Filed Pursuant to Rule 424(b)(4)

Registration Number 333-281724

PROSPECTUS

377,000 Common Shares

5,178,556 Pre-Funded Warrants

to purchase up to 5,178,556 Common Shares

5,555,556 Series A-1 Warrants

to purchase up to 5,555,556 Common Shares

5,555,556 Series A-2 Warrants to purchase

up to 5,555,556 Common Shares

361,111 Placement Agent Warrants to purchase

up to 361,111 Common Shares

16,650,779 Common Shares

Underlying the Series A-1 Warrants, Series A-2 Warrants, Pre-Funded Warrants and Placement Agent Warrants

Altamira Therapeutics Ltd.

We are offering on a “reasonable

best efforts” basis 377,000 of our common shares, par value $0.002 per share (“Common Shares”), together with Series

A-1 warrants to purchase up to 5,555,556 Common Shares (“Series A-1 Warrants”), and Series A-2 warrants to purchase up to

5,555,556 Common Shares (“Series A-2 Warrants” and collectively with the Series A-1 Warrants, the “Common Warrants”).

The combined public offering price for each Common Share and accompanying Common Warrants is $0.72. Each Common Share, or a Pre-Funded

Warrant (as defined below) in lieu thereof, is being sold together with the Common Warrants, each to purchase one Common Share. The Common

Shares and Common Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in

this offering. The Common Warrants will have an exercise price of $0.72 per Common Share and will be exercisable immediately following

issuance. The Series A-1 Warrants will expire on the earlier of the eighteen-month anniversary of the original issuance date or 60

days following the occurrence of Milestone 1 (as defined herein). The Series A-2 Warrants will expire on the earlier of the five-year

anniversary of the original issuance date or six months following the occurrence of Milestone 2 (as defined herein).

We are also offering 5,178,556

pre-funded warrants (the “Pre-Funded Warrants”) to purchase Common Shares to each purchaser whose purchase of Common Shares

in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than

4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Shares immediately following the consummation of this offering.

Each Pre-Funded Warrant will be exercisable for one Common Share. The purchase price of each Pre-Funded Warrant and accompanying Common

Warrants will equal the price per Common Share and accompanying Common Warrants being sold to the public in this offering, minus $0.002,

and the exercise price of each Pre-Funded Warrant will be $0.002 per Common Share. The Pre-Funded Warrants will be immediately exercisable

and may be exercised at any time until all of the Pre-Funded warrants are exercised in full. The Pre-Funded Warrants and Common Warrants

are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. This prospectus

also relates to the offering of Common Shares issuable upon exercise of the Pre-Funded Warrants, Placement Agent Warrants (as defined

below) and Common Warrants.

We refer to the Common Shares,

the Pre-Funded Warrants, Placement Agent Warrants and Common Warrants to be issued in this offering collectively as the “Securities.”

We will have a single closing

for all Securities purchased in this offering and the combined public offering price per Common Share (or Pre-Funded Warrant in lieu thereof)

and accompanying Common Warrants will be fixed for the duration of this offering. We expect this offering to be completed on or about

September 19, 2024, subject to satisfaction of customary closing conditions. We will deliver the Securities to be issued in connection

with this offering delivery versus payment or receipt versus payment, as the case may be, upon receipt of investor funds received by us.

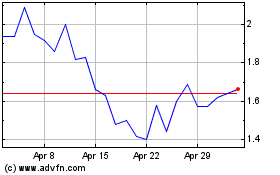

Our Common Shares are listed

on The Nasdaq Capital Market (“Nasdaq”) under the symbol “CYTO.” On September 17, 2024, the last reported sales

price of our Common Shares on Nasdaq was $0.7601.

The public offering price

per Common Share and accompanying Common Warrants or per Pre-Funded Warrant and accompanying Common Warrants was determined between us

and investors, in consultation with the Placement Agent (as defined below), based on market conditions at the time of pricing, our history

and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive

officers and the general condition of the securities markets at the time of this offering. In addition, there is no established public

trading market for the Pre-Funded Warrants or Common Warrants, and we do not expect a market for the Pre-Funded Warrants or Common Warrants

to develop. We do not intend to apply for a listing of the Pre-Funded Warrants or Common Warrants on any national securities exchange.

Without an active trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited.

We have engaged H.C.

Wainwright & Co., LLC (the “Placement Agent” or “Wainwright”), to act as our exclusive placement agent in

connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the Securities

offered by this prospectus. The Placement Agent is not purchasing or selling any of the Securities we are offering and the Placement Agent

is not required to arrange the purchase or sale of any specific number of Securities or dollar amount. We have agreed to pay to the Placement

Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the Securities offered by this prospectus.

We have also agreed to issue to the Placement Agent or its designees as compensation in connection with this offering, warrants (the “Placement

Agent Warrants”) to purchase up to 361,111 Common Shares (equal to 6.5% of the Common Shares sold in this offering (including

the Common Shares issuable upon the exercise of the Pre-Funded Warrants)), at an exercise price of $0.90 per Common Share, which represents 125%

of the combined public offering price per Common Share and accompanying Common Warrants, and which such Placement Agent Warrants are being

registered pursuant to this prospectus.

There is no minimum number

of Securities or amount of proceeds required as a condition to closing in this offering. Because there is no minimum offering amount required

as a condition to closing this offering, we may sell fewer than all of the Securities offered hereby, which may significantly reduce the

amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount

of Securities sufficient to pursue our business goals described in this prospectus.

In addition, because there

is no escrow trust or similar arrangement and no minimum offering amount, investors could be in a position where they have invested in

our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any

proceeds from the sale of Securities offered by us will be available for our immediate use, despite uncertainty about whether we would

be able to use such funds to effectively implement our business plan. We will bear all costs associated with the offering. See “Plan

of Distribution” on page 28 of this prospectus for more information regarding these arrangements.

We are a “foreign

private issuer” as defined under the federal securities laws and, as such, are subject to reduced public company reporting requirements.

See “Prospectus Summary – Implications of Being a Foreign Private Issuer.”

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk

Factors” contained in this prospectus beginning on page 6 and under similar headings in the other documents that are

incorporated by reference into this prospectus.

| | |

Per Common Share and

Accompanying Common Warrants | | |

Per Pre-Funded Warrant and Accompanying

Common

Warrants | | |

Total(2) | |

| Combined public offering price | |

$ | 0.720 | | |

$ | 0.718 | | |

$ | 3,989,643.21 | |

| Placement Agent’s fees (7.5%) (1) | |

$ | 0.054 | | |

$ | 0.054 | | |

$ | 300,000.02 | |

| Proceeds to us, before expenses (3) | |

$ | 0.666 | | |

$ | 0.664 | | |

$ | 3,689,643.19 | |

| (1) |

In addition, we have agreed to issue to the Placement Agent, or

its designees, as compensation in connection with this offering warrants to purchase up to a number of Common Shares equal to 6.5%

of the aggregate number of Common Shares (including the Common Shares issuable upon the exercise of the Pre-Funded Warrants) being

offered at an exercise price equal to 125% of the combined public offering price per Common Share and accompanying Common Warrants.

