false

0001826397

A1

0001826397

2024-10-15

2024-10-15

0001826397

AGRI:CommonSharesMember

2024-10-15

2024-10-15

0001826397

AGRI:SeriesWarrantsMember

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 15, 2024

AGRIFORCE

GROWING SYSTEMS, LTD.

(Exact

Name of Registrant as Specified in Charter)

| British

Columbia |

|

001-40578 |

|

|

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 800-525

West 8th Avenue |

|

|

| Vancouver,

BC, Canada |

|

V5Z

1C6 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (604) 757-0952

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Shares |

|

AGRI |

|

The

Nasdaq Capital Market |

| Series

A Warrants |

|

AGRIW |

|

The

Nasdaq Capital Market |

FORWARD-LOOKING

STATEMENTS

This

Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively, the “Filings”)

contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available

to, Registrant’s management as well as estimates and assumptions made by Registrant’s management. When used in the Filings

the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant’s management

identify forward-looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject

to risks, uncertainties, assumptions and other factors relating to Registrant’s industry, Registrant’s operations and results

of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize,

or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated,

expected, intended or planned.

Although

Registrant believes that the expectations reflected in the forward-looking statements are reasonable, Registrant cannot guarantee future

results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the

United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results.

Item

1.01 Entry into Material Definitive Agreement

On

October 15, 2024, AgriForce Growing Systems, Ltd. (the “Company”) sold sixteen million shares to two institutional investors

at a price per share of $0.05 per share for total proceeds of $800,000. The Shares were registered pursuant to a prospectus supplement

on Form 424(b)(4) (to the Registrant’s Prospectus, Registration No. 333-266722, dated August 18, 2022) filed with the SEC on the

same day. Each institutional investor (“Purchaser”) is entering into a securities purchase agreement for $400,000 or 8,000,000

common shares at $0.05 per share. Pursuant to those agreements, the Right of Participation held by Purchaser under Section 4.12 of that

certain Securities Purchase Agreement dated June 30, 2022 between the Company and the Purchaser is hereby extended to and including December

31, 2025. If the Company shall sell any shares of its Common Stock pursuant to any at-the-market offering or equity line of credit (however

denominated), the Company shall use 25% of the net proceeds from any such sales to repay the principal on any outstanding Debentures

(as such term is defined in the June 30, 2022 Securities Purchase Agreement) in accordance with the terms of such Debentures.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date:

October 16, 2024

| AGRIFORCE

GROWING SYSTEMS, LTD. |

|

| |

|

|

| By: |

/s/

Jolie Kahn |

|

| |

Jolie

Kahn |

|

| |

Chief

Executive Officer |

|

Exhibit

5.1

Exhibit

10.1

SECURITIES

PURCHASE AGREEMENT

This

Securities Purchase Agreement (this “Agreement”) is dated as of October 14, 2024 (the “Effective Date”)

by and among AgriForce Growing Systems, Ltd.. (the “Company” and_______ (the “Purchaser”).

WHEREAS,

subject to the terms and conditions set forth herein, the Purchaser desires to purchase, and the Company desires to sell, 8,000,000 shares

(the “Shares”) of the Company’s common stock, (the “Common Stock”) for an aggregate of $400,000

(or $0.05 per common share) (the “Offering”).

WHEREAS,

the Company and the Purchaser are executing and delivering this Agreement in reliance on an effective registration statement on Form

S-3 under the Securities Act of 1933, as amended (the “1933 Act”), file no. 333-266722 and the prospectus and prospectus

supplement filed in connection herewith.

NOW,

THEREFORE, in consideration of the mutual benefits to be derived hereby, the representations, warranties, covenants and agreements

herein contained, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties

hereto hereby agree as follows:

Article

I.

PURCHASE AND SALE

1.1

Purchase.On the closing date, which shall be October 15, 2024, the Company shall deliver or cause to be delivered to the Purchaser

the following:

this

Agreement duly executed by the Company; and

the

Shares via DWAC as set forth on the signature pages hereto

(a)

On the Closing Date, the Purchaser shall deliver the total purchase price set forth in the recitals hereto by wire transfer per the written

instructions of the Company.

