false

0001914023

0001914023

2024-08-27

2024-08-27

0001914023

ACACU:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnhalfOfOneWarrantMember

2024-08-27

2024-08-27

0001914023

ACACU:ClassCommonStockParValue0.0001PerShareMember

2024-08-27

2024-08-27

0001914023

ACACU:WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member

2024-08-27

2024-08-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August 27, 2024

Date of Report (Date of earliest event reported)

Acri Capital Acquisition Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41415 |

|

87-4328187 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

13284 Pond Springs Rd, Ste 405

Austin, Texas |

|

78729 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: 512-666-1277

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock and on-half of one Warrant |

|

ACACU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A Common Stock, par value $0.0001 per share |

|

ACAC |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

ACACW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 5.07. Submission

of Matters to a Vote of Security Holders.

As

previously announced in the Current Report on Form 8-K by Acri Capital Acquisition Corporation (the “Company” or “ACAC”)

on February 20, 2024, on February 18, 2024, ACAC entered into a business combination agreement (as amended, the “Business Combination

Agreement”) with Acri Capital Merger Sub I Inc., a Delaware corporation and subsidiary of the Company (“Purchaser,”

or “PubCo” after the consummation of the Business Combination, as defined below), Acri Capital Merger Sub II Inc., a Delaware

corporation and subsidiary of the Purchaser (“Merger Sub”), and Foxx Development Inc., a Texas corporation (“Foxx”),

pursuant to which: (a) ACAC will merge with and into Purchaser, with Purchaser as the surviving entity (the “Reincorporation Merger”);

(b) Foxx will merge with and into Merger Sub, with Merger Sub surviving as a wholly-owned subsidiary of Purchaser (the “Acquisition

Merger”, collectively with the Reincorporation Merger, the “Business Combination”).

On

August 27, 2024, the Company held a special meeting of the stockholders (the “Special Meeting”) in connection

with the Business Combination. The Business Combination is described in the definitive proxy statement/prospectus included in the Registration

Statement on Form S-4 (File No. 333-280613) that was filed publicly by the Purchaser with the SEC in connection with the Business

Combination and was declared effective by the SEC on July 26, 2024 (the “Registration Statement”).

On July

19, 2024, the record date for the Special Meeting, there were 3,971,634

shares of common stock of the Company entitled to be voted at the Special Meeting, approximately 81.79% of which were represented in person

or by proxy at the special meeting.

The final

results for the matter submitted to a vote of the Company’s stockholders at the special meeting are as follows:

1. The Business Combination Proposal

The stockholders

approved the proposal to (i) adopt and approve the Business Combination

Agreement and other Transaction Documents (as defined in the Business Combination Agreement), (ii) approve the Business Combination

which includes (x) the Reincorporation Merger between ACAC and Purchaser with Purchaser surviving the Reincorporation Merger, (y) the

Acquisition Merger between Foxx and Merger Sub, with Merger Sub surviving the Acquisition Merger and becoming a wholly-owned subsidiary

of Purchaser, and (iii) other transactions contemplated therein.

The

voting results were as follows:

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

2. The Charter Amendment Proposal

The stockholders

approved the proposal to adopt a proposed amended and restated certificate of

incorporation (the “Amended PubCo Charter”) of PubCo (as the surviving company in the Acquisition Merger) upon completion

of the Acquisition Merger.

The

voting results were as follows:

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

3. The Advisory Charter Amendment Proposal

The

stockholders approved, on a non-binding basis, the

following material differences between the Amended PubCo Charter and the

Company’s current charter, which are being presented pursuant to guidance of the SEC as four separate sub-proposals.

