false

0001755953

0001755953

2024-01-11

2024-01-11

0001755953

KERN:CommonStockParValue0.0001PerShareMember

2024-01-11

2024-01-11

0001755953

KERN:WarrantsToPurchaseCommonStockMember

2024-01-11

2024-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 11, 2024

| AKERNA CORP. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-39096 |

|

83-2242651 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1550 Larimer Street, #246, Denver, Colorado |

|

80202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 932-6537

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

KERN |

|

NASDAQ Capital Market |

| Warrants to purchase Common Stock |

|

KERNW |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01. Regulation FD Disclosure.

As previously disclosed,

on January 27, 2023, Akerna Corp., a Delaware corporation (“Akerna”), entered into the Agreement and Plan of Merger with Gryphon

Digital Mining, Inc., a Delware corporation (“Gryphon”) and Akerna Merger Co.. a Delaware corporation and wholly-owned subsidiary

of Akerna (such transaction, the “Merger”).

On January 11, 2024,

Gryphon issued a letter to its stockholders to provide them an update on the status of the Merger transaction. A copy of this letter is

filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

On January 12, 2024, Gryphon published a presentation. A copy of the

presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this

Item 7.01, and Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation

language in such filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

Additional Information

and Where to Find It

This Current Report on

Form 8-K may be deemed to be solicitation material with respect to the proposed transactions between Akerna and Gryphon and between Akerna

and MJ Acquisition Co. In connection with the proposed transactions, Akerna has filed relevant materials with the United States Securities

and Exchange Commission, or the SEC, including a registration statement on Form S-4 (File No. 333-271857) (the “Form S-4”)

that contains a prospectus and a proxy statement. Akerna mailed the proxy statement/prospectus to the Akerna stockholders on January 9,

2024. Investors and securityholders of Akerna and Gryphon are urged to read these materials because they contain important information

about Akerna, Gryphon and the proposed transactions. This Current Report on Form 8-K is not a substitute for the Form S-4, definitive

proxy statement/prospectus included in the Form S-4 or any other documents that Akerna may file with the SEC or send to securityholders

in connection with the proposed transactions. Investors and security holders may obtain free copies of the documents filed with the SEC

on Akerna’s website at www.akerna.com, on the SEC’s website at www.sec.gov or by directing a request to Akerna’s Investor

Relations at (516) 419-9915.

This Current Report on

Form 8-K is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the proposed transactions, and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the

Solicitation

Each of Akerna, Gryphon,

MJ Acquisition Co. and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the stockholders of Akerna in connection with the proposed transactions. Information about the executive officers and directors of

Akerna is set forth in the proxy statement/prospectus included in the Form S-4, as last filed with the SEC on January 8, 2024. Other information

regarding the interests of such individuals, who may be deemed to be participants in the solicitation of proxies for the stockholders

of Akerna, is also set forth in the proxy statement/prospectus included in the Form S-4. You may obtain free copies of these documents

as described above.

Cautionary Statements

Regarding Forward-Looking Statements

This Current Report on

Form 8-K contains forward-looking statements based upon the current expectations of Gryphon and Akerna. Actual results and the timing

of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties,

which include, without limitation: (i) the risk that the conditions to the closing of the proposed transactions are not satisfied, including

the failure to timely obtain stockholder approval for the transactions, if at all; (ii) uncertainties as to the timing of the consummation

of the proposed transactions and the ability of each of Akerna, Gryphon and MJ Acquisition Co. to consummate the proposed merger or asset

sale, as applicable; (iii) risks related to Akerna’s ability to manage its operating expenses and its expenses associated with the

proposed transactions pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental

or quasi-governmental entity necessary to consummate the proposed transactions; (v) the risk that as a result of adjustments to the exchange

ratio, Akerna stockholders and Gryphon stockholders could own more or less of the combined company than is currently anticipated; (vi)

risks related to the market price of Akerna’s common stock relative to the exchange ratio of outstanding securities of Akerna at

closing; (vii) unexpected costs, charges or expenses resulting from either or both of the proposed transactions; (viii) potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the proposed transactions; (ix) risks

related to the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan; and

(x) risks associated with the possible failure to realize certain anticipated benefits of the proposed transactions, including with respect

to future financial and operating results. Actual results and the timing of events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described

under the heading “Risk Factors” in the proxy statement/prospectus included in the Form S-4 and the periodic filings with

the SEC, including the factors described in the section titled “Risk Factors” in Akerna’s Annual Report on Form 10-K

for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each filed with the SEC,

and in other filings that Akerna makes and will make with the SEC in connection with the proposed transactions. You should not place undue

reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking

statements. Except as required by law, Akerna and Gryphon expressly disclaim any obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions, or circumstances

on which any such statements are based.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Dated: January 12, 2024 |

