Filed Pursuant to Rule 424(b)(4)

Registration No. 333-248728

PROSPECTUS

ACORDA THERAPEUTICS, INC.

158,408,779 Shares of Common Stock for Resale by Selling Stockholders

This prospectus relates to the resale from time to time of up to 158,408,779 shares of common stock of Acorda Therapeutics, Inc., or the Company, by the selling stockholders, including their transferees, pledgees or donees, or their respective successors. We are registering these shares on behalf of the selling stockholders, to be offered and sold by them from time to time, to satisfy certain registration rights that we have granted to the selling stockholders. The shares being registered for resale are issuable upon the conversion of or payment of interest with respect to our 6.00% Convertible Secured Senior Notes due 2024, or the senior secured convertible notes. We will not receive any proceeds from the sale of the shares offered by this prospectus or upon the conversion of the senior secured convertible notes.

The selling stockholders identified in this prospectus, or their respective transferees, pledgees or donees, or their respective successors, may offer the shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders may resell the shares of common stock directly or through one or more underwriters, broker-dealers or agents. For additional information on the methods of sale that may be used by the selling stockholders, see the section entitled “Plan of Distribution” on page 14. For a list of the selling stockholders, see the section entitled “Selling Stockholders” on page 10.

We have agreed to bear all of the expenses incurred in connection with the registration of these shares. The selling stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of shares of our common stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our common stock is listed on The Nasdaq Global Select Market under the symbol “ACOR.” On September 16, 2020, the last reported sale price of our common stock on The Nasdaq Global Select Market was $0.55 per share. You are urged to obtain current market quotations for our common stock.

Investing in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” on page 5, as well as in any applicable prospectus supplement, any related free writing prospectus and other information contained or incorporated by reference in this prospectus and any applicable prospectus supplement, before making a decision to invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 17, 2020.

TABLE OF CONTENTS

1

ABOUT THIS PROSPECTUS

This prospectus provides you with a general description of the shares of our common stock that may be resold by the selling stockholders. Before purchasing any securities described in this prospectus, you should carefully read both this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by or on behalf of us, together with the additional information described under “Where You Can Find More Information.”

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities described in this prospectus, you should refer to the registration statement, including its exhibits. Those exhibits may be filed with the registration statement or may be incorporated by reference to earlier Securities and Exchange Commission, or SEC, filings listed in the registration statement or in subsequent filings that we may make under the Securities Exchange Act of 1934, as amended.

We have not and the selling stockholders have not authorized anyone else to provide you with different or additional information from that contained in this prospectus or any accompanying prospectus supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give. We are not making an offer to sell or soliciting an offer to buy these securities under any circumstance in any jurisdiction where the offer or solicitation is not permitted. You should assume that the information contained in this prospectus, any prospectus supplement or any free writing prospectus that we have prepared is accurate only as of the date of the respective document in which the information appears, and that any information in documents that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

1

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference contain forward-looking statements relating to future events and our future performance within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You are cautioned that such statements involve risks and uncertainties, including:

|

|

•

|

we may not be able to successfully market Inbrija or any other products under development;

|

|

|

•

|

the COVID-19 pandemic, including related quarantines and travel restrictions, and the potential for the illness to affect our employees or consultants or those that work for other companies we rely upon, could have a material adverse effect on our business operations or product sales;

|

|

|

•

|

our ability to raise additional funds to finance our operations, repay outstanding indebtedness or satisfy other obligations, and our ability to control our costs or reduce planned expenditures and take other actions, which are necessary for us to continue as a going concern;

|

|

|

•

|

risks associated with complex, regulated manufacturing processes for pharmaceuticals, which could affect whether we have sufficient commercial supply of Inbrija to meet market demand;

|

|

|

•

|

third party payers (including governmental agencies) may not reimburse for the use of Inbrija or our other products at acceptable rates or at all and may impose restrictive prior authorization requirements that limit or block prescriptions;

|

|

|

•

|

competition for Inbrija, Ampyra and other products we may develop and market in the future, including increasing competition and accompanying loss of revenues in the U.S. from generic versions of Ampyra (dalfampridine) following our loss of patent exclusivity;

|

|

|

•

|

the ability to realize the benefits anticipated from acquisitions, among other reasons because acquired development programs are generally subject to all the risks inherent in the drug development process and our knowledge of the risks specifically relevant to acquired programs generally improves over time;

|

|

|

•

|

the risk of unfavorable results from future studies of Inbrija (levodopa inhalation powder) or from our other research and development programs, or any other acquired or in-licensed programs;

|

|

|

•

|

the occurrence of adverse safety events with our products;

|

|

|

•

|

the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or class action litigation;

|

|

|

•

|

failure to protect our intellectual property, to defend against the intellectual property claims of others or to obtain third party intellectual property licenses needed for the commercialization of our products; and

|

|

|

•

|

failure to comply with regulatory requirements could result in adverse action by regulatory agencies.

