0001014763false--12-31Q220230.010.0110000000100000001775951775950.010.0130000000030000000020292624202926242001160220011602150000015000000000000010147632023-01-012023-06-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2022-12-310001014763aimd:COVID19AntigenRapidTestKitsSalesMember2023-06-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2022-01-012022-06-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2022-04-012022-06-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2023-04-012023-06-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2023-01-012023-06-300001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2022-12-310001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2023-06-300001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2022-01-012022-06-300001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2022-04-012022-06-300001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2023-04-012023-06-300001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2023-01-012023-06-300001014763aimd:ProductCoDevelopmentAgreementMember2023-06-300001014763aimd:ProductCoDevelopmentAgreementMember2022-12-310001014763aimd:ProductCoDevelopmentAgreementMember2022-01-012022-06-300001014763aimd:ProductCoDevelopmentAgreementMember2022-04-012022-06-300001014763aimd:ProductCoDevelopmentAgreementMember2023-04-012023-06-300001014763aimd:ProductCoDevelopmentAgreementMember2023-01-012023-06-300001014763aimd:Chien-HsuanHuangMember2023-01-012023-06-300001014763aimd:Chien-HsuanHuangMember2023-04-012023-06-3000010147632022-01-3000010147632023-04-012023-04-260001014763aimd:TwoThousandTwentyThreeStockIncentivePlanMember2023-06-140001014763aimd:StockOptionAndWarrantsMember2023-01-012023-06-300001014763us-gaap:RestrictedStockUnitsRSUMember2023-06-300001014763us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001014763us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001014763us-gaap:RestrictedStockUnitsRSUMember2023-03-310001014763us-gaap:RestrictedStockUnitsRSUMember2022-12-310001014763aimd:CommonSharesMember2023-01-012023-06-300001014763aimd:CommonSharesMember2023-06-300001014763aimd:WarrantsMember2023-06-300001014763aimd:WarrantsMember2022-12-310001014763aimd:March2025ConvertibleNotesMember2022-01-012022-06-300001014763aimd:March2025ConvertibleNotesMember2022-04-012022-06-300001014763aimd:March2025ConvertibleNotesMember2023-04-012023-06-300001014763aimd:AinosKyMember2023-06-300001014763aimd:AinosKyMember2023-01-012023-06-300001014763aimd:ChenMember2023-06-300001014763aimd:ChenMember2023-04-012023-06-300001014763aimd:ChenMember2023-01-012023-06-300001014763aimd:ITwoChinaNoteMemberus-gaap:SubsequentEventMember2023-08-310001014763aimd:AinosKyMemberus-gaap:SubsequentEventMember2023-07-310001014763aimd:LiKuoLeeMember2023-06-300001014763aimd:March2025ConvertibleNotesMember2023-01-012023-06-300001014763aimd:March2025ConvertibleNotesMember2022-12-310001014763aimd:March2025ConvertibleNotesMember2023-06-300001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001014763us-gaap:RetainedEarningsMember2023-04-012023-06-300001014763us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001014763aimd:CommonStcksMember2023-04-012023-06-300001014763us-gaap:PreferredStockMember2023-04-012023-06-3000010147632023-03-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001014763us-gaap:RetainedEarningsMember2023-03-310001014763us-gaap:AdditionalPaidInCapitalMember2023-03-310001014763us-gaap:PreferredStockMember2023-03-310001014763aimd:CommonStcksMember2023-03-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001014763us-gaap:RetainedEarningsMember2023-06-300001014763us-gaap:AdditionalPaidInCapitalMember2023-06-300001014763aimd:CommonStcksMember2023-06-300001014763us-gaap:PreferredStockMember2023-06-300001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001014763us-gaap:RetainedEarningsMember2023-01-012023-06-300001014763us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001014763aimd:CommonStcksMember2023-01-012023-06-300001014763us-gaap:PreferredStockMember2023-01-012023-06-300001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001014763us-gaap:RetainedEarningsMember2022-12-310001014763us-gaap:AdditionalPaidInCapitalMember2022-12-310001014763aimd:CommonStcksMember2022-12-310001014763us-gaap:PreferredStockMember2022-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001014763us-gaap:RetainedEarningsMember2022-04-012022-06-300001014763us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001014763aimd:CommonStcksMember2022-04-012022-06-300001014763us-gaap:PreferredStockMember2022-04-012022-06-3000010147632022-03-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001014763us-gaap:RetainedEarningsMember2022-03-310001014763us-gaap:AdditionalPaidInCapitalMember2022-03-310001014763aimd:CommonStcksMember2022-03-310001014763us-gaap:PreferredStockMember2022-03-3100010147632022-06-300001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001014763us-gaap:RetainedEarningsMember2022-06-300001014763us-gaap:AdditionalPaidInCapitalMember2022-06-300001014763aimd:CommonStcksMember2022-06-300001014763us-gaap:PreferredStockMember2022-06-300001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001014763us-gaap:RetainedEarningsMember2022-01-012022-06-300001014763us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001014763aimd:CommonStcksMember2022-01-012022-06-300001014763us-gaap:PreferredStockMember2022-01-012022-06-3000010147632021-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001014763us-gaap:RetainedEarningsMember2021-12-310001014763us-gaap:AdditionalPaidInCapitalMember2021-12-310001014763aimd:CommonStcksMember2021-12-310001014763us-gaap:PreferredStockMember2021-12-3100010147632022-01-012022-06-3000010147632022-04-012022-06-3000010147632023-04-012023-06-3000010147632022-12-3100010147632023-06-3000010147632023-08-110001014763aimd:CommonStockAndShareMember2023-01-012023-06-300001014763aimd:WarrantsToPurchaseCommonStockMember2023-01-012023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from____to____

Commission File No. 0-20791

AINOS, INC. |

(Exact name of registrant as specified in its charter) |

Texas | | 75-1974352 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108

(858) 869-2986

(Address and telephone number, including area code, of registrant's principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | AIMD | | The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock | | AIMDW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes ☒ No

20,292,624 shares of common stock, par value $0.01 per share, outstanding as of August 11, 2023

AINOS, INC.

INDEX

PART I - FINANCIAL INFORMATION

ITEM 1. Financial Statements

Ainos, Inc.

Condensed Balance Sheets

(Unaudited)

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Assets | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 1,360,970 | | | $ | 1,853,362 | |

Accounts receivable (including amounts of related party of nil and $177,595 as of June 30, 2023 and December 31,2022, respectively) | | | 9,385 | | | | 201,546 | |

Inventory, net | | | 528,114 | | | | 595,222 | |

Other current assets | | | 241,230 | | | | 195,787 | |

Total current assets | | | 2,139,699 | | | | 2,845,917 | |

Intangible assets, net | | | 30,564,203 | | | | 32,806,738 | |

Property and equipment, net | | | 1,269,331 | | | | 1,375,676 | |

Other assets | | | 73,169 | | | | 80,683 | |

Total assets | | $ | 34,046,402 | | | $ | 37,109,014 | |

| | | | | | | | |

Liabilities and Stockholders' Equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Convertible notes payable, related party | | $ | - | | | $ | 376,526 | |

Other notes payable, related party | | | 684,000 | | | | 884,000 | |

Accrued expenses and others current liabilities | | | 429,503 | | | | 1,212,386 | |

Total current liabilities | | | 1,113,503 | | | | 2,472,912 | |

Convertible notes payable (including amounts of related party of $1,500,000 and nil as of June 30, 2023 and December 31, 2022, respectively) | | | 2,500,000 | | | | - | |

Other long-term liabilities | | | 37,562 | | | | 8,096 | |

Total liabilities | | | 3,651,065 | | | | 2,481,008 | |

Commitments and contingencies | | | | | | | | |

Stockholders' equity: | | | | | | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued | | | | | | | | |

Common stock, $0.01 par value; 300,000,000 shares authorized as of June 30, 2023 and December 31, 2022, 20,292,624 and 20,011,602 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | | | 202,926 | | | | 200,116 | |

Additional paid-in capital | | | 59,423,678 | | | | 58,745,149 | |

Accumulated deficit | | | (28,985,808 | ) | | | (24,115,606 | ) |

Translation adjustment | | | (245,459 | ) | | | (201,653 | ) |

Total stockholders’ equity | | | 30,395,337 | | | | 34,628,006 | |

Total liabilities and stockholders’ equity | | $ | 34,046,402 | | | $ | 37,109,014 | |

See accompanying notes to condensed financial statements.

