Aspen Technology, Inc. (NASDAQ: AZPN), the asset optimization

software company, today announced financial results for its third

quarter of fiscal year 2019 ended March 31, 2019.

“AspenTech’s strong third quarter results were highlighted by

annual spend growth of 9.7% year-over-year and positive growth

contributions from each product suite and geography,” said Antonio

Pietri, President and Chief Executive Officer of Aspen Technology.

“Our performance benefited from investments in our strategic growth

initiatives in recent quarters, an improving macroeconomic outlook

for our Engineering & Construction and upstream customers, and

strong execution by the AspenTech team.”

Pietri continued, “Our APM business had a record annual spend

quarter as customers increasingly recognized the value predictive

and prescriptive maintenance can have in improving their asset

operations. We also saw broadening adoption within the APM suite,

including the first site licenses for Aspen ProMV, our multivariate

analysis solution. We believe our strong APM performance is

indicative of the substantial opportunity for the APM suite and our

strengthening competitive position in this market.”

Third Quarter Fiscal 2019 and Recent Business

Highlights

- Annual spend, which the company defines

as the annualized value of all term license and maintenance

contracts at the end of the quarter, was approximately $526 million

at the end of the third quarter of fiscal 2019, which increased

9.7% compared to the third quarter of fiscal 2018 and 2.6%

sequentially.

- AspenTech repurchased approximately

800,000 shares of its common stock for $75 million in the third

quarter of fiscal 2019.

Summary of Third Quarter Fiscal Year 2019 Financial

Results

AspenTech’s total revenue of $148 million included:

- License revenue, which

represents the portion of a term license agreement allocated to the

initial license, was $98.5 million in the third quarter of fiscal

2019, compared to $79.1 million in the third quarter of fiscal

2018.

- Maintenance revenue, which

represents the portion of the term license agreement related to

on-going support and the right to future product enhancements, was

$41.9 million in the third quarter of fiscal 2019, compared to

$40.9 million in the third quarter of fiscal 2018.

- Services and other revenue was

$7.6 million in the third quarter of fiscal 2019, compared to $7.8

million in the third quarter of fiscal 2018.

For the quarter ended March 31, 2019, AspenTech reported income

from operations of $70.8 million, compared to income from

operations of $53.6 million for the quarter ended March 31,

2018.

Net income was $61.6 million for the quarter ended March 31,

2019, leading to net income per share of $0.88, compared to net

income per share of $0.61 in the same period last fiscal year.

Non-GAAP income from operations, which adds back the impact of

stock-based compensation expense, amortization of intangibles

associated with acquisitions and acquisition related fees, was

$78.3 million for the third quarter of fiscal 2019, compared to

non-GAAP income from operations of $59.9 million in the same period

last fiscal year. Non-GAAP net income was $67.5 million, or $0.96

per share, for the third quarter of fiscal 2019, compared to

non-GAAP net income of $49.0 million, or $0.67 per share, in the

same period last fiscal year. A reconciliation of GAAP to non-GAAP

results is presented in the financial tables included in this press

release.

AspenTech had cash and marketable securities of $65.6 million

and borrowings of $220 million at March 31, 2019.

During the third quarter, the company generated $90.0 million in

cash flow from operations and $89.1 million in free cash flow. Free

cash flow is calculated as net cash provided by operating

activities adjusted for the net impact of: purchases of property,

equipment and leasehold improvements; capitalized computer software

development costs, and other nonrecurring items, such as

acquisition related payments.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under

the rules of the U.S. Securities and Exchange Commission. Non-GAAP

financial measures are not based on a comprehensive set of

accounting rules or principles. This non-GAAP information

supplements, and is not intended to represent a measure of

performance in accordance with, disclosures required by generally

accepted accounting principles, or GAAP. Non-GAAP financial

measures should be considered in addition to, not as a substitute

for or superior to, financial measures determined in accordance

with GAAP. A reconciliation of GAAP to non-GAAP results is included

in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in

managing Aspen Technology’s business. As the result of adoption of

new licensing models, management believes that a number of Aspen

Technology’s performance indicators based on GAAP, including

revenue, gross profit, operating income and net income, should be

viewed in conjunction with certain non-GAAP and other business

measures in assessing Aspen Technology’s performance, growth and

financial condition. Accordingly, management utilizes a number of

non-GAAP and other business metrics, including the non-GAAP metrics

set forth in this press release, to track Aspen Technology’s

business performance. None of these non-GAAP metrics should be

considered as an alternative to any measure of financial

performance calculated in accordance with GAAP.

Conference Call and Webcast

Aspen Technology will host a conference call and webcast today,

April 24, 2019, at 4:30 p.m. (Eastern Time), to discuss the

company's financial results for the third quarter fiscal year 2019

as well as the company’s business outlook. The live dial-in number

is (833) 713-6081 or (702) 374-0603, conference ID code 4067052.