|

These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s beliefs and assumptions. All statements, other than statements of historical facts, included in this prospectus and the documents incorporated herein by reference regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management are forward-looking statements. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make, and investors should not place undue reliance on these statements. In addition to the risks and uncertainties described above, we have included important factors in the cautionary statements included in our Annual Report on Form 10-K, for the year ended December 31, 2019, as updated by our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, respectively, particularly in the “Risk Factors” sections of such reports (as updated by the disclosures in our subsequent filings with the SEC that are

2

incorporated by reference herein), that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make. Forward-looking statements in this prospectus are made only as of the date hereof and, except as required by law, we assume no obligation to update or revise any forward-looking statements contained in this prospectus, the accompanying prospectus supplement or any information incorporated by reference herein or therein, whether as a result of any new information, future events or otherwise.

3

THE COMPANY

We are a biopharmaceutical company focused on developing therapies that restore function and improve the lives of people with neurological disorders. We market Inbrija (levodopa inhalation powder), which is approved in the U.S. for intermittent treatment of OFF episodes, also known as OFF periods, in people with Parkinson’s disease treated with carbidopa/levodopa. Inbrija is for as needed use and utilizes our ARCUS pulmonary delivery system, a technology platform designed to deliver medication through inhalation that we believe has potential to be used in the development of a variety of inhaled medicines. We also market branded Ampyra (dalfampridine) Extended Release Tablets, 10 mg.

We were incorporated in 1995 as a Delaware corporation. Our principal executive offices are located at 420 Saw Mill River Road, Ardsley, New York 10502. Our telephone number is (914) 347-4300. Our website is www.acorda.com. Please note that all references to “www.acorda.com” in this prospectus and the accompanying prospectus supplement and documents incorporated by reference herein are inactive textual references only and that the information contained on Acorda’s website is neither incorporated by reference nor intended to be used in connection with this offering.

We and our subsidiaries own several registered trademarks in the U.S. and in other countries. These registered trademarks include, in the U.S., the marks “Acorda Therapeutics,” our stylized Acorda Therapeutics logo, “Biotie Therapies,” “Ampyra,” “Inbrija” and “ARCUS.” Also, our marks “Fampyra” and “Inbrija” are registered marks in the European Community Trademark Office and we have registrations or pending applications for these marks in other jurisdictions. Our trademark portfolio also includes several registered trademarks and pending trademark applications in the U.S. and worldwide for potential product names or for disease awareness activities. Third party trademarks, trade names, and service marks used in this report are the property of their respective owners.

4

RISK FACTORS

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019 and in Part II, Item 1A of our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, and as may be described in our future filings with the SEC, which are incorporated by reference in this prospectus, as well the other information contained in any applicable prospectus supplement or free writing prospectus. You should also carefully consider the other information included or incorporated by reference in this prospectus, any accompanying prospectus supplement and any free writing prospectus. Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus is a part to permit the selling stockholders to resell shares of our common stock that are issuable upon the conversion of or payment of interest with respect to the senior secured convertible notes. We are not selling any securities under this prospectus and we will not receive any proceeds from the sale of shares by the selling stockholders or upon the conversion of the senior secured convertible notes.

5

DESCRIPTION OF SECURITIES

Common Stock

We have the authority to issue 370,000,000 shares of common stock, $0.001 par value per share. As of September 9, 2020, there were 47,968,173 shares of our voting common stock were issued and outstanding (not including 29,304 shares of common stock that were held in treasury), and a maximum of 8,547,360 shares of common stock were issuable upon the exercise of outstanding options and the vesting and settlement of restricted stock units.

