Reports Return on Equity of 22.8% and Net

Combined Ratio of 87.3%

AMERISAFE, Inc. (Nasdaq: AMSF), a specialty provider of

workers’ compensation insurance focused on high-hazard industries,

today announced results for the first quarter ended March 31,

2024.

Three Months Ended

March 31,

2024

2023

% Change

(in thousands, except per share data) Net premiums earned

$

68,446

$

69,181

-1.1

%

Net investment income

7,366

7,433

-0.9

%

Net realized gains (losses) on investments (pre-tax)

(222

)

258

NM

Net unrealized gain on equity securities (pre-tax)

4,776

1,369

NM

Net income

16,925

17,339

-2.4

%

Diluted earnings per share

$

0.88

$

0.90

-2.2

%

Operating net income

13,327

16,054

-17.0

%

Operating earnings per share

$

0.69

$

0.83

-16.9

%

Book value per share

$

15.74

$

17.38

-9.4

%

Net combined ratio

87.3

%

82.2

%

Return on average equity

22.8

%

21.3

%

G. Janelle Frost, President and Chief Executive Officer, noted,

“Our strategy is fundamentally based on providing peace of mind

through protection for small to mid-sized businesses and caring for

their injured workers, which has a track record of creating value

for our shareholders. While soft market conditions are ongoing and

competition remains robust, loss costs continue to decline. We are

pleased to report an 87.3% combined ratio in the quarter through

disciplined underwriting practices, modest policy growth, and

favorable case loss development from prior accident years.”

INSURANCE RESULTS

Three Months Ended

March 31,

2024

2023

% Change

(in thousands) Gross premiums written

$

80,074

$

82,487

-2.9

%

Net premiums earned

68,446

69,181

-1.1

%

Loss and loss adjustment expenses incurred

39,991

39,009

2.5

%

Underwriting and certain other operating costs, commissions,

salaries and benefits

18,698

16,982

10.1

%

Policyholder dividends

1,072

931

15.1

%

Underwriting profit (pre-tax)

$

8,685

$

12,259

-29.2

%

Insurance Ratios: Current accident year loss ratio

71.0

%

71.0

%

Prior accident year loss ratio

-12.6

%

-14.6

%

Net loss ratio

58.4

%

56.4

%

Net underwriting expense ratio

27.3

%

24.5

%

Net dividend ratio

1.6

%

1.3

%

Net combined ratio

87.3

%

82.2

%

- Voluntary premiums on policies written in the quarter were flat

versus the first quarter of 2023 despite the continued declines in

approved loss costs.

- Payroll audits and related premium adjustments increased

premiums written by $6.4 million in the first quarter of 2024,

compared to an increase of $8.9 million in the first quarter of

2023 primarily due to moderating wage inflation from record levels

in the prior year.

- The loss ratio for the first quarter was 58.4%, compared to

56.4% in the first quarter of 2023. During the quarter, the Company

experienced favorable net loss reserve development for prior

accident years, which reduced loss and loss adjustment expenses by

$8.6 million, primarily from accident years 2017 through 2020.

- For the quarter ended March 31, 2024, the underwriting expense

ratio was 27.3% versus 24.5% in the same quarter of 2023. The prior

year's quarter expense ratio was favorably impacted by a $3.3M

profit-sharing commission.

- The effective tax rate for the quarter ended March 31, 2024 was

18.4% compared with 19.5% for March 31, 2023. The rate was slightly

lower than last year due to an increase in the proportion of

tax-exempt interest income relative to taxable interest income and

underwriting profit.

INVESTMENT RESULTS

Three Months Ended

March 31,

2024

2023

% Change

(in thousands) Net investment income

$

7,366

$

7,433

-0.9

%

Net realized gains (losses) on investments (pre-tax)

(222

)

258

NM

Net unrealized gains on equity securities (pre-tax)

4,776

1,369

NM

Pre-tax investment yield

3.3

%

3.1

%

Tax-equivalent yield (1)

3.7

%

3.5

%

_____________

(1)

The tax equivalent yield is calculated

using the effective interest rate and the appropriate marginal tax

rate.

