All amounts are in U.S. dollars QUEBEC CITY, Nov. 13

/PRNewswire-FirstCall/ -- AEterna Zentaris Inc.

(NASDAQ:AEZSNASDAQ:TSX:NASDAQ:AEZ), a global biopharmaceutical

company focused on endocrinology and oncology, today reported

financial and operating results for the third quarter ended

September 30, 2008. Third Quarter 2008 Highlights - Appointment on

September 1, 2008, of Juergen Engel, Ph.D. as President and CEO of

AEterna Zentaris, replacing Juergen Ernst who had been acting as

Interim President and CEO since April 2008. Mr. Ernst, the former

Chairman of the Company, was appointed Executive Chairman effective

September 1, 2008; - Completion of patient recruitment for the

second efficacy trial of the Phase 3 program in benign prostatic

hyperplasia (BPH) with lead compound, cetrorelix; - Start of second

stage of recruitment for the Phase 2 trial in ovarian cancer with

AEZS-108. The trial is part of a Phase 2 program in gynaecological

cancers which will include up to 82 women; - Signing of a license

and cooperation agreement for the commercialization of cetrorelix

in BPH, with Handok Pharmaceuticals Co., Ltd. (Handok) for the

Korean market. Subsequent to quarter end, signing of another

agreement with Handok for the commercialization of ozarelix in BPH

for the Korean market; and - Recovery of worldwide rights from

Ardana plc (LSE:ARA) for the Growth Hormone Secretagogue (GHS)

compound, AEZS-130. Future development options are currently being

evaluated for the use of this compound in growth hormone

deficiencies. Subsequent to Quarter-End On November 11, 2008,

AEterna Zentaris signed a definitive agreement to sell to Cowen

Healthcare Royalty Partners, L.P. ("CHRP") its rights to royalties

on future sales of Cetrotide(R) covered by its license agreement

with Merck Serono. The license agreement between AEterna Zentaris

and Merck Serono was signed in 2000 and granted Merck Serono

exclusive rights to market, distribute and sell Cetrotide

worldwide, with the exception of Japan, in the field of in vitro

fertilization. On closing, AEterna Zentaris will receive $52.5

million from CHRP. In addition, contingent on 2010 net sales of

Cetrotide(R) reaching a specified level, AEterna Zentaris would

receive an additional payment of $2.5 million from CHRP. Under the

terms of the agreement, if cetrorelix which is currently in Phase 3

clinical trials for the treatment of benign prostatic hyperplasia,

is approved for sale by the European regulatory authorities in an

indication other than in vitro fertilization, AEterna Zentaris has

agreed to make a one-time cash payment to CHRP for an amount

ranging from $5 million up to a maximum of $15 million. The amount

which would be due to CHRP will be higher the earlier the product

receives European regulatory approval. "We are very pleased with

the Cowen Healthcare Royalty Partners transaction for Cetrotide(R)

which is in line with our strategy of generating non-dilutive

financing. With this transaction, we strengthened our financial

position to focus on the development of cetrorelix in BPH, while

pursuing partnership opportunities for its future

commercialization," said Juergen Engel, Ph.D., President and Chief

Executive Officer of AEterna Zentaris. "At the drug development

level, both our Phase 3 program in BPH with cetrorelix, and our

Phase 2 program with our lead oncology compound, AEZS-108 in

ovarian and endometrial cancer, met their recruitment goals as

scheduled and remain on track. First results for cetrorelix in BPH

are still expected in the third quarter of 2009, while those for

AEZS-108 should be disclosed in the next few months." CONSOLIDATED

RESULTS FOR THE THIRD QUARTER ENDED SEPTEMBER 30, 2008 Consolidated

sales and royalties increased to $8.6 million for the three-month

period ended September 30, 2008, compared to $7.4 million for the

same period in 2007. The increase in sales and royalties for the

three-month period ended September 30, 2008 compared to the same

period last year is related primarily to additional sales of

Cetrotide(R), partly offset by the exclusion of sales from

Impavido(R) in the third quarter of 2008. License fees revenues

decreased to $2.4 million for the three-month period ended

September 30, 2008 compared to $3.7 million for the same period in

2007. The decrease for the three-month period ended September 30,

2008, compared to the same period in 2007, is mainly attributable

to a milestone payment received in 2007 from Ardana plc.

