FORT COLLINS, Colo., Feb. 16 /PRNewswire-FirstCall/ -- Advanced

Energy Industries, Inc. (NASDAQ:AEIS) today reported financial

results for the fourth quarter and year ended December 31, 2005.

(Logo: http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO) For

the 2005 fourth quarter, sales were $80.4 million, up 2.1 percent

compared to $78.8 million in the third quarter of 2005, and down

5.2 percent compared to $84.8 million in the fourth quarter of

2004. Gross profit was $30.2 million, or 37.6 percent of sales for

the fourth quarter of 2005, compared to $28.9 million, or 36.7

percent of sales in the third quarter of 2005, and $13.3 million,

or 15.7 percent of sales in the fourth quarter of 2004. Income from

continuing operations was $5.0 million, or $0.11 per diluted share,

in the fourth quarter of 2005, compared to a loss from continuing

operations of $4.2 million, or $0.11 per share, in the third

quarter of 2005, and a loss from continuing operations of $23.3

million, or $0.71 per share, in the fourth quarter of 2004. Fourth

quarter 2005 income from continuing operations reflects a tax rate

of 21 percent, which is lower than the Company's anticipated tax

rate of 40 percent due to the mix of foreign and domestic income in

the respective taxing jurisdictions, allowing the utilization of

the net operating loss carryforwards. During the fourth quarter

2005, the Company sold its IKOR technology assets, resulting in

income from discontinued operations of $5.0 million, or $0.11 per

diluted share. Net income from discontinued operations in the third

quarter of 2005 was $312,000, or $0.01 per diluted share, and

$340,000, or $0.01 per diluted share in the fourth quarter of 2004.

Fourth quarter 2005 net income was $10.0 million, or $0.22 per

diluted share, compared to a net loss of $3.9 million, or $0.10 per

share in the third quarter of 2005, and a net loss of $23.0

million, or $0.70 per share in the fourth quarter of 2004. The

third quarter 2005 net loss included a $3.0 million litigation

settlement, $2.1 million related to the early retirement of the

convertible debt, and a non-cash charge of $1.1 million related to

the write-off of deferred debt issuance costs. Included in the

fourth quarter 2004 net loss were $19.8 million in pre-tax charges

primarily attributable to increased excess and obsolete inventory

reserves, a change in an accounting estimate related to

demonstration equipment, employee severance and termination costs,

and intangible asset impairments. Dr. Hans Betz, president and

chief executive officer of Advanced Energy, said, "We continue to

improve our gross margin even on relatively flat sequential sales

volumes," said Dr. Betz. "Incremental operating margin above our

$66 million break even level was approximately 44 percent, and we

expect additional improvements throughout the year as we continue

to benefit from the increasing capability of our worldwide

manufacturing operations." Sales for the 2005 fiscal year were

$325.5 million, a 14.5 percent decrease compared to net sales of

$380.5 million in fiscal year 2004. Net income for the year was

$12.8 million, or $0.34 per diluted share, compared to net loss of

$12.7 million, or $0.39 per share in fiscal year 2004. Net income

from continuing operations was $3.6 million, or $0.10 per diluted

share, in fiscal year 2005, compared to a loss from continuing

operations of $14.7 million, or $0.45 per share, in fiscal year

2004. "We are currently experiencing increased demand for our

innovative portfolio of solutions that enable advanced processing,"

said Dr. Betz. "During the fourth quarter, we made progress in

further penetrating emerging opportunities in the solar market with

both our DC and RF power platforms, and in flat panel display with

our RF technology for a new etch application. We are

well-positioned to apply our technology leadership and worldwide

manufacturing excellence to a diverse set of high-growth,

high-profitability opportunities." Dr. Betz continued, "Based on

improving order trends, we currently expect first quarter 2006

sales to be $88 million to $91 million. We anticipate earnings per

share in the $0.17 to $0.19 range, including estimated stock-based

compensation expense of $600,000, or $0.01 per diluted share after

tax, due to our adoption of SFAS 123(R) in the first quarter of

2006." Fourth Quarter and Year-End 2005 Conference Call Management

will host a conference call today, Thursday, February 16, 2006 at

5:00 pm Eastern time to discuss Advanced Energy's financial

results. You may access this conference call by dialing

888-713-4717. International callers may access the call by dialing

706-679-7720. For a replay of this teleconference, please call

706-645-9291, and enter the pass code 4199312. The replay will be

available through Thursday, February 23, 2006. There will also be a

webcast available at http://www.advanced-energy.com/, and on the

investor relations page at http://ir.advanced-energy.com/. About

Advanced Energy Advanced Energy is a global leader in the

development and support of technologies critical to

high-technology, high-growth manufacturing processes used in the

production of semiconductors, flat panel displays, data storage

products, solar cells, architectural glass, and other advanced

product applications. Leveraging a diverse product portfolio and

technology leadership, Advanced Energy creates solutions that

maximize process impact, improve productivity and lower the cost of

ownership for its customers. This portfolio includes a

comprehensive line of technology solutions in power, flow, thermal

management, and plasma and ion beam sources for original equipment

manufacturers (OEMs) and end-users around the world. Advanced

Energy operates in regional centers in North America, Asia and

Europe and offers global sales and support through direct offices,

representatives and distributors. Founded in 1981, Advanced Energy

is a publicly held company traded on the Nasdaq National Market

under the symbol AEIS. For more information, please visit our

corporate website: http://www.advanced-energy.com/. Safe Harbor

Statement This press release contains certain forward-looking

statements, including the company's expectations with respect to

Advanced Energy's financial results for the first quarter of 2006.