AKERNA CORP. |

| |

|

| |

By: |

/s/ Jessica Billingsley |

| |

|

Name: |

Jessica Billingsley |

| |

|

Title: |

Chief Executive Officer |

4

Exhibit 99.1

Dear Gryphon Stockholders,

We deeply appreciate your patience and understanding during Gryphon’s

journey to going public, a pivotal process spanning two and a half years. Your support during this phase, as we worked diligently with

regulators, has been invaluable.

Exciting Milestones Ahead

We are thrilled to share important updates, within our regulatory bounds,

about Gryphon’s progress. Please note, our disclosures are limited to events up to the effective date of the filed S-4.

SEC Clearance Achievement

On January 9, 2024, the SEC marked a significant milestone for Gryphon

by declaring Akerna’s S-4, pertaining to our merger with Akerna (the “Business Combination”) effective. This crucial

step brings us closer to the stockholder vote for Akerna and Gryphon and the impending closing. For detailed information, the final prospectus

is available at https://www.sec.gov/Archives/edgar/data/1755953/000121390024002292/f424b30124_akerna.htm.

Key Merger Updates

Akerna is expected to hold a special meeting of its stockholders to

vote on the Business Combination on January 29, 2024, where 41% of outstanding Akerna shares are subject to support agreements requiring

them to vote in favor of the Business Combination. Gryphon shareholders will not need a special meeting, as we will be soliciting written

consents from our stockholders. Gryphon stockholders holding 72% of Gryphon’s outstanding shares have executed support agreements

requiring them to vote in favor of the Business Combination. The closing of the Business Combination is anticipated on or before January

31, 2024.

We will be in touch closer to closing regarding how to exchange your

Gryphon private shares for public company shares.

Looking Forward with Optimism:

The journey since our inception in October 2020 has been filled with

challenges and triumphs. As we eagerly anticipate the opportunities that listing on the Nasdaq will bring, we remain committed to building

on our legacy of excellence. Your steadfast support has been a cornerstone of our journey, and we’re excited to share the next chapter

with you.

Thank you for being a part of Gryphon’s remarkable journey.

Exhibit 99.2

January 2024

www.GryphonDigitalMining.com Disclaimer This presentation (“Presentation”) is being issued by Gryphon Digital Mining Inc . (the “Company”, “Gryphon” or “Gryphon Digital Mining”) for information purposes only . The content of this Presentation has not been approved by any securities regulatory authority . Reliance on this Presentation for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested . This Presentation is not an admission document, prospectus or an advertisement and is being provided for information purposes only and does not constitute or form part of, and should not be construed as, an offer or invitation to sell or any solicitation of any offer to purchase or subscribe for any securities of the Company in Canada, the United States or any other jurisdiction . Neither this Presentation, nor any part of it nor anything contained or referred to in it, nor the fact of its distribution, should form the basis of or be relied on in connection with or act as an inducement in relation to a decision to purchase or subscribe for or enter into any contract or make any other commitment whatsoever in relation to any securities of the Company . No representation or warranty, express or implied, is given by or on behalf of the Company, its directors, officers and advisors or any other person as to the accuracy, sufficiency or completeness of the information or opinions contained in this Presentation and no liability whatsoever is accepted by the Company, its directors, officers or advisors or any other person for any loss howsoever arising, directly or indirectly, from any use of such information or opinions or otherwise arising in connection therewith . Additional Information and Where to Find It This Presentation may be deemed to be solicitation material with respect to the proposed transactions between Akerna and Gryphon and between Akerna and MJ Acquisition Co . In connection with the proposed transactions, Akerna has filed relevant materials with the United States Securities and Exchange Commission, or the SEC, including a registration statement on Form S - 4 (File No . 333 - 271857 ) (the “Form S - 4 ”) that contains a prospectus and a proxy statement . Akerna mailed the proxy statement/prospectus to the Akerna stockholders on January 9 , 2024 . Investors and securityholders of Akerna and Gryphon are urged to read these materials because they contain important information about Akerna, Gryphon and the proposed transactions . This Presentation is not a substitute for the Form S - 4 , definitive proxy statement/prospectus included in the Form S - 4 or any other documents that Akerna may file with the SEC or send to securityholders in connection with the proposed transactions . Investors and security holders may obtain free copies of the documents filed with the SEC on Akerna’s website at www . akerna . com, on the SEC’s website at www . sec . gov or by directing a request to Akerna’s Investor Relations at ( 516 ) 419 - 9915 . This Presentation is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction, and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Participants in the Solicitation Each of Akerna, Gryphon, MJ Acquisition Co . and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Akerna in connection with the proposed transactions . Information about the executive officers and directors of Akerna is set forth in the proxy statement/prospectus included in the Form S - 4 , as last filed with the SEC on January 8 , 2024 . Other information regarding the interests of such individuals, who may be deemed to be participants in the solicitation of proxies for the stockholders of Akerna, is also set forth in the proxy statement/prospectus included in the Form S - 4 . You may obtain free copies of these documents as described above . 2