The following description of our common stock is only a summary and is subject to and qualified in its entirety by reference to our amended and restated certificate of incorporation, as amended (our “certificate of incorporation”), and our bylaws, as amended (our “bylaws”). Holders of common stock have one vote per share and have no preemption rights. Holders of common stock have the right to participate ratably in all distributions, whether of dividends or assets in liquidation, dissolution or winding up, subject to any superior rights of holders of preferred stock outstanding at the time. There are no redemption or sinking fund provisions applicable to the common stock. Holders of our common stock are not liable under our certificate of incorporation for further calls or assessment by us.

Computershare Trust Company, N.A. is the transfer agent and registrar for our common stock. Their address is P.O. Box 505000, Louisville, KY 40233-5000 and their telephone number is (800) 368-5948.

Section 203 of the Delaware General Corporation Law

We are subject to Section 203 of the Delaware General Corporation Law, which, subject to certain exceptions, prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the time that such stockholder became an interested stockholder, unless:

|

|

•

|

prior to such time, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested holder;

|

|

|

•

|

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned (a) by persons who are directors and also officers and (b) by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

at or subsequent to such time, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

In general, Section 203 defines “business combination” to include the following:

|

|

•

|

any merger or consolidation involving the corporation and the stockholder;

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

subject to certain exception, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

6

In general, Section 203 defines “interested stockholder” as an entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by such entity or person.

Certificate of Incorporation and Bylaws

Our certificate of incorporation and bylaws include a number of provisions that may have the effect of deterring hostile takeovers or delaying or preventing changes in control or our management. For example, our certificate of incorporation authorizes the issuance of up to 20,000,000 shares of preferred stock, $.001 par value per share, of which 1,000,000 shares have been designated as Series A Junior Participating Preferred Stock. Our board of directors has the authority, without approval of the stockholders, to issue and determine the rights and preferences of series of preferred stock. The ability to authorize and issue preferred stock with voting or other rights or preferences makes it possible for our board of directors to issue preferred stock with super voting, special approval, dividend or other rights or preferences on a discriminatory basis that could impede the success of any attempt to acquire us.

Our certificate of incorporation and bylaws also provide that our board of directors is divided into three classes, each serving staggered three-year terms ending at the annual meeting of our stockholders in the third year of their term. All directors elected to our classified board of directors will serve until the election and qualification of their respective successors or their earlier resignation or removal. Members of the board of directors may only be removed for cause and only by the affirmative vote of 75% of our outstanding voting stock. These provisions are likely to increase the time required for stockholders to change the composition of our board of directors.

Our certificate of incorporation and bylaws provide that a meeting of stockholders may only be called by our board of directors, the chairman of our board of directors or our chief executive officer. Our bylaws also specify requirements as to the form and content of a stockholder’s notice. The provisions may delay or preclude stockholders from calling a meeting of stockholders, bringing matters before a meeting of stockholders or from making nominations for directors at a stockholders’ meeting, which could delay or deter takeover attempts or changes in management. Our certificate of incorporation also does not provide for cumulative voting. The absence of cumulative voting may make it more difficult for stockholders owning less than a majority of our stock to elect any directors to our board of directors.

Our bylaws provide that any matter to be voted upon, other than the election of directors, shall be decided based on the majority of votes cast, except where a different vote is otherwise required by the bylaws, applicable law or our certificate of incorporation. The bylaws further provide that directors shall be elected by a plurality of votes cast by the stockholder entitled to vote on the election; provided, however that in an uncontested election, a director who receives a majority “withhold” vote shall be required to tender his or her resignation for consideration by the board of directors.

7

PRIVATE EXCHANGE OF CONVERTIBLE NOTES

On December 24, 2019, we completed the private exchange of $276.0 million aggregate principal amount of our outstanding 1.75% Convertible Senior Notes due 2021, or the 2021 Notes, for a combination of newly issued senior secured convertible notes and cash. For each $1,000 principal amount of exchanged 2021 notes, we issued $750 principal amount of senior secured convertible notes and made a cash payment of $200, which we refer to as the exchange. In the aggregate, we issued approximately $207.0 million aggregate principal amount of senior secured convertible notes and paid approximately $55.2 million in cash to participating holders. The exchange was conducted with a limited number of institutional holders of the 2021 notes pursuant to exchange agreements dated as of December 20, 2019.

