Advanced Energy Industries, Inc. (Nasdaq GM:AEIS) today

announced financial results for the third quarter ended September

30, 2010. Total sales for the third quarter were $141.0 million,

another record for the company, with earnings of $0.40 per diluted

share from continuing operations. The financials highlighted in

this release exclude results from the Aera® mass flow controller

business, which was sold to Hitachi Metals, Ltd. on October 15,

2010. Results for the quarter include a full quarter of operations

from PV Powered, Inc.

“We had another exceptional quarter with all key areas of our

business growing significantly. This record performance was

highlighted by the sixth straight quarter of growth in

semiconductor revenues, significant acceleration of our inverter

business, now 27% of sales, and strong operating leverage,” said

Dr. Hans Betz, chief executive officer. "The aggressive capacity

additions and investment in our inverter business have proven very

successful, as Advanced Energy was recently ranked #1 in the

3-phase North America solar PV inverter market, according to IMS

Research. With the diversification of Advanced Energy into high

growth power conversion markets, particularly inverters, we are

well positioned to capitalize on future opportunities and expand

our business."

Semiconductor sales rose 12.5% sequentially to $49.4 million,

representing 35.0% of total sales for the quarter. Sales to the

non-semiconductor thin film markets increased 49.8% sequentially to

$41.1 million, representing 29.2% of total sales for the quarter.

Inverter sales grew substantially to $37.4 million, or 26.5% of

total sales compared to $14.4 million in the second quarter.

Service revenue also exhibited healthy growth, increasing to $13.2

million, or 9.3% of total sales, compared to $10.7 million last

quarter.

Bookings for the third quarter reached a record $160.3 million,

increasing 17.2% compared to $136.7 million in the second quarter

of 2010. This resulted in a book-to-bill ratio of 1.14:1 for the

third quarter. Ending backlog for the third quarter increased 17.7%

sequentially to $128.5 million, compared to $109.2 million at the

end of the second quarter of 2010.

Gross margin for the third quarter was 43.1%, compared with

44.5% in the second quarter of 2010 and 31.9% in the same period

last year. The strong growth in inverter revenues this quarter

drove inverters to a larger percentage of total sales, pushing

margins down in the short-term.

Operating expenses for the third quarter increased to $38.4

million compared to $31.5 million in the second quarter in order to

support higher sales volumes, and as a result of an additional full

quarter of PV Powered expenses compared to just two months in the

second quarter. As a percent of sales, operating costs were 27.2%

compared to 31.4% of sales in the prior quarter. Operating costs

during the quarter also included $1.2 million in amortization of

acquired intangible assets related to the acquisition of PV

Powered.

Third quarter net income from continuing operations was $17.6

million or $0.40 per diluted share, compared to net income from

continuing operations of $11.5 million or $0.26 per diluted share

in the second quarter of 2010. In the same period a year ago, net

loss from continuing operations was $8.4 million or a loss of $0.20

per share.

Cash and investments were $112.4 million at the end of the third

quarter, compared to $128.9 million in the second quarter due to

investment in capital equipment as well as inventory purchases to

support our growing backlog of inverter sales.

Fourth Quarter 2010 Guidance

The Company anticipates fourth quarter 2010 results from

continuing operations, to be within the following ranges:

- Sales of $140 million to $150

million

- Gross profit of 41% to 43%

- Earnings per share of $0.36 to

$0.42

Third Quarter 2010 Conference Call

Management will host a conference call tomorrow, Monday,

November 1, 2010, at 8:30 a.m. Eastern Daylight Time to discuss

Advanced Energy's financial results. Domestic callers may access

this conference call by dialing (888) 771-4371. International

callers may access the call by dialing (847) 585-4405. Participants

will need to provide a conference pass code 28184917. For a replay

of this teleconference, please call (888) 843-7419 or (630)

652-3042, and enter the pass code 28184917. The replay will be

available for two weeks following the conference call. A webcast

will also be available on the Investor Relations web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy (NASDAQ:AEIS) is a global leader in innovative

power and control technologies for high-growth, thin-film

manufacturing and solar-power generation. Advanced Energy is

headquartered in Fort Collins, Colorado, with dedicated support and

service locations around the world. For more information, go to

www.advanced-energy.com.

