Advanced Energy Industries, Inc. (Nasdaq: AEIS), a global leader

in highly engineered, precision power conversion, measurement, and

control solutions, today announced a possible offer of £19.50

per share in cash to acquire the entire issued and to be issued

shares of XP Power Limited (LSE: XPP, “XP Power”), after submitting

three, all-cash, proposals to the Board of XP Power as set out

below:

- On October 24, 2023, at £17.00 per share in cash, valuing XP

Power's equity at £339m;

- On November 5, 2023, at £18.50 per share in cash, valuing XP

Power's equity at £369m; and

- On May 7, 2024, at £19.50 per share in cash, valuing XP Power's

equity at £468m (the “Latest Proposal”) and reflecting the

increased number of shares following XP Power’s November 6, 2023

equity raise executed at £11.50 per share (the “Fundraising”).

Each of these proposals has been at a significant premium to the

share price at the time of each respective proposal, but the Board

of XP Power unanimously rejected each of these proposals.

Given the lack of engagement from the Board of XP Power,

Advanced Energy believes that XP Power's shareholders should be

made aware of the Latest Proposal, which represents a compelling

and highly attractive opportunity particularly in light of the

November 6, 2023 Fundraising and February 16, 2024 Trading Update.

The possible acquisition of XP Power is consistent with Advanced

Energy’s growth strategy, but the company will remain price

disciplined when considering any potential acquisitions, including

the potential acquisition of XP Power.

The Latest Proposal at the price of £19.50 per share in cash

represents:

- a 68% premium to XP Power’s closing share price of £11.64 as of

May 20, 2024 (being the last business day prior to this

announcement);

- a 82% premium to XP Power’s 30-trading day volume weighted

average price of £10.74 as of May 20, 2024;

- a 70% premium to £11.50 per share raised on the November 6,

2023 Fundraising;

- a 15% increase to the October 24, 2023 proposal of £17.00 per

share, representing a 93% premium to XP Power’s closing share price

on the trading day before the offer, and a 38% or approximately

£130 million increase to XP Power’s implied equity value reflecting

the increased number of shares following the Fundraising;

- a 5% increase to the November 5, 2023 proposal of £18.50 per

share, representing a 80% premium to XP Power’s closing share price

on the trading day before the offer, and a 27% or approximately

£100 million increase to XP Power’s implied equity value reflecting

the increased number of shares following the Fundraising; and

- a 76% premium to XP Power’s closing share price on the trading

day before the May 7, 2024 proposal of £19.50 per share was

submitted to the Board of XP Power.

The total proposed consideration of the Latest Proposal is £571

million, based on the fully-diluted share count of 24.0 million

ordinary shares, reported net debt of £103.4 million at the end of

March 31, 2024, and no further dividends to be declared or paid

after this announcement. Advanced Energy intends to fund the

acquisition with cash available on its balance sheet.

Advanced Energy believes that the Latest Proposal provides a

unique opportunity for XP Power's shareholders to realize, on

completion of the possible offer, the value of their shareholdings

in cash at a highly attractive valuation. This valuation may not be

achieved should XP Power remain as a standalone company.

Furthermore, XP Power shares trade at low levels of liquidity which

continue to prevent shareholders looking for an exit in full to

monetize their position. Advanced Energy further believes that the

Latest Proposal addresses many of the current challenges facing XP

Power by:

- Providing additional scale and resources necessary to compete

more effectively in the precision power industry;

- Reducing cyclicality as part of a larger company with a broader

global market presence;

- Enhancing XP Power's position as a strategic supplier with a

more comprehensive product portfolio;

- Accelerating XP Power's innovation through access to broader

R&D resources and technologies;

- Providing support from a leadership team with deep power and

semiconductor industry experience;

- Creating greater opportunities for employees’ career

advancement, development and mobility within the larger

organization; and

- De-risking XP Power's standalone business plan.

Advanced Energy would welcome the opportunity to engage in a

constructive dialogue with the Board of XP Power and receive access

to necessary diligence.

“We believe that the proposed offer for XP Power provides

compelling value for both Advanced Energy's and XP Power's

shareholders,” said Steve Kelley, the president and CEO of Advanced

Energy. “By expanding our portfolio of products and technologies,

and combining our technical capabilities, we believe we will be

better able to meet the growing needs of our customers.”

Advanced Energy's shareholders do not need to take any action at

this time.

Rationale for the Offer

Advanced Energy's proposed offer is consistent with the

company’s strategy to focus on precision power and deliver more

value to customers in Industrial, Medical and Semiconductor

applications. Advanced Energy's strategy is to grow revenue with

highly engineered customized power conversion solutions. XP Power's

engineering capabilities and product portfolio would complement

Advanced Energy's existing technology and product base.

If completed, the acquisition will extend Advanced Energy's

ability to serve its customers with a broader and deeper set of

products and technologies. For semiconductor equipment use cases,

the acquisition of XP Power would expand a portfolio of embedded

system power solutions which would broaden Advanced Energy’s

ability to support its OEM customers. For Industrial and Medical

applications, the acquisition of XP Power would complement Advanced

Energy's offerings and extend its geographic footprint with an

expanded presence in the U.S., Europe, and Asia Pacific.

