U.S. Court Stalls Activision-Vivendi Deal - Analyst Blog

September 20 2013 - 1:00PM

Zacks

Activision Blizzard

Inc.(ATVI) recently received a setback when a U.S. Court

put a hold on Vivendi SA’s plan to sell its stake in the company.

Vivendi had planned to sell 85.0% of its stake in Activision to the

latter for $8.2 billion.

The lawsuit was filed by one of the

shareholders of Activision against both the parties, based on which

the Delaware Chancery court issued a preliminary injunction to stop

the transaction for the time being.

Vivendi had expressed its intent to

sell its stake in Activision in Jul 2013, which would enable it to

effectively split its Media and Telecom assets. The divestment

would bring down Vivendi’s stake in Activision to 12.0% while the

other investor group would control 24.9%.

As per the terms of the agreement,

Activision was supposed to buy the stake from Vivendi in two

separate transactions. Activision was supposed to first purchase

429 million shares from Vivendi for $5.83 billion. A separate

transaction led by a group including chief executive Bobby Kotick

and co-chairman Brian Kelly was supposed to buy another 172 million

shares worth $2.34 billion from Vivendi.

Activision’s decision to accept

Vivendi’s proposal indicates that it is trying to increase its

controlling stake so that it can take decisions more freely.

Vivendi wanted to have access to the $4.3 billion in cash that is

reflected in the balance sheet of Activision by way of dividend or

share sale. But as Activision wanted to have controlling stake from

the French company so it agreed to buy back shares from

Vivendi.

Both the parties cannot proceed

with the deal further, unless the court modifies its decision and

the transaction gets the approval of Activision shareholders. We

believe that the court’s decision is a temporary setback for both

the parties. Activision has already said that it remains committed

to the deal and the completion of the deal will boost its stock

price going forward.

Moreover, Activision’s strong

product pipeline positions it well for growth going forward.

However, stiff competition from Electronic Arts

(EA), Take-Two Interactive

Software Inc. (TTWO) and Zynga

Inc. (ZNGA) may pose some challenges.

Activision has a Zacks Rank #1

(Strong Buy).

ACTIVISION BLZD (ATVI): Free Stock Analysis Report

ELECTR ARTS INC (EA): Free Stock Analysis Report

TAKE-TWO INTER (TTWO): Free Stock Analysis Report

ZYNGA INC (ZNGA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

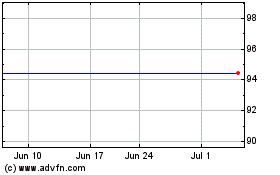

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

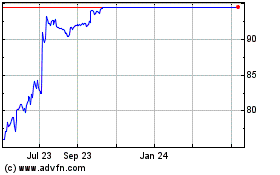

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024