Forward-Looking Language

The Company’s expectations with respect to guidance to financial

results for the fourth quarter ending December 31, 2010 and

statements that are not historical information are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such

risks and uncertainties include, but are not limited to: the

effects of global macroeconomic conditions upon demand for our

products, the volatility and cyclicality of the industries the

company serves, particularly the semiconductor industry, the timing

of orders received from customers, the company's ability to realize

cost improvement benefits, the ability to source materials and

manufacture products, and unanticipated changes to management's

estimates, reserves or allowances. These and other risks are

described in Advanced Energy's Form 10-K, Forms 10-Q and other

reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available on the SEC's

website at www.sec.gov. Copies may also be obtained from Advanced

Energy's website at www.advancedenergy.com or by contacting

Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data)

Three Months Ended

Nine Months Ended September 30, June 30,

September 30, 2010 2009 2010

2010 2009 Sales $ 140,966 $ 43,452 $ 100,107 $

310,760 $ 103,766 Cost of sales 80,276 29,597

55,548 176,304 77,244

Gross profit 60,690 13,855 44,559 134,456 26,522 43.1 % 31.9

% 44.5 % 43.3 % 25.6 % Operating expenses: Research and development

16,672 9,448 13,515 41,329 30,413 Selling, general and

administrative 20,545 9,801 17,183 49,956 27,723 Impairment of

goodwill - - - - 63,260 Amortization of intangible assets 1,177 -

767 1,944 102 Restructuring charges - 235

- - 4,370 Total

operating expenses 38,394 19,484

31,465 93,229 125,868

Income (loss) from operations 22,296 (5,629 ) 13,094 41,227 (99,346

) Other income, net 1,224 506

220 1,828 1,415 Income

(loss) from operations before income taxes 23,520 (5,123 ) 13,314

43,055 (97,931 ) Provision for income taxes 5,964

3,229 1,857 9,192

5,557 Net income (loss) from continuing operations

17,556 (8,352 ) 11,457 33,863

(103,488 ) Basic earnings (loss) per share

from continuing operations $ 0.41 $ (0.20 ) $ 0.27 $ 0.79 $ (2.47 )

Diluted earnings (loss) per share from continuing operations $ 0.40

$ (0.20 ) $ 0.26 $ 0.78 $ (2.47 )

Gain (loss) from discontinued operations, net of income

taxes 2,392 (79 ) 2,162

5,921 (740 ) Basic earnings (loss) per share

from discontinuing operations $ 0.06 $ (0.00 ) $ 0.05 $ 0.14 $

(0.02 ) Diluted earnings (loss) per share from discontinuing

operations $ 0.05 $ (0.00 ) $ 0.05 $ 0.14 $ (0.02 )

Net Income (loss) $ 19,948 $ (8,431 ) $

13,619 $ 39,784 $ (104,228 ) Basic earnings

(loss) per share $ 0.46 $ (0.20 ) $ 0.32 $ 0.93 $ (2.48 ) Diluted

earnings (loss) per share $ 0.45 $ (0.20 ) $ 0.31 $ 0.92 $ (2.48 )

Basic weighted-average common shares outstanding 43,254

42,004 42,806 42,711 41,944 Diluted weighted-average common shares

outstanding 43,849 42,004 43,327 43,293 41,944

CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands)

September 30, December 31, 2010 2009 ASSETS Current

assets: Cash and cash equivalents $ 101,566 $ 133,106 Marketable

securities 10,834 44,401 Accounts receivable, net 112,457 50,267

Inventories, net 66,691 28,567 Deferred income taxes 9,669 9,222

Income taxes receivable 4,325 - Assets held for sale 30,315 26,460

Other current assets 8,857 5,641 Total current assets

344,714 297,664 Property and equipment, net 24,732 18,687

Deposits and other 8,829 9,295 Goodwill and intangibles, net

97,068 - Deferred income tax assets, net 20,549

19,479 Total assets $ 495,892 $ 345,125 LIABILITIES

AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable $ 36,153 $ 23,802 Other accrued expenses 37,816 24,055

Acquisition related contingent liability 38,967 - Liabilities of

business held for sale 1,992 1,477 Total current

liabilities 114,928 49,334 Long-term liabilities

43,224 17,457 Total liabilities 158,152 66,791

Stockholders' equity 337,740 278,334 Total

liabilities and stockholders' equity $ 495,892 $ 345,125

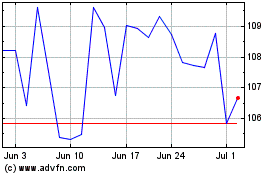

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

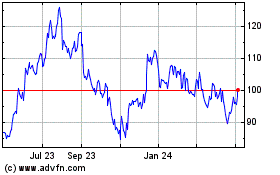

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024