Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-268087

PROSPECTUS

SUPPLEMENT

(To Prospectus dated October 31, 2022)

AST

SPACEMOBILE, INC.

$75,000,002

13,636,364 Shares

of Class A Common Stock

We

are offering 13,636,364 shares of our Class A common stock, par value $0.0001 per share

(“Class A Common Stock”) at a public offering price of $5.50 per share.

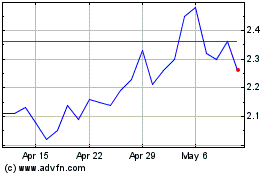

Our

Class A Common Stock is listed on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “ASTS”. On November

29, 2022, the closing price of our Class A Common Stock was $6.34 per share.

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading

“Risk Factors” beginning on page S-6 of this prospectus supplement, and under similar headings in other documents

filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion

of the factors you should carefully consider before deciding to invest in our securities.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 5.50 | | |

$ | 75,000,002 | |

| Underwriting discounts and commissions(1) | |

$ | 0.385 | | |

$ | 5,250,000 | |

| Proceeds before expenses | |

$ | 5.115 | | |

$ | 69,750,002 | |

(1) We have agreed to reimburse the underwriters

for certain expenses in connection with this offering. See “Underwriting.”

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined

if this prospectus supplement or the accompanying prospectus is accurate, truthful or complete. Any representation to the contrary is

a criminal offense.

We

have granted the underwriters an option to purchase up to an additional 2,045,454 shares of Class A Common Stock from us at the public

offering price, less the underwriting discounts and commissions, within 30 days of this prospectus supplement solely to cover overallotments,

if any.

The

underwriters expect to deliver the Class A Common Stock to investors on or about December 2, 2022, subject to customary closing conditions.

Sole

Book-Running Manager

B.

Riley Securities

The

date of this prospectus supplement is November 29, 2022.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. No one has been authorized

to provide you with information that is different from that contained in this prospectus supplement and the accompanying prospectus.

This prospectus supplement is dated as of the date set forth on the cover hereof. You should not assume that the information contained

in this prospectus supplement is accurate as of any date other than that date.

TRADEMARKS

This

document contains references to trademarks and service marks belonging to us or to other entities. Solely for convenience, trademarks

and trade names referred to in this prospectus supplement and the accompanying prospectus may appear without the ® or ™ symbols,

but such references are not intended to indicate, in any way, that we or the applicable licensor will not assert, to the fullest extent

under applicable law, rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade

names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CERTAIN

DEFINED TERMS

Unless

the context otherwise requires, references in this prospectus supplement to:

| ● | “A&R

Operating Agreement” refers to that certain Fifth Amended and Restated Limited Liability

Company Operating Agreement of AST LLC. |

| | | |

| ● | “AST

LLC” refers to AST & Science, LLC, a Delaware limited liability corporation. |

| | | |

| ● | “AST

LLC Common Unit” means a unit of ownership interest in AST LLC, which entitles the

holder thereof to the distributions, allocations and other rights under the A&R Operating

Agreement. |

| | | |

| ● | “Board

of Directors” refers to our board of directors. |

| | | |

| ● | “Business

Combination” refers to the transactions contemplated by the Equity Purchase Agreement. |

| | | |

| ● | “Bylaws”

refers to our Amended and Restated Bylaws. |

| | | |

| ● | “Charter”

refers to our Second Amended and Restated Certificate of Incorporation. |

| | | |

| ● | “Class

A Common Stock” means the shares of class A common stock, par value $0.0001 per share,

of the Company. |

| | | |

| ● | “Class

B Common Stock” means the shares of class B common stock, par value $0.0001 per share,

of the Company. |

| | | |

| ● | “Class

C Common Stock” means the shares of class C common stock, par value $0.0001 per share,

of the Company. |

| | | |

| ● | “Common

Stock” refers collectively to Class A Common Stock, Class B Common Stock and Class

C Common Stock. |

| | | |

| ● | “Common

Stock Purchase Agreement” refers to that certain Common Stock Purchase Agreement, dated

May 6, 2022, by and between the Company and B. Riley Principal Capital, LLC, related

to the sale from time to time of up to $75,000,000 of shares of Class A Common Stock. |

| | | |

| ● | “Equity

Distribution Agreement” means that certain Equity Distribution Agreement, dated as

of September 8, 2022, by and among the Company, AST LLC, Evercore Group L.L.C. and B. Riley

Securities, Inc. relating to the sale from time to time of up to $150,000,000 of shares of

Class A Common Stock under the Company’s at-the-market offering program. |

| | | |

| ● | “Exchange

Act” refers to the Securities Exchange Act of 1934, as amended. |

| | | |

| ● | “IoT”

refers to internet of things. |

| | | |

| ● | “LEO”

refers to Low-Earth orbit. |

| | | |

| ● | “Public

Warrants” refers to the warrants sold by the Company as part of the units in its initial

public offering and any additional warrants issued pursuant to the Warrant Agreement that

trade with the outstanding public warrants. |

| | | |

| ● | “Securities

Act” refers to the Securities Act of 1933, as amended. |

| | | |

| ● | “SpaceMobile

Service” refers to the global direct mobile broadband network that is expected to provide

connectivity to any standard, unmodified, off-the-shelf mobile phone or 2G/3G/4G LTE/5G and

IoT enabled device from the Company’s satellite network. |

| | | |

| ● | “underwriters”

refers to B. Riley Securities, Inc. |

| | | |

| ● | “Underwriting

Agreement” refers to that certain Underwriting Agreement, dated as of November 29, 2022, by and among the Company, AST LLC and

the underwriters. |

| | | |

| ● | “2G,”

“3G” and “5G” each refer to generations of mobile technology. |

| | | |

| ● | “4G

LTE” refers to fourth generation long-term evolution. |

Additionally,

references in this prospectus supplement to “SpaceMobile,” the “Company,” the “registrant,” “we,”

“us” and “our” in this prospectus supplement refer to AST SpaceMobile, Inc. (formerly known as New Providence

Acquisition Corp.), and references to our “management” or our “management team” refer to our officers and directors.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this

offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may

add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement or the accompanying prospectus. By using a shelf registration statement, we may offer the shares of our Class A Common Stock

under this prospectus supplement at prices and on terms to be determined by market conditions at the time of offering. If information

in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was

filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus supplement,

the accompanying prospectus and the documents incorporated into each by reference include important information about us, the securities

being offered and other information you should know before investing in our securities. You should also read and consider information

in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find More Information;

Incorporation of Documents by Reference.”