Ainos, Inc.

Condensed Statements of Operations

(Unaudited)

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Revenues | | $ | 28,555 | | | $ | 636,627 | | | $ | 77,719 | | | $ | 723,828 | |

Cost of revenues | | | (55,817 | ) | | | (318,963 | ) | | | (156,665 | ) | | | (360,042 | ) |

Gross (loss) profit | | | (27,262 | ) | | | 317,664 | | | | (78,946 | ) | | | 363,786 | |

Operating expenses: | | | | | | | | | | | | | | | | |

Research and development expenses | | | 1,671,187 | | | | 1,634,856 | | | | 3,370,070 | | | | 3,212,310 | |

Selling, general and administrative expenses | | | 618,149 | | | | 627,104 | | | | 1,380,614 | | | | 1,178,834 | |

Total operating expenses | | | 2,289,336 | | | | 2,261,960 | | | | 4,750,684 | | | | 4,391,144 | |

Loss from operations | | | (2,316,598 | ) | | | (1,944,296 | ) | | | (4,829,630 | ) | | | (4,027,358 | ) |

| | | | | | | | | | | | | | | | |

Non-operating income (expenses), net: | | | | | | | | | | | | | | | | |

Interest expense | | | (40,311 | ) | | | (18,796 | ) | | | (49,585 | ) | | | (35,483 | ) |

Other income, net | | | 7,182 | | | | 9,060 | | | | 9,013 | | | | 8,914 | |

Total non-operating expenses, net | | | (33,129 | ) | | | (9,736 | ) | | | (40,572 | ) | | | (26,569 | ) |

| | | | | | | | | | | | | | | | |

Net loss before income taxes | | | (2,349,727 | ) | | | (1,954,032 | ) | | | (4,870,202 | ) | | | (4,053,927 | ) |

Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

Net loss | | $ | (2,349,727 | ) | | $ | (1,954,032 | ) | | $ | (4,870,202 | ) | | $ | (4,053,927 | ) |

| | | | | | | | | | | | | | | | |

Net loss per common share - basic and diluted | | $ | (0.12 | ) | | $ | (0.20 | ) | | $ | (0.24 | ) | | $ | (0.42 | ) |

| | | | | | | | | | | | | | | | |

Weighted-average shares used in computing net loss per common share-basic and diluted | | | 20,095,705 | | | | 9,625,133 | | | | 20,053,886 | | | | 9,625,133 | |

See accompanying notes to condensed financial statements.

Ainos, Inc.

Condensed Statements of Comprehensive Loss

(Unaudited)

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Net loss | | $ | (2,349,727 | ) | | $ | (1,954,032 | ) | | $ | (4,870,202 | ) | | $ | (4,053,927 | ) |

Other comprehensive loss: | | | | | | | | | | | | | | | | |

Translation adjustment | | | (53,867 | ) | | | (165,687 | ) | | | (43,806 | ) | | | (223,746 | ) |

Comprehensive loss | | $ | (2,403,594 | ) | | $ | (2,119,719 | ) | | $ | (4,914,008 | ) | | $ | (4,277,673 | ) |

See accompanying notes to condensed financial statements.

Ainos, Inc.

Condensed Statements of Stockholders’ Equity

For the three months ended June 30, 2023 and 2022 (Unaudited)

| | Preferred Stock | | | Common Stock | | | Additional Paid-in | | | | | | Accumulated Other Comprehensive | | | Total Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Loss | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2023 | | | - | | | $ | - | | | | 20,011,602 | | | $ | 200,116 | | | $ | 58,965,981 | | | $ | (26,636,081 | ) | | $ | (191,592 | ) | | $ | 32,338,424 | |

Issuance of stock in exchange of vehicle | | | - | | | | - | | | | 61,157 | | | | 612 | | | | 47,947 | | | | - | | | | - | | | | 48,559 | |

Conversion of convertible notes payable to common stock | | | - | | | | - | | | | 93,333 | | | | 933 | | | | 273,856 | | | | - | | | | - | | | | 274,789 | |

Issuance of stock to settle vested RSUs | | | - | | | | - | | | | 126,532 | | | | 1,265 | | | | (1,265 | ) | | | - | | | | - | | | | - | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 137,159 | | | | - | | | | - | | | | 137,159 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,349,727 | ) | | | - | | | | (2,349,727 | ) |

Translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (53,867 | ) | | | (53,867 | ) |

Balance at June 30, 2023 | | | - | | | $ | - | | | | 20,292,624 | | | $ | 202,926 | | | $ | 59,423,678 | | | $ | (28,985,808 | ) | | $ | (245,459 | ) | | $ | 30,395,337 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2022 | | | - | | | $ | - | | | | 9,625,133 | | | $ | 96,251 | | | $ | 20,247,415 | | | $ | (12,208,811 | ) | | $ | (52,259 | ) | | $ | 8,082,596 | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 43,443 | | | | - | | | | - | | | | 43,443 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,954,032 | ) | | | - | | | | (1,954,032 | ) |

Translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (165,687 | ) | | | (165,687 | ) |

Balance at June 30, 2022 | | | - | | | $ | - | | | | 9,625,133 | | | $ | 96,251 | | | $ | 20,290,858 | | | $ | (14,162,843 | ) | | $ | (217,946 | ) | | $ | 6,006,320 | |

See accompanying notes to condensed financial statements.

Ainos, Inc.

Condensed Statements of Stockholders’ Equity

For the six months ended June 30, 2023 and 2022 (Unaudited)

| | Preferred Stock | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Accumulated Other Comprehensive | | | Total Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Loss | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2022 | | | - | | | $ | - | | | | 20,011,602 | | | $ | 200,116 | | | $ | 58,745,149 | | | $ | (24,115,606 | ) | | $ | (201,653 | ) | | $ | 34,628,006 | |

Issuance of stock in exchange of vehicle | | | - | | | | - | | | | 61,157 | | | | 612 | | | | 47,947 | | | | - | | | | - | | | | 48,559 | |

Conversion of convertible notes payable to common stock | | | - | | | | - | | | | 93,333 | | | | 933 | | | | 273,856 | | | | - | | | | - | | | | 274,789 | |

Issuance of stock to settle vested RSUs | | | - | | | | - | | | | 126,532 | | | | 1,265 | | | | (1,265 | ) | | | - | | | | - | | | | - | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 357,991 | | | | - | | | | - | | | | 357,991 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4,870,202 | ) | | | - | | | | (4,870,202 | ) |

Translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (43,806 | ) | | | (43,806 | ) |

Balance at June 30, 2023 | | | - | | | $ | - | | | | 20,292,624 | | | $ | 202,926 | | | $ | 59,423,678 | | | $ | (28,985,808 | ) | | $ | (245,459 | ) | | $ | 30,395,337 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2021 | | | - | | | $ | - | | | | 9,625,133 | | | $ | 96,251 | | | $ | 20,203,972 | | | $ | (10,108,916 | ) | | $ | 5,800 | | | $ | 10,197,107 | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 86,886 | | | | - | | | | - | | | | 86,886 | |

Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4,053,927 | ) | | | - | | | | (4,053,927 | ) |

Translation adjustment | | | - | | | | - | | | | - | | | | | | | | - | | | | - | | | | (223,746 | ) | | | (223,746 | ) |

Balance at June 30, 2022 | | | - | | | $ | - | | | | 9,625,133 | | | $ | 96,251 | | | $ | 20,290,858 | | | $ | (14,162,843 | ) | | $ | (217,946 | ) | | $ | 6,006,320 | |

See accompanying notes to condensed financial statements.

Ainos, Inc.