We have also agreed to pay to the Placement Agent a management fee equal to 1.0% of the gross proceeds of this offering, and

up to $20,000 for non-accountable expenses, and to reimburse the Placement Agent for its legal fees and other out-of-pocket

expenses in an amount up to $100,000 and for its clearing expenses in an amount of $15,950. See “Plan of Distribution”

on page 28 of this prospectus for a description of the fees and expenses to be paid to the Placement Agent for services performed

in connection with the offering. |

| (2) |

The amount of the proceeds to us presented in this table does not give effect to any exercise of the Common Warrants. |

| (3) |

Because

there is no minimum number of Securities or amount of proceeds required as a condition to closing in this offering, the actual public

offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than

the total maximum offering amounts set forth above. We estimate the total expenses of this offering payable by us, excluding the

Placement Agent fees and expenses, will be approximately $306,697. See “Plan of Distribution” on page 28 of this prospectus

for more information. |

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Consent under the Exchange

Control Act 1972 (and its related regulations) from the Bermuda Monetary Authority for the issue and transfer of our common shares to

and between residents and non-residents of Bermuda for exchange control purposes has been obtained for so long as our common shares remain

listed on an “appointed stock exchange,” which includes the Nasdaq Capital Market. In granting such consent, neither the Bermuda

Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness

of any of the statements made or opinions expressed herein.

Delivery of the Securities

to the purchasers is expected to be made on or about September 19, 2024, subject to satisfaction of customary closing conditions.

H.C. Wainwright &

Co.

The date of this prospectus is September 17, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). You should rely only

on the information contained in this prospectus or any related prospectus supplement.

This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below. You should read this prospectus in its entirety before making

an investment decision. You should also read and consider the information in the documents to which we have referred you in the section

of the prospectus entitled “Where You Can Find More Information.”

We have not authorized anyone

to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for

and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell

only the Securities offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information

contained in this prospectus is current only as of its date. Our business, financial condition, results of operations, and prospects may

have changed since that date.

Neither we nor the Placement

Agent have authorized anyone to provide you with information other than that contained in this prospectus, or any free writing prospectus

prepared by or on our behalf or to which we have referred you. We and the Placement Agent take no responsibility for and can provide no

assurance as to the reliability of, any other information that others may give you. We and the Placement Agent are offering to sell, and

seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus

is accurate only as of the date on the front cover page of this prospectus, or other earlier date stated in this prospectus, regardless

of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations

and future prospects may have changed since that date.

No action is being taken in

any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus

in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform

themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

For investors outside the

United States: We have not done anything that would permit the sale of our Securities in any jurisdiction where action for that purpose

is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform

themselves about, and observe any restrictions relating to, the offering of the Securities and the distribution of this prospectus outside

the United States.

Unless otherwise indicated

or the context otherwise requires, all references in this prospectus to “Altamira Therapeutics Ltd.,” or “Altamira,”

the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to (i) Auris

Medical Holding Ltd. a Bermuda company, or Auris Medical (Bermuda), the successor issuer to Auris Medical Holding AG (“Auris Medical

(Switzerland)”) under Rule 12g-3(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the

effective time at which Auris Medical (Switzerland) continued its corporate existence from Switzerland to Bermuda, which occurred on March

18, 2019, and (ii) to Altamira Therapeutics Ltd. after adoption of the new company name by resolution of Special General Meeting of Shareholders

held on July 21, 2021. The trademarks, trade names and service marks appearing in this prospectus are property of their respective owners.

On October 25, 2022, the Company

effected a one-for-twenty reverse share split (share consolidation) (the “2022 Reverse Share Split”) of the Company’s

issued and outstanding common shares. Effective as of November 2, 2023, the Company changed the currency denomination of the Company’s

authorized share capital from CHF to USD, reduced the issued share capital by reducing the par value of each common share in issue to

$0.0001 (pre-2023 Reverse Share Split (as defined below)) and reduced the authorized share capital to $12,000 divided into 100,000,000

(pre-2023 Reverse Share Split) common shares of $0.0001 (pre-2023 Reverse Share Split) par value each and 20,000,000 preference shares

of $0.0001 par value each. On December 13, 2023, the Company effected a one-for-twenty reverse share split (share consolidation) (the

“2023 Reverse Share Split”) of the Company’s issued and outstanding common shares, resulting in the Company’s

authorized share capital then being $12,000 divided into 5,000,000 common shares of $0.002 par value each and 20,000,000 preference shares

of $0.0001 par value each. On May 16, 2024, the Company increased its authorized share capital to $202,000 divided into 100,000,000 common

shares of $0.002 par value each and 20,000,000 preference shares of $0.0001 par value each. Unless indicated or the context otherwise

requires, all per share amounts and numbers of common shares in this prospectus have been retrospectively adjusted for the 2023 Reverse

Share Split. Documents incorporated by reference into this prospectus that were filed prior to October 25, 2022 and December 11, 2023,

do not give effect to the 2022 Reverse Share Split or the 2023 Reverse Share Split, as applicable.

The terms “dollar,”

“USD” or “$” refer to U.S. dollars and the term “Swiss Franc” and “CHF” refer to the

legal currency of Switzerland. On September 6, 2024, the exchange rate as reported by the U.S. Federal Reserve Bank was CHF 0.8428 to

USD 1.00.

PROSPECTUS

SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this

entire prospectus carefully, including the “Risk Factors,” “Information on the Company” and “Operating and

Financial Review and Prospects” sections and our consolidated financial statements, including the notes thereto, included elsewhere

in this prospectus or incorporated by reference herein, before deciding to invest in our Securities.

Overview

We are a preclinical-stage biopharmaceutical company

developing and supplying peptide-based nanoparticle technologies for efficient RNA delivery to extrahepatic tissues (OligoPhore™

/ SemaPhore™ platforms). We currently have two flagship siRNA programs using our proprietary delivery technology: AM-401 for KRAS

driven cancer and AM-411 for rheumatoid arthritis, both in preclinical development beyond in vivo proof of concept. The versatile delivery

platform is also suited for mRNA and other RNA modalities and made available to pharma or biotech companies through out-licensing. In

2023 we took a first step to reposition our company around the RNA delivery business by spinning off a 51% stake in Altamira Medica AG,

which manufactures and markets Bentrio®, an OTC nasal spray for allergic rhinitis. We thus continue to hold a 49% stake in the Bentrio®

business (with additional economic rights). Further, we have announced our intention to partner / divest also our AM-125 program, a nasal

spray for vertigo (post Phase 2), as well as our early- to late-stage clinical development programs in tinnitus and hearing loss.