In

deciding whether or not to invest in our securities, you should rely only on the information contained in, and incorporated by reference

into, this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information

or to make any representation other than those contained in, and incorporated by reference into, this prospectus supplement and the accompanying

prospectus. If anyone provides you with different or inconsistent information or representation, you should not rely on them. This prospectus

supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy our securities in

any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference is accurate only as of their respective dates, regardless

of the time of delivery of this prospectus supplement, the accompanying prospectus or any sale of our securities. Our business, financial

condition, results of operations and prospects may have changed materially since those dates.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of

the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and

should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were

accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our business, financial condition, results of operations or prospects.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus supplement and the accompanying prospectus may constitute “forward-looking statements” for

purposes of the federal securities laws. Forward-looking statements include, but are not limited to, statements regarding our expectations,

hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Words such

as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek”

and variations and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus supplement and the accompanying

prospectus may include, for example, statements about:

| ● | our

strategies and future financial performance, including our business plans or objectives,

products and services, pricing, marketing plans, operating expenses, market trends, revenues,

liquidity, cash flows, uses of cash and capital expenditures; |

| | | |

| ● | expected

functionality of the SpaceMobile Service; |

| | | |

| ● | the

timing and results of ongoing testing on our BlueWalker 3 test satellite; |

| | | |

| ● | anticipated

timing and level of deployment of satellites and anticipated developments in technology included

in our satellites; |

| | | |

| ● | anticipated

demand and acceptance of mobile satellite services; |

| | | |

| ● | anticipated

costs necessary to execute on our business plan, which costs are preliminary estimates and

are subject to change based upon a variety of factors, including but not limited to our success

in deploying and testing our constellation of satellites; |

| | | |

| ● | prospective

performance and commercial opportunities and competitors; |

| | | |

| ● | our

ability to finance our operations and research and development activities; |

| | | |

| ● | commercial

partnership acquisition and retention; |

| | | |

| ● | the

negotiation of definitive agreements with mobile network operators relating to the SpaceMobile

Service that would supersede preliminary agreements and memoranda of understanding; |

| | | |

| ● | our

success in retaining or recruiting, or changes required in, our officers, key employees or

directors; |

| | | |

| ● | our

expansion plans and opportunities, including the size of our addressable market; |

| | | |

| ● | our

ability to comply with domestic and foreign regulatory regimes and the timing of obtaining

regulatory approvals; |

| | | |

| ● | changes

in applicable laws or regulations; |

| | | |

| ● | our

ability to invest in growth initiatives and enter into new geographic markets; |

| | | |

| ● | the

impact of the novel coronavirus (“COVID-19”) pandemic; |

| | | |

| ● | the

possibility we may be adversely affected by other economic, business, and/or competitive

factors; |

| | | |

| ● | the

outcome of any legal proceedings that may be instituted against us; |

| | | |

| ● | our

ability to deal appropriately with conflicts of interest in the ordinary course of our business;

and |

| | | |

| ● | other

factors detailed under the section entitled “Risk Factors” in this prospectus

supplement and in the documents incorporated by reference herein. |

These

forward-looking statements are based on information available as of the date of this prospectus supplement and the accompanying prospectus

and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking

statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update

forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information,

future events or otherwise, except as may be required under applicable securities laws.

As

a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from

those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary does not contain all of the information that you should consider before investing in our securities offered by this prospectus

supplement. Before making an investment decision, you should carefully read the entire prospectus supplement and the accompanying prospectus,

including the “Risk Factors” sections, as well as our financial statements, including the accompanying notes, and the other

information incorporated by reference herein.

Our

Company

We

are building what we believe is the first space-based cellular broadband network designed to be accessible by standard unmodified mobile

phones. Our SpaceMobile Service is being designed to provide cost-effective, high-speed mobile broadband services with global coverage

to all end-users, regardless of where they live or work, without the need to purchase special equipment. We believe the SpaceMobile Service

would be the first global direct mobile broadband network using LEO satellites to provide connectivity to any standard, unmodified, off-the-shelf

mobile phone or 2G/3G/4G LTE/5G and IoT-enabled device. We intend to work with mobile network operators (“MNOs”) to offer

the SpaceMobile Service to the MNOs’ end-user customers. Our vision is that users will not need to subscribe to the SpaceMobile

Service directly with us, nor will they need to purchase any new or additional equipment. Instead, users will be able to access the SpaceMobile

Service when prompted on their mobile device that they are no longer within range of the land-based facilities of the MNO operator or

will be able to purchase a plan directly with their existing mobile provider.

The

SpaceMobile Service currently is planned to be provided through a network of 168 high-powered, large phased-array satellites in LEO.

We intend for worldwide mobile traffic subscribing to the SpaceMobile Service to be directed by the SpaceMobile constellation to terrestrial

gateways via high-throughput Q/V-band links and then directed to the in-country MNO’s core cellular network infrastructure, located

at our dedicated gateways. Our intent is that users will be able to connect to the SpaceMobile Service as if they were using a local

cell tower, with less communication delay effects than existing geostationary satellite communication systems experience.

Background

On

April 6, 2021, we completed the Business Combination with New Providence Acquisition Corp. (“NPA”), under which NPA was renamed

“AST SpaceMobile, Inc.,” and we were organized as an umbrella partnership-C corporation (“Up-C”) structure. As

a result of our Up-C structure, we are a holding company and, accordingly, all the business of AST LLC is held directly by AST LLC, of

which we are the Managing Member, and our only direct asset consists of the AST LLC Common Units. As the Managing Member of AST LLC,

we have full, exclusive and complete discretion to manage and control the business of AST LLC and to take all action we deem necessary,

appropriate, advisable, incidental or convenient to accomplish the purposes of AST LLC set forth in the A&R Operating Agreement,

and, accordingly, we present our financial statements on a consolidated basis with AST LLC for all periods following the Business Combination.

As of the open of trading on April 7, 2021, the Class A Common Stock and Public Warrants of AST SpaceMobile, formerly those of NPA, began

trading on Nasdaq as “ASTS” and “ASTSW,” respectively.

Corporate

Information

Our

principal executive offices are located at Midland International Air & Space Port, 2901 Enterprise Lane, Midland, Texas 79706, and

our telephone number is (432) 276-3966. Our website address is www.ast-science.com. Information contained on our website is not

a part of this prospectus supplement, and the inclusion of our website address in this prospectus is an inactive textual reference only.

THE

OFFERING

| Shares

Offered by Us |

|

13,636,364 shares

of our Class A Common Stock. |

| |

|

|

| Underwriters’

Option to Purchase Additional Shares |

|

We

have granted the underwriters an option to purchase up to an additional 2,045,454 shares of Class A Common Stock from us at the

public offering price, less the underwriting discounts and commissions, within 30 days of this prospectus supplement solely to cover

overallotments, if any. |

| |

|

|

| Shares

of Class A Common Stock Outstanding Immediately Prior to This Offering |

|

57,574,126

shares.