The senior secured convertible notes were issued pursuant to an indenture, dated as of December 23, 2019, among us, our wholly owned subsidiary, Civitas Therapeutics, Inc. (along with any domestic subsidiaries acquired or formed after the date of issuance, the guarantors), and Wilmington Trust, National Association, as trustee and collateral agent. The senior secured convertible notes are senior obligations of us and the guarantors, secured by a first priority security interest in substantially all of our assets and the assets of the guarantors, subject to certain exceptions described in the security agreement, dated as of December 23, 2019, between the grantors party thereto and Wilmington Trust, National Association, as collateral agent.

The senior secured convertible notes will mature on December 1, 2024 unless earlier converted in accordance with their terms prior to such date. Interest on the senior secured convertible notes will be payable semi-annually in arrears at a rate of 6.00% per annum on each June 1 and December 1, beginning on June 1, 2020. We may elect to pay interest in cash or shares of our common stock, subject to the satisfaction of certain conditions. If we elect to pay interest in shares of our common stock, such common stock will have a per share value equal to 95% of the daily volume-weighted average price for the 10 trading days ending on and including the trading day immediately preceding the relevant interest payment date.

The senior secured convertible notes will be convertible at the option of the holder into shares of our common stock at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date. The initial conversion rate for the senior secured convertible notes is 285.7142 shares of our common stock per $1,000 principal amount of senior secured convertible notes, which is equivalent to an initial conversion price of approximately $3.50 per share of common stock. The conversion rate is subject to adjustment in certain circumstances as described in the indenture, including in the event of a make-whole fundamental change, in which case the conversion rate would increase up to 561.7977 shares of our common stock per $1,000 principal amount of senior secured convertible notes.

We may elect to settle conversions of the senior secured convertible notes in cash, shares of our common stock or a combination of cash and shares of our common stock. Holders who convert their senior secured convertible notes prior to June 1, 2023 (other than in connection with a make-whole fundamental change) also will be entitled to an interest make-whole payment equal to the sum of all regularly scheduled stated interest payments, if any, due on such senior secured convertible notes on each interest payment date occurring after the conversion date for such conversion and on or before June 1, 2023. In addition, we will have the right to cause all senior secured convertible notes then outstanding to be converted automatically if the volume-weighted average price per share of our common stock equals or exceeds 130% of the conversion price for a specified period of time and certain other conditions are satisfied.

Holders of the senior secured convertible notes will have the right, at their option, to require us to purchase their senior secured convertible notes if a fundamental change (as defined in the indenture) occurs, in each case, at a repurchase price equal to 100% of the principal amount of the senior secured convertible notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the applicable repurchase date.

Subject to a number of exceptions and qualifications, the indenture restricts our ability and the ability of certain of our subsidiaries to, among other things, pay dividends or make other payments or distributions on capital stock, or purchase, redeem, defease or otherwise acquire or retire for value any capital stock, (ii) make certain investments, (iii) incur indebtedness or issue preferred stock, other than certain forms of permitted debt, which includes, among other items, indebtedness incurred to refinance the 2021 notes, (iv) create liens on assets, (v) sell assets, (vi) enter into certain transactions with affiliates or (vii) merge, consolidate or sell of all or substantially all assets. The indenture also requires us to make an offer to repurchase the senior secured convertible notes upon the occurrence of certain asset sales.

The indenture provides that a number of events will constitute an event of default, including, among other things, (i) a failure to pay interest for 30 days, (ii) failure to pay the senior secured convertible notes when due at maturity, upon any required repurchase, upon declaration of acceleration or otherwise, (iii) failure to convert the senior secured convertible

8

notes in accordance with the indenture and the failure continues for five business days, (iv) not issuing certain notices required by the indenture within a timely manner, (v) failure to comply with the other covenants or agreements in the indenture for 60 days following the receipt of a notice of non-compliance, (vi) a default or other failure by us to make required payments under other indebtedness of us or certain subsidiaries having an outstanding principal amount of $30.0 million or more, (vii) failure by us or certain subsidiaries to pay final judgments aggregating in excess of $30.0 million, (viii) certain events of bankruptcy or insolvency and (ix) the commercial launch in the United States of a product determined by the United States Food and Drug Administration to be bioequivalent to Inbrija. In the case of an event of default arising from certain events of bankruptcy or insolvency with respect to us, all outstanding senior secured convertible notes will become due and payable immediately without further action or notice. If any other event of default occurs and is continuing, the trustee or the holders of at least 25% in aggregate principal amount of the then outstanding senior secured convertible notes may declare all the notes to be due and payable immediately.