Recent Developments

OligoPhore™ / SemaPhore™ platforms for extrahepatic

RNA delivery

On August 12, 2024, we announced

the publication of a peer-reviewed article in Nature Immunology demonstrating a significant reduction in tumor growth in animal cancer

models through treatment with Zbtb46 mRNA delivered with Altamira’s SemaPhore™ nanoparticle technology. The publication by

a research group from Washington University, St. Louis, MO, showed systemic delivery of Zbtb46 mRNA with SemaPhore™ nanoparticles

in mouse models of sarcoma and metastatic breast cancer resulted in sustained Zbtb46 expression, a restored immunostimulatory tumor microenvironment

and a highly significant reduction in tumor growth (p<0.0001). When combined with an immune checkpoint inhibitor (anti-PD1) treatment,

outcomes were even more pronounced. According to the authors, the “Zbtb46 nanoparticles induced dramatic anti-PD1 response in both

anti-PD1-responsive [sarcoma] and anti-PD1-refractory [breast cancer] tumor models, generating long-term complete remission of tumor in

many of the treated animals.” Extended monotherapy with Zbtb46 nanoparticles produced complete remission even in mice refractory

to anti-PD1 treatment. Mice whose sarcoma was eliminated through treatment did not develop fresh cancers following repeated challenge,

indicating the development of a protective immunological memory.

On July 19, 2024, we announced

the preprint publication of a study demonstrating effective treatment of abdominal aortic aneurysm (AAA) in an animal model. The study

was conducted by a research group from Washington University, St. Louis, MO, and the University of South Florida, Tampa, FL. It showed

that treatment with SOD2 mRNA delivered systemically with peptide-based nanoparticles (SemaPhore™) to AAA mice resulted in a significant

reduction in aorta dilation (p<0.05), delayed rupture and a highly significant improvement in survival rates (p<0.01) compared to

untreated controls. AAA is an inflammatory disease involving oxidative stress caused by excessive levels of reactive oxygen species (ROS),

which results in an abnormal enlargement (bulge) of the abdominal aorta. The rupture of an AAA may be life-threatening; according to a

publication by Shaw and colleagues in StatPearls in 2024, more than 50% of patients die before they reach the emergency room, and those

who survive have very high morbidity.

On May 1, 2024, we announced

that we had filed a provisional patent application with the United States Patent Office (USPTO) which describes novel nanoparticle compositions

based on OligoPhore™, Altamira’s peptide-based oligonucleotide delivery platform, or derivatives thereof in combination with

siRNA sequences targeting the p65 protein, a component of the NF-κB transcription factor. Activation of p65 has been observed in

multiple types of cancer as well as in many inflammatory diseases. For instance, p65 is a well-known key checkpoint in rheumatoid arthritis

(RA) inflammation, and thought to regulate cell proliferation, cell death, and stimulate metastasis in cancer. The new filing is intended

to extend Altamira’s intellectual property related to its AM-411 development program for RA treatment, among others.

On March 25, 2024, we announced

that we had entered into a collaboration agreement with Univercells Group (“Univercells”) to evaluate the use of our SemaPhore™

platform for the delivery of mRNA vaccines. Univercells is a global life sciences company creating platforms for developing and manufacturing

biologics, including mRNA vaccines and therapeutics, in a simple, scalable and cost-efficient way. Under the terms of the agreement, Univercells

will test in vitro and in vivo a proprietary mRNA vaccine delivered with Altamira’s SemaPhore™ nanoparticle platform. Should

the experiments prove successful, Univercells and Altamira intend to discuss and negotiate a commercial agreement for the development

and manufacturing of nanoparticle-based mRNA vaccines using Univercells’ production platform.

On February 7, 2024, we announced

the publication of an article by Meng and colleagues in the Journal of Integrative Medicine which evaluates the use of various peptides

to enhance adeno-associated virus (AAV) cell transduction. Recombinant AAVs are commonly used as carriers to introduce nucleic acids in

cells for gene therapy; several AAV-based gene therapy drugs have already been approved by the U.S. Food and Drug Administration (FDA).

The study sought to find ways of increasing the endosomal release of AAV-based therapeutics by using peptides derived from melittin, a

component of bee venom known for its ability to permeabilize biological membranes. The research group evaluated 76 melittin derivatives,

including p5RHH, the peptide underlying Altamira’s OligoPhore™ / SemaPhore™ nanoparticle platform for RNA delivery.

The scientists discovered that insertion of p5RHH into the AAV vector (p5RHH-rAAV) not only enhanced cell transduction, but also succeeded

in transducing cell lines typically considered resistant to AAVs. Further, an in vivo study in mice showed that the addition of p5RHH

to the AAV capsid of several AAV serotypes significantly enhanced liver transduction compared to non-modified AAV vectors, observed up

to the last time point four weeks after systemic administration.

On January 24, 2024, we announced

that we had filed a second provisional patent application with the USPTO to provide broad coverage of different KRAS mutations in human

cancer treatment with nanoparticles comprising the Company’s OligoPhore™ platform and a single siRNA sequence, polyKRASmut.

The nanoparticles are developed by Altamira as AM-401. The second provisional application contains in vitro data confirming the ability

of polyKRASmut siRNA to knock down a broad range of KRAS mutations in cancer cell lines. These mutations include G12C,

G12V, G12D, G12R, G12A, and A146T, which account for 90.9% of KRAS mutations reported in pancreatic ductal adenocarcinoma (PDAC), 65.3%

in colorectal cancer (CRC) and 80.0% in non-small cell lung cancer (NSCLC).

Bentrio® for protection against airborne allergens

On April 24, 2024, we announced

the publication of the detailed results from the NASAR clinical trial with Bentrio® nasal spray in seasonal allergic rhinitis (SAR)

by Becker and colleagues in the journal Allergy. The NASAR trial enrolled 100 patients during two allergy seasons in Australia who were

randomized at a 1:1 ratio to receive either Bentrio® or saline nasal spray, the current standard of care in drug-free SAR management.

Study participants self-administered the treatment for two weeks three times per day. The primary efficacy endpoint was the reduction

in the mean daily reflective Total Nasal Symptom Score (rTNSS; ANCOVA model).

Bentrio®-treated patients

achieved a significantly lower rTNSS than the saline group (least square means difference -1.1, p = 0.013) with improvement observed across

all individual nasal symptoms. Health-related quality of life, as measured by the Rhinoconjunctivitis Quality of Life Questionnaire (RQLQ),

was significantly improved as well (p < 0.001). Patients and investigators rated the efficacy of treatment as significantly better

with Bentrio® compared to saline control (both p < 0.001). Both treatments showed similarly good safety and tolerability. With

Bentrio®, fewer patients used relief medication and more enjoyed symptom-free days compared to saline treatment.