Condensed Statements of Cash Flows

(Unaudited)

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

Cash flows from operating activities: | | | | | | |

Net loss | | $ | (4,870,202 | ) | | $ | (4,053,927 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | | 2,423,274 | | | | 2,378,835 | |

Loss on inventory write-downs | | | 57,474 | | | | - | |

Share-based compensation expense | | | 357,991 | | | | 86,886 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 192,161 | | | | (29,881 | ) |

Inventory | | | 10,814 | | | | (670,507 | ) |

Other current assets | | | (55,990 | ) | | | (775,909 | ) |

Accrued expenses and other current and long-term liabilities | | | (684,372 | ) | | | 838,484 | |

Operating lease liabilities | | | (9,603 | ) | | | (10,125 | ) |

Contract liabilities | | | - | | | | 606,866 | |

Net cash used in operating activities | | | (2,578,453 | ) | | | (1,629,278 | ) |

Cash flows from investing activities: | | | | | | | | |

Purchase of property and equipment | | | (71,262 | ) | | | (424,557 | ) |

Net cash used in investing activities | | | (71,262 | ) | | | (424,557 | ) |

Cash flows from financing activities | | | | | | | | |

Proceeds from convertible notes payable | | | 1,000,000 | | | | 850,000 | |

Proceeds from convertible notes payable, related party | | | 1,500,000 | | | | 550,000 | |

Proceeds from other notes payable, related party | | | - | | | | 800,000 | |

Repayments of convertible notes payable, related party | | | (114,026 | ) | | | - | |

Repayments of other notes payable, related party | | | (200,000 | ) | | | - | |

Net cash provided by financing activities | | | 2,185,974 | | | | 2,200,000 | |

Effect from foreign currency exchange | | | (28,651 | ) | | | (143,787 | ) |

Net (decrease) increase in cash and cash equivalents | | | (492,392 | ) | | | 2,378 | |

Cash and cash equivalents at beginning of period | | | 1,853,362 | | | | 1,751,499 | |

Cash and cash equivalents at end of period | | $ | 1,360,970 | | | $ | 1,753,877 | |

| | | | | | | | |

Supplemental cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 3,122 | | | $ | - | |

Noncash financing and investing activities | | | | | | | | |

Purchase of equipment and intangible assets by issuing convertible notes payable to a related party | | $ | - | | | $ | 26,000,000 | |

Conversion of convertible notes payable to common stock and accrued interest waived by convertible note holders | | $ | 274,789 | | | $ | - | |

Issuance of common stock in exchange of vehicle | | $ | 48,559 | | | $ | - | |

Payable for purchase of equipment | | $ | - | | | $ | 117,185 | |

See accompanying notes to the condensed financial statements.

Ainos, Inc.

Notes to Condensed Financial Statements

(Unaudited)

1. Description of Business

Organization and Business

Ainos, Inc. (the “Company”), incorporated in the State of Texas, is a diversified healthcare company focused on the development of novel point-of-care testing (POCT), therapeutics based on very low-dose interferon alpha (VELDONA), and synthetic RNA-driven preventative medicine. Our products include VELDONA clinical-stage human therapeutics, VELDONA Pet cytoprotein supplements, and telehealth-friendly POCTs powered by AI Nose technology platform.

The Company’s POCT platforms aim to provide connected, rapid and convenient testing of a broad range of health conditions. Building on its extensive research and development on VELDONA, the Company is focused on commercializing a suite of VELDONA-based products including VELDONA Pet cytoprotein supplements and VELDONA therapeutics for humans.

In 2021 and 2022, the Company acquired intellectual property from controlling shareholder, Ainos Inc., a Cayman Islands corporation (“Ainos KY”), and continues to expand its product portfolio into POCTs. Pivoting from the sales of COVID-19 POCT, the Company is commercializing POCTs that detect volatile organic compounds (VOC) emitted by the body, powered by the Company’s AI Nose technology platform. The Company’s lead VOC POCT candidate, Ainos Flora, aims to quickly and easily tests female vaginal health and certain common sexually transmitted infections (STIs).

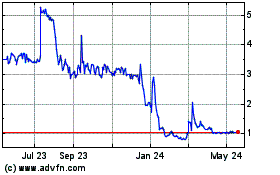

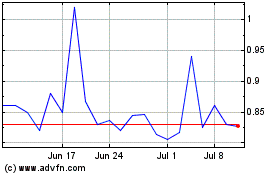

Underwritten Public Offering

The Company’s registration statement related to its underwritten public offering (the “Offering”) was declared effective on August 8, 2022, and the Company’s common stock and warrants began trading on the Nasdaq Capital Market (the “Nasdaq”) on August 9, 2022 under the trading symbols “AIMD” and “AIMDW”, respectively. The Company completed its underwritten public offering of an aggregated 780,000 units at a public offering price of $4.25 per unit. Each unit issued in the offering consisted of one share of common stock and one warrant to purchase one share of common stock at an exercise price of $4.25.

In connection with the Offering, the Company’s board of directors on April 29, 2022 and its shareholders on May 16, 2022 approved a 1-for-15 reverse stock split (the “Reverse Stock Split”) of the Company’s common stock prior to the effective date of the Offering. The par value and authorized shares of the Company’s common stock were not adjusted as a result of the Reverse Stock Split. All issued and outstanding common stock, restricted stock units (RSUs), outstanding convertible notes, warrants and options to purchase common stock and per share amounts contained in the financial statements have been retroactively adjusted to give effect to the Reverse Stock Split for all periods presented.

The Company filed a Certificate of Amendment to its Restated Certificate of Formation with the Secretary of State of Texas on August 8, 2022 that effectuated the Reverse Stock Split.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (the “GAAP”) and pursuant to the accounting disclosure rules and regulations of the Securities and Exchange Commission (the “SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed financial statements should be read in conjunction with the financial statements and notes included in the Company’s audited financial statements as of and for the year ended December 31, 2022 contained in the Annual Report on Form 10-K filed with the SEC on April 3, 2023.

In the opinion of management, the accompanying condensed financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods. The results for the three and six months ended June 30, 2023 are not necessarily indicative of the results to be expected for any subsequent quarter, the year ending December 31, 2023, or any other period.

There have been no material changes to the Company’s significant accounting policies as described in the audited financial statements as of December 31, 2022.

Use of Estimates

The preparation of condensed financial statements in conformity with GAAP requires management to make certain estimates, judgments, and assumptions that affect the reported amounts of assets and liabilities and disclosures as of the date of the condensed financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on various factors, including historical experience, and on various other assumptions that are believed to be reasonable under the circumstances, when these carrying values are not readily available from other sources. Significant items subject to estimates and assumptions include useful lives of property and equipment, valuation of stock option and warrants, and impairment testing of intangible assets. Actual results may differ from these estimates.

Liquidity

As of June 30, 2023, the Company had cash and cash equivalents of $1,360,970. The Company plans to finance its operations and development needs with its existing cash and cash equivalents, additional equity and/or debt financing arrangements, and expected revenue primarily from the sale of VELDONA Pet cytoprotein supplements to support the Company’s clinical trial activities, largely in connection with Ainos Flora and VELDONA therapeutics for humans. There can be no assurance that the Company will be able to obtain additional financing on terms acceptable to the Company, on a timely basis, or at all. If the Company is not able to obtain sufficient funds on acceptable terms when needed, the Company’s business, results of operations, and financial condition could be materially adversely impacted.

For the six months ended June 30, 2023, the Company generated a net loss of $4,870,202. The Company expects to continue incurring development expenses for the next twelve months as the Company advances Ainos Flora and VELDONA therapeutics for humans through clinical development until regulatory approval is received and the sales and marketing of the products are authorized.

The financial statements have been prepared on a going-concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred net operating losses in every year since inception and has an accumulated deficit as of June 30, 2023 of $28,985,808 and expects to incur additional losses and negative operating cash flows for at least the next twelve months. The Company’s ability to meet its obligations is dependent upon its ability to generate sufficient cash flows from operations and future financing transactions. Although management expects the Company will continue as a going concern, there is no assurance that management’s plans will be successful since the availability and amount of such funding is not certain. Accordingly, substantial doubt exists about the Company’s ability to continue as a going concern for at least one year from the issuance of these financial statements. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability of assets or the amounts and classifications of liabilities that may result from the possible inability of the Company to continue as a going concern.