Interested parties may also listen to a live webcast of the call by

logging on to the Investor Relations section of Aspen Technology’s

website, http://ir.aspentech.com/events-and-presentations, and

clicking on the “webcast” link. A replay of the call will be

archived on Aspen Technology’s website and will also be available

via telephone at (855) 859-2056 or (404) 537-3406, conference ID

code 4067052, through May 24, 2019.

About Aspen Technology

Aspen Technology (AspenTech) is a leading software supplier for

optimizing asset performance. Our products thrive in complex,

industrial environments where it is critical to optimize the asset

design, operation and maintenance lifecycle. AspenTech uniquely

combines decades of process modeling expertise with big data

machine learning. Our purpose-built software platform automates

knowledge work and builds sustainable competitive advantage by

delivering high returns over the entire asset lifecycle. As a

result, companies in capital-intensive industries can maximize

uptime and push the limits of performance, running their assets

safer, greener, longer and faster. Visit AspenTech.com to find out

more.

Forward-Looking Statements

The third paragraph of this press release contains

forward-looking statements for purposes of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Actual results may vary significantly from Aspen Technology’s

(AspenTech) expectations based on a number of risks and

uncertainties, including, without limitation: AspenTech’s

failure to increase usage and product adoption of aspenONE

offerings or grow the aspenONE APM business, and failure to

continue to provide innovative, market-leading solutions; the

demand for, or usage of, aspenONE software declines for any reason,

including declines due to adverse changes in the process or other

capital-intensive industries; unfavorable economic and market

conditions or a lessening demand in the market for asset process

optimization software; risks of foreign operations or transacting

business with customers outside the United States; risks of

competition and other risk factors described from time to time in

AspenTech’s periodic reports filed with the Securities and Exchange

Commission. AspenTech cannot guarantee any future results, levels

of activity, performance, or achievements. AspenTech expressly

disclaims any obligation to update forward-looking statements after

the date of this press release.

© 2019 Aspen Technology, Inc. AspenTech, aspenONE, the Aspen

leaf logo, Aspen, Aspen ProMV and Aspen Mtell are trademarks of

Aspen Technology, Inc. All rights reserved.

Source: Aspen Technology, Inc.

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited in Thousands, Except per Share Data)

Three Months EndedMarch

31,

Nine Months EndedMarch

31,

2019 2018 2019

2018 As Adjusted As Adjusted Revenue:

License $ 98,493 $ 79,073 $ 255,616 $ 214,938 Maintenance 41,878

40,897 125,955 121,890 Services and other 7,613 7,788

21,005 22,947 Total revenue 147,984 127,758

402,576 359,775

Cost of revenue:

License 1,658 1,279 5,142 3,743 Maintenance 4,962 4,259 14,241

13,061 Services and other 7,740 7,238 22,943

20,793 Total cost of revenue 14,360 12,776

42,326 37,597 Gross profit 133,624 114,982

360,250 322,178

Operating expenses:

Selling and marketing 27,410 25,246 80,532 72,690 Research and

development 20,520 21,584 61,893 60,863 General and administrative

14,863 14,533 46,246 49,188 Total

operating expenses 62,793 61,363 188,671

182,741 Income from operations 70,831 53,619 171,579 139,437

Interest income 6,835 6,304 21,389 18,849 Interest (expense) (2,350

) (1,485 ) (6,328 ) (3,952 ) Other (expense), net (34 ) (104 ) (485

) (958 ) Income before income taxes 75,282 58,334 186,155 153,376

Provision for (benefit from) income taxes 13,695 13,829

27,286 (63,681 ) Net income $ 61,587 $ 44,505

$ 158,869 $ 217,057

Net income per common

share: Basic $ 0.89 $ 0.62 $ 2.26 $ 3.00 Diluted $ 0.88 $ 0.61

$ 2.23 $ 2.97

Weighted average shares outstanding: Basic

69,423 71,828 70,286 72,402 Diluted 70,160 72,663 71,142 73,136

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS(Unaudited in

Thousands, Except Share and Per Share Data)

March 31, 2019

June 30, 2018 As Adjusted ASSETS

Current assets: Cash and cash equivalents $ 65,592 $ 96,165

Accounts receivable, net 45,293 41,810 Current contract assets

314,745 304,378 Contract costs 24,325 20,500 Prepaid expenses and

other current assets 11,124 10,509 Prepaid income taxes 1,573

2,601 Total current assets 462,652 475,963 Property,

equipment and leasehold improvements, net 7,589 9,806 Computer

software development costs, net 1,452 646 Goodwill 73,534 75,590

Intangible assets, net 31,756 35,310 Non-current contract assets

358,709 340,622 Deferred tax assets 1,696 11,090 Other non-current

assets 1,279 1,297 Total assets $ 938,667 $

950,324

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 4,023 $ 4,230 Accrued expenses and

other current liabilities 42,746 39,515 Income taxes payable 35,582

1,698 Borrowings under credit agreement 220,000 170,000 Current

deferred revenue 24,415 15,150 Total current

liabilities 326,766 230,593 Non-current deferred revenue 19,312

12,354 Deferred income taxes 154,901 214,125 Other non-current

liabilities 12,403 17,068 Commitments and contingencies (Note 16)