www.GryphonDigitalMining.com Disclaimer (Continued) Forward - Looking Statements Certain statements contained in this Presentation constitute “forward - looking information” or “forward - looking statements” (collectively, “forward - looking statements”) within the meaning of applicable Canadian and United States securities laws relating to, without limitation, expectations, intentions, plans and beliefs, including information as to the future events, results of operations and the Company’s future performance (both operational and financial) and business prospects . In certain cases, forward - looking statements can be identified by the use of words such as “expects”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “plans”, “seeks”, “projects” or variations of such words and phrases, or state that certain actions, events or results “may” or “will” be taken, occur or be achieved . Such forward - looking statements reflect the Company’s beliefs, estimates and opinions regarding its future growth, results of operations, future performance (both operational and financial), and business prospects and opportunities at the time such statements are made, and the Company undertakes no obligation to update forward - looking statements if these beliefs, estimates and opinions or circumstances should change . Forward - looking statements are necessarily based upon a number of estimates and assumptions made by the Company that are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies . Forward - looking statements are not guarantees of future performance . In particular, this Presentation contains forward - looking statements pertaining, but not limited, to : expectations regarding the price of bitcoin and sensitivity to changes in such prices ; industry conditions and outlook pertaining to the bitcoin and cryptocurrency market ; expectations respecting future competitive conditions ; expectations regarding future government regulation, industry activity levels ; expectations about shareholder approval of the Company’s pending merger with Akerna, beliefs about future power rates based upon historical rates, and the Company’s objectives, strategies and competitive strengths . By their nature, forward - looking statements involve numerous current assumptions, known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from those anticipated by the Company and described in the forward - looking statements . With respect to the forward - looking statements contained in this Presentation, assumptions have been made regarding, among other things : current and future prices for bitcoin ; future global economic and financial conditions ; current and future regulatory and legal regimes, demand for bitcoin and the product mix of such demand and levels of activity in the cryptocurrency finance markets and in such other areas in which the Company may operate, and supply and the product mix of such supply ; the accuracy and veracity of information and projections sourced from third parties respecting, among other things, current finance markets and proposed changes to those markets, supply and demand ; and, where applicable, each of those assumptions set forth in the footnotes provided herein in respect of particular forward - looking statements . A number of factors, risks and uncertainties could cause results to differ materially from those anticipated and described herein including, among others : volatility in market prices and demand for bitcoin ; effects of competition and pricing pressures ; risks related to interest rate fluctuations and foreign exchange rate fluctuations ; changes in general economic, financial, market and business conditions in the industries in which bitcoin are used ; alternatives methods to cryptocurrency ; increases in power rates and changing demand for bitcoin ; potential conflicts of interests ; actual results differing materially from management estimates and assumptions . the risk that the conditions to the closing of the proposed transactions are not satisfied, including the failure to timely obtain stockholder approval for the transactions, if at all ; uncertainties as to the timing of the consummation of the proposed transactions and the ability of each of Akerna, Gryphon and MJ Acquisition Co . to consummate the proposed merger or asset sale, as applicable ; risks related to Akerna’s ability to manage its operating expenses and its expenses associated with the proposed transactions pending closing ; risks related to the failure or delay in obtaining required approvals from any governmental or quasi - governmental entity necessary to consummate the proposed transactions ; the risk that as a result of adjustments to the exchange ratio, Akerna stockholders and Gryphon stockholders could own more or less of the combined company than is currently anticipated ; risks related to the market price of Akerna’s common stock relative to the exchange ratio ; unexpected costs, charges or expenses resulting from the proposed transaction ; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction ; risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan ; and risks associated with the possible failure to realize certain anticipated benefits of the proposed transaction, including with respect to future financial and operating results . These and other risks and uncertainties are more fully described under the heading “Risk Factors” in the proxy statement/prospectus included in the Form S - 4 in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in Akerna’s Annual Report on Form 10 - K for the year ended December 31 , 2022 and Quarterly Reports on Form 10 - Q for the quarters ended March 31 , 2023 , June 30 , 2023 and September 30 , 2023 , each filed with the SEC, and in other filings that Akerna makes and will make with the SEC in connection with the proposed transaction, including the proxy statement/prospectus described under “Additional Information and Where to Find It . ” You should not place undue reliance on these forward - looking statements, which are made only as of the date hereof or as of the dates indicated in the forward - looking statements . Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in its forward - looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended . There can be no assurance that forward - looking statements will materialize or prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements . The forward - looking statements contained in this Presentation are expressly qualified by this cautionary statement . Readers should not place undue reliance on forward - looking statements . These statements speak only as of the date of this Presentation . Except as may be required by law, the Company expressly disclaims any intention or obligation to revise or update any forward - looking statements or information whether as a result of new information, future events or otherwise . 3