Segments

Operating segments are defined as components of an entity for which separate financial information is available and that is regularly reviewed by the chief operating decision maker (the “CODM”) in deciding how to allocate resources to an individual segment and in assessing performance. The Company’s Chief Executive Officer is the Company’s CODM. The CODM reviews financial information prepared on the basis of accounting policy disclosed in its annual financial statement for purposes of making operating decisions, allocating resources, and evaluating financial performance of the Company. As such, the Company has determined that it operates as one operating segment.

Impairment of Intangible Assets

The Company reviews its definite-lived intangibles and other long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be fully recoverable. When such events occur, management determines whether there has been impairment by comparing the anticipated undiscounted future net cash flows to the carrying value of the asset or asset group. If impairment exists, the assets are written down to their estimated fair value. No impairment of definite-lived intangible and long-lived assets was recorded for the three and six months ended June 30, 2023 and 2022.

Recent Accounting Pronouncements Adopted

On January 1, 2023, the Company adopted Accounting Standards Update (the “ASU”) 2016-13 (the “ASU 2016-13”), Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which the Financial Accounting Standards Board (the “FASB”) issued in June 2016. The new standard changes the accounting for credit losses for financial assets and certain other instruments, including trade receivables and contract assets that are not measured at fair value through net income. Under legacy standards, the Company recognizes an impairment of receivables when it was probable that a loss had been incurred. Under the new standard pursuant to ASU 2016-13, the Company is required to recognize estimated credit losses expected to occur over the estimated life or remaining contractual life of an asset (which includes losses that may be incurred in future periods) using a broader range of information including reasonable and supportable forecasts about future economic conditions. The guidance is effective for smaller reporting companies (the “SRC”) as defined by the SEC for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years with early adoption permitted. The Company’s adoption of this new guidance did not have a material impact on the Company’s financial statements and related disclosure.

On January 1, 2023, the Company early adopted ASU 2020-06 (the “ASU 2020-06”), Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, which simplifies accounting for convertible instruments by removing major separation models required under current GAAP. ASU 2020-06 as issued by FASB in August 2020 removes certain settlement conditions that are required for equity contracts to qualify for the derivative scope exception, and it also simplifies the diluted earnings per share calculation in certain areas. ASU 2020-06 is effective for SRC’s fiscal years beginning after December 15, 2023, including interim periods within those fiscal years, with early adoption permitted. The Company’s early adoption of this new guidance did not have a material impact on its financial statements and related disclosures.

Accounting Standards Issued but Not Yet Adopted

No other new accounting pronouncement issued or effective has had, or is expected to have, a material impact on the Company’s financial statements.

3. Cash and Cash Equivalents

As of June 30, 2023 and December 31, 2022, cash and cash equivalents consist of cash on hand and cash in bank which is potentially subject to concentration of credit risk. Such balance is maintained at financial institutions that management determines to be of high-credit quality. Cash accounts at each institution are insured by the Federal Deposit Insurance Corporation in the U.S.A or Central Deposit Insurance Corporation in Taiwan up to certain limits. At times, such deposits may be in excess of the insurance limit. The Company has not experienced any losses on its deposits.

4. Inventory

Inventory stated at cost, net of reserve, consisted of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Raw materials | | $ | 354,175 | | | $ | 393,253 | |

Work in process | | | 67,736 | | | | 111,119 | |

Finished goods | | | 106,203 | | | | 90,850 | |

Total | | $ | 528,114 | | | $ | 595,222 | |

Inventory write-downs to estimated net realizable values were $14,694 and $ 57,474 for the three and six months ended June 30, 2023, respectively, compared to nil for the three and six months ended June 30, 2022.

5. Convertible Notes Payable and Other Notes Payable

As of June 30, 2023 and December 31, 2022, the respective notes payable was as follows:

| | June 30, 2023 | | | December 31, 2022 | |

Convertible notes payable, related party – current | | $ | - | | | $ | 376,526 | |

Other notes payable, related party - current | | | 684,000 | | | | 884,000 | |

March 2025 Convertible Notes, related party - noncurrent | | | 1,500,000 | | | | - | |

March 2025 Convertible Notes - noncurrent | | | 1,000,000 | | | | - | |

| | $ | 3,184,000 | | | $ | 1,260,526 | |

The Company received funding in the form of convertible promissory note from Dr. Stephen T. Chen, the former Chief Executive Officer or Chen, (the “Chen Note”) in 2016 for the purpose of supporting working capital. The Chen Note is payable on demand and can be converted into common stock of the Company any time at the conversion price of $2.52 or $2.81 per share. The Chen Note bears an interest rate of 0.75% or 0.65%. During the three months ended June 30, 2023, $114,026 of the Chen Note was paid off in cash and the remaining $262,500 of the Chen Note was assigned by Chen to unrelated parties who exercised the conversion right and converted the Chen Note into 93,333 shares of common stock of the Company. The accrued interest expense related to the converted Chen Note was waived by Chen and the assigned parties.

The other notes payable were issued to Ainos KY, which is the controlling shareholder of the Company, in exchange for $800,000 in cash to support working capital of the Company in March 2022 (the “KY Note”). The Company paid off $200,000 of the KY Note during the six months ended June 30, 2023. Another notes payable was issued to i2China in exchange for consulting service in 2020 (the “i2China Note”) which remains outstanding for the amount of $84,000 as of June 30, 2023. Both other notes payable bear an interest rate of 1.85% per annum.

All of the aforementioned convertible promissory notes and other notes payable are unsecured and due upon maturity. The Company may prepay the notes in whole or in part at any time. The holder of convertible notes has the option to convert some or all of the unpaid principal and accrued interest to common stock of the Company.

In July and August 2023, the Company paid off $300,000 of the KY Note and $42,000 of the i2China Note together with the accrued interest and the remaining principal amount is $300,000 and $42,000 for KY Note and i2China Note, respectively.

March 2025 Convertible Notes

On March 13, 2023, the Company entered into two convertible promissory note purchase agreements pursuant to Regulation S of the Securities Act of 1933 in the total principal amount of $3,000,000 with the following investors (the “March 2025 Convertible Notes” or “Notes”).

Convertible Note Issued to ASE Test, Inc. (the “ASE Note”)

Pursuant to the aforementioned agreement, ASE Test, Inc., a shareholder of Ainos KY, committed to pay a total aggregate amount of $2,000,000 to the Company in exchange for convertible promissory note(s) in three tranches in the amounts of $1,000,000 (the “First Tranche”), $500,000 (the “Second Tranche”), and $500,000 (the “Third Tranche”) which is conditioned, among other things, on the Company achieving certain business milestones. As of June 30, 2023, the Company received $1,500,000 in cash for the First Tranche and Second Tranche upon achieving pre-defined business milestones. The Third Tranche is pending on the achievement of milestone by the Company.

Convertible Note Issued to Li-Kuo Lee (the “Lee Note”)

The Company issued a convertible note to an unrelated party, Li-Kuo Lee in exchange of $1,000,000 in cash. As of June 30, 2023, the Company received the full amount of the payment.

The March 2025 Convertible Notes will mature in two years from the issuance dates, bearing interest at the rate of 6% compounded interest per annum. At any time after the issuance and before the maturity date, the Notes are convertible into the common stock of the Company at the conversion price of $1.50 per share, subject to anti-dilutive adjustment as set forth in the Notes. Unless previously converted, the Company shall repay the outstanding principal amount plus all accrued and unpaid interest on the maturity date. The Notes shall be an unsecured general obligation of the Company.

The total interest expense of convertible notes payable and other notes payable for the three and six months ended June 30, 2023 were $37,991 and $44,924, respectively, compared with the three and six months ended June 30, 2022 of $18,602 and $34,486, respectively. As of June 30, 2023 and December 31, 2022, the unpaid accrued interest expense was $64,795 and $35,282, respectively, among which $37,562 and nil was long-term liabilities, respectively.

6. Stockholders’ Equity

Common Stock

During the three months ended June 30, 2023, the Company issued an additional 281,022 shares of common stock as a result of delivering 126,532 shares to settle vested RSUs, an additional 93,333 shares for the conversion of Chen Note (see Note 5), and 61,157 shares in exchange for a vehicle with a related party (see Note 11). As of June 30, 2023, there were 20,292,624 shares of common stock legally issued and outstanding.