Consolidated R&D costs, net of tax credits and grants were

$13.9 million for the three-month period ended September 30, 2008

compared to $9.8 million for the same period in 2007. Additional

R&D expenses for the three-month period ended September 30,

2008, compared to the same period in 2007 are mainly related to the

advancement of the Phase 3 program in BPH with the compound,

cetrorelix. Consolidated selling, general and administrative

(SG&A) expenses were $3.3 million for the three-month period

ended September 30, 2008 compared to $5.8 million for the same

period in 2007. The decrease in SG&A expenses for the

three-month period ended September 30, 2008 compared to the same

period in 2007 is primarily related to organizational changes and

cost saving measures that were implemented in the second quarter of

2008. Consolidated net loss for the three-month period ended

September 30, 2008 was $13.9 million or $0.26 per basic and diluted

share compared to $8.7 million or $0.16 per basic and diluted share

for the same period in 2007. The increase in net loss for the

three-month period ended September 30, 2008 compared to the same

period last year, is mainly related to the advancement of the

cetrorelix Phase 3 program for BPH, lower manufacturing margins and

foreign exchange loss. The cash and short-term investments were $11

million as at September 30, 2008. CONFERENCE CALL Management will

be hosting a conference call for the investment community beginning

at 10:00 a.m. Eastern Time, today, November 13, 2008, to discuss

third quarter 2008 financial results. To participate in the live

conference call by telephone, please dial 416-646-3095,

514-807-8791 or 800-814-4859. Individuals interested in listening

to the conference call on the Internet may do so by visiting

http://www.aezsinc.com/. A replay will be available on the

Company's Web site for 30 days. About AEterna Zentaris Inc. AEterna

Zentaris Inc. is a global biopharmaceutical company focused on

endocrine therapy and oncology with proven expertise in drug

discovery, development and commercialization. News releases and

additional information are available at http://www.aezsinc.com/.

Forward-Looking Statements This press release contains

forward-looking statements made pursuant to the safe harbor

provisions of the U.S. Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks and

uncertainties, which could cause the Company's actual results to

differ materially from those in the forward-looking statements.

Such risks and uncertainties include, among others, the

availability of funds and resources to pursue R&D projects, the

successful and timely completion of clinical studies, the ability

of the Company to take advantage of business opportunities in the

pharmaceutical industry, uncertainties related to the regulatory

process and general changes in economic conditions. Investors

should consult the Company's quarterly and annual filings with the

Canadian and U.S. securities commissions for additional information

on risks and uncertainties relating to the forward-looking

statements. Investors are cautioned not to rely on these

forward-looking statements. The Company does not undertake to

update these forward-looking statements. We disclaim any obligation

to update any such factors or to publicly announce the result of

any revisions to any of the forward-looking statements contained

herein to reflect future results, events or developments except if

we are requested by a governmental authority or applicable law.