The

number of shares does not reflect our Class B Common Stock and Class C Common Stock or any shares of Class A Common Stock that may

be issued from time to time under the Common Stock Purchase Agreement or the Equity Distribution Agreement after the date of this

prospectus supplement. As of November 29, 2022, 50,636,922 shares of our Class B Common Stock and 78,163,078 shares of our Class

C Common Stock were issued and outstanding. |

| |

|

|

| Shares

of Class A Common Stock Outstanding Immediately Following This Offering |

|

71,210,490 shares (or 73,255,944 shares if

the underwriters exercise their option to purchase additional shares in full).

The

number of shares does not reflect our Class B Common Stock and Class C Common Stock or any shares of Class A Common Stock that may

be issued from time to time under the Common Stock Purchase Agreement or the Equity Distribution Agreement after the date of this

prospectus supplement. As of November 29, 2022, 50,636,922 shares of our Class B Common Stock and 78,163,078 shares of

our Class C Common Stock were issued and outstanding. |

| |

|

|

| Voting |

|

Under

our Charter, holders of Class A Common Stock, Class B Common Stock and Class C Common Stock will vote together as a single class

on all matters submitted to the stockholders for their vote or approval, except as required by applicable law. Holders of Class A

Common Stock and Class B Common Stock are entitled to one vote per share on all matters submitted to the stockholders for their vote

or approval. Prior to the Sunset Date, as defined in the Stockholders’ Agreement, the holders of Class C Common Stock are entitled

to the lesser of (i) 10 votes per share and (ii) the Class C Share Voting Amount on all matters submitted to stockholders for their

vote or approval. See “Description of Securities” in the prospectus for more information. |

| Use

of Proceeds |

|

We

intend to use the net proceeds from the sale of shares of our Class A Common Stock for general corporate purposes. Our management

will retain broad discretion over the allocation of the net proceeds from the sale of the shares of Class A Common Stock offered

by this prospectus supplement. See “Use of Proceeds.” |

| |

|

|

| Risk

Factors |

|

See

the section titled “Risk Factors” in this prospectus supplement and the accompanying prospectus and in the documents

incorporated herein by reference for a discussion of certain factors you should carefully consider before deciding to invest in our

securities. |

| |

|

|

| Market

for Class A Common Stock |

|

Our

Class A Common Stock is currently traded on the Nasdaq Global Select Market under the symbol “ASTS.”

Share

totals do not reflect 10,800,000 shares of Class A Common Stock that may be issued pursuant to the SpaceMobile 2020 Incentive Award

Plan. Share totals also do not reflect shares of Class A Common Stock underlying the 128,800,000 AST LLC Common Units, which are

redeemable into either shares of Class A Common Stock on a one-for-one basis or cash at the option of the Redemption Election Committee.

Upon redemption of any number of AST LLC Common Units by a holder, a corresponding number of shares of Class B Common Stock or Class

C Common Stock held by such redeeming holder will be cancelled. Share totals also do not reflect 17,597,600 shares of Class A Common

Stock underlying the Company’s outstanding Public Warrants and Private Placement Warrants. |

Except

as otherwise indicated, the information in this prospectus reflects or assumes the following:

| ● | no

exercise of Public Warrants or Private Placement Warrants outstanding as of November 29,

2022, and |

| | | |

| ● | no

exercise by the underwriters of their option to purchase up to an additional 2,045,454

shares of Class A Common Stock in this offering. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before purchasing any of our securities, you should carefully consider the risks described

below, as well as any amendment, supplement or update to the risk factors reflected in subsequent filings with the SEC, which are incorporated

by reference into this prospectus supplement, and all of the other information contained in this prospectus supplement and the accompanying

prospectus and incorporated by reference into this prospectus supplement and the accompanying prospectus. You should carefully review

and consider the risks and uncertainties described in the section entitled “Risk Factors” in our annual report on Form 10-K

for the year ended December 31, 2021, filed with the SEC on March 31, 2022, as supplemented and modified by the information below. These

risks and uncertainties are not the only ones facing us. Additional risks and uncertainties that we are unaware of, or that we currently

deem immaterial, also may become important factors that affect us. If any of such risks or the risks described below or in our SEC filings

occur, our business, financial condition, results of operations or prospects could be materially and adversely affected. In that case,

the trading price of our securities could decline, and you may lose some or all of your investment.

Risks

Related to this Offering

We

have broad discretion in how we use the net proceeds from this offering, and we may not use these proceeds effectively or in ways with

which you agree.

We

have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Our management will have

broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated

at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the

net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our

Class A Common Stock. See “Use of Proceeds” in this prospectus supplement for a more detailed information.

Because

the public offering price of our Class A Common Stock sold in this offering will be higher than the net tangible book value per share

of our outstanding Class A Common Stock following this offering, new investors will experience immediate and substantial dilution.

The

public offering price of our Class A Common Stock sold in this offering will be higher than the net tangible book value per share of

our Class A Common Stock immediately following this offering based on the total value of our tangible assets less our total liabilities.

Therefore, if you purchase shares of our Class A Common Stock in this offering, you will experience immediate and substantial dilution.

See the section of this prospectus entitled “Dilution.”

We

require substantial amounts of capital, and we expect such requirements will increase in the future. As a result, you may experience

future dilution as a result of future equity offerings and such dilution may be substantial.

In

order to execute our business plans, we will need a significant amount of capital. We will incur significant expenses and capital expenditures

in the near term and in the future to further our business plan and develop the SpaceMobile Service, including expenses to:

| ● | design,

develop, assemble and launch our satellites; |

| | | |

| ● | design

and develop the components of the SpaceMobile Service; |

| | | |

| ● | conduct

research and development; |

| | | |

| ● | purchase

raw materials and components; |

| | | |

| ● | launch

and test our systems; |

| ● | expand

our design, development, maintenance and repair capabilities; and |

| | | |

| ● | increase

our general and administrative functions to support our growing operations. |

Because

we will incur much of the costs and expenses from these efforts before we receive any revenues with respect thereto, our losses in future

periods will be significant. Also, we have in the past and may in the future find that these efforts are more expensive than we currently

anticipate, as our business plan is dependent upon our ability to successfully launch satellites and build the SpaceMobile Service, but

also to control costs. Design, manufacture and launch of satellite systems are highly complex and historically have been subject to frequent

delays and cost over-runs. The nature of our business thus requires us to regularly reevaluate our business plans and forecasts, and

any prior projections should be disregarded unless otherwise indicated. Given the novelty of our business, there is no guarantee that

our capital needs will not increase, and such increases may be substantial.