Advanced Energy is leveraging its strong balance sheet with over

$1.0 billion of cash on hand and low-cost debt to create

significant long-term value for its shareholders. If completed, the

acquisition of XP Power will offer opportunities for Advanced

Energy to grow its earnings and expand its gross margins.

Additional Information Regarding this Announcement

There can be no certainty that any firm offer will be made, nor

as to the terms on which any firm offer might be made. Any offer

for XP Power, if made, will be made in accordance with section 139

of the Securities and Futures Act 2001 of Singapore and the

Singapore Code on Take-overs and Mergers (the "Singapore Takeover

Code”), and be subject to the jurisdiction of the Securities

Industry Council of Singapore (the "Council"), which administers

the Singapore Takeover Code. Such an offer (if any) would not be

subject to the jurisdiction of the UK Panel on Takeovers and

Mergers which administers the City Code on Takeovers and Mergers

(the “UK Takeover Code”).

In consultation with the Council, Advanced Energy has undertaken

to, by not later than 5.00 pm (London time) on June 18, 2024, being

28 days after this announcement date to announce a firm intention

to make an offer for the shares of XP Power in accordance with Rule

3.5 of the Singapore Takeover Code or announce that it does not

intend to make an offer. This deadline can be extended with the

consent of the Council, at the request of XP Power, taking into

account all relevant factors, including (a) the status of

negotiations between Advanced Energy and XP Power, and (b) the

anticipated timetable for their completion.

In the event that Advanced Energy announces that it does not

intend to make an offer for XP Power, Advanced Energy and any

person acting in concert with it will be prevented from announcing

an offer or possible offer for XP Power or taking certain other

action for six months from the date of such announcement, except in

the circumstances permitted by Note 1 on Rule 33.1 of the Singapore

Takeover Code and specified in the announcement.

About Advanced Energy

Advanced Energy Industries, Inc. (Nasdaq: AEIS) is a global

leader in the design and manufacture of highly engineered,

precision power conversion, measurement and control solutions for

mission-critical applications and processes. Advanced Energy’s

power solutions enable customer innovation in complex applications

for a wide range of industries including semiconductor equipment,

industrial production, medical and life sciences, data center

computing, networking, and telecommunications. With engineering

know-how and responsive service and support for customers around

the globe, the company builds collaborative partnerships to meet

technology advances, propels growth of its customers and innovates

the future of power. Advanced Energy has devoted four decades to

perfecting power. It is headquartered in Denver, Colorado, USA. For

more information, visit www.advancedenergy.com.

Further Information

J.P. Morgan Securities Asia Private Limited ("J.P. Morgan") is

acting as lead financial adviser exclusively for Advanced Energy

and no one else in connection with the matters set out in this

announcement. J.P. Morgan will not regard any other person as its

client in relation to the matters in this announcement and will not

be responsible to anyone other than Advanced Energy for providing

the protections afforded to clients of J.P. Morgan or its

affiliates, nor for providing advice in relation to any matter

referred to herein.

The Hongkong and Shanghai Banking Corporation Limited, Singapore

Branch (“HSBC”) is acting as joint financial adviser exclusively

for Advanced Energy and no one else in connection with the matters

set out in this announcement. HSBC will not regard any other person

as its client in relation to the matters in this announcement and

will not be responsible to anyone other than Advanced Energy for

providing the protections afforded to clients of HSBC or its

affiliates, nor for providing advice in relation to any matter

referred to herein.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

The directors of Advanced Energy (including those who may have

delegated detailed supervision of this announcement) (“Directors”)

have taken all reasonable care to ensure that the facts stated and

all opinions expressed in this announcement are fair and accurate

in all material respects and that no material facts have been

omitted from this announcement, and they jointly and severally

accept responsibility accordingly. Where any information has been

extracted or reproduced from published or otherwise publicly

available sources, the sole responsibility of the Directors has

been to ensure, through reasonable enquiries, that such information

has been accurately extracted from such sources or, as the case may

be, reflected or reproduced in this announcement.

A copy of this announcement will be made available on

https://www.advancedenergy.com/ no later than 12 noon (MT) on the

business day following the date of this announcement. The content

of the website referred to above is not incorporated into and does

not form part of this announcement.

Important Notices

Not for release, publication or distribution, in whole or in

part in, into or from any jurisdiction where doing so would

constitute a violation of the relevant laws or regulations of that

jurisdiction.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise.

The distribution of this announcement in jurisdictions outside

the United Kingdom and Singapore may be restricted by law and

therefore persons into whose possession this announcement comes

should inform themselves about, and observe, such restrictions. Any

failure to comply with the restrictions may constitute a violation

of the securities law of any such jurisdiction.

The directors of Advanced Energy do not accept any

responsibility for any information relating to XP Power or any

opinion or rationale expressed by XP Power.