The 2021 notes received by the Company in the exchange were cancelled in accordance with their terms. Upon completion of the exchange, $69.0 million of 2021 notes remain outstanding.

On December 20, 2019, we also entered into a registration rights agreement with the holders participating in the exchange, pursuant to which we filed a Registration Statement on Form S-3 on January 15, 2020 (File No. 333-235929), which became effective on January 24, 2020, following the issuance of the senior secured convertible notes to register the resale of the shares of up to 9,598,979 shares of common stock issuable with respect to the senior secured convertible notes (the “January 2020 Registration Statement”). On June 15, 2020, following the approval by our stockholders of the issuance of more than 19.99% of our outstanding shares, we filed a Registration Statement on Form S-3 on June 29, 2020 (File No. 333-239519), which became effective on July 6, 2020, to register the resale of up to an additional 8,698,049 shares of common stock issuable with respect to the senior secured convertible notes (the “July 2020 Registration Statement” and, together with the “January 2020 Registration Statement,” the “Prior Registration Statements”).

Under the registration rights agreement, we also agreed to file a registration statement within 10 business days following the date we amend our certificate of incorporation to increase the number of authorized shares of common stock. On August 31, 2020, we filed such an amendment to increase the number of authorized shares of common stock from 80,000,000 to 370,000,000. The registration statement of which this prospectus is a part registers the resale of those shares of common stock issuable with respect to the senior secured convertible notes in excess of the 18,297,028 shares registered with the Prior Registration Statements. We have reserved for issuance 176,705,807 shares of common stock with respect to the conversion of the senior secured convertible notes, including shares that may become issuable in the event of a make-whole fundamental change, and shares of common stock that may become issuable in the future with respect to interest payments (including interest make-whole payments) on the senior secured convertible notes.

Under the registration rights agreement, we agreed to use reasonable best efforts to cause the registration of all shares of common stock issuable with respect to the senior secured convertible notes to become effective and to thereafter maintain the effectiveness of such registration statements. The registration rights agreement includes customary indemnification rights in connection with the registration statements. The registration statement of which this prospectus is a part has been filed in accordance with the registration rights agreement.

9

SELLING STOCKHOLDERS

The shares of common stock being offered by the selling stockholders are those issuable to the selling stockholders upon conversion of or payment of interest with respect to the senior secured convertible notes. For additional information regarding the issuance of the senior secured convertible notes, see “Private Exchange of Convertible Notes” above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except for the ownership of the senior secured convertible notes and the 2021 notes, the selling stockholders have not had any material relationship with us within the past three years.

The table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of the shares of common stock and the senior secured convertible notes, as of August 31, 2020, assuming full conversion of the senior secured convertible notes held by the selling stockholders on that date, without regard to any limitation on conversion. Additional selling stockholders may be named in one or more post-effective amendments to this prospectus.

In accordance with the terms of registration rights agreement with the holders of the senior secured convertible notes, this prospectus generally covers the resale of that number of shares of common stock equal to the number of shares of common stock issuable upon conversion of the related senior secured convertible notes, determined as if the outstanding senior secured convertible notes were converted, as applicable, in full (including the interest make-whole payment that would apply if the conversion had occurred on such date), in each case as of the trading day immediately preceding the date the registration statement of which this prospectus forms a part was initially filed with the SEC, less 18,297,028 shares of common stock that were registered for resale on the Prior Registration Statements. Notwithstanding the foregoing, the maximum number of shares that may be resold under this prospectus is 158,408,779.

The amount listed in the third column reflects the number of shares being offered by each selling stockholder and the amount listed in the fourth column reflects the number of shares remaining following the sale of such shares and those that were previously registered for resale. The amounts listed do not assume sales by any other selling stockholder and are subject to the maximum number of shares that may be resold under this prospectus.