Article

II.

REPRESENTATIONS AND WARRANTIES

2.1

Representations and Warranties of the Company. The Company hereby makes the following representations and warranties to each Purchaser:

(a)

Organization and Qualification. Each of the Company and any subsidiary is an entity duly incorporated or otherwise organized,

validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization, with the requisite power

and authority to own and use its properties and assets and to carry on its business as currently conducted. The Company is not in violation

or default of any of the provisions of its respective certificate or articles of incorporation, bylaws or other organizational or charter

documents. The Company is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each

jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the

failure to be so qualified or in good standing, as the case may be, could not have or reasonably be expected to result in: (i) a material

adverse effect on the legality, validity or enforceability of any Transaction Document, (ii) a material adverse effect on the results

of operations, assets, business or condition (financial or otherwise) of the Company and the Subsidiary, taken as a whole, or (iii) a

material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any

Transaction Document (any of (i), (ii) or (iii), a “Material Adverse Effect”), and no Proceeding has been instituted

in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(b)

Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions

contemplated by this and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company

and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary action on the part of the

Company and no further action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith.

This Agreement has been (or upon delivery will have been) duly executed by the Company and, when delivered in accordance with the terms

hereof, will constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms,

except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws

of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability

of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions

may be limited by applicable law.

(c)

Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any

notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other

Person in connection with the execution, delivery and performance by the Company of this Agreement, other than the filing of the prospectus

supplement with the Commission and a listing of additional shares notice with the Nasdaq stock market (collectively, the “Required

Filings”).

(d)

Issuance of the Shares. The Share are duly authorized and, when issued and paid for in accordance with the applicable Transaction

Documents, shall be nonassessable, free and clear of all Liens imposed by the Company or any third party.

2.2

Representations and Warranties of the Purchaser. The Purchaser, hereby represents and warrants as of the date hereof and as of

the Closing Date to the Company as follows (unless as of a specific date therein):

(a)

Organization; Authority. Purchaser is either an individual or an entity duly incorporated or formed, validly existing and in good

standing under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability

company or similar power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise

to carry out its obligations hereunder. The execution and delivery of this Agreement and performance by Purchaser of the transactions

contemplated by this Agreement have been duly authorized by all necessary corporate, partnership, limited liability company or similar

action, as applicable, on the part of Purchaser. This Agreement has been duly executed by Purchaser, and when delivered by Purchaser

in accordance with the terms hereof, will constitute the valid and legally binding obligation of Purchaser, enforceable against it in

accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization,

moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws

relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification

and contribution provisions may be limited by applicable law.

(b)

No Conflicts. The execution, delivery and performance by the Purchaser of this Agreement and the consummation by it of the

transactions contemplated hereby do not and will not (i) conflict with or violate any provision of the Purchaser’s certificate

or articles of incorporation, bylaws or other organizational or charter documents (as applicable), (ii) conflict with, or constitute

a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon

any of the properties or assets of the Purchaser or give to others any rights of termination, amendment, acceleration or cancellation

(with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument or other understanding to

which the Purchaser is a party or by which any property or asset of the Purchaser is bound or affected, or (iii) subject to the Required

Filings, conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction

of any court or governmental authority to which the Purchaser is subject (including federal and state securities laws and regulations),

or by which any property or asset of Purchaser is bound or affected; except in the case of each of clauses (ii) and (iii), for such that

do not materially adversely affect the ability of such Purchaser to consummate the transactions contemplated hereby.