Attachment: Financial summary (In thousands of US dollars, except

share and per share data) Three months ended Nine months ended

Sept. 30, Sept. 30, (Unaudited) 2008 2007 2008 2007

-------------------------------------------------------------------------

-------------------------------------------------------------------------

$ $ $ $ Revenues Sales and royalties 8,630 7,372 24,822 22,392

License fees 2,399 3,671 6,412 9,436

-------------------------------------------------------------------------

11,029 11,043 31,234 31,828

-------------------------------------------------------------------------

Operating expenses Cost of sales 4,986 3,290 14,348 9,675 Research

and development costs, net of tax credits and grants* 13,880 9,835

44,914 25,557 Selling, general and administrative* 3,277 5,847

14,287 15,257 Depreciation and amortization: Property, plant and

equipment 433 426 1,199 1,183 Intangible assets 839 1,024 2,555

3,014

-------------------------------------------------------------------------

23,415 20,422 77,303 54,686

-------------------------------------------------------------------------

Loss from operations (12,386) (9,379) (46,069) (22,858) Other

income (expenses) Interest income 149 494 737 1,369 Interest

expense - (15) (68) (68) Foreign exchange (loss) gain (1,324) (170)

429 (766) Loss on disposal of long-lived assets held for sale (90)

- (125) -

-------------------------------------------------------------------------

(1,265) 309 973 535

-------------------------------------------------------------------------

Loss before income taxes (13,651) (9,070) (45,096) (22,323) Income

tax (expense) recovery (228) 1,012 (228) 4,287

-------------------------------------------------------------------------

Net loss from continuing operations (13,879) (8,058) (45,324)

(18,036) Net loss from discontinued operations - (646) - (624)

-------------------------------------------------------------------------

Net loss for the period (13,879) (8,704) (45,324) (18,660)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Net loss per share from continuing operations Basic and diluted

(0.26) (0.15) (0.85) (0.34)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Net loss per share Basic and diluted (0.26) (0.16) (0.85) (0.35)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Weighted average number of shares Basic and diluted 53,187,470

53,184,803 53,187,470 53,181,248

-------------------------------------------------------------------------

-------------------------------------------------------------------------

* Stock-based compensation costs included in: Research and

development 50 64 166 180 Selling, general and administra- tive 52

447 78 1,312

-------------------------------------------------------------------------

102 511 244 1,492

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Consolidated Statement of Comprehensive Income Three months ended

Nine months ended Sept. 30, Sept. 30, (Unaudited) 2008 2007 2008

2007

-------------------------------------------------------------------------

-------------------------------------------------------------------------

$ $ $ $ Net loss for the period (13,879) (8,704) (45,324) (18,660)

Other comprehensive income (loss): Foreign currency translation

(3,169) 6,315 (2,650) 13,204 Variation in the fair value of

short-term investments (15) 81 (3) (87)

-------------------------------------------------------------------------

Comprehensive loss (17,063) (2,308) (47,977) (5,543)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(In thousands of US dollars) CONSOLIDATED BALANCE SHEETS September

30, December 31, Unaudited 2008 2007

-------------------------------------------------------------------------

-------------------------------------------------------------------------

$ $ Cash and short-term investments 10,957 41,387 Other current

assets 15,374 18,193 ---------------------------- 26,331 59,580

Long-term assets 46,227 63,783 ---------------------------- Total

assets 72,558 123,363 ----------------------------

---------------------------- Current liabilities 17,611 22,255

Deferred revenues 4,508 3,333 Long-term payable 197 - Employee

future benefits 9,384 9,184 ---------------------------- 31,700

34,772 Shareholders' equity 40,858 88,591

---------------------------- Total liabilities and shareholders'

equity 72,558 123,363 ----------------------------

---------------------------- DATASOURCE: AETERNA ZENTARIS INC.

CONTACT: Investor Relations: Ginette Vallieres, Investor Relations

Coordinator, (418) 652-8525 ext. 265, ; Media Relations: Paul

Burroughs, Director of Communications, Office: (418) 652-8525 ext.

406, Cell: (418) 575-8982,

Copyright

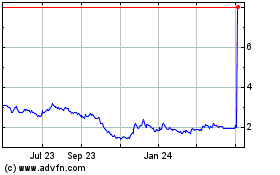

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

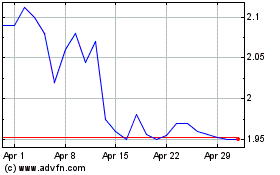

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024