AM-125 in acute vestibular syndrome

On June 20, 2024, we announced

the publication of an article by Özgirgin and colleagues in the journal Frontiers in Neurology describing the rationale for and use

of betahistine in the treatment of residual dizziness following standard of care physical repositioning procedures for benign paroxysmal

positional vertigo (BPPV). BPPV is characterized by repeated episodes of vertigo produced by changes in the head position relative to

gravity, e.g. when tipping the head backward. It is typically caused by dislodged inner ear particles (otoconia) in one of the semicircular

canals, most often the posterior canal. The debris elicits unwanted vestibular stimulation and is often cleared through physical repositioning

procedures such as the Epley maneuver, which is strongly recommended by the Clinical Practice Guideline of the American Academy of Otolaryngology–Head

and Neck Surgery.

Even in case of a successful

physical repositioning procedure, patients may experience residual dizziness. This may last for a few days up to several weeks and may

affect quality of life and be of incapacitating nature. Based on their review of available treatment options, the authors of the publication

suggest the use of vestibular habituation therapies and vestibular rehabilitation programs to facilitate vestibular compensation and

treatment with betahistine for improvement of inner ear blood supply and promotion of vestibular compensation. BPPV is the most common

type of vertigo and accounts for 17 to 42% of all diagnosed cases; in the United States, healthcare costs associated with the diagnosis

of BPPV alone approach $2 billion per year.

“At the market” program

On January 19, 2024, we entered

into a sales agreement (the “HCW Sales Agreement”) with Wainwright. Pursuant to the terms of the HCW Sales Agreement, we may

offer and sell our Common Shares, from time to time through Wainwright by any method deemed to be an “at-the-market” offering

as defined in Rule 415(a)(4) promulgated under the Securities Act. Pursuant to the HCW Sales Agreement, as of September 17, 2024, we have

sold 637,460 Common Shares under the HCW Sales Agreement for aggregate gross proceeds of $1.66 million.

The

HCW Sales Agreement effectively replaced the sales agreement that we entered into with A.G.P./Alliance Global Partners (“A.G.P.”

and the “A.G.P. Sales Agreement”) on November 20, 2018, and amended on April 5, 2019. Pursuant to the terms of the A.G.P.

Sales Agreement, the Company could offer and sell its Common Shares, from time to time through A.G.P. by any method deemed to be an “at-the-market”

offering as defined in Rule 415(a)(4) promulgated under the Securities Act. Prior to its termination, we sold an aggregate of 123,512

of our Common Shares for an aggregate offering price of $13.1 million pursuant to the A.G.P. Sales Agreement.

Corporate Information

We are an exempted company

incorporated under the laws of Bermuda. We began our current operations in 2003. On April 22, 2014, we changed our name from Auris Medical

AG to Auris Medical Holding AG and transferred our operational business to our newly incorporated subsidiary Auris Medical AG, which is

now our main operating subsidiary (since renamed as Altamira Therapeutics AG). On March 13, 2018, we effected a corporate reorganization

through a merger into a newly formed holding company for the purpose of effecting the equivalent of a 10-1 “reverse share split.”

Following shareholder approval at an extraordinary general meeting of shareholders held on March 8, 2019 and upon the issuance of a certificate

of continuance by the Registrar of Companies in Bermuda on March 18, 2019, the Company discontinued as a Swiss company and, pursuant to

Article 163 of the Swiss Federal Act on Private International Law and pursuant to Section 132C of the Companies Act 1981 of Bermuda (the

“Companies Act”), continued existence under the Companies Act as a Bermuda company with the name “Auris Medical Holding

Ltd.” Following shareholders’ approval at a special general meeting of shareholders held on July 21, 2021, we changed our

name to Altamira Therapeutics Ltd. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, telephone

number +1 (441) 295 5950.

We maintain a website at www.altamiratherapeutics.com

where general information about us is available. Investors can obtain copies of our filings with the Securities and Exchange Commission,

or the SEC or the Commission, from this site free of charge, as well as from the SEC website at www.sec.gov. We are not incorporating

the contents of our website into this prospectus.

Implications of Being a Foreign Private Issuer

We currently report under the Exchange Act as

a non-U.S. company with foreign private issuer, or FPI, status. Although we no longer qualify as an emerging growth company, as long as

we qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from certain provisions of the Exchange Act

that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange

Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange

Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from

trades made in a short period of time; and |

| ● | the rules under the Exchange

Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information,

or current reports on Form 8-K, upon the occurrence of specified significant events. |

THE

OFFERING

This summary highlights information presented

in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider

before investing in our Common Shares. You should carefully read this entire prospectus before investing in our common shares including

“Risk Factors,” our consolidated financial statements and the documents incorporated herein.

Common Shares

Offered by us |

377,000 Common Shares at a combined public offering price of $0.72 per Common Share and accompanying Common Warrants. |

| |

|

Pre-Funded

Warrants

Offered by us |

We are also offering to those purchasers whose

purchase of Common Shares in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding Common Shares immediately following consummation

of this offering, the opportunity to purchase, if they so choose, Pre-Funded Warrants to purchase up to 5,178,556 Common Shares in lieu

of Common Shares that would otherwise result in ownership in excess of 4.99% (or 9.99%, as applicable) of our outstanding Common Shares.

The exercise price of each Pre-Funded Warrant

will be $0.002 per Common Share. The purchase price of each Pre-Funded Warrant and accompanying Common Warrants will equal the price per

Common Share and accompanying Common Warrants being sold to the public in this offering, minus $0.002.

Each Pre-Funded Warrant will be immediately exercisable

and may be exercised at any time until exercised in full. There is no expiration date for the Pre-Funded Warrants. To better understand

the terms of the Pre-Funded Warrants, you should carefully read the “Description of Securities We Are Offering” section of

this prospectus. You should also read the form of Pre-Funded Warrant, which is filed as an exhibit to the registration statement that

includes this prospectus.

This prospectus also relates to the offering of

the Common Shares issuable upon exercise of the Pre-Funded Warrants. |

Common

Warrants

Offered by us |

The Common Warrants will have an exercise price

of $0.72 per Common Share. The Series A-1 Warrants will expire on the earlier of the eighteen-month anniversary of the original issuance

date or 60 days following the occurrence of Milestone 1. The Series A-2 Warrants will expire on the earlier of the five-year anniversary

of the original issuance date or six months following the occurrence of Milestone 2.

The Common Shares and Pre-Funded Warrants, and

the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately.

To better understand the terms of the Common Warrants,

you should carefully read the “Description of Securities We Are Offering” section of this prospectus. You should also read

the forms of Common Warrants, which are filed as exhibits to the registration statement that includes this prospectus. This prospectus

also relates to the offering of the Common Shares issuable upon exercise of the Common Warrants. |

| |

|

Placement Agent

Warrants

Offered by us |

We have also agreed to issue to the Placement

Agent or its designees as compensation in connection with this offering, warrants to purchase up to 361,111 Common Shares. The Placement

Agent Warrants will be exercisable beginning on the date of issuance and will have substantially the same terms as the Common Warrants,

except that the Placement Agent Warrants will have an exercise price of $0.90 per Common Share (representing 125% of the combined

public offering price per Common Share and accompanying Common Warrants) and a termination date that will be five years from the commencement

of the sales pursuant to this offering. See “Plan of Distribution” below.