Series D redeemable convertible preferred stock, $0.10 par

value—Authorized— 3,636 shares as of March 31, 2019 and June 30,

2018Issued and outstanding— none as of March 31, 2019 and June 30,

2018 — — Stockholders’ equity: Common stock, $0.10 par value—

Authorized—210,000,000 sharesIssued— 103,478,590 shares at March

31, 2019 and 103,130,300 shares at June 30, 2018Outstanding—

69,108,515 shares at March 31, 2019 and 71,186,701 shares at June

30, 2018 10,348 10,313 Additional paid-in capital 730,830 715,475

Retained earnings 1,224,377 1,065,507 Accumulated other

comprehensive income 1,229 1,388 Treasury stock, at cost—34,370,075

shares of common stock at March 31, 2019 and 31,943,599 shares at

June 30, 2018 (1,541,499 ) (1,316,499 ) Total stockholders’ equity

425,285 476,184 Total liabilities and stockholders’

equity $ 938,667 $ 950,324

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited in Thousands)

Three Months EndedMarch

31,

Nine Months EndedMarch 31, 2019

2018 2019 2018 As

Adjusted As Adjusted Cash flows from operating

activities: Net income $ 61,587 $ 44,505 $ 158,869 $ 217,057

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 2,014 1,544

6,063 4,902 Net foreign currency (gains) losses (295 ) 96 23 1,086

Stock-based compensation 6,254 5,353 21,454 17,222 Deferred income

taxes (2,373 ) (32,662 ) (49,847 ) (123,443 ) Provision for

(recovery from) bad debts (353 ) 1,401 474 1,373 Other non-cash

operating activities 124 107 341 314

Changes in assets and

liabilities: Accounts receivable 12,281 1,762 (4,183 ) 1,429

Contract assets 14,531 33,160 (27,397 ) (7,767 ) Contract costs

(1,279 ) (592 ) (3,825 ) (651 ) Prepaid expenses, prepaid income

taxes, and other assets (1,543 ) 3,949 201 4,908 Accounts payable,

accrued expenses, income taxes payable and other liabilities (4,738

) (2,656 ) 32,980 (4,448 ) Deferred revenue 3,829 17,100

17,983 15,847 Net cash provided by operating

activities 90,039 73,067 153,136 127,829

Cash flows from investing activities: Purchases of

property, equipment and leasehold improvements (26 ) (61 ) (206 )

(217 ) Payments for business acquisitions, net of cash — (22,900 )

— (33,700 ) Payments for capitalized computer software costs (905 )

57 (1,094 ) (299 ) Net cash used in investing activities

(931 ) (22,904 ) (1,300 ) (34,216 )

Cash flows from financing

activities: Exercises of stock options 1,415 3,854 5,881 7,402

Repurchases of common stock (76,759 ) (49,328 ) (224,182 ) (154,365

) Payments of tax withholding obligations related to restricted

stock (2,262 ) (1,945 ) (11,916 ) (5,412 ) Deferred business

acquisition payments (500 ) — (1,700 ) (2,600 ) Proceeds from

credit agreement — 19,000 50,000 30,000 Payments of credit

agreement issuance costs — — — (351 ) Net cash

used in financing activities (78,106 ) (28,419 ) (181,917 )

(125,326 ) Effect of exchange rate changes on cash and cash

equivalents 162 628 (492 ) 834 Increase

(decrease) in cash and cash equivalents 11,164 22,372 (30,573 )

(30,879 ) Cash and cash equivalents, beginning of period 54,428

48,703 96,165 101,954

Cash and cash

equivalents, end of period $ 65,592 $ 71,075 $

65,592 $ 71,075 Supplemental disclosure of

cash flow information: Income taxes paid, net $

21,296

$ 8,920 $

39,123

$ 38,662 Interest paid 2,187 1,417 5,728 3,456

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESReconciliation of GAAP to Non-GAAP Results of

Operations and Cash Flows(Unaudited in Thousands, Except per

Share Data)

Three Months EndedMarch 31, Nine Months

EndedMarch 31, 2019 2018

2019 2018 As Adjusted As

Adjusted

Total

expenses

GAAP total expenses (a) $ 77,153 $ 74,139 $ 230,997 $ 220,338 Less:

Stock-based compensation (b) (6,254 ) (5,353 ) (21,454 ) (17,222 )