Forward-looking statements are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such

risks and uncertainties include, but are not limited to: the

volatility and cyclicality of the semiconductor, semiconductor

capital equipment and flat panel display industries, Advanced

Energy's ongoing ability to develop new products in a highly

competitive industry characterized by increasingly rapid

technological changes, and other risks described in Advanced

Energy's Form 10-K, Forms 10-Q and other reports and statements, as

filed with the Securities and Exchange Commission. These reports

and statements are available on the SEC's website at

http://www.sec.gov/ . Copies may also be obtained from Advanced

Energy's website at http://www.advanced-energy.com/ or by

contacting Advanced Energy's investor relations at 970-221-4670.

The company assumes no obligation to update the information in this

press release. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data) Three Months

Ended Years Ended December 31, September 30, December 31, 2005 2004

2005 2005 2004 Sales $80,387 $84,811 $78,756 $325,482 $380,537 Cost

of sales 50,196 71,536 49,834 208,401 265,911 Gross profit 30,191

13,275 28,922 117,081 114,626 Operating expenses: Research and

development 9,635 11,987 9,610 39,720 49,004 Selling, general and

administrative 13,671 12,305 13,421 53,631 54,174 Amortization of

intangible assets 481 538 504 2,050 3,925 Restructuring charges 166

3,670 210 2,706 3,912 Litigation settlement -- -- 3,000 3,000 --

Demonstration equipment charge -- 3,752 -- -- 3,752 Impairment of

intangible assets -- 3,326 -- -- 3,326 Total operating expenses

23,953 35,578 26,745 101,107 118,093 Income (loss) from operations

6,238 (22,303) 2,177 15,974 (3,467) Other income (expense), net 123

(1,690) (4,796) (7,479) (7,256) Income (loss) from continuing

operations before income taxes 6,361 (23,993) (2,619) 8,495

(10,723) Provision (benefit) for income taxes (1,330) 648 (1,584)

(4,873) (3,947) Income (loss) from continuing operations 5,031

(23,345) (4,203) 3,622 (14,670) Gain on sale of discontinued assets

5,210 -- -- 7,855 -- Results of discontinued operations (216) 340

312 1,340 1,923 Provision for income taxes -- -- -- -- -- Income

from discontinued operations 4,994 340 312 9,195 1,923 Net income

(loss) $10,025 $(23,005) $(3,891) $12,817 $(12,747) Net income

(loss) per basic share Income (loss) from continuing operations

$0.11 $(0.71) $(0.11) $0.10 $(0.45) Income from discontinued

operations $0.11 $0.01 $0.01 $0.25 $0.06 Basic earnings (loss) per

share $0.23 $(0.70) $(0.10) $0.35 $(0.39) Net income (loss) per

diluted share Income (loss) from continuing operations $0.11

$(0.71) $(0.11) $0.10 $(0.45) Income from discontinued operations

$0.11 $0.01 $0.01 $0.25 $0.06 Diluted earnings (loss) per share

$0.22 $(0.70) $(0.10) $0.34 $(0.39) Basic weighted-average common

shares outstanding 44,416 32,698 38,366 37,084 32,649 Diluted

weighted-average common shares outstanding 44,902 32,698 38,366

37,434 32,649 CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in

thousands) December 31, December 31, 2005 2004 ASSETS Current

assets: Cash and cash equivalents $52,874 $38,404 Marketable

securities 6,811 69,578 Accounts receivable, net 68,992 72,053

Inventories, net 56,199 73,224 Other current assets 6,773 6,140

Total current assets 191,649 259,399 Property and equipment, net

39,294 44,746 Deposits and other 3,808 6,468 Goodwill and

intangibles, net 69,843 80,308 Customer service equipment, net

2,407 2,968 Deferred debt issuance costs, net -- 2,086 Deferred

income tax assets, net 3,116 -- Total assets $310,117 $395,975

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Trade

accounts payable $22,028 $17,683 Other accrued expenses 23,977

28,615 Current portion of capital leases and senior borrowings

1,216 3,726 Accrued interest payable on convertible subordinated

notes -- 2,460 Total current liabilities 47,221 52,484 Long-term

liabilities: Capital leases and senior borrowings 2,974 4,679

Deferred income tax liabilities, net -- 3,709 Convertible

subordinated notes payable -- 187,718 Other long-term liabilities

2,492 2,407 Total long-term liabilities 5,466 198,513 Total

liabilities 52,687 250,997 Stockholders' equity 257,430 144,978

Total liabilities and stockholders' equity $310,117 $395,975

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in

thousands) Years Ended December 31, 2005 2004 NET CASH PROVIDED BY

(USED IN) OPERATING ACTIVITIES $36,051 $(11,378) NET CASH PROVIDED

BY INVESTING ACTIVITIES 67,032 12,329 NET CASH USED IN FINANCING

ACTIVITIES (85,972) (5,191) EFFECT OF CURRENCY TRANSLATION ON CASH

(2,641) 1,122 INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

14,470 (3,118) CASH AND EQUIVALENTS, beginning of period 38,404

41,522 CASH AND EQUIVALENTS, end of period $52,874 $38,404

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Cathy Kawakami, Director of Corporate and Investor

Relations of Advanced Energy Industries, Inc., +1-970-407-6732, Web

site: http://www.advanced-energy.com/

http://ir.advanced-energy.com/

Copyright

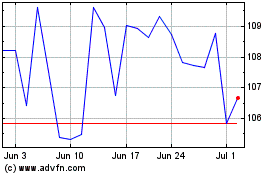

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

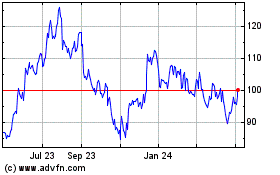

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024