www.GryphonDigitalMining.com To create a financially nimble, highly profitable, and environmentally responsible bitcoin miner Mission Statement 4

www.GryphonDigitalMining.com Target Capitalization • All - stock transaction with Gryphon shareholders retaining at least 92.5% ownership of the combined company on a fully diluted basis • Simultaneous with the merger, Akerna expects to sell its cannabis software business to create a pure - play, ESG - committed, net - carbon neutral, bitcoin miner. Both transactions are conditioned on the other closing. • The merger and sale transaction are subject to the approval of Akerna’s stockholders (41% in voting support agreements), and the merger is subject to the approval of Gryphon’s stockholders (72% in voting support agreements) • Listing of the combined company is subject to the approval of the Nasdaq Capital Market and is expected to trade under the ticker “GRYP” • SEC declared effectiveness on Form S - 4. Shareholder vote scheduled for Jan 29, 2024 5 Creating a leading carbon - neutral bitcoin miner with top - tier efficiency * Proposed Merger – Akerna (Nasdaq: KERN) *”Top - tier efficiency” as defined by bitcoin efficiency, which is a measure of the number of bitcoin generated per exahash of ha shing power deployed.

www.GryphonDigitalMining.com Target Capitalization • Certified Clean Energy Operation as one of the inaugural recipients of the Green Proofs for Bitcoin certification • Net Carbon Neutral miner pursuing a negative carbon strategy with the acquisition of carbon offset credits and mining operations using carbon - neutral energy • CEO & Director, Rob Chang, previously served as CFO of Riot Blockchain and as MD at Cantor Fitzgerald • Chairperson, Brittany Kaiser, globally - renowned expert in blockchain technology and digital assets • CFO, Sim Salzman, previously served as CFO of Marathon Digital Holdings • Chief Technical Advisor, Chris Ensey, is the former CEO & COO of Riot Blockchain and has developed over 100 MW in mining operations • Up to 1.2 Exahash of combined hashrate • 0.86 exahash of self mining • 0.34 exahash via a 22.5% gross profit royalty via management fees paid by third - party bitcoin miner • Breakeven Cost per BTC ~$15,746/BTC* 6 Creating an industry leader in bitcoin mining. Size & Scale Leadership Team ESG Investment Highlights *Based on YTD through Sept 30, 2023

www.GryphonDigitalMining.com Target Capitalization • Former CFO, Riot Blockchain • Former Managing Director, Head of Metals & Mining Research, Cantor Fitzgerald • Current Board Member: Fission Uranium and Ur - Energy • Member: Young Presidents Organization (YPO) 7 Industry leading management team Rob Chang CEO & Director • Former CEO and COO, Riot Blockchain • Former CTO, BlueVoyant • Former COO and Founder, Dunbar Cybersecurity • Former Principal Security Strategist & Associate Director, IBM Chris Ensey Chief Technical Advisor Management Team • Former CFO, Marathon Digital Holdings • Oversaw market cap growth from $500 million to $8 billion over 12 months • Former CFO, Las Vegas Monorail Company • Former Senior Auditor, BDO & RSM Sim Salzman CFO

