By Sarah E. Needleman

Activision Blizzard Inc. has agreed to acquire King Digital

Entertainment PLC for $5.9 billion, thrusting the videogame

publisher deep into the fast-growing but fickle world of mobile

games.

The deal adds King Digital's "Candy Crush" games--among the

top-grossing apps in the Apple Inc. and Google Inc. ecosystems--to

Activision's stable of hit franchises, such as "Call of Duty" and

"Skylanders." Games in those popular series drove Activision to

another quarter of revenue and profit that topped Wall Street's

expectations.

But the proposed acquisition raises questions about whether

King, operating under Activision's umbrella, will have any better

chance in replicating the success it found in 2012, when "Candy

Crush Saga" positioned casual and free apps as viable alternatives

to pricier games played on TVs and PCs.

Those concerns have been pervasive since King's first day of

trading in March 2014, when the stock sank 16%. King's free games

continue to lure dollars away from players through in-app

purchases, just fewer of them.

On Tuesday, a day ahead of King's scheduled earnings report, the

company said it had 474 million monthly active users in its third

quarter, down from 495 million a year ago. "Gross bookings," a

measure of revenues that haven't yet materialized, came in higher

than the company expected, but margins were lower from a year

earlier. Non-GAAP adjusted revenue was $473 million for the July

through September period, down from $523.4 million a year ago.

Other mobile-game companies, such as "Angry Birds" maker Rovio

Entertainment Ltd., have also struggled amid steep competition from

newcomers and troubles in consistently siphoning enough cash from

players to keep up rapid expansion in the industry.

Still, mobile is one of the fastest-growing segments of the

videogame industry and a pillar in gamers' shift from playing among

friends in the same room to playing among millions online. Spending

on mobile and tablet games is expected to reach $40 billion by

2019, according to research firm IHS Global.

King faces formidable rivals in Supercell Oy and Machine Zone

Inc., two closely held firms that have focused on only a few games

that sit atop Apple's chart of top-grossing apps.

In an interview, King Digital Chief Executive Riccardo Zacconi

said a deal with Activision will help the company enter into new

genres and that King, in return, will bring its massive player

network, analytics and mobile expertise to Activision.

In announcing the deal late Monday, Activision reported a

third-quarter profit of 21 cents a share, compared with 23 cents a

share in the year-earlier period. Analysts had expected profit of

15 cents a share, according to Thomson Reuters. The company also

generated $1.04 billion in revenue, compared with $1.17 billion a

year earlier, but above Wall Street's expectations of $951.7

million.

On a conference call with analysts Tuesday morning, Activision

credited a major expansion for its "Destiny" franchise with growing

digital full-game downloads up 39% from a year earlier.

But the company took a hit from lower sales of "Skylanders," its

"toys-to-life" franchise. Activision said the genre, which marries

collectible figurines with videogames, is facing increasing

competition, including from toy-aisle heavyweights such as Lego A/S

and Hasbro Inc.

For the fourth quarter, Activision expects adjusted revenue of

$2.15 billion, and earnings of 82 cents a share. Activision's stock

fell sharply at the start of trading in New York on Tuesday to

$32.50 before bouncing back, up 4.1% to $35.95.

Activision is paying $18 a share for King, a 20% premium to the

company's 4 p.m. EDT price of $14.96 on the New York Stock Exchange

on Oct. 30. Activision is paying for the deal in part with $3.4

billion in cash held offshore, and the rest with loans.

The proposed acquisition, which is taking place through

subsidiary ABS Partners C.V., will be accretive to 2016 adjusted

revenue and per-share earnings by about 30%, Activision said. The

deal is expected to close in spring 2016.

"King will continue to be run independently," Mr. Zacconi said,

adding that the deal includes long-term contracts with key people

at the company.

The acquisition is Activision's latest effort to grow beyond the

living room. Last month, the company announced the launch of a new

division dedicated to competitive videogames, or so-called

e-sports.

A big draw for Activision is establishing a massive base of

users who regularly clock in hours playing, whether that be through

online-enabled consoles or on mobile devices. It said its monthly

active users, an increasingly important metric in the videogame

industry, grew 27% from a year earlier.

Activision said that with King, it will have an active monthly

user base of nearly 550 million people--describing the pool of

gamers in terms usually reserved for social networks. In their own

earnings reports recently, rivals Electronic Arts Inc. and

Microsoft Corp. touted their networks of users.

On its conference call, Activision said it can leverage those

half-billion plugged-in gamers not only for consistent purchases of

downloadable content, but by cross-promoting games and making use

of its back catalog of intellectual property, which goes back to

the 1980s.

Mr. Zacconi said he first met Activision chief Robert Kotick

three years ago, describing the get-together as a meeting of

minds--and of mutual respect and fear. "Fear because you respect

your competition," Mr. Zacconi said.

Jens Hansegard contributed to this article.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 13:34 ET (18:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

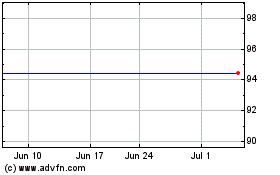

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

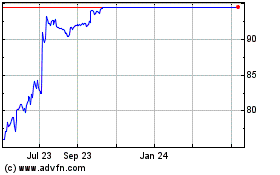

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024