Warrants

As of June 30, 2023 and December 31, 2022, warrants issued and outstanding in connection with financing are summarized as below:

| | June 30, | | | December 31, | |

(In number of shares) | | 2023 | | | 2022 | |

Public warrant with exercise price of $4.25 | | | 897,000 | | | | 897,000 | |

Private warrant with exercise price of $4.675 | | | 39,000 | | | | 39,000 | |

Total | | | 936,000 | | | | 936,000 | |

As disclosed in Note 1, the Company issued public warrants together with common stocks in connection with its underwritten public offering effective August 8, 2022. The Company further issued private warrants to Maxim Group LLC, as representative of underwriter pursuance to an underwriting agreement. Each warrant has a contractual term of 5 years, expiring on August 8, 2027, and can be exercised for the purchase of one share of common stock of the Company.

The Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the instruments’ specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity (the “ASC480), and ASC 815, Derivatives and Hedging (the “ASC 815”). The assessment considers whether the instruments are free standing financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the instruments meet all of the requirements for equity classification under ASC 815, including whether the instruments are indexed to the Company’s own common shares and whether the instrument holders could potentially require “net cash settlement” in a circumstance outside of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and as of each subsequent period end date while the instruments are outstanding. Management has concluded that the warrants issued in connection with the underwritten public offering qualify for equity accounting treatment and recorded in the additional paid-in capital.

In addition, the warrant issued by the Company to i2China in 2020 in exchange for consulting services is accounted for under ASC 718, Compensation - Stock Compensation. Refer to Note 8.

As of June 30, 2023, none of the warrants have been exercised nor have expired.

7. Revenue

Revenue is recognized upon shipment of products based upon contractually stated pricing at standard payment terms within 30 days. The revenue generated by product sales is recognized at point in time. For the three and six months ended June 30, 2023 and 2022, the Company generated revenue solely from sales of COVID-19 Antigen Rapid Test Kits in the Taiwan market. There was no revenue recognized from performance obligation satisfied or partially satisfied in prior periods, nor were there any unsatisfied performance obligations as of June 30, 2023 and December 31, 2022.

8. Share-Based Compensation

2023 Stock Incentive Plan

The Company effectuated an amendment to its 2021 Stock Incentive Plan, now restated as the Company 2023 Stock Incentive Plan (the “2023 SIP” or “Plan”) which includes, among other things, a change in the number of reserved shares under the Plan. Under the 2023 SIP, subject to a change in capital structure or a change in control, the aggregate number of shares which may be issued or transferred pursuant to awards under the Plan will be equal to up to twenty percent (20%) of shares of outstanding common stock of the Company existing as of December 31st of the previous calendar year (the “Plan Share Reserve”). Upon the effectiveness of the 2023 SIP on June 14, 2023, the aggregate number of shares which may be issued pursuant to awards under the Plan is 4,355,376 shares of common stock, including shares that remained available for grant under the 2021 Stock Incentive Plan. As of June 30, 2023, no shares have been granted under the 2023 SIP.

2021 Stock Incentive Plan

On September 28, 2021, the Company’s board of directors, and on May 16, 2022, its shareholders approved the 2021 Stock Incentive Plan (the “2021 SIP”). During the period from January 1, 2023 up to the date that the prior plan was superseded by the 2023 SIP, no shares were granted under the 2021 SIP.

2021 Employee Stock Purchase Plan

On September 28, 2021, the Company’s board of directors, and on May 16, 2022, its shareholders approved the 2021 Employee Stock Purchase Plan (the “2021 ESPP”). As of June 30, 2023, no shares were issued under the 2021 ESPP.

Restricted Stock Units (“RSUs”)

RSUs entitle the recipient to be paid out an equal number of common stock shares upon vesting. The fair value of RSUs is based on market price of the underlying stock on the date of grant. A summary of the Company’s RSUs activity and related information for the three and six months ended June 30, 2022 was Nil and for the three and six months ended June 30, 2023 was as follows:

| | Number of Share | | | Weighted-Average Grant Date Fair Value Per Share | |

Unvested balance at December 31, 2022 | | | 800,000 | | | $ | 2.42 | |

RSUs granted | | | - | | | $ | - | |

RSUs vested* | | | (29,332 | ) | | $ | 11.10 | |

RSUs forfeited | | | (38,000 | ) | | $ | 1.43 | |

Unvested balance at March 31, 2023 | | | 732,668 | | | $ | 2.12 | |

RSUs granted | | | - | | | $ | - | |

RSUs vested** | | | (101,100 | ) | | $ | 1.34 | |

RSUs forfeited | | | (34,850 | ) | | $ | 1.27 | |

Unvested balance at June 30, 2023 | | | 596,718 | | | $ | 2.30 | |

* The common stock underlying the vested RSUs was delivered to grantees during the three months ended June 30, 2023.

** 3,900 shares of vested RSUs have not been settled by issuance of common shares to grantees as of June 30, 2023.

Stock Options and Warrants

During the three and six months ended June 30, 2023 and 2022, no shares were granted, forfeited, expired or exercised. As of June 30, 2023, there were 36,666 shares in the form of stock options and 30,174 shares in the form of warrants outstanding.

Share-Based Compensation Expense

Shared-based compensation expense for the three and six months ended June 30, 2023 were $137,159 and $357,991, respectively, compared to the three and six months ended June 30, 2022 amount of $43,443 and $86,886, respectively.

As of June 30, 2023, the total unrecognized compensation cost related to outstanding RSUs, stock options and warrants was $1,439,499, which the Company expects to recognize over a weighted-average period of 1.85 years.

9. Income Taxes

The Company did not record a federal, state, or foreign income tax provision or benefit for the three or six months ended June 30, 2023 and 2022 due to the expected loss before income taxes to be incurred for the years ended December 31, 2023 and 2022, as well as the Company’s continued maintenance of a full valuation allowance against its net deferred tax assets due to its historical deficit.

10. Net Loss per Common Share

The following table sets forth the computation of the basic and diluted net loss per share attributable to common stockholders:

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Net loss attributable to common stockholders, basic and diluted | | $ | (2,349,727 | ) | | $ | (1,954,032 | ) | | $ | (4,870,202 | ) | | $ | (4,053,927 | ) |

Weighted-average number of shares used in computing net loss per share attributable to common stockholders, basic and diluted | | | 20,095,705 | | | | 9,625,133 | | | | 20,053,886 | | | | 9,625,133 | |

Net loss per share attributable to common stockholders, basic and diluted | | $ | (0.12 | ) | | $ | (0.20 | ) | | $ | (0.24 | ) | | $ | (0.42 | ) |

The following potentially dilutive securities have been excluded from the computations of diluted weighted average shares outstanding because they would be anti-dilutive:

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Option and RSUs to purchase common stock | | | 633,384 | | | | 36,666 | | | | 633,384 | | | | 36,666 | |

Warrants to purchase common stock | | | 966,174 | | | | 30,174 | | | | 966,174 | | | | 30,174 | |

Convertible note to purchase common stock | | | 1,666,667 | | | | 9,197,405 | | | | 1,666,667 | | | | 9,197,405 | |

Total potential shares | | | 3,266,225 | | | | 9,264,245 | | | | 3,266,225 | | | | 9,264,245 | |

11. Related Party Transactions

The following is a summary of related party transactions that met our disclosure threshold:

Asset Purchase Agreement

Ainos KY and the Company entered into an Asset Purchase Agreement dated as of November 18, 2021 (the “Asset Purchase Agreement”), as modified by an Amended and Restated Asset Purchase Agreement dated as of January 29, 2022 (the “Amended Asset Purchase Agreement”).

Pursuant to the Asset Purchase Agreement, the Company acquired certain intellectual property assets and certain manufacturing, testing, and office equipment for a total purchase price of $26,000,000 that included $24,886,023 for intangible intellectual property assets and $1,113,977 for equipment. As consideration the Company issued to Ainos KY a convertible promissory note in the principal amount of $26,000,000 upon closing on January 30, 2022 (the “APA Convertible Note”). Ainos KY converted all of the APA Convertible Note on or about August 8, 2022 upon the Company’s up-listing to the Nasdaq Capital Markets.