We

expect to raise additional funds through the issuance of equity, equity related or debt securities, or through obtaining credit from

government or financial institutions or commercial partners, although our ability, if any, to access the capital markets during this

period of volatility may require us to modify our current expectations. We are in discussions with various financing sources to enhance

liquidity. We may in the future offer additional shares of our Class A Common Stock or other securities convertible into or exchangeable

for our Class A Common Stock at prices that may not be the same as the price per share in this offering, including under the Common Stock

Purchase Agreement and Equity Distribution Agreement (to date, we have sold an aggregate of 4,454,084 shares of Class A Common

Stock for aggregate net proceeds of approximately $34.4 million under such programs). We may sell shares or other securities in any

other offering at a price per share that is less than the price per share paid by any investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our Class A Common Stock, or securities convertible or exchangeable into Class A Common Stock, in future transactions may be

higher or lower than the price per share paid by any investors in this offering. We may also issue equity to companies that we partner

with in certain circumstances. Given the substantial capital needs of our business and business plans, any such dilution may be substantial.

Exercise

of outstanding Public Warrants and/or Private Placement Warrants to purchase our Class A Common Stock will result in dilution to our

stockholders.

As

of September 30, 2022, there were 11,547,600 Public Warrants and 6,050,000 Private Placement Warrants outstanding to purchase 17,597,600

shares of our Class A Common Stock, which may be exercised at any time. To the extent any of our warrants are exercised, additional shares

of our Class A Common Stock will be issued, which will result in dilution to the holders of our Class A Common Stock and increase the

number of shares eligible for resale in the public market. Sales of substantial numbers of such shares in the public market or the fact

that such warrants may be exercised could adversely affect the market price of our Class A Common Stock.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering after deducting estimated underwriters’ fees and offering expenses will be

approximately $68.8 million, or approximately $79.2 million if the underwriters

exercise their overallotment option in full.

We

expect to use the proceeds that we receive from this offering for general corporate purposes. As of the date of this prospectus supplement,

we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate to those uses, for any net proceeds

we receive. Accordingly, we will retain broad discretion over the use of these proceeds.

DILUTION

If

you invest in our securities in this offering, your ownership interest will be diluted to the extent of the difference between the public

offering price per share of our Class A Common Stock and the as-adjusted net tangible book value per share of our Class A Common Stock

immediately after this offering. Such calculation does not reflect any dilution associated with exercise of our outstanding warrants,

which could cause the actual dilution to the public stockholders to be higher, particularly where a cashless exercise is utilized. As

of September 30, 2022, our net tangible book value was $296.7 million, or $5.46 per share of Class A Common Stock. We calculate net tangible

book value per share by dividing our net tangible assets (total tangible assets less total liabilities) by the number of outstanding

shares of our Class A Common Stock.

After

giving effect to the sale by us of shares of our Class A Common Stock in this offering at the public offering price of $5.50 per

share, after deducting the underwriting discount and estimated offering expenses payable by us in connection with this offering, our

adjusted net tangible book value as of September 30, 2022 would have been approximately $365.4 million, or $5.37 per share of Class

A Common Stock. This amount represents an immediate decrease in net tangible book value of $0.09 per share of our Class A Common

Stock to existing stockholders and an immediate dilution of $0.13 per share of our Class A Common

Stock to purchasers in this offering. The following table illustrates the dilution on a per share basis to new investors

participating in this offering:

| Public offering price per share of Class A Common Stock | |

| | | |

$ | 5.50 | |

| Net tangible book value per share as of September 30, 2022 | |

$ | 5.46 | | |

| | |

| Decrease per share attributable to new investors in this offering | |

$ | (0.09) | | |

| | |

| As adjusted net tangible book value per share as of September 30, 2022 after giving effect to this offering | |

| | | |

$ | 5.37 | |

| Dilution per share of Class A Common Stock to new investors in this offering | |

| | | |

$ | 0.13 | |

If

the underwriters exercise their option to purchase an additional 2,045,454 shares of Class A Common Stock in full, the

as-adjusted net tangible book value per share of our Class A Common Stock immediately after this offering would be

$5.37 per share, and the dilution in net tangible book value per share to new investors in this

offering would be $0.13 per share of Class A Common Stock, based on the public offering price of

$5.50 per share of Class A Common Stock, after deducting the underwriting

discount and estimated offering expenses payable by us in connection with this offering.

If

the underwriters exercise their option to purchase additional shares of Class A Common Stock, the number of shares of Class A Common

Stock held by new investors will increase to 15,681,818, or approximately 21.4% percent, of the total number of shares of our Class

A Common Stock outstanding after this offering.

The

number of shares of our Class A Common Stock expected to be outstanding immediately after this offering included in the table above

is based on 54,369,296 shares of our Class A Common Stock, reflective of the number of shares of our Class A Common Stock

outstanding as of September 30, 2022, and does not reflect issuances subsequent to September 30, 2022, the last date for which

financial statements of the Company are available, including the issuance of 2,175,040 shares of our Class A Common Stock under the

Equity Distribution Agreement. No shares were issued under the Common Stock Purchase Agreement subsequent to September 30, 2022.

Share totals also do not reflect 10,800,000 shares of Class A Common Stock that may be issued pursuant to the SpaceMobile

2020 Incentive Award Plan, shares of Class A Common Stock underlying the 128,800,000 AST LLC Common Units and the shares of Class A

Common Stock that may be issued in connection with the vesting and conversion of Equity Incentive Units, each of which are

redeemable into either shares of Class A Common Stock on a one-for-one basis or cash at the option of the Redemption Election

Committee, or 17,597,600 shares of Class A Common Stock underlying the Company’s outstanding Public Warrants and Private

Placement Warrants.

DIVIDEND

POLICY

We

have not declared or paid any dividends on our Common Stock to date. We do not currently intend to pay any dividends in the foreseeable

future. We expect to retain future earnings, if any, to fund the development and growth of our business. Any future determination relating

to dividend policy will be made at the discretion of our Board of Directors and will depend on a number of factors, including our future

earnings, capital requirements, financial condition, prospects and other factors that our Board of Directors may deem relevant.

