Form 8-K - Current report

February 14 2024 - 8:04AM

Edgar (US Regulatory)

false000160397800016039782024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 14, 2024

AquaBounty Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware | 001-36426 | 04-3156167 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

2 Mill & Main Place, Suite 395, Maynard, Massachusetts

(Address of principal executive offices)

01754

(Zip Code)

978-648-6000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Title of each class | Trading Symbol(s) | Name of exchange on which registered |

Common Stock, par value $0.001 per share | AQB | The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On February 14, 2024, AquaBounty Technologies, Inc. (the “Company”) issued a press release announcing updates to the Company’s fundraising efforts and its decision to sell its Indiana farm operation. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information set forth in this Item 7.01, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| | AquaBounty Technologies, Inc. |

| | (Registrant) |

| | |

February 14, 2024 | | /s/ David A. Frank |

| | David A. Frank |

| | Chief Financial Officer |

AquaBounty Technologies Provides Fundraising Update

MAYNARD, Mass., February 14, 2024 -- AquaBounty Technologies, Inc. (NASDAQ: AQB) (“AquaBounty” or the “Company”), a land-based aquaculture company utilizing technology to enhance productivity and sustainability, today announced an update on the Company’s fundraising efforts.

As previously announced in November 2023, AquaBounty has been exploring a wide range of financing alternatives to strengthen its balance sheet and increase its cash position. Today, the Company is announcing that, as a first step in this process, it has made the decision to sell its Indiana farm operation. The Indiana land-based, recirculating aquaculture facility has been growing AquaBounty’s GE Atlantic salmon since 2019 and has succeeded in its objective to demonstrate the Company’s ability to grow and sell its salmon in the market. With construction on its Ohio farm site roughly 30 percent completed, the Company plans to prioritize the financing alternatives necessary to resume and complete its construction, while the proceeds from the sale of its Indiana farm are expected to provide needed liquidity to AquaBounty’s balance sheet.

AquaBounty is also announcing that it has engaged Berenson & Company as its investment bank to advise on the sale process for the Indiana farm and on additional financing alternatives for the Company.

Sylvia Wulf, Chief Executive Officer of AquaBounty said, “We have been focused on securing funding for our near and long-term needs, so we can continue to pursue our growth strategy. Making the decision to sell our Indiana farm was a difficult one for us. We have built a strong operation there with a passionate and experienced team, and I want to take this opportunity to express my gratitude to our team members in Indiana for the job they have done over the last eight years to transform the facility and create a well-run operation. Our focus will be on harvesting the remaining GE Atlantic salmon for sale over the coming months to ready the farm for a new owner.

“We are proceeding to pursue additional funding across multiple financing alternatives with the goal of securing our cash requirements in the coming months.

“As always, I look forward to providing my fellow stockholders with an update in the near future,” concluded Wulf.

About AquaBounty

At AquaBounty Technologies, Inc. (NASDAQ: AQB), we believe we are a leader in land-based sustainable aquaculture from start to finish. As a vertically integrated Company from broodstock to grow out, we are leveraging decades of expertise in fish breeding, genetics, and health & nutrition to deliver disruptive solutions that address food insecurity and climate change issues. We are committed to feeding the world efficiently, sustainably and profitably. AquaBounty provides fresh Atlantic salmon to nearby markets by raising its fish in carefully monitored land-based fish farms through a safe, secure and sustainable process. The Company’s land-based Recirculating Aquaculture System (“RAS”) farms, including a grow-out farm located in Indiana, United States and a broodstock and egg production farm located on Prince Edward Island, Canada, are close to key consumption markets and are designed to prevent disease and to include multiple levels of fish containment to protect wild fish populations. AquaBounty is raising nutritious salmon that is free of antibiotics and contaminants and provides a solution resulting in a reduced carbon footprint and no risk of pollution to marine ecosystems as compared to traditional sea-cage farming. For more information on AquaBounty, please visit www.aquabounty.com or follow us on Facebook, Twitter, LinkedIn and Instagram.

Forward-Looking Statements

This press release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended, including regarding potential financing alternatives for the Company, its operations, and construction of its Ohio farm, as well as a potential sale of the Company’s Indiana farm operation. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these statements because they involve significant risks and uncertainties about AquaBounty. AquaBounty may use words such as “continue,” “believe,” “will,” “may,” “expect,” the negative forms of these words and similar expressions to identify such forward-looking statements. Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are, among other things, our ability to continue as a going concern; a failure to raise financing for our Company operations and activities on acceptable terms; the potential for additional delays and increased costs related to construction of our new farm; a failure to sell the Indiana farm on acceptable terms; the effect of changes in applicable laws, regulations and policies; our ability to secure any necessary regulatory approvals and permits; the degree of market acceptance of our products; our failure to retain and recruit key personnel; and the price and volatility of our common stock. Forward-looking statements speak only as of the date hereof, and, except as required by law, AquaBounty undertakes no obligation to update or revise these forward-looking statements. For information regarding the risks faced by us, please refer to our public filings with the Securities and Exchange Commission (“SEC”), available on the Investors section of our website at www.aquabounty.com and on the SEC’s website at www.sec.gov.

Company & Investor Contact:

AquaBounty Technologies

investors@aquabounty.com

Media Contact:

Vince McMorrow

Fahlgren Mortine

(614) 906-1671

vince.mcmorrow@Fahlgren.com

v3.24.0.1

Document and Entity Information

|

Feb. 14, 2024 |

| Document and Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity Registrant Name |

AquaBounty Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36426

|

| Entity Tax Identification Number |

04-3156167

|

| Entity Address, Address Line One |

2 Mill & Main Place

|

| Entity Address, Address Line Two |

Suite 395

|

| Entity Address, City or Town |

Maynard

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01754

|

| City Area Code |

978

|

| Local Phone Number |

648-6000

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

AQB

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001603978

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

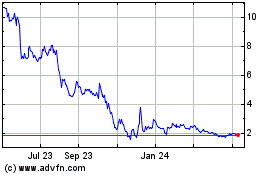

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Nov 2024 to Dec 2024

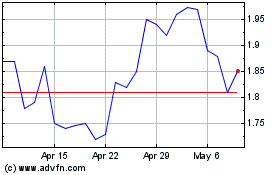

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Dec 2023 to Dec 2024