www.GryphonDigitalMining.com Target Capitalization 8 Unparalleled Pedigreed Leadership • CEO, Falcon International, one of the largest private cannabis companies in California • Former COO & EVP, E*Trade Bank and other senior roles at E*Trade Financial • Former President of Harvest Health & Recreation Inc., which was acquired for $2.1 billion Steven Gutterman Independent Director • Member of the Board of Directors, NRG Energy • Former Chief Digital Health and Analytics Officer, Humana • Former Chief Technology and Digital Officer, USAA • Former CEO of Citi FinTech, Citigroup Heather Cox Independent Director Board of Directors • Globally renowned blockchain thought - leader, having co - authored 22 laws in the US to promote and protect blockchain businesses • Current Member of the Congressional Standing Committee on Blockchain, Fintech and Digital Innovation for Wyoming • Keynote speaker on blockchain, data & privacy for governments, corporate training & universities Brittany Kaiser Chair of the Board

www.GryphonDigitalMining.com Target Capitalization October 2020 : Company Founded April 2021 : Purchased 7,200 S19j Pro miners from Bitmain June 2021 : Hosting agreement signed with CoinMint LLC for 23 MW of carbon - neutral energy August 2021 : Gryphon secures a 22.5% Net Operating Profit Royalty via management services fee with a third - party bitcoin miner on all of its blockchain operations September 2021 : First machines deployed and generating bitcoin December 2022 : Gryphon achieves self mining hashrate of 0.72 EH/s as royalty partner begins operations Jan/Feb/ Mar/May/ Jul/Aug/ Sept/Nov/ Dec 2022 : Gryphon ranks at or tied for first in bitcoin efficiency vs. publicly disclosing peers January 2023 : Gryphon announces proposed merger with Akerna (KERN: Nasdaq) June 2023 : Gryphon expands self mining hashrate to 0.86 EH/s with acquisition of upgraded S19j Pro+ machines and expansion to 28 MW at CoinMint Jan/Feb/ Apr/May/ Jun/Aug/ 2023 : Gryphon ranks at or tied for first in bitcoin efficiency vs. publicly disclosing peers Jan 2024 : SEC declares S - 4 merger registration statement effective 9 Unparalleled Growth in Just Over 3 Short Years Company Overview - History

www.GryphonDigitalMining.com Target Capitalization 10 Company Overview – Snapshot 1.2 Exahash of Carbon - Neutral Bitcoin Mining Power Carbon - Neutral Miner pursuing a negative carbon strategy Attributable 0.34 Exahash of hashing power from Royalty Partner pending 0.86 Exahash from self mining

www.GryphonDigitalMining.com Target Capitalization • Hydro - powered host in an economic opportunity zone • Direct cost pass - through with profit sharing model • ~ $15,746/BTC cost* • Gryphon has secured 28 MW of power for its ~9,000 machines • Hosting and share structure reduces capital investment and financial risk 11 Partnering with one of the largest digital currency data centers in the world Location – 28 MW Hydro - Powered Energy *Based on YTD through Sept 30, 2023

www.GryphonDigitalMining.com Target Capitalization • Gryphon is an industry leader in Bitcoin Efficiency, posting a superior 76 BTC/EH** in September 2023 • Peer average Bitcoin Efficiency of 63 BTC/EH • Gryphon has consistently placed at or near the top of these publicly available bitcoin efficiency scores • Top 3 efficiency among all peers since inception • At or tied for 1 st in nine of the last 12 months • Superior performance driven by Gryphon’s experienced mining team, fleet of efficient miners, and royalty stream • Impact of royalty stream was minimal until Jan 2023 12 Gryphon also outperforms peers in Bitcoin Efficiency* Leading Bitcoin Efficiency *Bitcoin Efficiency is a measure of the number of bitcoin generated per exahash of hashing power deployed Source: Company Reports GryphonPeer Average Peer Rank Sep-21 218 181 2 Oct-21 199 165 3 Nov-21 173 148 2 Dec-21 166 151 3 Jan-22 183 141 1 Feb-22 134 118 1 Mar-22 146 132 1 Apr-22 136 121 2 May-22 132 107 1 Jun-22 129 108 2 Jul-22 139 112 1 Aug-22 141 118 1 Sep-22 122 105 1 Oct-22 115 105 2 Nov-22 106 94 1 Dec-22 115 96 1 Jan-23 113 95 1 Feb-23 94 81 1 Mar-23 94 81 2 Apr-23 86 71 1 May-23 101 84 1 Jun-23 81 65 1 Jul-23 80 67 2 Aug-23 77 63 1 Sep-23 76 TBD TBD