Working Capital Advances

Refer to Chen Note, KY Note and ASE Note in Note 5 which proceeds were used for working capital advances. The total interest expense incurred in related to the notes for the three and six months ended June 30, 2023 were $23,031 and $26,841, respectively, compared to $18,602 and $34,486, respectively, for the three and six months ended June 30, 2022. As of June 30, 2023 and December 31, 2022, unpaid accrued interest expenses were $46,712 and $35,282, respectively.

Purchase and Sales

Ainos COVID-19 Test Kits Sales and Marketing Agreement with Ainos KY

On June 14, 2021, the Company entered into an exclusive agreement with Ainos KY to serve as the master sales and marketing agent for the Ainos COVID-19 Antigen Rapid Test Kit and COVID-19 Nucleic Acid Test Kit which were developed and will be manufactured by Taiwan Carbon Nano Technology Corporation (the “TCNT”), a controlling shareholder of Ainos KY (the “Sales and Marketing Agreement”). On June 7, 2021, the Taiwan Food and Drug Administration (the “TFDA”) approved emergency use authorization (the “EUA”) to TCNT for the Ainos COVID-19 Antigen Rapid Test Kit that will be sold and marketed under the “Ainos” brand in Taiwan. On June 21, 2022, the Company began marketing the Ainos SARS-CoV-2 Antigen Rapid Self-Test (together with Ainos COVID-19 Antigen Rapid Test Kit, the “COVID-19 Antigen Rapid Test Kits”) under a separate EUA issued by the TFDA to TCNT on June 13, 2022.

The Company incurred costs associated with manufacturing COVID-19 Antigen Rapid Test Kits by TCNT pursuant to the Sales and Marketing Agreement, totaling nil and $46,635 for the three and six months ended June 30, 2023, respectively, compared with the amount for the three and six months ended June 30, 2022 of $483,992 and $870,404, respectively. As of June 30, 2023 and December 31, 2022, the accounts payable to TCNT were nil and $24,365, respectively; the prepayment to TCNT were $90,519 and nil, respectively.

COVID-19 Antigen Rapid Test Kits Sales

The Company sold COVID-19 Antigen Rapid Test Kits to affiliates of ASE Test Inc., totaling $12,541 and $12,541 for the three and six months ended June 30, 2023, respectively, compared with the amount for the three and six months ended June 30, 2022 of $401,259 and $482,359, respectively. As of June 30, 2023, and December 31, 2022, the accounts receivable to aforementioned related parties were nil and $177,595, respectively.

Product Co-development Agreement

Pursuant to a five-year Product Co-development Agreement effective on August 1, 2021 (the “Product Co-Development Agreement”) with TCNT, the development expenses incurred were $74,733 and $152,196 for the three and six months ended June 30, 2023, respectively, compared to $206,748 and $374,170 for the three and six months ended June 30, 2022, respectively. As of June 30, 2023 and December 31, 2022, the accounts payable were $25,089 and $70,113, respectively. Under the agreement, the Company made deposits of $31,071 and $31,490 to TCNT as of June 30, 2023 and December 31, 2022, respectively.

Miscellaneous

On April 26, 2023, the Company issued a total of 61,157 shares of common stock to Ting-Chuan Lee, a director of the Company, pursuant to a purchase and sale agreement relating to the Company’s acquisition of a vehicle. The purchase price was determined by the market price of the vehicle in the amount of $48,559.

The Company engaged Ms. Chien-Hsuan Huang as a medical device development consultant in September 2022. Ms. Huang is the spouse of one of the board of directors of the Company. The R&D expense was $19,618 and $39,344 for the three and six months ended June 30, 2023, respectively.

12. Commitments and Contingencies

The Company operates in an industry characterized by extensive patent litigation. Competitors may claim that the Company’s products infringe upon their intellectual property. Resolution of patent litigation or other intellectual property claims is typically time consuming and costly and can result in significant damage awards and injunctions that could prevent the manufacture and sale of the affected products or require the Company to make significant royalty payments in order to continue selling the affected products. As of June 30, 2023, there were no such commitments or contingencies.

13. Subsequent Events

On August 9, 2023, the Company entered into a Co-Development Agreement (the “Agreement”) with Nisshinbo Micro Devices Inc., a Japan corporation (“NISD”), and Taiwan Inabata Sangyo Co., Ltd., a Taiwan corporation (“Inabata”). Pursuant to the Agreement, NISD will outsource development of the odor platform and delivery of gas sensor products to the Company. Inabata is responsible for coordinating the co-development effort between NISD and the Company.

The Company will provide the deliverables in phases and performance obligations will be satisfied upon NISD’s acceptance. The total contract price is variable based on the quantity specified by NISD for future purchase orders. The Agreement is effective August 9, 2023 and expires on August 31, 2026.

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The unaudited condensed financial statements and this Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the financial statements and notes thereto for the year ended December 31, 2022 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our 2022 Annual Report. In addition to historical information, this discussion and analysis contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are subject to risks and uncertainties, including those set forth under “Part I. Item 1A. Risk Factors” in our 2022 Annual Report, “Part II. Item 1A. Risk Factors” in this Quarterly Report, and elsewhere in this Quarterly Report, that could cause actual results to differ materially from historical results or anticipated results.

When used in this Quarterly Report, all references to "Ainos," the "Company," "we," "our" and "us" refer Ainos, Inc.

Overview

Ainos, Inc. (the “Company”, “we” or “us”), incorporated in the State of Texas, is a diversified healthcare company focused on the development of novel point-of-care testing (POCT), therapeutics based on very low-dose interferon alpha (VELDONA), and synthetic RNA-driven preventative medicine. Our products include VELDONA clinical-stage human therapeutics, VELDONA Pet cytoprotein supplements, and telehealth-friendly POCTs.

The Company’s POCT platforms are designed to provide rapid and convenient testing of a broad range of health conditions. Building on its extensive research and development on VELDONA, the Company is focused on commercializing a suite of VELDONA-based products including VELDONA Pet cytoprotein supplements and VELDONA therapeutics for humans.

In 2021 and 2022, the Company acquired intellectual property from controlling shareholder, Ainos Inc., a Cayman Islands corporation (“Ainos KY”), and continues to expand its product portfolio into POCTs. Pivoting from the sales of COVID-19 POCT, the Company is commercializing POCTs that detect volatile organic compounds (VOC) emitted by the body, powered by the Company’s AI Nose technology platform. The Company’s lead VOCT POCT candidate, Ainos Flora, aims to quickly and easily tests female vaginal health and certain common sexually transmitted infections (STIs).

Our Portfolio of Products

Our portfolio of products is currently comprised of the following:

| • | COVID-19 Antigen Rapid Test Kit. We currently market and sell COVID-19 antigen rapid test kits in Taiwan under emergency use authorization (“EUA”) issued by the Taiwan Federal and Drug Administration (“TFDA”) for healthcare professional use and for self-test use. We market the test kits under the Ainos brand name. The kit is manufactured by TCNT, our product co-developer. |

| | |

| • | VOC POCT – Ainos Flora. Our Ainos Flora device, powered by the Company’s proprietary AI Nose technology (“AI Nose”) is currently under clinical study in Taiwan. The device is intended to perform a non-invasive test for female vaginal health and certain common STIs within a few minutes. A companion app is also being developed that enables users to conveniently manage test results. We believe Ainos Flora provides connected, convenient, discreet, rapid testing in a point-of-care setting. |

| | |

| • | VOC POCT – Ainos Pen. Our Ainos Pen device is designed to be a cloud-connected, multi-purpose, portable breath analyzer that is intended to monitor health conditions within minutes, powered by AI Nose. We expect consumers to be empowered to share their test results with their physicians through in-person and telehealth medical consultations. |

| | |

| • | VOC POCT – CHS430. The CHS430 device, powered by AI Nose, is intended to provide non-invasive testing for ventilator-associated pneumonia within few minutes, as compared to current standard of care invasive culture tests that typically take more than two days to provide results. We plan to be the exclusive sales agent for CHS430, pursuant to our Product Co-Development Agreement with our co-developer, TCNT, who will manufacture the product. |

| | |

| • | Very Low-Dose Oral Interferon Alpha (“VELDONA”). VELDONA is a low-dose oral interferon alpha (“IFN-α”) formulation based on nearly four decades of the Company’s research on IFN-α’s broad treatment applications. Our pipeline candidates under development for human indications include thrombocytopenia, Sjögren’s syndrome, aphthous stomatitis, chemotherapy-induced stomatitis, common cold, oral warts for human immunodeficiency virus (HIV) seropositive patients, influenza, oral treatment for COVID-19. We intend to explore various business opportunities, including out-licensing, to advance these indications. •VELDONA Pet. Leveraging our VELDONA technology, we recently launched five VELDONA Pet cytoprotein health supplements for pet dogs and cats. Our VELDONA Pet product line is formulated to address a variety of health issues in dogs and cats, including skin, gum, emotion, discomfort caused by allergies, eye; and weight-related issues. We are currently launching sales and marketing in Taiwan and plan to develop sales and marketing opportunities in other Asian regions and the U.S.A. |

| | |

| • | Synthetic RNA (“SRNA”). We are developing a SRNA technology platform in Taiwan with a long-term goal of developing next-generating precision treatments and rapid tests. |