|

Name of Selling Stockholder

|

Number of Shares

Owned Prior to

Offering (1)

|

Maximum Number

of Shares to be Sold

Pursuant to the

Prospectus (1)

|

Number of

Shares Owned

After Offering (1)

|

|

Canyon Value Realization Fund, L.P. (2)

|

7,112,437

|

7,112,437

|

–

|

|

Canyon Value Realization MAC 18 Ltd. (2)

|

238,482

|

238,482

|

–

|

|

Davidson Kempner International, Ltd. (3)

|

14,225,732

|

14,225,732

|

–

|

|

Davidson Kempner Partners (3)

|

6,026,398

|

6,026,398

|

–

|

|

D. E. Shaw Valence Portfolios, L.L.C. (4)

|

12,009,904

|

12,009,904

|

–

|

|

DKIP (Cayman) Ltd II (3)

|

13,773,644

|

13,773,644

|

–

|

|

EP Canyon Ltd. (2)

|

711,157

|

711,157

|

–

|

|

Jefferies LLC (5)

|

2,573,550

|

2,573,550

|

–

|

|

M.H. Davidson & Co. (3)

|

995,106

|

995,106

|

–

|

|

Nineteen77 Global Multi-Strategy Alpha Master Limited (6)

|

25,735,509

|

25,735,509

|

–

|

|

Tenor Opportunity Master Fund, Ltd. (7)

|

1,715,700

|

1,715,700

|

–

|

|

The Canyon Value Realization Master Fund, L.P. (2)

|

15,421,575

|

15,421,575

|

–

|

|

Wells Fargo Securities, LLC (8)

|

4,304,692

|

4,304,692

|

–

|

_______________

|

(1)

|

The number of shares owned prior to the offering reflects the number of shares each selling stockholder would own if we elect to pay interest on the senior secured convertible notes in shares of common stock and if the senior secured convertible notes were converted into shares of common stock following a make-whole fundamental change, as defined in the indenture governing the senior secured convertible notes. The number of shares reported as owned after this offering includes the sale of any shares that are registered for resale pursuant to the registration statement of which this prospectus forms a part and shares that were previously registered for resale on the Prior Registration Statements.

|

10

|

(2)

|

The address for each of Canyon Value Realization Fund, L.P., Canyon Value Realization MAC 18 Ltd., EP Canyon Ltd. and The Canyon Value Realization Master Fund, L.P. is c/o Canyon Capital Advisors LLC, 2000 Avenue of the Stars, 11th Floor, Los Angeles, California 90067. Consists of (a) 7,112,437 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by Canyon Value Realization Fund, L.P., (b) 238,482 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by Canyon Value Realization MAC 18 Ltd., (c) 711,157 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by EP Canyon Ltd. and (d) 15,421,575 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by The Canyon Value Realization Master Fund, L.P. Canyon Capital Advisors LLC serves as the investment advisor for each of Canyon Value Realization Fund, L.P., Canyon Value Realization MAC 18 Ltd., EP Canyon Ltd. and The Canyon Value Realization Master Fund, L.P. Mitchell R. Julis and Joshua S. Friedman control entities which own 100% of Canyon Capital Advisors, LLC. By virtue of the relationships described in this footnote, each entity and individual named herein may be deemed to share beneficial ownership of all shares held by the other entities named herein. Each entity and individual named herein expressly disclaims any such beneficial ownership, except to the extent of their individual pecuniary interests therein. Each of Canyon Value Realization Fund, L.P., Canyon Value Realization MAC 18 Ltd., EP Canyon Ltd. and The Canyon Value Realization Master Fund, L.P. is an affiliate of a broker-dealer, but is not itself a broker-dealer. The securities identified in the table above for each of Canyon Value Realization Fund, L.P., Canyon Value Realization MAC 18 Ltd., EP Canyon Ltd. and The Canyon Value Realization Master Fund, L.P. were acquired in the ordinary course of business and at the time of acquisition, none of Canyon Value Realization Fund, L.P., Canyon Value Realization MAC 18 Ltd., EP Canyon Ltd. and The Canyon Value Realization Master Fund, L.P. or their respective affiliates had an agreement or understanding, directly or indirectly, with any person to distribute the securities.

|

|

(3)

|

The address for each of Davidson Kempner International, Ltd., Davidson Kempner Partners, DKIP (Cayman) Ltd II and M.H. Davidson & Co. is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor, New York, New York 10022. Consists of (a) 14,225,732 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by Davidson Kempner International, Ltd., (b) 6,026,398 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by Davidson Kempner Partners, (c) 13,773,644 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by DKIP (Cayman) Ltd II and (d) 995,106 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes beneficially owned by M.H. Davidson & Co. Davidson Kempner Capital Management LP serves as the investment manager for each of Davidson Kempner International, Ltd., Davidson Kempner Partners, DKIP (Cayman) Ltd II and M.H. Davidson & Co. and Zachary Z. Altschuler serves as the managing member of Davidson Kempner Capital Management LP. By virtue of the relationships described in this footnote, each entity and individual named herein may be deemed to share beneficial ownership of all shares held by the other entities named herein. Each entity and individual named herein expressly disclaims any such beneficial ownership, except to the extent of their individual pecuniary interests therein.

