities

7,046

7,525

Long-term debt

4,758

5,000

Total liabilities

78,546

91,964

Commitments and contingencies

Stockholders' Equity:

Class A Common Stock, $.0001 par value,

800,000,000 shares authorized, 71,819,926 and 51,730,904 shares

issued and outstanding as of December 31, 2022 and 2021,

respectively.

7

5

Class B Common Stock, $.0001 par value,

200,000,000 shares authorized, 50,041,757 and 51,636,922 shares

issued and outstanding as of December 31, 2022 and 2021,

respectively.

5

5

Class C Common Stock, $.0001 par value,

125,000,000 shares authorized, 78,163,078 shares issued and

outstanding as of December 31, 2022 and 2021, respectively.

8

8

Additional paid-in capital

235,384

171,155

Accumulated other comprehensive income

(loss)

229

(433

)

Accumulated deficit

(102,101

)

(70,461

)

Noncontrolling interest

226,294

251,693

Total stockholders' equity

359,826

351,972

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

438,372

$

443,936

AST SPACEMOBILE, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in thousands, except

share and per share data)

Year Ended December

31,

2022

2021

Revenues

$

13,825

$

12,405

Cost of sales (exclusive of items shown

separately below)

6,714

7,563

Gross profit

7,111

4,842

Operating expenses:

Engineering services

54,212

29,599

General and administrative costs

48,332

35,636

Research and development costs

45,620

23,440

Depreciation and amortization

4,711

2,913

Total operating expenses

152,875

91,588

Other income:

Gain on remeasurement of warrant

liabilities

19,114

15,766

Other income (expense), net

24,154

(1,950

)

Total other income, net

43,268

13,816

Loss before income tax expense

(102,496

)

(72,930

)

Income tax expense

617

331

Net loss before allocation to

noncontrolling interest

(103,113

)

(73,261

)

Net loss attributable to noncontrolling

interest

(71,473

)

(42,708

)

Net loss attributable to common

stockholders

$

(31,640

)

$

(30,553

)

Net loss per share attributable to holders

of Class A Common Stock (1)

Basic and diluted

$

(0.58

)

$

(0.37

)

Weighted average shares of Class A Common

Stock outstanding (1)

Basic and diluted

54,437,073

51,729,785

(1)

Net loss per share information for the year ended December 31, 2021

did not include the loss prior to the date of Business Combination.

AST SPACEMOBILE, INC.

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(Dollars in thousands)

Year Ended December

31,

2022

2021

Net loss before allocation to

noncontrolling interest

$

(103,113

)

$

(73,261

)

Other comprehensive loss

Foreign currency translation

adjustments

(295

)

(666

)

Total other comprehensive loss

(295

)

(666

)

Total comprehensive loss before allocation

to noncontrolling interest

(103,408

)

(73,927

)

Comprehensive loss attributable to

noncontrolling interest

(71,704

)

(43,109

)

Comprehensive loss attributable to common

stockholders

$

(31,704

)

$

(30,818

)

AST SPACEMOBILE, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

(Dollars in thousands, except

share and per share data)

For the Three Months Ended

December 31,

2022

2021

Revenues

$

-

$

6,220

Cost of sales (exclusive of items shown

separately below)

-

3,441

Gross profit

-

2,779

Operating expenses:

Engineering services

16,004

10,842

General and administrative costs

10,698

11,605

Research and development costs

14,651

7,949

Depreciation and amortization

1,254

864

Total operating expenses

42,607

31,260

Other income:

Gain on remeasurement of warrant

liabilities

17,445

18,042

Other expense, net

(57

)

(2,106

)

Total other income, net

17,388

15,936

Loss before income tax expense

(25,219

)

(12,545

)

Income tax (benefit) expense

(130

)

258

Net loss before allocation to

noncontrolling interest

(25,089

)

(12,803

)

Net loss attributable to noncontrolling

interest

(16,860

)

(9,693

)

Net loss attributable to common

stockholders

$

(8,229

)

$

(3,110

)

Net loss per share attributable to holders

of Class A Common Stock

Basic and diluted

$

(0.14

)

$

(0.06

)

Weighted average shares of Class A Common

Stock outstanding

Basic and diluted

60,799,275

51,729,943

AST SPACEMOBILE, INC.