Summary of Disclosure Requirements under the Singapore

Takeover Code

Dealings by investors

Rule 8 of the UK Takeover Code does not apply to XP Power, and

the Singapore Takeover Code does not require investors to make

public disclosures of their positions or dealings in relevant

securities of the parties to an offer, except dealings by parties

to an offer or their associates. However, as XP Power is admitted

to trading on a regulated market in the United Kingdom, the vote

holder and issuer notification rules set out in Chapter 5 of the

Disclosure Guidance and Transparency Rules (“DTRs”) apply to XP

Power, and will continue to apply to it irrespective of the

commencement or duration of the offer period under the Singapore

Takeover Code. Any person who is in doubt of his or her obligations

under the DTRs is advised to obtain appropriate legal advice.

For the avoidance of doubt, as XP Power is not listed on the

Official List of the Singapore Exchange Securities Trading Limited,

the provisions of the Securities and Futures Act 2001 of Singapore

relating to disclosure of interests in securities do not apply to

XP Power.

Dealings by parties to an offer

Pursuant to Rule 12 of the Singapore Takeover Code (“Rule 12”),

dealings in relevant securities of an offeree company such as XP

Power during an offer period must be:

(i)

publicly disclosed, if the dealing is by

an offeror, the offeree company or any of their associates for

their own accounts or for the account of their discretionary

clients (see Rule 12.1); and

(ii)

privately disclosed to the SIC, if the

dealing is by an offeror, the offeree company or any of their

associates for the account of non-discretionary investment clients

(other than the offeror, the offeree company and any of their

associates) (see Rule 12.2).

Where an offeror, the offeree company or any of their associates

deal in relevant securities of an offeree company during an offer

period only as brokerage agents for investment clients and not as

principal, such dealings do not need to be disclosed, whether

publicly or privately to the SIC (see Rule 12.3).

Any disclosure of dealings which is required to be made pursuant

to Rule 12 must be made no later than 12 noon GMT on the dealing

day following the date of the relevant dealing (see Note 4 on Rule

12).

Any public disclosure of dealings in relevant securities must be

made in writing via an RIS and to the SIC (see Note 5(a) on Rule

12).

A private disclosure of dealings in relevant securities must be

made in writing to the SIC. The SIC has the right under the

Singapore Takeover Code to make public such information when

circumstances warrant it (see Note 5(b) on Rule 12).

General

Further information on the Singapore Takeover Code is available

on, and a copy of the Singapore Takeover Code is available for

download from, the website of the SIC at www.mas.gov.sg/sic. Any

person who is in any doubt about his or her obligations under the

Singapore Takeover Code is advised to consult his or her

professional advisers immediately.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Statements in this release that are not historical information are

forward-looking statements. For example, statements relating to our

beliefs, expectations and plans are forward-looking statements, as

are statements that certain actions, conditions, or circumstances

will continue. These forward-looking statements include, among

others, statements relating to our business and our results of

operations, a potential transaction with XP Power and our

objectives, strategies, plans, goals and targets. The factors that

could cause our actual results to differ materially from

expectations include but are not limited to the following factors:

(a) the ability of Advanced Energy and XP Power to enter into a

definitive agreement for a transaction; (b) satisfaction or waiver

of the conditions to closing of any transaction (including by

reason of the failure to obtain any necessary regulatory approvals)

in the anticipated timeframe or at all; (c) the risk that a

transaction may not occur; and (d) fluctuations in our financial

results; and other factors described under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in Advanced Energy's most

recent Annual Report on Form 10-K filed by Advanced Energy with the

Securities and Exchange Commission and in any subsequently filed

Form 10-Q. These reports and statements are available on the SEC’s

website at www.sec.gov. Copies may also be obtained from Advanced

Energy's investor relations page at ir.advancedenergy.com or by

contacting Advanced Energy's investor relations at +1 970 407 6555.

Advanced Energy cautions shareholders and prospective investors

that actual results may differ materially from those indicated by

the forward-looking statements. Advanced Energy undertakes no

obligation to publicly update or revise any forward-looking

statements made by Advanced Energy or on its behalf, whether as a

result of new information, future developments, subsequent events

or changes in circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520370119/en/

Enquiries Advanced Energy Investor and Press

Relations Edwin Mok – Investor Relations, +1 970 407 6555 Simon

Flat – Press Relations, +44 (0) 797 624 5243

J.P. Morgan (Lead Financial Adviser to Advanced Energy)

Drago Rajkovic James Robinson Richard Walsh +44 (0) 207 134

1482

HSBC (Joint Financial Adviser to Advanced Energy) Anthony

Parsons Alex Thomas Frank Ehrlich +44 (0) 207 991 8888

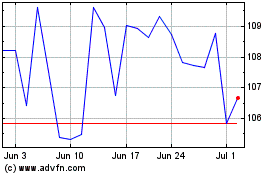

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

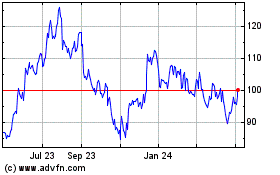

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Nov 2023 to Nov 2024