|

|

(4)

|

The address for D. E. Shaw Valence Portfolios, L.L.C. is c/o D. E. Shaw & Co., L.P., 1166 Avenue of the Americas, 9th Floor, New York, New York 10036. Consists of 12,009,904 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes but does not include 3,340 shares of common stock owned by entities that may be deemed to be affiliates of D. E. Shaw Valence Portfolios, L.L.C. D. E. Shaw & Co., L.P., or DESCO LP, and D. E. Shaw & Co., L.L.C., or DESCO LLC, serve as the investment adviser and the manager, respectively, for D. E. Shaw Valence Portfolios, L.L.C. Julius Gaudio, Maximilian Stone, and Eric Wepsic, or their designees, exercise voting and investment control over these 11,645,167 shares on DESCO LP’s and DESCO LLC’s behalf. D. E. Shaw & Co., Inc., or DESCO Inc., serves as the general partner of DESCO LP. D. E. Shaw & Co. II, Inc., or DESCO II Inc., serves as the managing member of DESCO LLC. David E. Shaw serves as President and sole shareholder of each of DESCO Inc. and DESCO II Inc. By virtue of the relationships described in this footnote, each of DESCO LP, DESCO LLC, DESCO Inc., DESCO II Inc. and David E. Shaw may be deemed to share beneficial ownership with respect to these shares in their respective capacities described above. None of DESCO LP, DESCO LLC, DESCO Inc., DESCO II Inc. and David E. Shaw owns any such shares of common stock directly and each expressly disclaims any such beneficial ownership of such common stock, except to the extent of their individual

|

11

|

|

pecuniary interests therein. D. E. Shaw Valence Portfolios, L.L.C. may be deemed to be an affiliate of a broker-dealer, but is not itself a broker-dealer. The securities identified in the table above for D. E. Shaw Valence Portfolios, L.L.C. were acquired in the ordinary course of business and at the time of acquisition, neither D. E. Shaw Valence Portfolios, L.L.C. nor any of its affiliates had an agreement or understanding, directly or indirectly, with any person to distribute the securities.

|

|

(5)

|

The address for Jefferies LLC is 520 Madison Avenue, New York, New York 10022. Consists of 2,573,550 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes. Jefferies LLC is a broker-dealer. The securities identified in the table above for Jefferies LLC were acquired in the ordinary course of business and at the time of acquisition, neither Jefferies LLC nor any of its affiliates had an agreement or understanding, directly or indirectly, with any person to distribute the securities.

|

|

(6)

|

The address for Nineteen77 Global Multi-Strategy Alpha Master Limited, or GLEA, is c/o Maples Corporate Services Limited, Ugland House, PO Box 309, Grand Cayman KY1-1104, Cayman Islands. Consists of 25,735,509 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes. UBS O’Connor LLC, or O’Connor, is the investment manager of GLEA and shares voting and investment power with respect to these shares in this capacity. Kevin Russell, the Chief Investment Officer of O’Connor, also has voting control and investment discretion over the securities described herein held by GLEA. By virtue of the relationships described in this footnote, each entity and individual named herein may be deemed to share beneficial ownership of all shares held by the other entities named herein. Each entity and individual named herein expressly disclaims any such beneficial ownership, except to the extent of their individual pecuniary interests therein.

|

|

(7)

|

The address for Tenor Opportunity Master Fund, Ltd. is 190 Elgin Avenue, George Town, Grand Cayman, KY1-9007, Cayman Islands. Consists of 1,715,700 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes. Tenor Capital Management Company, L.P. serves as the controlling entity for Tenor Opportunity Master Fund, Ltd. and shares voting and investment power with respect to these shares in this capacity. Tenor Management GP, LLC is the general partner of Tenor Capital Management Company, L.P. and Robin R. Shah is the sole managing member of Tenor Management GP, LLC. By virtue of the relationships described in this footnote, each entity and individual named herein may be deemed to share beneficial ownership of all shares held by the other entities named herein. Each entity and individual named herein expressly disclaims any such beneficial ownership, except to the extent of their individual pecuniary interests therein.