MATERIAL

UNITED STATES TAX CONSEQUENCES

TO NON-U.S. HOLDERS OF CLASS A COMMON STOCK

This

section summarizes certain United States federal income and estate tax consequences of the ownership and disposition of Class A Common

Stock by a non-U.S. holder. You are a non-U.S. holder if you are, for United States federal income tax purposes:

| ● | a

nonresident alien individual, |

| | | |

| ● | a

foreign corporation, or |

| | | |

| ● | an

estate or trust that in either case is not subject to United States federal income tax on

a net income basis on income or gain from Class A Common Stock. |

This

section does not consider the specific facts and circumstances that may be relevant to a particular non-U.S. holder and does not address

the treatment of a non-U.S. holder under the laws of any state, local or foreign taxing jurisdiction. This section is based on the tax

laws of the United States, including the Internal Revenue Code of 1986, as amended (the “Code”), existing and proposed regulations,

and administrative and judicial interpretations, all as of the date hereof. These laws are subject to change, possibly on a retroactive

basis.

If

an entity or arrangement that is treated as a partnership for United States federal income tax purposes holds the Class A Common Stock,

the United States federal income tax treatment of a partner will generally depend on the status of the partner and the tax treatment

of the partnership. A partner in a partnership holding the Class A Common Stock should consult its tax advisor with regard to the United

States federal income tax treatment of an investment in the Class A Common Stock.

You

should consult a tax advisor regarding the United States federal tax consequences of acquiring, holding and disposing of Class A Common

Stock in your particular circumstances, as well as any tax consequences that may arise under the laws of any state, local or foreign

taxing jurisdiction.

Dividends

If

we make a distribution of cash or other property (other than certain distributions of our stock) in respect of our Class A Common Stock,

the distribution generally will be treated as a dividend to the extent of our current or accumulated earnings and profits, as determined

under United States federal income tax principles. Any portion of a distribution that exceeds our current and accumulated earnings and

profits will generally be treated first as a tax-free return of capital, on a share-by-share basis, to the extent of your tax basis in

our Class A Common Stock (and will reduce your basis in such Class A Common Stock), and, to the extent such portion exceeds your tax

basis in our Class A Common Stock, the excess will be treated as gain from the taxable disposition of the Class A Common Stock, the tax

treatment of which is discussed below under “Gain on Disposition of Class A Common Stock”.

Except

as described below, dividends paid to you on Class A Common Stock are subject to withholding of United States federal income tax at a

30% rate or at a lower rate if you are eligible for the benefits of an income tax treaty that provides for a lower rate. Even if you

are eligible for a lower treaty rate, the withholding agent will generally be required to withhold at a 30% rate (rather than the lower

treaty rate) on dividend payments to you, unless you have furnished to the withholding agent:

| ● | a

valid Internal Revenue Service (“IRS”) Form W-8 or an acceptable substitute form

upon which you certify, under penalties of perjury, your status as a non-United States person

and your entitlement to the lower treaty rate with respect to such payments, or |

| | | |

| ● | in

the case of payments made outside the United States to an offshore account (generally, an

account maintained by you at an office or branch of a bank or other financial institution

at any location outside the United States), other documentary evidence establishing your

entitlement to the lower treaty rate in accordance with U.S. Treasury regulations. |

If

you are eligible for a reduced rate of United States withholding tax under a tax treaty, you may obtain a refund of any amounts withheld

in excess of that rate by filing a refund claim with the United States IRS.

If

dividends paid to you are “effectively connected” with your conduct of a trade or business within the United States, and,

if required by a tax treaty, the dividends are attributable to a permanent establishment that you maintain in the United States, withholding

agents are generally not required to withhold tax from the dividends, provided that you have furnished to the withholding agent a valid

IRS Form W-8ECI or an acceptable substitute form upon which you represent, under penalties of perjury, that:

| ● | you

are a non-United States person, and |

| | | |

| ● | the

dividends are effectively connected with your conduct of a trade or business within the United

States and are includible in your gross income. |

“Effectively

connected” dividends are taxed at rates applicable to United States citizens, resident aliens and domestic United States corporations.

If

you are a corporate non-U.S. holder, “effectively connected” dividends that you receive may, under certain circumstances,

be subject to an additional “branch profits tax” at a 30% rate or at a lower rate if you are eligible for the benefits of

an income tax treaty that provides for a lower rate.

Gain

on Disposition of Class A Common Stock

You

generally will not be subject to United States federal income tax on gain that you recognize on a disposition of Class A Common Stock

unless:

| ● | the

gain is “effectively connected” with your conduct of a trade or business in the

United States, and the gain is attributable to a permanent establishment that you maintain

in the United States, if that is required by an applicable income tax treaty as a condition

for subjecting you to United States taxation on a net income basis, |

| | | |

| ● | you

are an individual, you hold the Class A Common Stock as a capital asset, you are present

in the United States for 183 or more days in the taxable year of the sale and certain other

conditions exist, or |

| | | |

| ● | we

are or have been a “United States real property holding corporation” (as described

below), at any time within the five-year period preceding the disposition or your holding

period, whichever period is shorter, you are not eligible for a treaty exemption, and either

(i) our Class A Common Stock is not regularly traded on an established securities market

during the calendar year in which the sale or disposition occurs or (ii) you owned or are

deemed to have owned, at any time within the five-year period preceding the disposition or

your holding period, whichever period is shorter, more than 5% of our Class A Common Stock. |

If

the gain from the taxable disposition of shares of our Class A Common Stock is effectively connected with your conduct of a trade or

business in the United States (and, if required by a tax treaty, the gain is attributable to a permanent establishment that you maintain

in the United States), you will be subject to tax on the net gain derived from the sale at rates applicable to United States citizens,

resident aliens and domestic United States corporations. If you are a corporate non-U.S. holder, “effectively connected”

gains that you recognize may also, under certain circumstances, be subject to an additional “branch profits tax” at a 30%

rate or at a lower rate if you are eligible for the benefits of an income tax treaty that provides for a lower rate. If you are an individual

non-U.S. holder described in the second bullet point immediately above, you will be subject to a flat 30% tax (unless an applicable income

tax treaty provides otherwise) on the gain derived from the sale, which may be offset by United States source capital losses, even though

you are not considered a resident of the United States.

We

will be a United States real property holding corporation at any time that the fair market value of our “United States real property

interests,” as defined in the Code and applicable Treasury Regulations, equals or exceeds 50% of the aggregate fair market value

of our worldwide real property interests and our other assets used or held for use in a trade or business (all as determined for the

U.S. federal income tax purposes). We believe that we are not, and do not anticipate becoming in the foreseeable future, a United States

real property holding corporation.