An integral part of our operating strategy is to create multiple revenue streams through commercializing our product portfolio and leveraging our intellectual property patents. Our recent launch of VELDONA Pet, a series of health supplements for pet dogs and cats based on VELDONA formulation, is our latest effort to execute the diversification strategy.

In 2023, we are prioritizing sales and marketing of VELDONA Pet, commercializing our lead VOC POCT candidate, Ainos Flora, and pursuing out-licensing of our VELDONA human drug candidates. We are initiating sales and marketing of VELDONA Pet in Taiwan and intend to explore commercial opportunities in other Asian regions and the U.S.A. We recently assigned Topmed International Biotech Co. to exclusively market VELDONA Pet in Taiwan.

As of June 30, 2023, we had available cash and cash equivalents of $1,360,970. We anticipate business revenues and further potential financial support from external sources to fund our operations over the next twelve months. We have based this estimate on assumptions that may prove to be incorrect, and we could exhaust our available capital resources sooner than we expect. See “Item 2 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” for additional information. To finance our continuing operations, we will need to raise additional capital, which cannot be assured.

Impact of COVID-19 on Our Business

Substantially all of our operating revenue comes from the sale of COVID-19 test kits in Taiwan under emergency use authorization. We recently launched new product line called VELDONA Pet. We plan to generate sales revenue from VELDONA Pet initially in Taiwan and explore commercialization opportunities in other Asian regions and the U.S.A.

We believe that during the COVID-19 pandemic, consumers have become increasingly familiar with at-home tests. Moving forward, people may seek additional at-home tests to manage other infections as quickly as possible. Home self-testing and self-collection have been increasingly available for other infections such as vaginal or STIs. We believe this new user behavior, supported by a variety of telehealth platforms, will become increasingly accommodative for our other POCT products as COVID-19 becomes an endemic.

We are continuing to monitor the potential impact of COVID-19, but we cannot be certain the future impact on our business, financial condition, results of operations and prospects.

Results of Operations for Quarter Ended June 30, 2023 (“Q2 2023”) and June 30, 2022 (“Q2 2022”):

| | Three months ended June 30, | | | Change | |

| | 2023 | | | 2022 | | | Amount | | | % | |

| | | | | | | | | | | | |

Revenues | | $ | 28,555 | | | $ | 636,627 | | | $ | (608,072 | ) | | (96 | %) |

Cost of revenues | | | (55,817 | ) | | | (318,963 | ) | | | 263,146 | | | | 83 | % |

Gross (loss) profit | | | (27,262 | ) | | | 317,664 | | | | (344,926 | ) | | (109 | %) |

Operating expenses: | | | | | | | | | | | | | | | | |

Research and development expenses | | | 1,671,187 | | | | 1,634,856 | | | | 36,331 | | | | 2 | % |

Selling, general and administrative expenses | | | 618,149 | | | | 627,104 | | | | (8,955 | ) | | (1 | %) |

Total operating expenses | | | 2,289,336 | | | | 2,261,960 | | | | 27,376 | | | | 1 | % |

Loss from operations | | | (2,316,598 | ) | | | (1,944,296 | ) | | | (372,302 | ) | | | 19 | % |

| | | | | | | | | | | | | | | | |

Non-operating income (expenses), net: | | | | | | | | | | | | | | | | |

Interest expense | | | (40,311 | ) | | | (18,796 | ) | | | (21,515 | ) | | | 114 | % |

Other income, net | | | 7,182 | | | | 9,060 | | | | (1,878 | ) | | (21 | %) |

Total non-operating expenses, net | | | (33,129 | ) | | | (9,736 | ) | | | (23,393 | ) | | | 240 | % |

| | | | | | | | | | | | | | | | |

Net loss before income taxes | | | (2,349,727 | ) | | | (1,954,032 | ) | | | (395,695 | ) | | | 20 | % |

Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

Net loss | | $ | (2,349,727 | ) | | $ | (1,954,032 | ) | | $ | (395,695 | ) | | | 20 | % |

Revenues, Cost and Gross Profit (Loss)

The Company reported $28,555, and $636,627 in revenue in Q2 2023 and Q2 2022, respectively, from product sales of Ainos COVID-19 Antigen Rapid Test Kits in Taiwan. The decrease of revenue in Q2 2023 reflected a slowdown of COVID-19 infection in Taiwan which resulted in a decrease in selling price and sales volume.

The cost of revenue relating to product sales in Q2 2023 was $55,817 compared to $318,963 in Q2 2022. The decrease of cost of revenue was due to a decrease in sales volume but offset by an increase in inventory loss.

Gross (loss) profit from product sales in Q2 2023 was $(27,262) as compared to $317,664 in Q2 2022. The gross loss was due to a decrease in sales volume and selling price as well as recognition of inventory loss in Q2 2023.

Research and Development (R&D) Expenses

R&D expenses in Q2 2023 and Q2 2022 were $1,671,187 and $1,634,856, respectively. The slight increase of $36,331 (2%) was due to increased expenses associated with staffing expenditures (including share-based compensation) and professional expense, but offset by a decrease in clinical trial fees. We expect that our R&D expenses related to clinical trials will continue to grow as we further develop VOC POCT and VELDONA drug candidates and increase the pace of clinical trials previously delayed during the COVID-19 pandemic.

The share-based compensation expense and the depreciation and amortization expense in Q2 2023 and Q2 2022 were $1,210,429 and 1,155,754, respectively. When excluding these non-cash expenses, R&D expenses slightly decreased to $460,758 in Q2 2023 from $479,102 in Q2 2022 due to limitations on recruiting patients for clinical trials for VOC POCT and VELDONA human related drug candidates, but offset by an increase in R&D personnel expense.

Selling, General and Administrative (SG&A) Expenses

SG&A expenses were $618,149 and $627,104 in Q2 2023 and Q2 2022, respectively, reflecting a slight decrease of $8,955 (1%).

The share-based compensation expense and the depreciation and amortization expense in Q2 2023 and Q2 2022 were $121,025 and $125,223, respectively. When excluding these non-cash expenses, SG&A expenses slightly decreased to $497,124 in Q2 2023 compared to $501,881 in Q2 2022.

Operating Loss

The Company’s operating loss was $2,316,598 and $1,944,296 in Q2 2023 and Q2 2022, respectively, reflecting a $372,302 (19%) increase in operating loss between the reporting periods. We incurred a gross loss in product sales that did not offset operating expenses. We continued to invest resources to execute our growth strategy and product roadmap to improve our profitability.

Interest Expense

In Q2 2023, interest expense was $40,311 compared to $18,796 in Q2 2022. The increase in interest expense was due to accrued interest for convertible notes issued in March 2023 bearing a higher interest rate.

Net Loss

Net loss was $2,349,727 in Q2 2023 compared to $1,954,032 in Q2 2022, resulting in a $395,695 (20%) increase in net loss attributable to shareholders of our common stock. The net loss was due to a gross loss in product sales post COVID-19 pandemic.