- Net investment income for the quarter ended March 31, 2024,

decreased 0.9% to $7.4 million, despite increased reinvestment

rates as compared to the prior year.

- Net unrealized gains on equity securities were $4.8 million as

a result of robust equity market returns during the quarter.

- As of March 31, 2024, the carrying value of AMERISAFE’s

investment portfolio, including cash and cash equivalents, was

$899.9 million.

CAPITAL MANAGEMENT

During the first quarter of 2024, the Company paid a regular

quarterly cash dividend of $0.37 per share on March 22, 2024 which

represented an 8.8% increase in the quarterly dividend compared

with 2023. On April 23, 2024 the Company’s Board of Directors

declared a quarterly cash dividend of $0.37 per share, payable on

June 21, 2024 to shareholders of record as of June 14, 2024.

Book value per share at March 31, 2024, was $15.74, an increase

of 3.0% from $15.28 at December 31, 2023.

SUPPLEMENTAL INFORMATION

Three Months Ended

March 31,

2024

2023

(in thousands, except share and per share data) Net

income

$

16,925

$

17,339

Less: Net realized gains (losses) on investments

(222

)

258

Net unrealized gains on equity securities

4,776

1,369

Tax effect (1)

(956

)

(342

)

Operating net income (2)

$

13,327

$

16,054

Average shareholders’ equity (3)

$

296,773

$

325,144

Less: Average accumulated other comprehensive loss

(7,967

)

(11,656

)

Average adjusted shareholders’ equity (2)

$

304,740

$

336,800

Diluted weighted average common shares

19,211,282

19,235,411

Return on average equity (4)

22.8

%

21.3

%

Operating return on average adjusted equity (2)

17.5

%

19.1

%

Diluted earnings per share

$

0.88

$

0.90

Operating earnings per share (2)

$

0.69

$

0.83

_____________

(1)

The tax effect of net realized losses on

investments and net unrealized gains (losses) on equity securities

is calculated with an effective tax rate of 21%.

(2)

Operating net income, average adjusted

shareholders’ equity, operating return on average adjusted equity

and operating earnings per share are non-GAAP financial measures.

Management believes that investors’ understanding of core operating

performance is enhanced by AMERISAFE’s disclosure of these

financial measures.

(3)

Average shareholders’ equity is calculated

by taking the average of the beginning and ending shareholders’

equity for the applicable period.

(4)

Return on average equity is calculated by

dividing the annualized net income by the average shareholders’

equity.

NON-GAAP FINANCIAL MEASURES

This release contains non-GAAP financial measures within the

meaning of Regulation G promulgated by the U.S. Securities and

Exchange Commission (the SEC) and includes a reconciliation of

non-GAAP financial measures to the most directly comparable

financial measures calculated in accordance with GAAP in the

Supplemental Information in this release.

Management believes that investors’ understanding of core

operating performance is enhanced by AMERISAFE’s disclosure of

these financial measures which include operating net income,

average adjusted shareholders’ equity, operating return on average

adjusted equity and operating earnings per share.

CONFERENCE CALL INFORMATION

AMERISAFE has scheduled a conference call for April 25, 2024, at

10:30 a.m. Eastern Time to discuss the results for the quarter and

comment on future periods. To participate in the conference call,

dial 323-794-2551 (Conference Code 2635571) at least ten minutes

before the call begins.

Investors, analysts and the general public will also have the

opportunity to listen to the conference call over the Internet by

visiting the “Investor Relations Home” page of the “Investors”

section of the Company’s website (http://www.amerisafe.com). To

listen to the live call on the web, please visit the website at

least fifteen minutes before the call begins to register, download

and install any necessary audio software. For those who cannot

listen to the live webcast, an archive will be available shortly

after the call at the same website location.

ABOUT AMERISAFE

AMERISAFE, Inc. is a specialty provider of workers’ compensation

insurance focused on small to mid-sized employers engaged in

hazardous industries, principally construction, trucking, logging

and lumber, agriculture, and manufacturing. AMERISAFE actively

markets workers’ compensation insurance in 27 states.