To better understand the terms of the Placement

Agent Warrants, you should carefully read the descriptions of the Placement Agent Warrants in the “Description of Securities We

Are Offering” and “Plan of Distribution” sections of this prospectus. You should also read the form of Placement Agent

Warrant, which is filed as an exhibit to the registration statement that includes this prospectus. This prospectus also relates to the

offering of the Common Shares issuable upon exercise of the Placement Agent Warrants. |

| |

|

Common Shares

Outstanding |

3,401,524 shares as of September 17, 2024. |

Common Shares to be

Outstanding After

This Offering |

8,957,080 Common Shares, assuming exercise in full of all Pre-Funded Warrants and no exercise of the Common Warrants and Placement Agent Warrants being offered in this offering. |

| |

|

| Use of Proceeds |

We estimate that the net proceeds of this offering,

after deducting Placement Agent fees and estimated offering expenses, will be approximately $3.3 million, assuming the exercise in full

of all Pre-Funded Warrants offered hereby and assuming no exercise of the Common Warrants and Placement Agent Warrants.

We currently intend to use the net proceeds from

this offering for working capital and general corporate purposes. |

| |

|

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 and other information included and incorporated by reference in this prospectus for a discussion of factors that you should carefully consider before deciding to invest in our Securities. |

| |

|

| Lock-Up Agreements |

The Company and our directors and officers have agreed with the Placement Agent, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Common Shares or securities convertible into or exercisable or exchangeable for our Common Shares for a period of seventy-five (75) days after the closing of this offering. See “Plan of Distribution” for more information. |

| |

|

| Nasdaq Listing |

Our Common Shares are listed on Nasdaq under the symbol “CYTO.” We do not intend to apply for the listing of the Pre-Funded Warrants, Placement Agent Warrants or Common Warrants on any national securities exchange or other trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants, Placement Agent Warrants and Common Warrants will be limited. |

The number of our Common Shares

to be issued and outstanding after this offering is based on 3,401,524 Common Shares issued and outstanding as of September 17, 2024 and

excludes:

| |

● |

404,608 of our Common Shares issuable upon the

exercise of options outstanding as of September 17, 2024 at a weighted average exercise price of $2.56 per Common Share; and |

| |

● |

677,893 Common Shares issuable upon the exercise

of warrants outstanding as of September 17, 2024 at a weighted average exercise price of $16.51 per Common Share. |

Unless otherwise indicated, the information in

this prospectus, including the number of Common Shares outstanding after this offering, does not reflect any exercise of the Common Warrants

or the Placement Agent Warrants, and exercise in full of all Pre-Funded Warrants issued in this offering.

RISK

FACTORS

Any investment in our securities involves a

high degree of risk. You should carefully consider the risks described below and in “Item 3. Key Information—D. Risk factors”

in our Annual Report on Form 20-F for the year ended December 31, 2023, incorporated by reference herein, and all of the information included

or incorporated by reference in this prospectus before deciding whether to purchase our Securities. The risks and uncertainties described

below or incorporated by reference in this prospectus are not the only risks and uncertainties we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also impair our business operations. If any of the events or circumstances

described in the following risk factors actually occur, our business, financial condition and results of operations would suffer. In that

event, the price of our Common Shares could decline, and you may lose all or part of your investment. The risks discussed below also include

forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See

“Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to this Offering

Purchasers who purchase our Securities in

this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit

of a securities purchase agreement.

In addition to rights

and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities

purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract

provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including:

(i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for two (2) years from closing, subject to certain

exceptions; (iii) agreement to not enter into any financings for seventy-five (75) days from closing, subject to certain exceptions;

and (iv) indemnification for breach of contract.

This is a reasonable best efforts offering,

with no minimum amount of Securities required to be sold, and we may not raise the amount of capital we believe is required for our business

plans, including our near-term business plans, nor will investors in this offering receive a refund in the event that we do not sell an

amount of Securities sufficient to pursue the business goals outlined in this prospectus.

The Placement Agent has agreed

to use its reasonable best efforts to solicit offers to purchase the Securities in this offering. The Placement Agent has no obligation

to buy any of the Securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the Securities.

We may sell fewer than all of the Securities offered hereby, which may significantly reduce the amount of proceeds received by us, and

investors in this offering will not receive a refund in the event that we do not sell an amount of Securities sufficient to support our

business goals and continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we

believe is required for our operations in the short-term and may need to raise additional funds to complete such short-term operations.

Such additional capital may not be available or available on terms acceptable to us, or at all.

There is no required minimum

number of Securities that must be sold as a condition to completion of this offering, and we have not, nor will we, establish an escrow

account in connection with this offering. Because there is no minimum offering amount required as a condition to the closing of this offering,

the actual offering amount, the Placement Agent fees and proceeds to us are not presently determinable and may be substantially less than

the maximum amounts set forth herein. Because there is no escrow account and no minimum offering amount, investors could be in a position

where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because

there is no escrow account in operation and no minimum investment amount, any proceeds from the sale of Securities offered by us will

be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our

business plan. Investor funds will not be returned under any circumstances whether during or after the offering.

There is no public market for the Pre-Funded Warrants or the

Common Warrants sold in this offering.

There is no established public

trading market for the Pre-Funded Warrants or Common Warrants being sold in this offering. We will not list the Pre-Funded Warrants or

Common Warrants on any securities exchange or nationally recognized trading system, including Nasdaq. Therefore, we do not expect a market

to ever develop for the Pre-Funded Warrants or Common Warrants. Without an active market, the liquidity of the Pre-Funded Warrants and

the Common Warrants will be limited.

The Pre-Funded Warrants and Common Warrants

are speculative in nature. Holders of the Pre-Funded Warrants and the Common Warrants offered hereby will have no rights as common shareholders

with respect to Common Shares underlying such warrants until such holders exercise their warrants and acquire our Common Shares, except

as otherwise provided in the Pre-Funded Warrants and the Common Warrants.

The Pre-Funded Warrants and

Common Warrants do not confer any rights of Common Share ownership on their holders, such as voting rights or the right to receive dividends,

but merely represent the right to acquire Common Shares at a fixed price. Commencing on the date of issuance, holders of the Pre-Funded

Warrants and the Common Warrants may exercise their right to acquire the underlying Common Shares and pay the respective stated warrant

exercise price per Common Share. Following this offering, the market value of the Common Warrants is uncertain and there can be no assurance

that the market value of the Common Warrants, if any, will equal or exceed their combined public offering prices. There can be no assurance

that the market price of the Common Shares will ever equal or exceed the exercise price of the Common Warrants, and consequently, whether

it will ever be profitable for holders of Common Warrants to exercise the Common Warrants.

Until holders of the Pre-Funded

Warrants and the Common Warrants acquire Common Shares upon exercise thereof, holders of such Pre-Funded Warrants and Common Warrants

will have no rights with respect to Common Shares, except as provided in the Pre-Funded Warrants and the Common Warrants, respectively.