Results of Operations for the Six Months Ended June 30, 2023 (“H1 2023”) and June 30, 2022 (“H1 2022”):

| | Six months ended June 30, | | | Change | |

| | 2023 | | | 2022 | | | Amount | | | % | |

| | | | | | | | | | | | |

Revenues | | $ | 77,719 | | | $ | 723,828 | | | $ | (646,109 | ) | | (89 | %) |

Cost of revenues | | | (156,665 | ) | | | (360,042 | ) | | | 203,377 | | | (56 | %) |

Gross (loss) profit | | | (78,946 | ) | | | 363,786 | | | | (442,732 | ) | | (122 | %) |

Operating expenses: | | | | | | | | | | | | | | | |

Research and development expenses | | | 3,370,070 | | | | 3,212,310 | | | | 157,760 | | | | 5 | % |

Selling, general and administrative expenses | | | 1,380,614 | | | | 1,178,834 | | | | 201,780 | | | | 17 | % |

Total operating expenses | | | 4,750,684 | | | | 4,391,144 | | | | 359,540 | | | | 8 | % |

Loss from operations | | | (4,829,630 | ) | | | (4,027,358 | ) | | | (802,272 | ) | | | 20 | % |

| | | | | | | | | | | | | | | | |

Non-operating income (expenses), net: | | | | | | | | | | | | | | | | |

Interest expense | | | (49,585 | ) | | | (35,483 | ) | | | (14,102 | ) | | | 40 | % |

Other income, net | | | 9,013 | | | | 8,914 | | | | 99 | | | | 1 | % |

Total non-operating expenses, net | | | (40,572 | ) | | | (26,569 | ) | | | (14,003 | ) | | | 53 | % |

| | | | | | | | | | | | | | | | |

Net loss before income taxes | | | (4,870,202 | ) | | | (4,053,927 | ) | | | (816,275 | ) | | | 20 | % |

Provision for income taxes | | | - | | | | - | | | | | | | | | |

Net loss | | $ | (4,870,202 | ) | | $ | (4,053,927 | ) | | $ | (816,275 | ) | | | 20 | % |

Revenues, Cost and Gross Profit (Loss)

The Company reported $77,719 of revenue for the six months ended June 30, 2023, as compared to $723,828 for the six months ended June 30, 2022 from product sales of Ainos COVID-19 Antigen Rapid Test Kits in Taiwan. The decrease of revenue in H1 2023 reflected a slowdown of COVID-19 infection in Taiwan resulting in a decrease in selling price and sales volume.

The cost of revenue relating to product sales for the six months ended June 30, 2023 was $156,665 compared to $360,042 for the six months ended June 30, 2022. The decrease of cost of revenue was due to a decrease in sales volume but offset by an increase of approximately $57,000 in inventory loss and approximately $20,000 in idle manufacturing capacity.

Gross (loss) profit from product sales for the six months ended June 30, 2023 was $(78,946) as compared to $363,786 for the six months ended June 30, 2022. The gross loss was due to a decrease in sales volume and selling price as well as recognition of inventory loss and idle capacity cost in H1 2023.

Research and Development (R&D) Expenses

R&D expenses for the six months ended June 30, 2023 and 2022 were $3,370,070 and $3,212,310, respectively. The $157,760 (5%) increase was largely due to increased expenses associated with staffing expenditures (including share-based compensation) and professional expense, but offset by a decrease in clinical trial fees. We expect that our R&D expenses related to clinical trials will continue to grow as we further develop VOC POCT and VELDONA drug candidates and increase the pace of clinical trials previously delayed during the COVID-19 pandemic.

The share-based compensation expense and the depreciation and amortization expense in H1 2023 and H1 2022 were $2,405,414 and 2,291,966, respectively. When excluding these non-cash expenses, R&D expenses slightly increased to $964,656 in H1 2023 from $920,344 in H1 2022 due to an increase in R&D personnel expense, but offset by a decrease in clinical trial fees due to delays caused by the COVID-19 pandemic.

Selling, General and Administrative (SG&A) Expenses

SG&A expenses were $1,380,614 and $1,178,834 for the six months ended June 30, 2023 and 2022, respectively. The $201,780 (17%) increase was largely due to increased expenses associated with share-based compensation as the Company granted RSUs to employees and board of directors in the second half of 2022 and fully recorded amortized compensation expense in H1 2023.

The share-based compensation expense and the depreciation and amortization expense in H1 2023 and H1 2022 were $327,495 and 145,447, respectively. When excluding these non-cash expenses, SG&A expenses slightly increased to $1,053,119 in H1 2023 compared to $1,033,387 in H1 2022.

Operating Loss

The Company’s operating loss was $4,829,630 and $4,027,358 in H1 2023 and H1 2022, respectively, reflecting an $802,272 (20%) increase in operating losses between the reporting periods. We incurred a gross loss in product sales that did not offset operating expenses. We continued to invest resources to execute our growth strategy and product roadmap to improve our profitability.

Interest Expense

In H1 2023, interest expense was $49,585 compared to $35,483 in H1 2022. The increase in interest expense was due to accrued interest for convertible notes issued in March 2023 offset by a decrease of interest expense as a result of settlement of convertible notes during H1 2023.

Net Loss

Net loss was $4,870,202 in H1 2023 compared to $4,053,927 in H1 2022, resulting in an $816,275 (20%) increase in net loss attributable to our shareholder of common stock. The net loss was due to gross loss in product sales post COVID-19 pandemic while our VEDOLNA Pet sales launched in July 2023.

Liquidity and Capital Resources

As of June 30, 2023 and December 31, 2022, the Company had available cash of $1,360,970 and $1,853,362, respectively.

The following table summarizes our cash flow during the six months period ended June 30, 2023 and 2022:

| | Six months ended June 30, | |

| | 2023 | | | 2022 | |

Net cash used in operating activities | | | (2,578,453 | ) | | | (1,629,278 | ) |

Net cash used in investing activities | | | (71,262 | ) | | | (424,557 | ) |

Net cash provided by financing activities | | | 2,185,974 | | | | 2,200,000 | |

Operating activities:

Cash used in operating activities increased by $949,175 in H1 2023 compared to H1 2022. Our net loss for H1 2023 increased by $816,275 primarily due to a gross loss from COVID-19 antigen test kit sales as a result of slow-down of COVID-19 infection in Taiwan. The operating cash outflow as a result of changes in operating assets and liabilities was mainly attributable to:

| · | No cash out expenses including share-based compensation, depreciation and amortization, and loss on inventory write-downs increased approximately by $373,000 |

| · | Working capital injected into accounts receivable, inventories and other current assets increased by approximately $1,623,000 |

| · | Working capital injected into accrued expenses, lease liabilities and other current and long-term liabilities decreased by approximately $2,129,000. |

Investing activities

Cash used for investing activities in H1 2023 was $71,262 compared to $424,557 in H1 2022, respectively, due to lower levels of R&D equipment and office facility acquisition, major investments in 2022.

Financing activities

Cash received from financing activities was $2,185,974 and $2,200,000 in H1 2023 and H1 2022, respectively. The $14,026 decrease was primarily reflected by the following:

| · | Repayment of convertible notes and other notes payable increased $314,026; but |

| · | Proceeds from convertible notes and other notes payable increased by $300,000. |

As disclosed in Note 5 Convertible Notes Payable and Other Notes Payable, we received $2.5 million in proceeds from convertible note financing in March 2023. Meanwhile, we made partial cash payment of the KY Note and Chen Note during H1 2023.

In 2023, we project an increase in the pace of clinical trial spending to advance our VOC POCT and VELDONA drug candidates and expect to invest more in R&D activities. We also plan to allocate sales and marketing efforts for VELDONA Pet.

The Company anticipates that cash reserves, business revenues, and potential debt financing through convertible and non-convertible notes will fund the Company’s operations over the next twelve months. There can be no assurance that we will be successful in our efforts to make the Company profitable. If those efforts are not successful, the Company may raise additional capital through the issuance of equity securities, debt financings or other sources to further implement its business plan. However, if such financing is not available when needed and at adequate levels, the Company will need to reevaluate its operating plan.

Critical Accounting Policies and Significant Management Estimates

Our management’s discussion and analysis of our financial condition and results of operations are based on our unaudited condensed financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States, or U.S. GAAP. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses.

We evaluate our estimates and judgments, including those related to inventory valuation, useful lives of property and equipment, valuation of stock option and warrants, and impairment testing of intangible assets, on an ongoing basis. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.