Filed by Akoya Biosciences, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under

the Securities Exchange Act of 1934

Filer: Akoya Biosciences, Inc.

Subject Company: Akoya Biosciences, Inc.

SEC File No.: 001-40344

Date:

January 15, 2025

Talking Points and Customer-Facing

FAQs

Talking Points for Customer Conversations.

Use the appropriate talking points based on the customer’s specific

concerns to address their questions and provide reassurance. Below are key themes to guide your conversations. PLEASE NOTE: It

is critically important that you are clear in customer conversations that the merger has not yet closed. Until it does, Akoya and Quanterix

remain separate companies conducting their respective businesses independently. The merger is expected to close in Q2 2025. All Q and

A should be framed in this way (so the below will be purely forward looking):

| · | Customer Reassurance |

| | | "This merger is designed to strengthen, not disrupt,

your experience. Following the closing of the merger, you’ll continue to receive the same high-quality products, services, and support

you’ve come to expect, with even greater opportunities for innovation and collaboration." |

| · | Expanded Capabilities |

| | | "The combination of Akoya’s spatial biology capabilities

and Quanterix’s ultra-sensitive biomarker detection will create an unmatched ability to detect and monitor disease progression from

tissue to blood, empowering you to accelerate breakthroughs in your work.” |

| · | Focus on Innovation |

| | | "This merger will amplify our commitment to delivering

cutting-edge solutions tailored to the unique needs of researchers and clinicians in high-growth areas like oncology, neurology, and immunology." |

| · | Path to Growth |

| | | "With enhanced resources and expertise, following the

merger, we will be better positioned to invest in R&D, expand service offerings, and drive advancements in biomarker discovery, benefiting

both current and future customer needs." |

| · | Strategic Advantage |

| | | "By combining our strengths, we will be setting a new

standard in biomarker research, offering an integrated solution that enables earlier disease detection, deeper insights, and improved

patient outcomes." |

| · | Unwavering Commitment |

| | | "Our primary goal remains your success. This merger

is a step forward in providing more comprehensive solutions, ensuring we remain your trusted partner in biomarker discovery and diagnostics." |

Customer-Facing FAQs

General Information

| · | How will the merger with Quanterix enhance the customer experience? |

| | | Akoya’s merger with Quanterix, once closed, will bring

together complementary technologies to deliver an integrated solution for biomarker discovery. This partnership will enhance Akoya’s

ability to scale, innovate, and offer even greater value to its customers by combining tissue-based spatial biology with ultra-sensitive

biomarker detection. |

Talking Points and Customer-Facing

FAQs

| · | What happens to Akoya after the merger? |

| | | Immediately following the merger Akoya will be a wholly owned

subsidiary of Quanterix. Akoya’s technologies, expertise, and customer relationships will remain integral to the combined company’s

operations and future innovations. |

| · | Will the Akoya brand name still be used? |

| | | We are still in the very early phases of planning. Decisions

around branding will be addressed following the close of the merger during the integration process. |

| · | How will Akoya’s mission and focus be preserved within Quanterix? |

| | | Akoya’s mission to advance spatial biology and support

researchers in oncology and immunology aligns closely with Quanterix’s goals. The merger will strengthen this focus by providing

additional resources and technologies to drive innovation and customer success. |

| · | Tell me more about Quanterix. |

| | | Quanterix is a leader in ultra-sensitive biomarker detection,

particularly in blood-based assays. Their technology will complement Akoya’s tissue-based spatial biology solutions, creating a

seamless platform for tracking biomarkers from tissue to blood. |

Customer Impact

| · | Will my current Akoya products or services be affected? |

| | | There will be no immediate changes to your current Akoya

products or services. Post closing, we believe the merger will enhance your experience by offering expanded solutions and support. |

| · | Will contracts with Akoya still be valid? |

| | | The merger will have no legal effect on any existing contracts,

warranties, and service agreements with Akoya. |

| · | Will there be changes in pricing? |

| | | No immediate changes are planned. Any future pricing changes

will be pro-actively communicated to you by the sales representative. |

| · | What if I have ongoing projects or services with Akoya? |

| | | All ongoing projects and services will continue as planned.