Upon exercise of the Pre-Funded Warrants and Common Warrants, such holders will be entitled to the rights of a common shareholder only

as to matters for which the record date occurs after the exercise date.

We have broad discretion in how we use the

net proceeds of this offering, and we may not use these proceeds effectively or in ways with which you agree.

Our management will have broad

discretion as to the application of the net proceeds of this offering and could use them for purposes other than those contemplated at

the time of the offering. We currently intend to use the net proceeds, if any, from this offering for working capital and general corporate

purposes. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover,

our management may use the net proceeds for corporate purposes that may not increase the market price of our Common Shares or other securities.

See the section of this prospectus titled “Use of Proceeds” on page 12.

Risks Related to our Securities

We need to raise capital in this offering

to support our operations, and there is substantial doubt about our ability to continue as a going concern. If we are unable to raise

capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect that we will need

additional funding. We have incurred recurring losses and negative cash flows from operations since inception and we expect to generate

losses from operations for the foreseeable future primarily due to research and development costs for our RNA delivery platforms and our

product candidates AM-401 and AM-411. We also expect to continue to incur additional costs associated with operating as a public company.

We expect our total cash need

in 2024 to be in the range of CHF 5.0 to 6.0 million, prior to the receipt of any proceeds from this offering. Our assumptions may prove

to be wrong, and we may have to use our capital resources sooner than we currently expect. To the extent that we will be unable to generate

sufficient cash proceeds from the planned divestiture or partnering of our AM-125 development program and revenues from our 49% stake

in our associated company Altamira Medica AG, the receipt of grants, licensing and service fees from collaborations in the field of RNA

delivery as well as further issuances of Common Shares under the purchase agreement we entered into with Lincoln Park Capital Fund, LLC

on December 5, 2022 (the “LPC Purchase Agreement”) and/or under the HCW Sales Agreement, we may need substantial additional

financing to meet these funding requirements. These factors raise substantial doubt about the Company’s ability to continue as a

going concern. The financial statements incorporated by reference in this prospectus have been prepared on a going concern basis, which

contemplates the continuity of normal activities and realization of assets and settlement of liabilities in the normal course of business.

The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Because there is substantial

doubt over the Company’s going concern, this may negatively affect the valuation of the Company’s investments in its subsidiaries

and result in a revaluation of these holdings. Our board of directors will need to consider the interests of our creditors and take appropriate

action to restructure the business if it appears that we are insolvent or likely to become insolvent. Our future funding requirements

will depend on many factors, including but not limited to:

| · | the scope, rate of progress, results and cost of our nonclinical

testing and other related activities; |

| · | the cost of sourcing key ingredients for our RNA delivery

programs and of manufacturing our product candidates and any products that we may develop; |

| · | the scope of the further development of our RNA delivery platforms

and the number and characteristics of product candidates that we pursue; and |

| · | the terms and timing of any collaborative, licensing, and

other arrangements that we may establish, including any required milestone and royalty payments thereunder. |

Additional funds may not be

available on a timely basis, on favorable terms, or at all, and such funds, if raised, may not be sufficient to enable us to continue

to implement our long-term business strategy. If we are not able to raise capital when needed, we could be forced to delay, reduce or

eliminate our product development programs or commercialization efforts, which could materially harm our business, prospects, financial

condition and operating results. This could then result in bankruptcy, or the liquidation of the Company.

You may experience future dilution as a

result of future equity offerings or other equity issuances.

In order to raise additional

capital, we believe that we will offer and issue additional Common Shares or other securities convertible into or exchangeable for our

Common Shares in the future. We cannot assure you that we will be able to sell Common Shares or other securities in any other offering

at a price per share that is equal to or greater than the price per share paid by purchasers in this offering, and investors purchasing

other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional Common

Shares or other securities convertible into or exchangeable for our Common Shares in future transactions may be higher or lower than the

price per share in this offering.

In addition, we have a significant

number of warrants, options and convertible debt outstanding. To the extent that outstanding options, warrants or convertible debt have

been or may be exercised or converted or other Common Shares are issued, you may experience further dilution. Further, we may choose to

raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current

or future operating plans, which may lead to further dilution.

Our Common Shares

may be involuntarily delisted from trading on The Nasdaq Capital Market if we fail to comply with the continued listing requirements.

A delisting of our Common Shares is likely to reduce the liquidity of our Common Shares and may inhibit or preclude our ability to raise

additional financing.

We

are required to comply with certain Nasdaq continued listing requirements, including a series of financial tests relating to shareholder

equity, market value of listed securities and number of market makers and shareholders. If we fail to maintain compliance with any of

those requirements, our Common Shares could be delisted from The Nasdaq Capital Market.

On

multiple occasions in recent years, we failed to maintain compliance with the minimum bid price requirement. To address that non-compliance,

on each of May 1, 2019, October 25, 2022, and December 13, 2023, we effected a “reverse share split” at a ratio of 20-for-1

and, in each case, we subsequently regained compliance as our share price increased. Additionally, on May 25, 2023, we received a letter

from Nasdaq indicating that we were no longer in compliance with Nasdaq’s minimum shareholders’ equity requirement. On November

21, 2023, we regained compliance. However, there can be no assurance that we will be able to successfully maintain compliance with the

several Nasdaq continued listing requirements.

If,

for any reason, Nasdaq should delist our Common Shares from trading on its exchange and we are unable to obtain listing on another national

securities exchange or take action to restore our compliance with the Nasdaq continued listing requirements, a reduction in some or all

of the following may occur, each of which could have a material adverse effect on our shareholders:

| ● | the liquidity of our Common Shares; |

| ● | the market price of our Common Shares; |

| ● | our ability to obtain financing for the continuation of our

operations; |

| ● | the number of institutional and general investors that will

consider investing in our Common Shares; |

| ● | the number of investors in general that will consider investing

in our Common Shares; |

| ● | the number of market makers in our Common Shares; |

| ● | the availability of information concerning the trading prices

and volume of our Common Shares; and |

| |

● |

the number of broker-dealers willing to execute trades in our Common Shares. |

Moreover,

delisting may make unavailable a tax election that could affect the U.S. federal income tax treatment of holding, and disposing of, our

Common Shares. See “Taxation—Material U.S. Federal Income Tax Considerations for U.S. Holders” below.

If we are or become classified as a passive

foreign investment company (“PFIC”), our U.S. shareholders and holders of the Common Warrants and Pre-Funded Warrant may suffer

adverse tax consequences as a result.

A non-U.S. corporation, such

as our Company, will be considered a PFIC for any taxable year if either (i) at least 75% of its gross income is passive income or (ii)

at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable

to assets that produce or are held for the production of passive income.