FATCA

Withholding

Pursuant

to sections 1471 through 1474 of the Code, commonly known as the Foreign Account Tax Compliance Act (“FATCA”), a 30% withholding

tax (“FATCA withholding”) may be imposed on certain payments to you or to certain foreign financial institutions, investment

funds and other non-US persons receiving payments on your behalf if you or such persons fail to comply with certain information reporting

requirements. Payments of dividends that you receive in respect of Class A Common Stock could be affected by this withholding if you

are subject to the FATCA information reporting requirements and fail to comply with them or if you hold Class A Common Stock through

a non-US person (e.g., a foreign bank or broker) that fails to comply with these requirements (even if payments to you would not otherwise

have been subject to FATCA withholding). You should consult your own tax advisors regarding the relevant U.S. law and other official

guidance on FATCA withholding.

Federal

Estate Taxes

Class

A Common Stock held by a non-U.S. holder at the time of death will be included in the holder’s gross estate for United States federal

estate tax purposes, unless an applicable estate tax treaty provides otherwise.

Backup

Withholding and Information Reporting

We

and other payors are required to report payments of dividends on Class A Common Stock on IRS Form 1042-S even if the payments are exempt

from withholding. You are otherwise generally exempt from backup withholding and information reporting requirements with respect to dividend

payments and the payment of the proceeds from the sale of Class A Common Stock effected at a United States office of a broker provided

that either (i) you have furnished a valid IRS Form W-8 or other documentation upon which the payor or broker may rely to treat the payments

as made to a non-United States person, or (ii) you otherwise establish an exemption.

Payment

of the proceeds from the sale of Class A Common Stock effected at a foreign office of a broker generally will not be subject to information

reporting or backup withholding. However, a sale effected at a foreign office of a broker could be subject to information reporting in

the same manner as a sale within the United States (and in certain cases may be subject to backup withholding as well) if (i) the broker

has certain connections to the United States, (ii) the proceeds or confirmation are sent to the United States or (iii) the sale has certain

other specified connections with the United States.

UNDERWRITING

We,

AST LLC and the underwriters have entered into an underwriting agreement, dated the date of this prospectus supplement, with respect

to the shares of Class A Common Stock being offered. Subject to certain conditions, the underwriters have agreed to purchase the respective

number of shares of Class A Common Stock shown opposite its name in the following table. B. Riley Securities, Inc. is the sole representative

of the underwriters in this offering. We will file the Underwriting Agreement as an exhibit to a Current Report on Form 8-K, which will

be incorporated by reference in this prospectus. In the case a single underwriter is listed on the cover page of this prospectus supplement,

all references to “underwriters” shall be deemed to refer to such underwriter.

| Underwriters | |

|

Number of Shares |

|

| B. Riley Securities, Inc. | |

| 13,636,364 | |

| | |

| | |

| Total | |

| 13,636,364 | |

The

underwriters are committed to take and pay for all of the shares of Class A Common Stock being offered, if any are taken, other than

the shares of Class A Common Stock covered by the option described below unless and until that option is exercised.

We

have agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act, and to

contribute to payments that the underwriters may be required to make for these liabilities.

Option

to Purchase Additional Shares of Class A Common Stock

The

underwriters have an option to buy up to an additional 2,045,454 shares of Class A Common Stock from us at the public offering price

less the underwriting discount to cover sales by the underwriters of a greater number of shares than the total number set forth in the

table above. They may exercise this option for 30 days from the date of this prospectus supplement solely to cover any overallotments.

If any shares of Class A Common Stock are purchased pursuant to this option, the underwriters will severally purchase such shares in

approximately the same proportion as set forth in the table above, and the underwriters will offer the additional securities on the same

terms as those on which the shares of Class A Common Stock are being offered.

Commissions

and Discounts

The

underwriters propose to offer the shares of Class A Common Stock directly to the public at the initial public offering price set

forth on the cover of this prospectus supplement and to certain dealers at such offering price less a concession not in excess of

$0.231 per share of Class A Common Stock. After the initial public offering of the shares of Class A Common Stock, the

offering price and the selling concession may be changed by the underwriters. The underwriters may effect such transactions by

selling securities to or through dealers and such dealers may receive compensation in the form of discounts, concessions or

commissions from the underwriters and/or purchasers of the securities for whom they may act as agents or to whom they may sell as

principal. The offering of securities by the underwriters is subject to receipt and acceptance and subject to the

underwriters’ right to reject any order in whole or in part.

The

following table shows the per share and total underwriting discounts and commissions to be paid by us to the underwriters assuming both

no exercise and full exercise of the underwriters’ option to purchase additional shares of Class A Common Stock.

| | |

No Exercise | |

Full Exercise |

| Per Share | |

$ | 0.385 | | |

$ | 0.385 | |

| Total | |

$ | 5,250,000 | | |

$ | 6,037,500 | |

We

estimate that the total expenses of the offering, including registration, filing and listing fees, printing fees and legal and accounting

expenses, but excluding underwriting discounts and commissions, will be approximately $1.0 million, all of which will be paid by us.

We have agreed to reimburse the underwriters for certain of their expenses up to $375,000 in connection with this offering and up to

$15,000 incurred in connection with the clearance of this offering with the Financial Industry Regulatory Authority, Inc. B. Riley Securities,

Inc. has agreed to reimburse certain expenses of the Company in connection with the offering.

No

Sales of Similar Securities

We

have agreed with the underwriters that, for a period of 90 days after the date of this prospectus supplement, subject to certain exceptions,

we will not (A) offer for sale, sell, pledge, or otherwise dispose of (or enter into any transaction or device that is designed to, or

could be expected to, result in the disposition by any person at any time in the future of) any shares of Class A Common Stock or securities

convertible into or exercisable or exchangeable for Class A Common Stock (other than the issuance of the Class A Common Stock offered

hereby and shares issued pursuant to employee benefit plans, qualified stock option plans or other employee compensation plans existing

on the date hereof or pursuant to currently outstanding options, warrants or rights not issued under one of those plans, including for

the avoidance of doubt, the issuance of Class A Common Stock upon redemption of membership interests in AST LLC so long as such issuance

is not in violation of a Lock-Up Agreement (as defined below)), or sell or grant options, rights or warrants with respect to any shares

of Class A Common Stock or securities convertible into or exchangeable for Class A Common Stock (other than the grant of options pursuant

to option plans existing on the date hereof), (B) enter into any swap or other derivatives transaction that transfers to another, in

whole or in part, any of the economic benefits or risks of ownership of such shares of Class A Common Stock, whether any such transaction

described in clause (A) or (B) above is to be settled by delivery of Class A Common Stock or other securities, in cash or otherwise,

(C) file or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any shares

of Class A Common Stock or securities convertible, exercisable or exchangeable into Class A Common Stock or any other securities of the

Company (other than any registration statement on Form S-8), or (D) publicly disclose the intention to do any of the foregoing, in each

case without the prior written consent of B. Riley Securities, Inc., on behalf of the underwriters; except that if we obtain the prior

written consent of B. Riley Securities, Inc., the restrictions in this paragraph will not prohibit the announcement or signing of an

equity financing by us involving the sale of Class A Common Stock, or securities convertible into or exchangeable into Class A Common

Stock to a strategic investor, provided that such Class A Common Stock or other securities may not be resold by the purchaser thereof

or require the approval of stockholders of the Company at any time prior to completion of the 90 day lock-up period.