(d)

Purchaser Status. At the time Purchaser was offered the Shares, it was, and as of the date hereof it is an “accredited investor”

as defined in Rule 501 under the Securities Act and would not be disqualified under Rule 506(d) of the 1933 Act on the basis of being

a “bad actor”, as that term is established in the September 19, 2013 Small Entity Compliance Guide published by the Securities

and Exchange Commission. Purchaser, either alone or together with its representatives, has such knowledge, sophistication and experience

in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Shares,

and has so evaluated the merits and risks of such investment. Purchaser is able to bear the economic risk of an investment in the Shares

and, at the present time, is able to afford a complete loss of such investment.

(e)

Solicitation. Purchaser is not purchasing the Shares as a result of any advertisement, article, notice or other communication

regarding the Shares published in any newspaper, magazine or similar media, broadcast over television or radio, disseminated over the

Internet or presented at any seminar or, to its knowledge, any other general solicitation or general advertisement.

Article

III.

OTHER AGREEMENTS OF THE PARTIES

3.1

Extension of Right of Participation; Use of Proceeds.

(a)

The Right of Participation held by Purchaser under Section 4.12 of that certain Securities Purchase Agreement dated June 30, 2022 between

the Company and the Purchaser is hereby extended to and including December 31, 2025.

(b)

If the Company shall sell any shares of its Common Stock pursuant to any at-the-market offering or equity line of credit (however denominated),

the Company shall use 25% of the net proceeds from any such sales to repay the principal on any outstanding Debentures (as such term

is defined in the June 30, 2022 Securities Purchase Agreement) in accordance with the terms of such Debentures.

Article

IV.

MISCELLANEOUS

4.1

Fees and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each party shall pay the fees and

expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the

negotiation, preparation, execution, delivery and performance of this Agreement.

4.2

Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument

signed, in the case of an amendment, by the Company and the Purchaser, or, in the case of a waiver, by the party against whom enforcement

of any such waived provision is sought. No waiver of any default with respect to any provision, condition or requirement of this Agreement

shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition

or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise

of any such right.

4.3

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and

permitted assigns. The Purchaser may not assign this Agreement or any rights or obligations hereunder without the prior written consent

of the Company; provided, however, that the Company shall be permitted to assign this Agreement to any Person that acquires the Company

or its business (whether by merger, stock purchase or the acquisition or all or substantially all of the Company’s assets).

4.4

No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors

and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

4.5

Governing Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents

shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the

principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and

defense of the transactions contemplated by this Agreement (whether brought against a party hereto or its respective affiliates, directors,

officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting

in New York County, New York . Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting

in the New York County, New York for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated

hereby or discussed herein (including with respect to the enforcement of this Agreement), and hereby irrevocably waives, and agrees not

to assert in any action, suit or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that

such suit, action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal

service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered

or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this

Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained

herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If either party shall commence

an action or proceeding to enforce any provisions of the Transaction Documents, then the prevailing party in such action, suit or proceeding

shall be reimbursed by the other party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation,

preparation and prosecution of such action or proceeding.

(Signature

Pages Follow)

IN

WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

| Shares Subscribed For: | |

| 8,000,0000 | |

| Subscription Amount ($0.05 for each Share): | |

$ | 400,000 | |

| Purchaser: |

|

| |

|

|

| |

|

| Full Legal Name of Purchaser (Please print) |

|

| |

|

| Signature of (or on behalf of) Purchaser |

|

| |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| DWAC instructions: |

|

| |

|

|

| Participant # |

|

| |

|

|

| Account # |

|

| Accepted by the Company: |

|

| |

|

|

| AgriForce Growing Systems, Ltd |

|

| |

|

|

| By:

|

|

|

| Name: |

|

|

| Title: |

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AGRI_CommonSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AGRI_SeriesWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

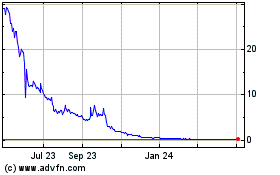

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From Nov 2024 to Dec 2024

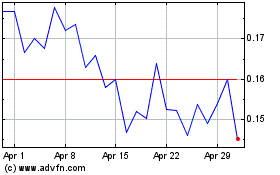

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From Dec 2023 to Dec 2024