Based upon our current and

projected income and assets, and projections as to the value of our assets, we do not anticipate that we will be a PFIC for the 2024 taxable

year or the foreseeable future. However, no assurance can be given in this regard because the determination of whether we will be or become

a PFIC is a factual determination made annually that will depend, in part, upon the composition of our income and assets, and we have

not and will not obtain an opinion of counsel regarding our classification as a PFIC. Fluctuations in the market price of our Common Shares

may cause us to be classified as a PFIC in any taxable year because the value of our assets for purposes of the asset test, including

the value of our goodwill and non-recorded intangibles, may be determined by reference to the market price of our Common Shares from time

to time (which may be volatile). If our market capitalization subsequently declines, we may be or become classified as a PFIC for the

2024 taxable year or future taxable years. Furthermore, the composition of our income and assets may also be affected by how, and how

quickly, we use our liquid assets and any future fundraising activity. Under circumstances where our revenues from activities that produce

passive income significantly increases relative to our revenues from activities that produce non-passive income, or where we determine

not to deploy significant amounts of cash for active purposes, our risk of becoming classified as a PFIC may substantially increase. It

is also possible that the Internal Revenue Service (the “IRS”) may challenge the classification or valuation of our Company’s

assets, including its goodwill and other non-recorded intangibles, or the classification of certain amounts received by our Company, which

may result in our Company being, or becoming classified as, a PFIC for the 2024 taxable year or future taxable years. Accordingly, there

can be no assurance that we will not be a PFIC in the current or for any future taxable year and U.S. investors should invest in our Common

Shares, Common Warrants or Pre-Funded Warrants only if they are willing to bear the U.S. federal income tax consequences associated with

investments in PFICs.

If we were a PFIC for any

taxable year during which a U.S. investor held our Common Shares, Common Warrants or Pre-Funded Warrants, certain adverse U.S. federal

income tax consequences could apply to the U.S. Holder. See “Taxation—Material U.S. Federal Income Tax Considerations for

U.S. Holders.”

PRESENTATION

OF FINANCIAL AND OTHER INFORMATION

We report under International

Financial Reporting Standards as issued by the International Accounting Standards Board and Interpretations (collectively “IFRS”).

None of the consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United

States.

The terms “dollar,”

“USD” or “$” refer to U.S. dollars, the term, “Swiss Francs” or “CHF” refers to the legal

currency of Switzerland and the terms “€” or “euro” are to the currency introduced at the start of the third

stage of European economic and monetary union pursuant to the treaty establishing the European Community, as amended. Unless otherwise

indicated, all references to currency amounts in this prospectus are in Swiss Francs.

We have made rounding adjustments

to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic

aggregation of the figures that preceded them.

MARKET

AND INDUSTRY DATA

This prospectus contains industry,

market and competitive position data that are based on industry publications and studies conducted by third parties as well as our own

internal estimates and research. These industry publications and third-party studies generally state that the information that they contain

has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements

that constitute forward-looking statements, including statements concerning our industry, our operations, our anticipated financial performance

and financial condition, and our business plans and growth strategy and product development efforts. These statements constitute forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. The words “may,” “might,”

“will,” “should,” “estimate,” “project,” “plan,” “anticipate,”

“expect,” “intend,” “outlook,” “believe” and other similar expressions are intended to

identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe

to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties.

Forward-looking statements

appear in a number of places in this prospectus and include, but are not limited to, statements regarding our intent, belief or current

expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available

to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed

or implied in the forward-looking statements due to various factors, including, but not limited to:

| ● | our operation as a drug development-stage

company with limited operating history and a history of operating losses; |

| ● | our need for substantial additional

funding to continue the development of our RNA delivery platforms and product candidates before we can expect to become profitable from

the out-licensing of our platform technology and products and the possibility that we may be unable to raise additional capital when

needed; |

| ● | the timing, scope, terms and

conditions of a potential divestiture or partnering of the Company’s AM-125 development program in vertigo as well as the cash

such transaction(s) may generate; |

| ● | our dependence on the success

of OligoPhore™, SemaPhore™, AM-401 and AM-411, which are still in preclinical development, and may eventually prove to be

unsuccessful; |

| ● | the chance that we may become

exposed to costly and damaging liability claims resulting from the testing of our product candidates in the clinic; |

| ● | the chance our clinical trials

may not be completed on schedule, or at all, as a result of factors such as delayed enrollment or the identification of adverse effects; |

| ● | our reliance on our current

strategic relationship with Washington University and the potential success or failure of strategic relationships, joint ventures or

mergers and acquisitions transactions; |

| ● | our reliance on third parties

to conduct certain of our nonclinical studies and on third-party, single-source suppliers to supply certain key ingredients for our RNA

delivery platforms or produce our product candidates; |

| ● | our ability to obtain, maintain

and protect our intellectual property rights and operate our business without infringing or otherwise violating the intellectual property

rights of others; |

| ● | our ability to meet the continuing

listing requirements of Nasdaq and remain listed on The Nasdaq Capital Market; |

| ● | the chance that certain intangible

assets related to our product candidates will be impaired; and |

| |

● |

other risk factors discussed under “Item

3. Key Information—D. Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2023. |

Our actual results or performance

could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly,

no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of

them do so, what impact they will have on our results of operations, cash flows or financial condition. Except as required by law, we

are under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether

written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise.

USE

OF PROCEEDS

We estimate that we will receive

net proceeds from this offering of approximately $3.3 million (assuming the sale of the maximum number of Securities offered hereby),

based upon a combined public offering price of $0.72 per Common Share and accompanying Common Warrants, after deducting Placement Agent

fees and estimated offering expenses payable by us and assuming no exercise of the Common Warrants and Placement Agent Warrants and exercise

in full of the Pre-Funded Warrants.

However, because this is a

reasonable best efforts offering with no minimum number of Securities or amount of proceeds as a condition to closing, the actual offering

amount, Placement Agent fees, and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts

set forth on the cover page of this prospectus, and we may not sell all or any of the Securities we are offering. As a result, we may

receive significantly less in net proceeds. Based on the combined public offering price set forth above, we estimate that our net proceeds

from the sale of 75%, 50%, and 25% of the Securities offered in this offering would be approximately $2.4 million, $1.5 million, and $0.6

million, respectively, after deducting the Placement Agent fees and estimated offering expenses payable by us, and assuming no exercise

of the Common Warrants and Placement Agent Warrants and exercise in full of the Pre-Funded Warrants. We will only receive additional proceeds

from the exercise of the Pre-Funded Warrants, if any, and the Placement Agent Warrants and Common Warrants we are issuing in this offering

if the Pre-Funded Warrants, Placement Agent Warrants and the Common Warrants are exercised for cash. We cannot predict when or if the

Pre-Funded Warrants, Placement Agent Warrants or the Common Warrants will be exercised. It is possible that these warrants may expire

and may never be exercised.

These estimates exclude the

proceeds, if any, from the exercise of Common Warrants offered hereby. If all of the Common Warrants offered hereby were to be exercised

in cash at an exercise price of $0.72 per Common Share, we would receive additional proceeds of approximately $8.0 million. We cannot

predict when or if these Common Warrants will be exercised. It is possible that these Common Warrants may expire and may never be exercised.