We are committed to ensuring a seamless transition following the closing of the merger, without disrupting your work. |

| · | Will there be changes to how I place orders or receive support? |

| | | No immediate changes are planned. You can continue using

the same channels for orders and support until further notice. |

| · | Will you continue to support Akoya’s existing platforms? |

| | | Yes, Akoya’s platforms will continue to be supported,

ensuring continuity and reliability for our customers. |

| · | Will Akoya’s CLIA-certified lab services still be available? |

| | | Yes, prior to completion of the merger, Akoya’s CLIA-certified

lab services will continue to operate. Over time, following the closing of the merger, these services may be expanded to incorporate new

capabilities from Quanterix’s technology portfolio. |

| · | Will I need to change how I interact with Akoya’s teams? |

| | | Your existing points of contact and support teams remain

the same for now. Over time, following completion of the merger, you may see communications and interactions transition to Quanterix branding,

but the high-quality support you rely on will continue uninterrupted. |

Talking Points and Customer-Facing FAQs

Financial and Market Position

| · | How does this merger benefit the long-term stability of the company? |

| | | We anticipate that the combined company will be well-capitalized

and well-positioned to invest in growth initiatives, innovation, and expanded customer solutions. |

Integration and Future Outlook

| · | How will this merger benefit Akoya’s customers in the long term? |

| | | Once the merger is closed, long-term benefits will include

access to a broader range of technologies, faster innovation cycles, and solutions tailored to your needs in oncology, neurology, and

immunology research. |

| · | What new markets or applications will Akoya customers gain access to? |

| | | Following the closing of the merger, Akoya customers will

gain access to Quanterix’s expertise in ultra-sensitive liquid biopsy applications, opening opportunities in neurology, immunology,

and clinical diagnostics. |

| · | How will the combined company ensure seamless support during the post-closing integration process? |

| | | Following the closing of the merger, the integration will

be carefully managed to ensure minimal disruption to customer support, product availability, or ongoing projects. Customers can expect

the same high level of service throughout the transition. |

| · | What can Akoya customers expect next? |

| | | Following the closing of the merger, customers can expect

exciting announcements about new product developments, enhanced workflows, and broader application support. Updates will be shared regularly

through newsletters, webinars, and direct communication with your account teams. |

IMPORTANT ADDITIONAL INFORMATION

In connection with the proposed transaction, Quanterix will file with

the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration

statement”), which will contain a joint proxy statement of Quanterix and Akoya and a prospectus of Quanterix (the “joint proxy

statement/prospectus”), and each of Quanterix and Akoya may file with the SEC other relevant documents regarding the proposed transaction.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN

THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY QUANTERIX AND AKOYA, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT QUANTERIX, AKOYA AND THE PROPOSED TRANSACTION.

A definitive copy of the joint proxy statement/prospectus will be mailed to Quanterix and Akoya stockholders when that document is final.

Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus, as well as

other filings containing information about Quanterix and Akoya, free of charge from Quanterix or Akoya or from the SEC’s website

when they are filed. The documents filed by Quanterix with the SEC may be obtained free of charge at Quanterix’s website, at www.quanterix.com,

or by requesting them by mail at Quanterix Investor Relations, 900 Middlesex Turnpike, Billerica, MA 01821. The documents filed by Akoya

with the SEC may be obtained free of charge at Akoya’s website, at www.akoyabio.com, or by requesting them by mail at Akoya Biosciences,

100 Campus Drive, 6th Floor, ATTN: Chief Legal Officer, Marlborough, MA 01752.

Talking Points and Customer-Facing FAQs

PARTICIPANTS IN THE SOLICITATION

Quanterix and Akoya and certain of their respective directors and executive

officers may be deemed to be participants in the solicitation of proxies from the stockholders of Quanterix or Akoya in respect of the

proposed transaction. Information about Quanterix’s directors and executive officers is available in Quanterix’s proxy statement

dated April 15, 2024, for its 2024 Annual Meeting of Stockholders, and other documents filed by Quanterix with the SEC. Information

about Akoya’s directors and executive officers is available in Akoya’s proxy statement dated April 23, 2024, for its