Our

officers and directors and certain of our stockholders who have appointed a director to our Board of Directors have, pursuant to lock-up

agreements (the “Lock-Up Agreements”), agreed with the underwriters that, for a period of 90 days after the date of this

prospectus supplement, subject to certain exceptions, they will not (A) offer for sale, sell, pledge, or otherwise dispose of (or enter

into any transaction or device that is designed to, or could be expected to, result in the disposition by any person at any time in the

future of) any shares of Class A Common Stock (including, without limitation, shares of Class A Common Stock that may be deemed to be

beneficially owned by such directors, officers and stockholders in accordance with the rules and regulations of the Securities and Exchange

Commission and shares of Class A Common Stock that may be issued upon exercise of any options or warrants) or securities convertible

into or exercisable or exchangeable for Class A Common Stock, (B) enter into any swap or other derivatives transaction that transfers

to another, in whole or in part, any of the economic benefits or risks of ownership of shares of Class A Common Stock or securities convertible

into or exercisable or exchangeable for Class A Common Stock, whether any such transaction described in clause (A) or (B) above is to

be settled by delivery of Class A Common Stock or other securities, in cash or otherwise, (C) make any demand for or exercise any right

or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any shares of Class

A Common Stock or securities convertible into or exercisable or exchangeable for Class A Common Stock or any other securities of the

Company (other than any registration on Form S-8), or (D) publicly disclose the intention to do any of the foregoing, in each case without

the prior written consent of B. Riley Securities, Inc.

The

restrictions in the immediately preceding paragraph do not apply, subject to certain conditions, to (a) transactions relating to shares

of Class A Common Stock or other securities acquired in the open market after the completion of this offering, (b) bona fide gifts,

sales or other dispositions of shares of any class of the Company’s capital stock, (c) the exercise of warrants or the exercise

of stock options granted pursuant to the Company’s stock option/incentive plans or otherwise outstanding on the date hereof, (d)

transfers of securities by will, other testamentary document or intestate succession to the legal representative, heir, beneficiary or

a member of the immediate family; (e) transfers to the Company in connection with the “net” or “cashless” exercise

of options or other rights to purchase Class A Common Stock granted pursuant to an equity incentive plan, stock purchase plan or other

similar arrangement currently in effect in satisfaction of any tax withholding obligations through cashless surrender or otherwise, (f)

transfers to the Company or dispositions by employees of the Company to sell a sufficient number of shares of Class A Common Stock to

cover tax obligations arising from the vesting of restricted stock units; or (g) the establishment of any contract, instruction or plan

that satisfies all of the requirements of Rule 10b5-1 under the Exchange Act, (h) reporting of any dispositions of Class A Common Stock

pursuant to Section 16 under the Exchange Act made prior to the date of this offering and were eligible for delayed reporting on Form

5 pursuant to the rules and regulations of the Securities and Exchange Commission; and (i) any demands or requests for, exercises of

any right with respect to, or taking of any action in preparation of, the registration by the Company under the Securities Act of such

person’s shares of Class A Common Stock, provided that no transfer of such person’s shares of Class A Common Stock registered

pursuant to the exercise of any such right and no registration statement shall be filed under the Securities Act with respect to any

of such person’s shares of Class A Common Stock during the Lock-Up Period.

B.

Riley Securities, Inc., in its sole discretion, may release or waive the restrictions on our securities subject to the lock-up agreements

described above in whole or in part at any time as more fully described in the lock-up agreements. B. Riley Securities Inc. may agree

to such a release or waiver with us under a variety of circumstances, including if there is a material increase to the trading price

of our Class A common stock or in connection with certain strategic investments.

Listing

Our

Class A Common Stock and Public Warrants are listed on Nasdaq under the symbols “ASTS” and “ASTSW,” respectively.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company. The transfer agent and registrar’s

address is 1 State Street 30th Floor, New York, New York, 10004.

Price

Stabilization, Short Positions, Penalty Bids and Market Making

In

connection with the offering, the underwriters may purchase and sell shares of our Class A Common Stock in the open market. These transactions

may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale

by the underwriters of a greater number of shares than they are required to purchase in the offering, and a short position represents

the amount of such sales that have not been covered by subsequent purchases.

A

“covered short position” is a short position that is not greater than the amount of additional shares of Class A Common Stock

for which the underwriters’ option described above may be exercised. The underwriters may cover any covered short position by either

exercising their option to purchase additional shares of Class A Common Stock or purchasing shares in the open market. In determining

the source of shares to cover the covered short position, the underwriters will consider, among other things, the price of shares available

for purchase in the open market as compared to the price at which they may purchase additional shares pursuant to the option described

above.

“Naked”

short sales are any short sales that create a short position greater than the amount of additional shares for which the option described

above may be exercised. The underwriters must cover any such naked short position by purchasing shares in the open market. A naked short

position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the Class

A Common Stock in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions

consist of various bids for or purchases of Class A Common Stock made by the underwriters in the open market prior to the completion

of the offering.

The

underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting

discount received by it because the representative has repurchased shares sold by or for the account of such underwriter in stabilizing

or short covering transactions.

Purchases

to cover a short position and stabilizing transactions, as well as other purchases by the underwriters for their own accounts, may have

the effect of preventing or retarding a decline in the market price of our Class A Common Stock, and together with the imposition of

the penalty bid, may stabilize, maintain or otherwise affect the market price of the Class A Common Stock. As a result, the price of

our Class A Common Stock may be higher than the price that otherwise might exist in the open market. The underwriters are not required

to engage in these activities and may end any of these activities at any time. These transactions may be effected on Nasdaq, in the over-the-

counter market or otherwise.

In

connection with this offering, the underwriters may engage in passive market making transactions in the Class A Common Stock on Nasdaq

in accordance with Rule 103 of Regulation M under the Exchange Act during a period before the commencement of offers or sales of Class

A Common Stock and extending through the completion of distribution. A passive market maker must display its bid at a price not in excess

of the highest independent bid of that security. However, if all independent bids are lowered below the passive market maker’s

bid, that bid must then be lowered when specified purchase limits are exceeded. Passive market making may cause the price of our Class

A Common Stock to be higher than the price that otherwise would exist in the open market in the absence of those transactions. The underwriters

are not required to engage in passive market making and may end passive market making activities at any time.