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(Dollars in thousands)

For the Three Months Ended

December 31,

2022

2021

Net loss before allocation to

noncontrolling interest

$

(25,089

)

$

(12,803

)

Other comprehensive income (loss)

Foreign currency translation

adjustments

1,570

(172

)

Total other comprehensive income

(loss)

1,570

(172

)

Total comprehensive loss before allocation

to noncontrolling interest

(23,519

)

(12,975

)

Comprehensive loss attributable to

noncontrolling interest

(15,789

)

(9,826

)

Comprehensive loss attributable to common

stockholders

$

(7,730

)

$

(3,149

)

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Dollars in thousands)

Years Ended December

31,

2022

2021

Cash flows from operating activities:

Net loss before allocation to

noncontrolling interest

$

(103,113

)

$

(73,261

)

Adjustments to reconcile net loss before

noncontrolling interest to cash used in operating activities:

Gain on sale of interest in NanoAvionika

UAB

(24,542

)

-

Depreciation and amortization

4,711

2,913

Gain on remeasurement of warrant

liabilities

(19,114

)

(15,766

)

Loss on sale of Property and equipment

305

-

Non-cash lease expense

720

574

Stock-based compensation

9,391

3,736

Issuance of common stock for commitment

shares

332

-

Changes in operating assets and

liabilities:

Accounts receivable

(1,993

)

(220

)

Prepaid expenses and other current

assets

(24,588

)

(4,216

)

Inventory

(2,461

)

1,039

Accounts payable and accrued expenses

18,438

2,091

Operating lease liabilities

(680

)

(398

)

Deferred revenue

2,395

3,572

Other assets and liabilities

(16,265

)

(159

)

Net cash used in operating activities

(156,464

)

(80,095

)

Cash flows from investing activities:

Purchase of property and equipment

(30,317

)

(15,080

)

BlueWalker 3 satellite - construction in

process

(26,967

)

(39,712

)

Proceeds from sale of Nano, net of cash

deconsolidated and transaction costs

25,932

-

Net cash used in investing activities

(31,352

)

(54,792

)

Cash flows from financing activities:

Proceeds from issuance of common stock

102,023

-

Proceeds from Business Combination

-

456,420

Direct costs incurred for the Business

Combination

-

(39,542

)

Issuance of incentive equity units under

employee stock plan

73

-

Proceeds from warrant exercises

14

14

Proceeds from debt

230

49

Net cash provided by financing

activities

102,340

416,941

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

195

(294

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(85,281

)

281,760

Cash, cash equivalents and restricted

cash, beginning of period

324,537

42,777

Cash, cash equivalents and restricted

cash, end of period

$

239,256

$

324,537

Supplemental disclosure of cash flow

information:

Non-cash transactions:

Purchases of construction in process in

accounts payable and accrued expenses

$

4,670

$

3,265

Purchases of property and equipment in

accounts payable and accrued expenses

256

1,429

Right-of-use assets obtained in exchange

for operating lease liabilities

1,129

1,557

Purchases of property and equipment using

proceeds from long-term debt

-

5,000

Cash paid during the fiscal year for:

Interest

$

224

$

13

Income taxes, net

684

186

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230330005877/en/

Investors: Scott Wisniewski investors@ast-science.com

Media: Brandyn Bissinger press@ast-science.com +1 866 845

6521

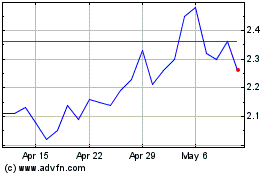

AST SpaceMobile (NASDAQ:ASTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

AST SpaceMobile (NASDAQ:ASTS)

Historical Stock Chart

From Apr 2023 to Apr 2024