The

voting results were as follows:

(1) Advisory

Charter Amendment Proposal A – To change the name of PubCo to “Foxx

Development Holdings Inc.” on and from the time of the Business Combination;

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

(2) Advisory

Charter Amendment Proposal B – To change the total number of authorized

shares from 23,000,000 shares, consisting of (a) 22,500,000 shares of common stock, including (i) 20,000,000 shares of

Class A common stock, and (ii) 2,500,000 shares of Class B common stock, and (b) 500,000 shares of preferred stock, to 50,000,000 shares

of common stock, par value $0.0001 per share;

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

(3) Advisory

Charter Amendment Proposal C – To redesignate all shares of Class B

common stock to shares of Class A common stock;

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

(4) Advisory

Charter Amendment Proposal D – To allow the officers of PubCo to

receive reasonable indemnification and compensation for their services, which shall be set by the PubCo board of directors (the “PubCo

Board”) or a designated committee of the PubCo Board;

| FOR |

|

AGAINT |

|

ABSTAIN |

| 3,147,082 |

|

101,439 |

|

0 |

Item 7.01 Regulation

FD Disclosure.

On

August 27, 2024, the Company issued a press release announcing the approval of the Business Combination by its stockholders. A copy

of the press release is furnished as Exhibit 99.1 hereto. The information in this Item 7.01 and the press releases hereto shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

In connection with the Special

Meeting, 1,750,663 shares of Class A common stock of the Company were rendered for redemption.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Acri Capital Acquisition Corporation |

| |

|

| Date: August 27, 2024 |

By: |

/s/ “Joy” Yi Hua |

| |

Name: |

“Joy” Yi Hua |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Acri Capital Acquisition Corporation and Foxx Development

Inc. Announce

Business Combination Approval by Acri Capital Acquisition

Corporation stockholders

Austin, Texas, August 27, 2024 (GLOBE NEWSWIRE) -- Acri

Capital Acquisition Corporation (the “Company”) (Nasdaq: ACAC), a special purpose acquisition company, today announced

that, their previously announced business combination (the "Business Combination") with Foxx

Development Inc. (“Foxx”), a consumer electronics and integrated Internet-of-Things

(IoT) solution company catering to both retail and institutional clients, was approved at a special meeting of stockholders (the

"Special Meeting") of the Company on August 27, 2024. Approximately 96.9% of the votes cast at the Special Meeting were

in favor of the Business Combination. The Company plans to file the results of the Special Meeting, as tabulated by an independent inspector

of elections, on a Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”) later today.

Subject to the satisfaction of closing conditions,

the transaction is expected to close in the following month. The combined company will be renamed as “Foxx

Development Holdings Inc.”, and its shares of common stock and warrants are expected to begin trading on the Nasdaq under

the symbols “FOXX” and “FOXXW”, respectively, once the transaction is closed.

About Acri Capital Acquisition Corporation

Acri Capital Acquisition Corporation is a blank check

company, also commonly referred to as a special purpose acquisition company, or SPAC, formed for the purpose of effecting a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses with one

or more businesses or entities.

About Foxx Development Inc.

Foxx, established

in 2017 as a Texas incorporated company, is a consumer electronics and integrated Internet-of-Things (IoT) solution company catering to

both retail and institutional clients. With robust research and development capabilities and a strategic commitment to cultivating long-term

partnerships with mobile network operators, distributors and suppliers around the world, FOXX currently sells a diverse range of products

including mobile phones, tablets and other consumer electronics devices throughout the United States, and is in the process of developing

and distributing end-to-end communication terminals and IoT solutions.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and section 21E of

the U.S. Securities Exchange Act of 1934 (“Exchange Act”) that are based on beliefs and assumptions and on information currently

available to ACAC, Foxx and/or PubCo. In some cases, you can identify forward-looking statements by the following words: “may,”

“will,” “could,” “would,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other

similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these

words. Any statements that refer to expectations, projections or other characterizations of future events or circumstances, including

the consummation of the transactions under the business combination agreement, projections of market opportunity and market share, the

capability of Foxx’s business plans including its plans to expand, the sources and uses of cash from the proposed transactions,

the anticipated enterprise value of the combined company following the consummation of the proposed transactions, any benefits of Foxx’s

partnerships, strategies or plans as they relate to the proposed transactions, anticipated benefits of the proposed transactions and expectations

related to the terms and timing of the proposed transactions are also forward-looking statements. These statements involve risks, uncertainties

and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those

expressed or implied by these forward-looking statements. Although each of ACAC, Foxx and PubCo believes that it has a reasonable basis