2024 Annual Meeting of Stockholders, and other documents filed by Akoya with the SEC. Other information regarding the persons who may,

under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed

with the SEC regarding the proposed transaction when they become available. Investors should read the joint proxy statement/prospectus

carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from

Quanterix or Akoya as indicated above.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger of Quanterix and Akoya,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Talking Points and Customer-Facing

FAQs

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this communication which are not historical

in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes

of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements are based on, among other things, projections as to the anticipated benefits

of the proposed transaction as well as statements regarding the impact of the proposed transaction on Quanterix’s and Akoya’s

business and future financial and operating results, the amount and timing of synergies from the proposed transaction and the closing

date for the proposed transaction. Words and phrases such as “may,” “approximately,” “continue,” “should,”

“expects,” “projects,” “anticipates,” “is likely,” “look ahead,” “look

forward,” “believes,” “will,” “intends,” “estimates,” “strategy,” “plan,”

“could,” “potential,” “possible” and variations of such words and similar expressions are intended

to identify such forward-looking statements. Quanterix and Akoya caution readers that forward-looking statements are subject to

certain risks and uncertainties that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree

of occurrence, which could cause actual results to differ materially from anticipated results. Such risks and uncertainties include, among

others, the following possibilities: the occurrence of any event, change or other circumstances that could give rise to the right of one

or both of the parties to terminate the definitive merger agreement entered into between Quanterix and Akoya; the outcome of any legal

proceedings that may be instituted against Quanterix or Akoya; the failure to obtain necessary regulatory approvals (and the risk that

such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of

the proposed transaction) and stockholder approvals or to satisfy any of the other conditions to the proposed transaction on a timely

basis or at all; the possibility that the anticipated benefits and synergies of the proposed transaction are not realized when expected

or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the

strength of the economy and competitive factors in the areas where Quanterix and Akoya do business; the possibility that the proposed

transaction may be more expensive to complete than anticipated; diversion of management’s attention from ongoing business operations

and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement

or completion of the proposed transaction; changes in Quanterix’s share price before the closing of the proposed transaction; risks

relating to the potential dilutive effect of shares of Quanterix common stock to be issued in the proposed transaction; and other factors

that may affect future results of Quanterix, Akoya and the combined company. Additional factors that could cause results to differ

materially from those described above can be found in Quanterix’s Annual Report on Form 10-K for the year ended December 31,

2023, as amended, Akoya’s Annual Report on Form 10-K for the year ended December 31, 2023, and in other documents Quanterix

and Akoya file with the SEC, which are available on the SEC’s website at www.sec.gov.

All forward-looking statements, expressed or implied, included in this

communication are expressly qualified in their entirety by the cautionary statements contained or referred to herein. If one or more events

related to these or other risks or uncertainties materialize, or if Quanterix’s or Akoya’s underlying assumptions prove to

be incorrect, actual results may differ materially from what Quanterix and Akoya anticipate. Quanterix and Akoya caution readers not to

place undue reliance on any such forward-looking statements, which speak only as of the date they are made and are based on information

available at that time. Neither Quanterix nor Akoya assumes any obligation to update or otherwise revise any forward-looking statements

to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of

unanticipated events except as required by federal securities laws.

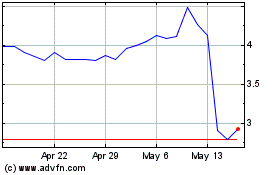

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Dec 2024 to Jan 2025

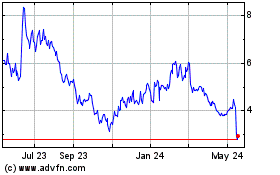

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Jan 2024 to Jan 2025