Applied Molecular Transport Reports Second Quarter 2023 Financial Results

August 14 2023 - 4:01PM

Applied Molecular Transport Inc. (Nasdaq: AMTI) (AMT), a

biopharmaceutical company, today reported financial results for the

second quarter ended June 30, 2023.

Financial Results for the Second Quarter

Ended June 30, 2023

Research and development (R&D)

expenses. Total R&D expenses for the second quarter of

2023 were $2.6 million, compared to $22.8 million for the same

period in 2022. The overall decrease was attributable to a

restructuring of operations, related reductions in workforce

implemented in March 2023 and discontinuing all research and

development activities.

General and administrative (G&A)

expenses. Total G&A expenses for the second quarter of

2023 were $7.0 million, compared to $9.4 million for the same

period in 2022. The overall decrease was attributable to a

restructuring of operations and related reductions in workforce

implemented in March 2023.

Restructuring, impairment, and related

charges. Total restructuring, impairment, and related

charges for the second quarter of 2023 were $8.1 million, primarily

comprised of write offs of right-of-use assets and related

leasehold improvements upon the company vacating leased premises

for its corporate headquarters and manufacturing warehouse.

Restructuring charges for the same period in 2022 were $3.8

million, primarily comprised of severance payments and other

employee-related separation costs associated with a reduction in

workforce implemented in May 2022.

Net loss. Net loss for the

second quarter of 2023 was $17.3 million, compared to $35.9 million

for the same period in 2022. Operating expenses for the second

quarter of 2023 were $17.7 million and interest income was $0.4

million.

Cash and cash equivalents. As

of June 30, 2023, cash and cash equivalents were $22.5 million.

About Applied Molecular Transport

Inc.

AMT is a clinical-stage biopharmaceutical

company that has a proprietary technology platform that enables the

design of novel biologic product candidates in patient-friendly

oral dosage forms. The company has completed four Phase 2 clinical

trials for its most advanced product candidate, AMT-101.

For additional information on AMT, please

visit www.appliedmt.com.

Forward-Looking Statements

This press release contains forward-looking

statements as that term is defined in Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such forward-looking statements involve substantial risks and

uncertainties. All statements other than statements of historical

facts contained in this press release are forward-looking

statements including statements relating to AMT’s plans,

expectations, forecasts and future events. Such forward-looking

statements include, but are not limited to, statements regarding

the ability of AMT to enter into a strategic transaction and

sufficiency of AMT’s cash resources. In some cases, you can

identify forward- looking statements by terminology such as

“believe,” “estimate,” “intend,” “may,” “plan,” “potentially,”

“will,” “expect,” “enable,” “likely” or the negative of these terms

or other similar expressions. We have based these forward-looking

statements largely on our current expectations and projections

about future events and trends that we believe may affect our

financial condition, results of operations, business strategy and

financial needs. Actual events, trends or results could differ

materially from the plans, intentions and expectations disclosed in

these forward-looking statements based on various

factors. Information regarding the foregoing and

additional risks may be found in the section entitled “Risk

Factors” in AMT’s Annual and Quarterly Reports on Form 10-K and

10-Q filed with the Securities and Exchange Commission (the “SEC”),

and AMT’s future reports to be filed with the SEC. These

forward-looking statements are made as of the date of this press

release, and AMT assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements, except as required by law.

Applied Molecular Transport

Inc.Condensed Balance

Sheets(unaudited)(in thousands)

| |

|

|

|

| |

June 30,2023 |

|

December 31,2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

22,457 |

|

|

$ |

61,145 |

|

|

Prepaid expenses |

|

860 |

|

|

|

2,688 |

|

|

Other current assets |

|

— |

|

|

|

186 |

|

|

Total current assets |

|

23,317 |

|

|

|

64,019 |

|

| Property and equipment,

net |

|

39 |

|

|

|

8,183 |

|

| Operating lease right-of-use

assets |

|

1,477 |

|

|

|

33,222 |

|

| Finance lease right-of-use

assets |

|

— |

|

|

|

584 |

|

| Restricted cash |

|

— |

|

|

|

916 |

|

| Other assets |

|

127 |

|

|

|

522 |

|

|

Total assets |

$ |

24,960 |

|

|

$ |

107,446 |

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

156 |

|

|

$ |

1,583 |

|

|

Accrued expenses |

|

2,202 |

|

|

|

8,660 |

|

|

Lease liabilities, operating lease - current |

|

1,458 |

|

|

|

4,639 |

|

|

Lease liabilities, finance lease - current |

|

— |

|

|

|

205 |

|

|

Total current liabilities |

|

3,816 |

|

|

|

15,087 |

|

| Lease liabilities, operating

lease |

|

254 |

|

|

|

31,228 |

|

| Lease liabilities, finance

lease |

|

— |

|

|

|

49 |

|

| Other liabilities |

|

244 |

|

|

|

244 |

|

|

Total liabilities |

|

4,314 |

|

|

|

46,608 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

431,862 |

|

|

|

426,804 |

|

|

Accumulated deficit |

|

(411,220 |

) |

|

|

(365,970 |

) |

|

Total stockholders’ equity |

|

20,646 |

|

|

|

60,838 |

|

|

Total liabilities and stockholders’ equity |

$ |

24,960 |

|

|

$ |

107,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applied Molecular Transport

Inc.Condensed Statements of

Operations(unaudited)(in thousands,

except share and per share amounts)

| |

|

|

|

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

2,558 |

|

|

$ |

22,802 |

|

|

$ |

15,546 |

|

|

$ |

54,041 |

|

|

General and administrative |

|

7,045 |

|

|

|

9,433 |

|

|

|

13,797 |

|

|

|

20,770 |

|

|

Restructuring, impairment, and related charges |

|

8,129 |

|

|

|

3,787 |

|

|

|

16,872 |

|

|

|

3,787 |

|

|

Total operating expenses |

|

17,732 |

|

|

|

36,022 |

|

|

|

46,215 |

|

|

|

78,598 |

|

| Loss from operations |

|

(17,732 |

) |

|

|

(36,022 |

) |

|

|

(46,215 |

) |

|

|

(78,598 |

) |

|

Interest income, net |

|

419 |

|

|

|

75 |

|

|

|

998 |

|

|

|

72 |

|

|

Other income (expense), net |

|

(20 |

) |

|

|

2 |

|

|

|

(33 |

) |

|

|

6 |

|

| Net loss |

$ |

(17,333 |

) |

|

$ |

(35,945 |

) |

|

$ |

(45,250 |

) |

|

$ |

(78,520 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.44 |

) |

|

$ |

(0.93 |

) |

|

$ |

(1.15 |

) |

|

$ |

(2.03 |

) |

| Weighted-average shares of

common stock outstanding, basic and diluted |

|

39,333,046 |

|

|

|

38,748,741 |

|

|

|

39,261,122 |

|

|

|

38,695,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Refer to the

Company’s applicable SEC filings for previously reported

periods. |

|

|

|

|

Investor Relations and Media

Contact:Alexandra SantosWheelhouse Life Science

Advisorsasantos@wheelhouselsa.com

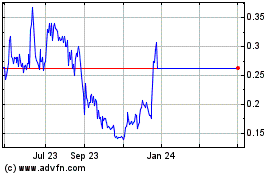

Applied Molecular Transp... (NASDAQ:AMTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Applied Molecular Transp... (NASDAQ:AMTI)

Historical Stock Chart

From Feb 2024 to Feb 2025