for each forward-looking statement contained in this communication, each of ACAC, Foxx and PubCo cautions you that these statements are

based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. In addition,

there will be risks and uncertainties described in the Registration Statement. These filings may identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Neither ACAC nor Foxx can assure you that the forward-looking statements in this communication will prove to be accurate. These forward-looking

statements are subject to a number of risks and uncertainties, including, among others, the ability to complete the transactions due to

the failure to obtain approval from ACAC’s stockholders or satisfy other closing conditions in the business combination agreement,

the occurrence of any event that could give rise to the termination of the business combination agreement, the ability to recognize the

anticipated benefits of the transactions, the amount of redemption requests made by ACAC’s public stockholders, costs related to

the transactions, the impact of the global COVID-19 pandemic, the risk that the transaction disrupts current plans and operations as a

result of the announcement and consummation of the transactions, the outcome of any potential litigation, government or regulatory proceedings

and other risks and uncertainties, including those included under the heading “Risk Factors” in the

Registration Statement on Form S-4 (File No. 333-280613) that was filed publicly by the PubCo with the SEC in connection with

the Business Combination and was declared effective by the SEC on July 26, 2024, ACAC’s Annual Report on Form 10-K filed

with the SEC on March 22, 2024 (the “Form 10-K”), ACAC’s final prospectus dated June 10, 2022 filed with the SEC (the

“Final Prospectus”) related to ACAC’s initial public offering, and in its subsequent quarterly reports on Form 10-Q

and other filings with the SEC. There may be additional risks that neither ACAC or Foxx presently know or that ACAC and Foxx currently

believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In light

of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty

by ACAC, Foxx, their respective directors, officers or employees or any other person that ACAC and Foxx will achieve their objectives

and plans in any specified time frame, or at all. The forward-looking statements in this press release represent the views of ACAC and

Foxx as of the date of this communication. Subsequent events and developments may cause those views to change. However, while ACAC and

Foxx may update these forward-looking statements in the future, there is no current intention to do so, except to the extent required

by applicable law. You should, therefore, not rely on these forward-looking statements as representing the views of ACAC or Foxx as of

any date subsequent to the date of this communication.

Contact Information

Company Contact:

Acri Capital Acquisition Corporation

Ms. “Joy” Yi Hua, Chairwoman

Email: acri.capital@gmail.com

Investor Relations Contact:

International Elite Capital

Annabelle Zhang

Telephone: +1(646) 866-7989

Email: acri@iecapitalusa.com

Foxx Contact:

Foxx Development Inc.

Greg Foley, CEO

Telephone: +1(201) 962-5550

Email: greg.foley@foxxusa.com

v3.24.2.u1

Cover

|

Aug. 27, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 27, 2024

|

| Entity File Number |

001-41415

|

| Entity Registrant Name |

Acri Capital Acquisition Corporation

|

| Entity Central Index Key |

0001914023

|

| Entity Tax Identification Number |

87-4328187

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

13284 Pond Springs Rd

|

| Entity Address, Address Line Two |

Ste 405

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78729

|

| City Area Code |

512

|

| Local Phone Number |

666-1277

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A Common Stock and on-half of one Warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A Common Stock and on-half of one Warrant

|

| Trading Symbol |

ACACU

|

| Security Exchange Name |

NASDAQ

|

| Class A Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACAC

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50

|

| Trading Symbol |

ACACW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACACU_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnhalfOfOneWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACACU_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACACU_WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

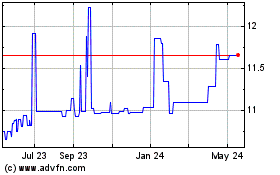

Acri Capital (NASDAQ:ACACU)

Historical Stock Chart

From Nov 2024 to Dec 2024

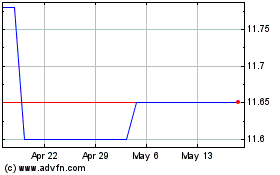

Acri Capital (NASDAQ:ACACU)

Historical Stock Chart

From Dec 2023 to Dec 2024