FORWARD LOOKING STATEMENTS

Statements made in this press release that are not historical

facts, including statements accompanied by words such as “will,”

“believe,” “anticipate,” “expect,” “estimate,” or similar words are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 regarding AMERISAFE’s

plans and performance. These statements are based on management’s

estimates, assumptions and projections as of the date of this

release and are not guarantees of future performance and include

statements regarding management’s views and expectations of the

workers’ compensation market, the Company’s growth opportunities,

underwriting margins and actions by competitors. Actual results may

differ materially from the results expressed or implied in these

statements if the underlying assumptions prove to be incorrect or

as the results of risks, uncertainties and other factors on the

business and operations of the Company and our policyholders and

the market value of our investment portfolio. Additional factors

that may affect our results are set forth in the Company’s filings

with the Securities and Exchange Commission, including AMERISAFE’s

Annual Report on Form 10-K. AMERISAFE cautions you not to place

undue reliance on the forward-looking statements contained in this

release. AMERISAFE does not undertake any obligation to publicly

update or revise any forward-looking statements to reflect future

events, information or circumstances that arise after the date of

this release.

AMERISAFE, INC. AND

SUBSIDIARIES

Consolidated Statements of

Income

(in thousands, except per

share amounts)

Three Months Ended

March 31,

2024

2023

(unaudited) Revenues: Gross premiums written

$

80,074

$

82,487

Ceded premiums written

(3,926

)

(4,179

)

Net premiums written

$

76,148

$

78,308

Net premiums earned

$

68,446

$

69,181

Net investment income

7,366

7,433

Net realized gains (losses) on investments

(222

)

258

Net unrealized gains on equity securities

4,776

1,369

Fee and other income

123

197

Total revenues

80,489

78,438

Expenses: Loss and loss adjustment expenses incurred

39,991

39,009

Underwriting and other operating costs

18,698

16,982

Policyholder dividends

1,072

931

Provision for investment related credit loss benefit

(17

)

(19

)

Total expenses

59,744

56,903

Income before taxes

20,745

21,535

Income tax expense

3,820

4,196

Net income

$

16,925

$

17,339

Basic EPS: Net income

$

16,925

$

17,339

Basic weighted average common shares

19,122,168

19,131,356

Basic earnings per share

$

0.89

$

0.91

Diluted EPS: Net income

$

16,925

$

17,339

Diluted weighted average common shares: Weighted average

common shares

19,122,168

19,131,356

Restricted stock and RSUs

89,114

104,055

Diluted weighted average common shares

19,211,282

19,235,411

Diluted earnings per share

$

0.88

$

0.90

AMERISAFE, INC. AND

SUBSIDIARIES

Consolidated Balance

Sheets

(in thousands)

March 31,

December 31,

2024

2023

(unaudited) Assets Investments

$

866,559

$

857,786

Cash and cash equivalents

33,375

38,682

Amounts recoverable from reinsurers

127,503

129,963

Premiums receivable, net

143,987

132,861

Deferred income taxes

21,183

20,403

Deferred policy acquisition costs

18,994

17,975

Other assets

31,542

31,492

$

1,243,143

$

1,229,162

Liabilities and Shareholders’ Equity Liabilities:

Reserves for loss and loss adjustment expenses

$

668,059

$

673,994

Unearned premiums

124,288

116,585

Insurance-related assessments

15,624

16,896

Other liabilities

134,078

129,236

Shareholders’ equity

301,094

292,451

Total liabilities and shareholders’ equity

$

1,243,143

$

1,229,162

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424992242/en/

Andy Omiridis, EVP & CFO AMERISAFE 337.463.9052

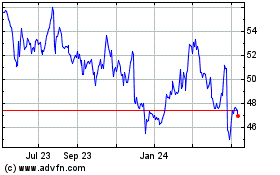

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Dec 2024 to Jan 2025

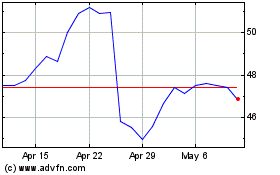

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Jan 2024 to Jan 2025