www.GryphonDigitalMining.com Target Capitalization • Gryphon has spent only $44/TH to build its entire operation (machines, hosting, management, etc.) • Peer average Invested Capital Efficiency $116/TH** • Superior performance driven by unique royalty stream with a third - party miner, resourceful capital raising, disciplined capital deployment and asset light model 13 Gryphon outperforms peers in Invested Capital Efficiency* Industry Leader in Capital Efficiency *Invested Capital per terahash is defined as (Paid In Capital + Short - and Long - Term Debt + Short - and Long - Term Capital Leases – Liquid Assets) / Forecast hashrate that includes royalty stream ** Based on most recent publicly reported financial statements $44 $66 $85 $90 $93 $94 $96 $104 $117 $129 $157 $177 $180 $116 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Invested Capital ($)/TH IC/TH Average (ex-Gryphon)

www.GryphonDigitalMining.com Target Capitalization • Gryphon has an agreement to manage all of Sphere 3D’s blockchain operations for a five - year period • Gryphon earns 22.5% of gross operating profit royalty from all of Sphere 3D’s current and future blockchain operations through August 2026 • Sphere 3D’s fully deployed 15,000 miners are expected to have over 1.5 Exahash and generate 1,232 BTC on an annual basis based on current network hashrate* • Sphere has moved to terminate this arrangement and Gryphon is confident it will prevail 14 Unique Royalty Stream Provides Additional Cash Flows 22.5% MSA with Sphere 3D Forecast 2024 Revenue from Royalty ~$6M *Based on an estimated average hashrate of 400 exahash and BTC price of US$26,000

www.GryphonDigitalMining.com Target Capitalization • Gryphon Digital Mining was among a select inaugural group of 5 miners to be awarded a “ Green Proofs for Bitcoin” certification • Certifications were issued to Bitcoin miners based on their clean energy use and contributions to grid stability via demand response • Developed in partnership with over 35 miners, NGOs, grid operators, and other energy and crypto market participants, its approach to scoring is aligned with best practices for sustainability leadership and to approaches to corporate ESG reporting 15 Independently verified certification based on clean energy use Key Success Factor: Green Proofs for Bitcoin

www.GryphonDigitalMining.com Target Capitalization 16 2024E Gross Profit Sensitivity Analysis *As of Sept 30, 2023 10,129,698 20,000 25,000 30,000 35,000 40,000 350,000,000 3,133,704 8,730,499 14,327,295 19,924,090 25,520,885 375,000,000 1,833,398 6,864,901 12,088,577 17,312,252 22,535,928 400,000,000 897,042 5,232,502 10,129,698 15,026,894 19,924,090 425,000,000 70,845 3,792,151 8,401,276 13,010,402 17,619,527 450,000,000 -663,552 2,511,838 6,864,901 11,217,964 15,571,027 Global Hash Rate (TH/s) BTC - USD

Contact: Rob@GryphonMining.com

v3.23.4

Cover

|

Jan. 11, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity File Number |

001-39096

|

| Entity Registrant Name |

AKERNA CORP.

|

| Entity Central Index Key |

0001755953

|

| Entity Tax Identification Number |

83-2242651

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1550 Larimer Street

|

| Entity Address, Address Line Two |

#246

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

888

|

| Local Phone Number |

932-6537

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

KERN

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

KERNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

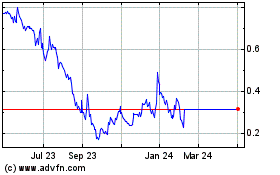

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Dec 2024 to Jan 2025

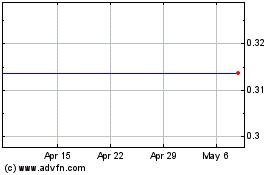

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Jan 2024 to Jan 2025