Additionally, these Common Warrants contain a cashless exercise provision that permit exercise of such Common Warrants on a cashless basis

at any time when there is no effective registration statement under the Securities Act covering the issuance of the underlying Common

Shares.

These estimates also exclude

the proceeds, if any, from the exercise of Placement Agent Warrants to be issued to the Placement Agent or its designees as compensation

in connection with this offering. If all of the Placement Agent Warrants were to be exercised in cash at an exercise price of $0.90 per

Common Share, we would receive additional proceeds of approximately $0.3 million. We cannot predict when or if these Placement Agent Warrants

will be exercised. It is possible that these Placement Agent Warrants may expire and may never be exercised. Additionally, these Placement

Agent Warrants contain a cashless exercise provision that permit exercise of such Placement Agent Warrants on a cashless basis at any

time when there is no effective registration statement under the Securities Act covering the issuance of the underlying Common Shares.

We currently intend to use

the net proceeds from this offering for working capital and other general corporate purposes. This expected use of net proceeds from this

offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans

and business conditions evolve. The foregoing represents our intentions as of the date of this prospectus based upon our current plans

and business conditions to use and allocate the net proceeds of the offering. However, our management will have significant flexibility

and discretion in the timing and application of the net proceeds of the offering. Unforeseen events or changed business conditions may

result in application of the proceeds of the offering in a manner other than as described in this prospectus. Our shareholders may not

agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net

proceeds for corporate purposes that may not result in our being profitable or increase our market value.

Pending our use of the net

proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments, including short-term,

investment-grade, interest-bearing instruments and U.S. government securities.

DIVIDEND

POLICY

We have never paid a dividend,

and we do not anticipate paying dividends in the foreseeable future. We intend to retain all available funds and any future earnings to

fund the development and expansion of our business. As a result, investors in our Common Shares will benefit in the foreseeable future

only if our Common Shares appreciate in value.

Any future determination to

declare and pay dividends to holders of our Common Shares will be made at the discretion of our board of directors, which may take into

account several factors, including general economic conditions, our financial condition and results of operations, available cash and

current and anticipated cash needs, capital requirements, contractual, legal, tax and regulatory restrictions, the implications of the

payment of dividends by us to our shareholders and any other factors that our board of directors may deem relevant. In addition, pursuant

to the Companies Act, a company may not declare or pay dividends if there are reasonable grounds for believing that (1) the company is,

or would after the payment be, unable to pay its liabilities as they become due or (2) that the realizable value of its assets would thereby

be less than its liabilities. Under our bye-laws, each of our common shares is entitled to dividends if, as and when dividends are declared

by our board of directors, subject to any preferred dividend right of the holders of any preferred shares.

We are a holding company with

no material direct operations. As a result, we would be dependent on dividends, other payments or loans from our subsidiaries in order

to pay a dividend. Our subsidiaries are subject to legal requirements of their respective jurisdictions of organization that may restrict

their paying dividends or other payments, or making loans, to us.

CAPITALIZATION

The table below sets forth

our cash and cash equivalents and our total capitalization (defined as total debt and shareholders’ equity) as of December 31, 2023:

| ● | on a pro forma basis to give

effect to the issuance of 1,192,739 of our Common Shares for an aggregate of $2,643,956 in gross proceeds pursuant to the HCW Sales Agreement

and the LPC Purchase Agreement subsequent to December 31, 2023; |

| |

● |

on a pro forma as adjusted basis to give further effect to our issuance and sale of 377,000 Common Shares and Pre-Funded Warrants to purchase up to 5,178,556 Common Shares and accompanying Common Warrants to purchase up to 11,111,112 Common Shares in this offering, at a combined public offering price of $0.72 per Common Share and accompanying Common Warrants, after deducting Placement Agent’s fees and estimated offering expenses payable by us, excluding the proceeds, if any, from the exercise of the Common Warrants or Placement Agent Warrants issued in this offering, assuming the immediate full exercise for cash of any Pre-Funded Warrants issued in this offering and assuming no value is attributed to the Common Warrants being sold in this offering. |

Investors should read this

table in conjunction with our audited consolidated financial statements and related notes as of and for the year ended December 31, 2023

and management’s discussion and analysis thereon, each as incorporated by reference into this prospectus, as well as “Use

of Proceeds” in this prospectus.

U.S. dollar amounts have

been translated into Swiss Francs at a rate of CHF 0.8405 to USD 1.00, the official exchange rate quoted as of December 29, 2023 by the

U.S. Federal Reserve Bank. Such Swiss Franc amounts are not necessarily indicative of the amounts of Swiss Francs that could actually

have been purchased upon exchange of U.S. dollars on December 29, 2023 and have been provided solely for the convenience of the reader.

On September 6, 2024, the exchange rate as reported by the U.S. Federal Reserve Bank was CHF 0.8428 to USD 1.00.

The pro forma as adjusted information below is

illustrative only and our capitalization following the completion of this offering is subject to adjustment based on the actual public

offering price of our Securities and other terms of this offering determined at pricing. You should read this capitalization table in

conjunction with “Use of Proceeds,” and our financial statements and the related notes thereto appearing elsewhere in this

prospectus or incorporated by reference herein.

| | |

As of December 31, 2023 | |

| | |

Actual | | |

Pro Forma | | |

Pro

Forma

As

Adjusted | |

| | |

(in thousands of CHF,

except for share amounts) | |

| Cash and cash equivalents | |

| 617 | | |

| 2,795 | | |

| 5,600 | |

| Lease liabilities | |

| 100 | | |

| 100 | | |

| 100 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Share capital | |

| | | |

| | | |

| | |

| Common Shares, par value $0.002 per share; 1,477,785 Common Shares issued and outstanding on an actual basis, 2,670,524 Common Shares issued and outstanding on a pro forma basis, 8,226,080 Common Shares issued and outstanding on a pro forma as adjusted basis | |

| 3 | | |

| 5 | | |

| 14 | |

| Share premium | |

| 20,103 | | |

| 22,279 | | |

| 25,075 | |

| Other reserves | |

| 4,399 | | |

| 4,399 | | |

| 4,399 | |

| Accumulated deficit | |

| (18,046 | ) | |

| (18,046 | ) | |

| (18,046 | ) |

| Total shareholders’ equity attributable to owners of the Company | |

| 6,459 | | |

| 8,637 | | |

| 11,442 | |

| Total capitalization | |

| 6,559 | | |

| 8,737 | | |

| 11,542 | |

The above discussion and table

are based on 1,477,785 Common Shares outstanding as of December 31, 2023 and exclude:

| ● | 145,324 of our Common Shares

issuable upon the exercise of options outstanding as of December 31, 2023 at a weighted average exercise price of $22.17 per Common

Share; and |

| ● | 759,167 of our Common Shares

issuable upon the exercise of warrants outstanding as of December 31, 2023 at a weighted average exercise price of $15.59 per