FORT COLLINS, Colo., April 25 /PRNewswire-FirstCall/ -- Advanced

Energy Industries, Inc. (NASDAQ:AEIS) today announced financial

results for the first quarter ended March 31, 2007. Sales were

$107.3 million for the first quarter of 2007, an increase of 2.7%

compared to $104.5 million in the fourth quarter of 2006, and an

increase of 14.1% compared with $94.0 million in the first quarter

of 2006. Gross profit was $48.3 million, or 45.0% of sales, an

increase of 7.6%, compared with $44.9 million, or 42.9% of sales

for the fourth quarter of 2006, and 25.1% higher than $38.6

million, or 41.0% of sales in the first quarter of 2006. Operating

profit for the first quarter of 2007, which included a $2.8 million

restructuring charge related to the closure of our factory in

Stolberg, Germany, was $17.9 million, or 16.7% of sales, an

increase of 7.8%, compared with $16.6 million, or 15.9% of sales in

the fourth quarter of 2006, and an increase of 35.6%, compared to

$13.2 million, or 14.0% of sales in the first quarter of 2006.

(Logo: http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO) Net

income from continuing operations for the first quarters of 2007

and 2006 was $12.7 million and $12.8 million, respectively, or

$0.28 per diluted share for each period; however, the first quarter

of 2007 included the above mentioned restructuring charge of $2.8

million, and an effective tax rate of 35% in the first quarter of

2007 compared to a 15% tax rate in the first quarter of 2006. "We

are pleased with our results this quarter and are particularly

encouraged by the strength in the semiconductor and solar markets.

Semiconductor revenues were sequentially 8% higher than the fourth

quarter of 2006, and solar revenues were 103% higher from the prior

quarter representing 7% of our overall sales," said Dr. Hans Betz,

president and chief executive officer of Advanced Energy. "Our

strong operating performance demonstrates the progress of our

strategic initiatives including streamlining our operations and

leveraging our technology to diversify our business. We remain

excited about the potential of the markets that we serve and in our

ability to grow." Second Quarter 2007 Guidance The Company

anticipates second quarter 2007 results to be within the following

ranges: * Sales of $102 million to $106 million. * Earnings per

share of $0.26 to $0.29. First Quarter 2007 Conference Call

Management will host a conference call today, Wednesday, April 25,

2007 at 5:00 pm Eastern Time to discuss Advanced Energy's financial

results. You may access this conference call by dialing

888-713-4717. International callers may access the call by dialing

706-679-7720. For a replay of this teleconference, please call

706-645-9291, and enter the pass code 1215631. The replay will be

available through May 2, 2007. There will also be a webcast

available on the Investor Relations webpage at

http://ir.advanced-energy.com/. About Advanced Energy Advanced

Energy is a global leader in the development and support of

technologies critical to thin film deposition manufacturing

processes used in the production of semiconductors, flat panel

displays, data storage products, solar cells, architectural glass,

and other advanced product applications. Leveraging a diverse

product portfolio and technology leadership, Advanced Energy

creates solutions that maximize process impact, improve

productivity and lower the cost of ownership for its customers. The

Company's portfolio includes a comprehensive line of technology

solutions in power, flow, thermal management, and plasma and ion

beam sources for original equipment manufacturers (OEMs) and

end-users around the world. Advanced Energy operates in regional

centers in North America, Asia and Europe and offers global sales

and support through direct offices, representatives and

distributors. Founded in 1981, Advanced Energy is a publicly held

company traded on the Nasdaq Global Market under the symbol AEIS.

For more information, please visit our corporate website:

http://www.advanced-energy.com/. The Company's expectations with

respect to financial results for the second quarter of 2007 are

forward looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements are subject to known and

unknown risks and uncertainties that could cause actual results to

differ materially from those expressed or implied by such

statements. Such risks and uncertainties include, but are not

limited to: the volatility and cyclicality of the industries the

company serves, the timing of orders received from customers, the

company's ability to realize cost improvement benefits from the

global operations initiatives underway, and unanticipated changes

to management's estimates, reserves or allowances. These and other

risks are described in Advanced Energy's Form 10-K, Forms 10-Q and

other reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available on the SEC's

website at http://www.sec.gov/. Copies may also be obtained from

Advanced Energy's website at http://www.advanced-energy.com/ or by

contacting Advanced Energy's investor relations at 970-221-4670.

Forward- looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data) Three Months

Ended March 31, December 31, 2007 2006 2006 Sales $107,323 $93,950

$104,533 Cost of sales 59,014 55,400 59,639 Gross profit 48,309

38,550 44,894 Operating expenses: Research and development 12,035

10,459 12,240 Selling, general and administrative 15,218 14,405

15,535 Amortization of intangible assets 324 477 450 Restructuring

charges 2,792 29 20 Total operating expenses 30,369 25,370 28,245

Income from operations 17,940 13,180 16,649 Other income, net 1,554

1,833 1,060 Income from continuing operations before income taxes

19,494 15,013 17,709 (Provision) benefit for income taxes (6,823)

(2,252) 21,697 Income from continuing operations 12,671 12,761

39,406 Gain on sale of discontinued assets -- -- 1,000 Income from

discontinued operations -- -- 1,000 Net income $12,671 $12,761

$40,406 Net income per basic share Income from continuing

operations $0.28 $0.29 $0.88 Income from discontinued operations

$-- $-- $0.02 Basic earnings per share $0.28 $0.29 $0.90 Net income

per diluted share Income from continuing operations $0.28 $0.28

$0.87 Income from discontinued operations $-- $-- $0.02 Diluted

earnings per share $0.28 $0.28 $0.89 Basic weighted-average common

shares outstanding 44,941 44,571 44,826 Diluted weighted-average

common shares outstanding 45,636 45,004 45,345 CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands) March 31,

December 31, 2007 2006 ASSETS Current assets: Cash and cash

equivalents $51,073 $58,240 Marketable securities 105,259 85,978

Accounts receivable, net 76,318 74,794 Inventories, net 57,655

52,778 Deferred income taxes 19,677 24,434 Other current assets

3,688 4,503 Total current assets 313,670 300,727 Property and

equipment, net 31,647 33,571 Deposits and other 7,690 2,640

Goodwill and intangibles, net 65,681 65,584 Customer service

equipment, net 616 832 Deferred income tax assets, net 8,833 8,549

Total assets $428,137 $411,903 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Trade accounts payable $17,428 $16,310 Other

accrued expenses 30,170 36,488 Current portion of capital leases

and senior borrowings 127 131 Total current liabilities 47,725

52,929 Long-term liabilities: Capital leases and senior borrowings

175 198 Other long-term liabilities 9,616 2,986 Total long-term

liabilities 9,791 3,184 Total liabilities 57,516 56,113

Stockholders' equity 370,621 355,790 Total liabilities and

stockholders' equity $428,137 $411,903

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Lawrence D. Firestone, Executive Vice President, CFO

of Advanced Energy Industries, Inc., +1-970-407-6570, Web site:

http://www.advanced-energy.com/

Copyright

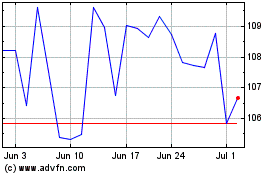

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

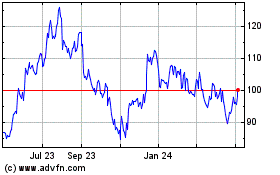

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024