|

|

(8)

|

The address for Wells Fargo Securities, LLC is 375 Park Avenue, 4th Floor, New York, New York 10152. Consists of 4,304,692 shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes. Wells Fargo Securities, LLC is a broker-dealer. The securities identified in the table above for Wells Fargo Securities, LLC were acquired in the ordinary course of business and at the time of acquisition, neither Wells Fargo Securities, LLC nor any of its affiliates had an agreement or understanding, directly or indirectly, with any person to distribute the securities.

|

12

PLAN OF DISTRIBUTION

We are registering the shares of common stock issuable upon conversion of or payment of interest with respect to the senior secured convertible notes to permit the resale of these shares of common stock by the holders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

|

|

•

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

•

|

in the over-the-counter market;

|

|

|

•

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

•

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

privately negotiated transactions;

|

|

|

•

|

sales pursuant to Rule 144;

|

|

|

•

|

broker-dealers may agree with the selling securityholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

•

|

any other method permitted pursuant to applicable law.

|

If the selling stockholders effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of common stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholders may also sell shares of common stock short and deliver shares of common stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of common stock to broker-dealers that in turn may sell such shares.

13

The selling stockholders may pledge or grant a security interest in some or all of the senior secured convertible notes or shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment or supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the shares of common stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Under the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the registration statement of which this prospectus forms a part.

The selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Securities Exchange Act of 1934, as amended, which may limit the timing of purchases and sales of any of the shares of common stock by the selling stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

We will pay all expenses of the registration of the shares of common stock pursuant to the registration rights agreement, estimated to be approximately $70,000 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that a selling stockholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the selling stockholders against liabilities, including some liabilities under the Securities Act, in accordance with the registration rights agreements, or the selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, in accordance with the related registration rights agreement, or we may be entitled to contribution.

Once sold under the registration statement of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

14

LEGAL MATTERS

The validity of the securities covered by this prospectus will be passed upon for us by Covington & Burling LLP. If applicable, counsel for any underwriters, dealers or agents will be named in the applicable prospectus supplement.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019, and the effectiveness of our internal control over financial reporting as of December 31, 2019, as set forth in their reports, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s reports, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, can also be accessed free of charge on our website at www.acorda.com under “Investors — Financial Information — SEC Filings.” These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We have filed with the SEC a registration statement under the Securities Act of 1933, as amended, relating to the offering of these securities. The registration statement, including the attached exhibits, contains additional relevant information about us and the securities. This prospectus does not contain all of the information set forth in the registration statement. You can obtain a copy of the registration statement, at prescribed rates, from the SEC at the address listed above. The registration statement and the documents referred to below under “Incorporation by Reference” are also available on our website, www.acorda.com. We have not incorporated by reference into this prospectus the information on, or that can be accessed through, our website, and you should not consider it to be a part of this prospectus.

15

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information which we incorporate by reference is an important part of this prospectus, and certain information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below, and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, prior to the termination of the offering:

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, filed on May 8, 2020 and August 10, 2020, respectively;

|

|

|

•

|

our Current Reports on Form 8-K, filed on January 15, 2020, June 16, 2020, June 26, 2020, July 14, 2020, July 24, 2020, July 31, 2020, August 28, 2020 and August 31, 2020; and

|

You may access our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to any of these reports, free of charge on the SEC’s website. Information contained on, or that can be accessed through, our website is not part of this prospectus.

In addition, we will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference, other than exhibits to those documents. You should direct any requests for documents to Corporate Secretary, Acorda Therapeutics, Inc., 420 Saw Mill River Road, Ardsley, New York 10502, or call (914) 347-4300.

We are responsible for the information contained or incorporated by reference in this prospectus, any accompanying prospectus supplement and in any related free-writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making offers to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in or incorporated by reference in this prospectus is accurate as of the date on the front of this prospectus or incorporated document only, as the case may be. Our business, financial condition, results of operations and prospects may have changed since that date.

16

158,408,779 Shares

Common Stock

Prospectus

September 17, 2020

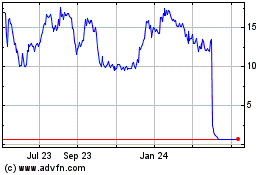

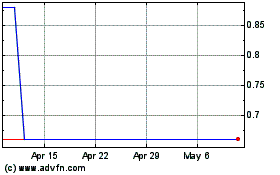

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Sep 2023 to Sep 2024