Mosaic to Buyback 43.3M MAC Trusts Shares - Analyst Blog

December 10 2013 - 5:05PM

Zacks

Fertilizer maker The Mosaic Company (MOS) has

landed an agreement to buyback 43.3 million shares from the

Margaret A. Cargill Foundation and the Anne Ray Charitable Trust

(“the MAC Trusts”) over the next eight months.

Under the share repurchase agreement, the Minnesota-based company

will buy 21.7 million of the MAC Trusts' Class A shares on January

8, 2014. The balance 21.6 million shares will be bought by Mosaic

beginning in February 2014 in seven equal installments. The

purchase price will be determined by the volume weighted average

closing price of the company’s common stock during the preceding

20-day trading period.

Mosaic was formed in 2014 through the combination of the fertilizer

businesses of agribusiness giant Cargill Incorporated and IMC

Global Inc.

Cargill sold its 64% interest (285.8 million shares) in Mosaic in

2011 in a split-off to its shareholders, including the MAC Trusts,

and a debt exchange with some of its debt holders. Following the

stake sale, the MAC Trusts and Cargill debt holders sold 157

million of these shares in secondary offerings or to Mosaic,

thereby completing the disposition of shares designated to be sold

during the 15-month period after the split off.

The remaining 128.8 million shares received by the MAC Trusts and

other shareholders were subject to transfer restrictions, which

were removed on Nov 26, 2013. Mosaic has been in talks with Cargill

and the MAC Trusts, following May 26, 2013, regarding the

disposition of the Class A shares, including potential share

repurchases.

The repurchase deal represents a significant step in achieving

Mosaic’s objective of having a more efficient balance sheet by the

middle of next year. The company is also looking for other options

to return value to shareholders.

Mosaic’s shares, which are down roughly 17% so far this year, fell

1.7% to close at $46 yesterday.

Fertilizer producers are grappling with weak pricing. Mosaic and

other fertilizers makers face significant challenges following the

exit of world's largest potash maker Uralkali Group from one of the

biggest potash cartels – the Belarus Potash Company (BPC).

Mosaic had a lackluster third-quarter 2013, reported on Nov 5, with

profit tumbling 70% year over year to $124 million or 29 cents per

share. The bottom line was hit by lower potash and phosphate

pricing, cautious buyer behavior and a late fall application season

in North America.

Revenues fell roughly 28% year over year to $1,908.7 million.

Double-digit declines across phosphate and potash franchises on

lower selling prices dragged down the top line. The company

witnessed lower sales volumes in both businesses in the

quarter.

While Mosaic envisions healthy demand in North America based on

excellent crop nutrient affordability, it expects a challenging

pricing environment.

Mosaic is a Zacks Rank #4 (Sell) stock.

Other stocks in the fertilizer and related industries with

favorable Zacks Rank are China Bluechip ADR

(CBLUY), The Andersons, Inc. (ANDE) and

The Scotts Miracle-Gro Co. (SMG). While China

Bluechip and The Andersons carry a Zacks Rank #1 (Strong Buy),

Scotts Miracle-Gro holds a Zacks Rank #2 (Buy).

ANDERSONS INC (ANDE): Free Stock Analysis Report

CHINA BLUECHEM (CBLUY): Get Free Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

SCOTTS MIRCL-GR (SMG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

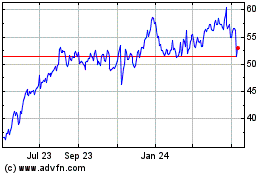

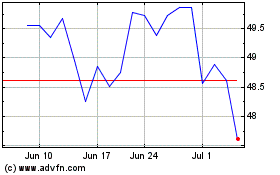

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Oct 2024 to Oct 2024

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Oct 2023 to Oct 2024