Electronic

Distribution

In

connection with this offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means, such

as e-mail. In addition, a prospectus in electronic format may be made available on websites maintained by one or more underwriters, or

selling group members, if any, participating in this offering. Other than the prospectus in electronic format, the information on such

websites is not part of this prospectus. The representative may agree to allocate a number of shares of our Class A Common Stock to underwriters

for sale to their online brokerage account holders. Internet distributions will be allocated by the representative to underwriters that

may make Internet distributions on the same basis as other allocations.

Other

Relationships

The

underwriters and their affiliates are full service financial institutions engaged in various activities, which may include sales and

trading, commercial and investment banking, advisory, investment management, investment research, principal investment, hedging, market

making, brokerage and other financial and non-financial activities and services. The underwriters and their affiliates have engaged,

and may in the future engage, in investment banking, commercial banking and other financial advisory and commercial dealings with us

and our affiliates. In addition, B. Riley Principal Capital, LLC, an affiliate of B. Riley Securities, Inc., is party to the Common Stock

Purchase Agreement, pursuant to which the Company may sell shares of Class A Common Stock to B. Riley Principal Capital, LLC, and B.

Riley Securities, Inc. is a sales agent under the Equity Distribution Agreement.

B. Riley Securities, Inc. intends to allocate 97,273 shares of Class A Common Stock to certain of our officers, directors

and employees who elected to participate in this offering.

Offer

Restrictions Outside the United States

Other

than in the United States, no action has been taken by us or the underwriters that would permit a public offering of the securities offered

by this prospectus supplement in any jurisdiction where action for that purpose is required. The securities offered by this prospectus

supplement may not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements

in connection with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances

that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus

supplement comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution

of this prospectus. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any securities

offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

Prohibition

of Sales to EEA Retail Investors

In

relation to each Member State of the European Economic Area (each, a “Relevant State”), an offer to the public of any shares

of Class A Common Stock may not be made in that Relevant State, except that an offer to the public in that Relevant State of any shares

of Class A Common Stock may be made at any time under the following exemptions under the Prospectus Regulation:

(a)

to any legal entity which is a “qualified investor” as defined under the Prospectus

Regulation;

(b)

to fewer than 150 natural or legal persons (other than “qualified investors” as

defined under the Prospectus Regulation), per Relevant State, subject to obtaining the prior consent of the underwriters for any such

offer; or

(c)

in any other circumstances falling within Article 1(4) of the Prospectus Regulation;

provided

that no such offer of shares of Class A Common Stock shall result in a requirement for the Company or any underwriter to publish

a prospectus pursuant to Article 3 of the Prospectus Regulation or a supplemental prospectus pursuant to Article 23 of the Prospectus

Regulation and each person who initially acquires any shares of Class A Common Stock or to whom any offer is made will be deemed to have

represented, warranted and agreed to and with the underwriters and the Company that it is a qualified investor within the meaning of

Article 2(e) of the Prospectus Regulation. The Company, the underwriters and their affiliates will rely upon the truth and accuracy of

the foregoing representation, warranty and agreement.

For

the purposes of this provision, the expression an “offer to the public” in relation to any shares in any Relevant State means

the communication in any form and by any means of sufficient information on the terms of the offer and any shares of Class A Common Stock

to be offered so as to enable an investor to decide to purchase or subscribe for any shares of Class A Common Stock, and the expression

“Prospectus Regulation” means Regulation (EU) 2017/1129.

Prohibition

of Sales to UK Retail Investors

An

offer to the public of any shares of Class A Common Stock may not be made in the United Kingdom, except that an offer to the public in

the United Kingdom of any shares of Class A Common Stock may be made at any time under the following exemptions under the UK Prospectus

Regulation:

(a)

to any legal entity which is a “qualified investor” as defined under the UK Prospectus Regulation;

(b)

to fewer than 150 natural or legal persons (other than “qualified investors” as defined under the UK Prospectus Regulation),

subject to obtaining the prior consent of the underwriters for any such offer; or

(c)

in any other circumstances falling within section 86 of the Financial Services and Markets Act 2000 (as amended, “FSMA”);

provided

that no such offer of shares of Class A Common Stock shall result in a requirement for the Company or any underwriter to publish

a prospectus pursuant to section 85 of the FSMA or a supplemental prospectus pursuant to Article 23 of the UK Prospectus Regulation and

each person who initially acquires any shares of Class A Common Stock or to whom any offer is made will be deemed to have represented,

warranted and agreed to and with the underwriters and the Company that it is a qualified investor within the meaning of Article 2(e)

of the UK Prospectus Regulation. The Company, the underwriters and their affiliates will rely upon the truth and accuracy of the foregoing

representation, warranty and agreement.

For

the purposes of this provision, the expression an “offer to the public” in relation to any shares in the United Kingdom means

the communication in any form and by any means of sufficient information on the terms of the offer and any shares of Class A Common Stock

to be offered so as to enable an investor to decide to purchase or subscribe for any shares of Class A Common Stock, and the expression

“UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Notice

to prospective investors in Canada

The

shares of Class A Common Stock may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited

investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and

are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Any resale of the shares of Class A Common Stock must be made in accordance with an exemption from, or in a transaction not subject to,

the prospectus requirements of applicable securities laws.

Securities

legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus

supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised

by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser

should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars

of these rights or consult with a legal advisor.

Pursuant

to section 3A.3 of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the

disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Sullivan & Cromwell LLP, New York, New York. Certain legal

matters will also be passed upon for the underwriters by Simpson Thacher & Bartlett LLP, New York, New York.

EXPERTS

The

consolidated financial statements of the Company as of December 31, 2021 and for the year ended December 31, 2021 incorporated by reference

in this prospectus supplement and the accompanying prospectus have been so incorporated in reliance of the report of KPMG LLP, an independent

registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

The

consolidated financial statements of the Company as of December 31, 2020 and for the year ended December 31, 2020 incorporated by reference

in this prospectus supplement and the accompanying prospectus have been so incorporated in reliance of the report of BDO USA, LLP, an

independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing

and accounting.

WHERE

YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available

Information

We

file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

website address is www.ast-science.com. The information on our website, however, is not, and should not be deemed to be,

a part of this prospectus supplement.

This

prospectus supplement is part of a registration statement that we filed with the SEC and does not contain all of the information in the

registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus

supplement about these documents are summaries, and each statement is qualified in all respects by reference to the document to which

it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of

the registration statement through the SEC’s website, as provided above.

Incorporation

by Reference

The