Amortization of intangibles (1,157 ) (526 ) (3,380 ) (1,578 )

Litigation judgment — — — (1,548 ) Acquisition related fees (15 )

(378 ) (8 ) (706 )

Non-GAAP total

expenses $ 69,727 $

67,882 $ 206,155 $

199,284

Income from

operations

GAAP income from operations $ 70,831 $ 53,619 $ 171,579 $ 139,437

Plus: Stock-based compensation (b) 6,254 5,353 21,454 17,222

Amortization of intangibles 1,157 526 3,380 1,578 Litigation

judgment — — — 1,548 Acquisition related fees 15 378 8 706

Non-GAAP income from operations

$ 78,257 $ 59,876

$ 196,421 $ 160,491

Net

income

GAAP net income $ 61,587 $ 44,505 $ 158,869 $ 217,057 Plus:

Stock-based compensation (b) 6,254 5,353 21,454 17,222 Amortization

of intangibles 1,157 526 3,380 1,578 Litigation judgment — — —

1,548 Acquisition related fees 15 378 8 706 Less: Income tax effect

on Non-GAAP items (c) (1,559 ) (1,758 ) (5,217 ) (5,916 )

Non-GAAP net income

$ 67,454 $ 49,004

$ 178,494 $ 232,195

Diluted income

per share

GAAP diluted income per share $ 0.88 $ 0.61 $ 2.23 $ 2.97 Plus:

Stock-based compensation (b) 0.08 0.06 0.30 0.23 Amortization of

intangibles 0.02 0.01 0.05 0.02 Litigation judgment — — — 0.02

Acquisition related fees — 0.01 — 0.01 Less: Income tax effect on

Non-GAAP items (c) (0.02 ) (0.02 ) (0.07 ) (0.08 )

Non-GAAP diluted income per share

$ 0.96 $ 0.67

$ 2.51 $ 3.17 Shares used

in computing Non-GAAP diluted income per share 70,160 72,663 71,142

73,136

Three Months EndedMarch 31,

Nine Months EndedMarch 31, 2019 2018

2019 2018 As Adjusted As Adjusted

Free Cash

Flow

GAAP cash flow from operating activities $ 90,039 $ 73,067 $

153,136 $ 127,829 Purchase of property, equipment and

leasehold improvements (26 ) (61 ) (206 ) (217 ) Capitalized

computer software development costs (905 ) 57 (1,094 ) (299 )

Non-capitalized acquired technology (d) — — — 75 Acquisition

related fee payments 16 780 27 868 Litigation related payments

— 4,286

— 4,286 Free Cash Flow

$ 89,124 $ 78,129

$ 151,863 $ 132,542 (a)

GAAP total expenses

Three Months EndedMarch 31,

Nine Months EndedMarch 31, 2019 2018

2019 2018 As Adjusted As Adjusted Total

costs of revenue $ 14,360 $ 12,776 $ 42,326 $ 37,597 Total

operating expenses 62,793 61,363 188,671

182,741 GAAP total expenses $ 77,153 $ 74,139

$ 230,997 $ 220,338 (b) Stock-based

compensation expense was as follows:

Three Months

EndedMarch 31, Nine Months EndedMarch 31,

2019 2018 2019 2018 Cost of maintenance

$ 379 $ — $ 916 $ — Cost of services and other 366 345 1,038 1,119

Selling and marketing 1,228 979 3,687 2,870 Research and

development 1,518 1,892 5,451 5,679 General and administrative

2,763 2,137 10,362 7,554 Total

stock-based compensation $ 6,254 $ 5,353 $ 21,454

$ 17,222

(c) The income tax effect on non-GAAP

items for the three and nine months ended March 31, 2019 is

calculated utilizing the Company's statutory tax rate of 21

percent. The income tax effect on non-GAAP items for the three and

nine months ended March 31, 2018 is calculated utilizing the

Company's estimated federal and state tax rate.

(d) In the nine months ended March 31, 2018, the Company has

excluded $0.1 million of final payments related to non-capitalized

acquired technology from prior fiscal periods from free cash flow

to be consistent with the treatment of other transactions where the

acquired assets were capitalized.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190424006014/en/

Media ContactDavid GripAspenTech+1

781-221-5273david.grip@aspentech.comInvestor ContactBrian

DenyeauICR+1 646-277-1251brian.denyeau@icrinc.com

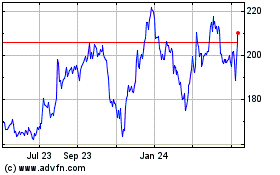

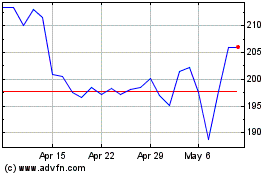

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Jul 2023 to Jul 2024