By Roque Ruiz, Katherine Riley and Sarah E. Needleman

If there is one thing Epic Games Inc. and Apple Inc. can both

agree on even as they battle each other, it is that the app economy

is worth fighting over.

In the 13 years since Apple launched its App Store, the number

of apps has exploded. The business of delivering them to people's

smartphones has grown into a revenue stream worth tens of billions

of dollars annually for Apple and the other main marketplace

operator, Alphabet Inc.'s Google.

App stores have become critical gatekeepers in accessing

software that lets users do everything on the internet, including

watch television, read books and check the weather. Key to the

stores' business models is that they collect a commission on

consumers' purchases of digital goods and services. They don't take

a portion of sales of real-world goods and services, like T-shirts

or car rides purchased through an app from their stores, but when

someone spends on a videogame perk or subscribes to an online

fitness program, the gatekeepers get their cuts.

The fees that Apple and Google charge -- 30% in many cases --

are at the center of lawsuits filed by "Fortnite" creator Epic

Games against the tech giants. Epic claims that Apple's App Store

rules stifle competition and run afoul of antitrust law. Apple

disputes Epic's allegations, saying that its rules are applied

evenly and that charging a commission is legal and covers expenses

such as maintaining user privacy.

The trial in Epic's case against Apple started May 3 and has the

potential to upend a key part of the iPhone maker's services

business.

Here is a snapshot of the rising app economy.

Consumers spend billions of dollars in app stores.

Consumer spending on digital goods and services has surged over

the years, according to analytics firm Sensor Tower, and the amount

of money the companies make off commissions has grown in

tandem.

Apple launched the App Store in 2008 -- the year after it

introduced the first iPhone -- with 500 apps. The Google Play store

was launched in 2012 by integrating the Android app marketplace

with Google's music and ebook platform. Each company's decision to

require in-app purchases of digital goods, services and

subscriptions to be routed through their payment-processing systems

helped bolster revenue for both.

Apple and Google both recently pledged to reduce their

commissions for developers in some instances starting this

year.

Game apps dominate spending.

Mobile games generate revenue mainly through sales of virtual

goods or access to special modes of play. That spending has

propelled game apps such as Tencent Holdings Ltd.'s "Honor of

Kings" and Niantic Inc.'s "Pokémon Go" to among the biggest apps by

annual revenue in the App Store and Google Play, according to

Sensor Tower.

Digital ads are growing in apps.

In addition to in-app purchases, many apps make money through

advertising sales, a business that has been growing in recent

years, data from Omdia show. Ads commonly appear in games as videos

that reward players for watching them with in-game perks. Apple and

Google set the guidelines that enable developers to generate

revenue from in-app ads.

Apple doesn't make money directly from in-app ads, but Google

does with its AdMob platform. Both companies offer developers the

option to pay to have their apps featured at the top of users'

search results or to reach customers on app-store pages. Such

revenue isn't captured, however, in the chart below.

Netflix, Tinder and TikTok are among the most popular nongame

apps.

More nongame apps have been among the top 10 apps for consumers'

digital spending in the App Store than in Google Play in recent

years. Those apps have included Netflix Inc., Match Group Inc.'s

Tinder and ByteDance Ltd.'s TikTok.

Epic, whose "Fortnite" game has been among the top mobile apps

by digital spending, has tried to broaden its attack on Apple and

Google beyond the game world. It has sought testimony from the

companies including Match and Spotify Technology SA, as well as

smaller app developers, to help make its case. A Match executive

told a Senate panel last month that app-store fees are the

company's fastest-growing expense and would soon eclipse $500

million annually.

Netflix, Spotify and other companies have sidestepped Apple's

cut by shifting to selling subscriptions and downloads through

their websites instead of their apps. Apple bars companies from

mentioning in their apps where else consumers can go to subscribe,

and it doesn't let companies mention the 30% cut of revenue it

collects.

Consumers are downloading more apps than ever.

The growth in downloads reflects how people are increasingly

turning to mobile devices as their primary means of accessing the

internet. It also speaks to the popularity of the free-to-play and

"freemium" models embraced by developers, which give consumers a

chance to try an app before having to commit to spending any money

on it.

Free-to-play games are entirely free but offer the option to

purchase virtual perks or experiences, while freemium apps provide

basic features at no cost and charge for additional or full

access.

The number of app-store developers is rising.

The pool of active developers on Apple's App Store and Google's

Play store has steadily grown over the years, a trend driven by

people's increased reliance on mobile devices for accessing the

internet, according to analysts at analytics firm App Annie Inc.

The pandemic accelerated that trend, boosting demand in particular

for food-and-drink, shopping and game apps, they said.

Most apps in Apple's App Store are free.

The total number of apps in the App Store was lower last year

than in 2017, in part because Apple purges those that no longer

meet its criteria for inclusion. It completed big purges of apps

from its platform in 2016 and 2017.

Meanwhile, the proportion of apps that are free and don't offer

in-app purchases has increased. Despite this trend, Apple's App

Store revenue has been rising because consumers have been spending

more money in apps that do offer in-app purchases as well as on

paid apps. The number of active iPhones world-wide also has

increased to more than a billion this year from around 900 million

in 2019.

Write to Roque Ruiz at Roque.RuizGonzalez@wsj.com and Sarah E.

Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

May 16, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

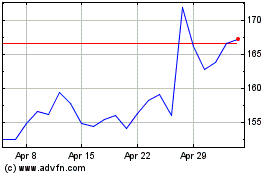

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024