UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 16, 2015

AV Homes, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-07395 |

|

23-1739078 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 8601 N. Scottsdale Rd. Suite 225

Scottsdale, Arizona |

|

85253 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (480) 214-7400

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On September 16, 2015, AV Homes, Inc. (the

“Company”) will present business and financial information to institutional investors and ratings agencies. Attached hereto as Exhibit 99.1, and incorporated by reference herein, is the Investor Presentation that will be referenced by

executives of the Company. The Investor Presentation includes forward-looking statements which are described more fully within the body of the presentation.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the

Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AV Homes, Inc. |

|

|

|

|

| Date: September 16, 2015 |

|

|

|

By: |

|

/s/ Roger A. Cregg |

|

|

|

|

Name: |

|

Roger A. Cregg |

|

|

|

|

Title: |

|

Director, President, and Chief Executive Officer

(Principal Executive Officer) |

Exhibit Index

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation |

Exhibit 99.1

Investor Presentation

September 2015

HOMESTM

CONFIDENTIAL

Disclaimer

Forward-Looking Statements

This Investor

Presentation contains “forward-looking statements” within the meaning of the U.S. federal securities laws, which statements may include information regarding the plans, intentions, expectations, future financial performance, or future

operating performance of the Company. Forward-looking statements are based on the expectations, estimates, or projections of management as of the date of this Investor Presentation. Although our management believes these expectations, estimates, or

projections to be reasonable as the date hereof, forward-looking statements are inherently subject to significant business risks, economic and competitive uncertainties, and other contingencies which could cause our actual results or performance to

differ materially from what may be expressed or implied in the forward-looking statements. Such factors include, among others: the cyclical nature of the homebuilding industry and its dependence on broader economic conditions; competition for home

buyers, properties, financing, raw materials and skilled labor; overall market supply and demand for new homes; our ability to successfully integrate acquired businesses; conflicts of interest involving our largest stockholder; contractual

restrictions under a stockholders agreement with our largest stockholder; our ability to access sufficient capital; our ability to generate sufficient cash to service our indebtedness and potential need for additional financing; terms of our

financing documents that may restrict our operations and corporate actions; fluctuations in interest rates; contingent liabilities that may affect our liquidity; the availability of mortgage financing for home buyers; cancellations of home sale

orders; declines in home prices in our primary regions; inflation affecting homebuilding costs; elimination or reduction of tax benefits associated with home ownership; warrant and construction defect claims; availability and suitability of

undeveloped land and improved lots; ability to develop communities within expected timeframes; the seasonal nature of our business; impacts of weather conditions and natural disasters; our ability to recover our costs in the event of reduced home

sales; dependence on our senior management; effect of our expansion efforts on our cash flows and profitability; effects of government regulation of development and homebuilding projects; our ability to realize our deferred income tax asset; costs

of environmental compliance; and potential dilution related to future financing activities. Other important factors that could cause our actual results or performance to differ materially from our forward-looking statements include those set forth

in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2014, and in our other filings with the Securities and Exchange Commission (the “SEC”), which filings are available on

www.sec.gov. Readers are cautioned not to place undue reliance on any forward-looking statements contained herein, which reflect management’s opinions only as of the date hereof. The Company disclaims any intention or obligation to update or

revise any forward-looking statements to reflect subsequent events and circumstances, except to the extent required by applicable law.

Incorporation by Reference

This Investor

Presentation should be read in conjunction with our filings with the SEC described below, which are hereby “incorporated by reference” into this Investor Presentation. Our SEC filings are available to the public over the Internet at the

SEC’s website at www.sec.gov. Some information contained in this Investor Presentation updates the information incorporated by reference, and information that we file subsequently with the SEC will automatically update this Investor

Presentation. In other words, in the case of a conflict or inconsistency between information set forth in this Investor Presentation and/or information incorporated by reference into this Investor Presentation, you should rely on the information

contained in the most recently dated document.

We incorporate by reference into this Investor Presentation the

following documents filed with the SEC (other than, in each case, documents or information deemed furnished and not filed in accordance with the SEC rules, including pursuant to Item 2.02 or Item 7.01 of Form 8 K, and no such information

shall be deemed specifically incorporated by reference hereby):

our Annual Report on Form 10-K for the year

ended December 31, 2014, filed with the SEC on February 27, 2015;

our Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2015 and June 30, 2015, filed with the SEC on April 21, 2015 and July 31, 2015, respectively;

our Current Reports on Form 8-K filed during fiscal 2015; and

All documents filed by us under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, on or after the date of this Investor Presentation.

*Information in this Investor Presentation is as of June 30, 2015 unless otherwise stated

HOMESTM

2

CONFIDENTIAL

Management Presenters

Roger Cregg

Director, President and Chief

Executive Officer

Over 36 years of experience

Former CFO at PulteGroup from 1998 to 2011

Current Director of Comerica Inc. and former Director and Chair of the Federal Reserve Bank of Chicago, Detroit Branch

Michael Burnett

Chief Financial Officer and Executive Vice President

Over 25 years of experience in accounting / corporate finance

Former CFO of American Traffic Solutions

Previously served in various financial roles at JDA Software, Allied Waste Industries and as a certified public accountant

with Arthur Andersen

HOMESTM

3

AV Homes Company Update

HOMESTM

CONFIDENTIAL

AV Homes Overview

AV Homes (“AVHI” or the “Company”) is among the fastest growing publicly traded homebuilders actively developing communities in the Charlotte, Raleigh, Orlando,

Jacksonville and Phoenix markets

69 communities including approximately 17,900 owned or controlled residential

lots

AVHI also owns over 7,000 acres of residential, commercial, and multifamily land that management plans to

opportunistically monetize

AVHI’s markets rank highly in the U.S. for demographics that favor both

traditional buyers and active adult buyers

Management actively focused on accelerating growth through

strategic M&A in target markets, building on the successful acquisitions of Royal Oak Homes in 2014 and Bonterra Builders in 2015

7/31/15 Residential Lot Composition

By geography

16%

19%

65%

Florida

Arizona

North Carolina

By community type

42%

58%

Active adult

Primary residential

Total lots: 17,900

Inventory by status

Land held for development

Homes completed or

under constuction

Land under development

3%

40%

57%

Book value of inventory: $594mm

HOMESTM

5

CONFIDENTIAL

Attractively Positioned in High Growth Markets

In-Migration

Since 2000, Florida, Arizona and

North Carolina have increased their respective populations faster than the U.S. average

NC, FL and AZ are

ranked 2nd, 3rd and 5th by adults aged 50 years for US states to which they would move

Favorable

Active Adult

Trends

Active Adult (AA) market is growing

10,000 baby boomers projected to turn 65 every day for the next 19 years

AA resident is younger

Average age of 61 today vs. 67 a decade ago

AA

population is wealthier

Average income of $81,000, 100% increase since 2001

AA communities are more popular

2% of all U.S. households in 2001 to 3% in 2007

55+ Years Population Growth (‘12 – ‘17E)

25% 23% 21% 21% 20% 18% 12%

Orlando, FL

Phoenix, AZ

Port St. Lucie, FL

Raleigh, NC

Charlotte, NC

Jacksonville, FL

US

AVHI AA Market Share

24% 11% 9%

Port St. Lucie, FL

Orlando, FL

Phoenix,

AZ

Strong

International

Commerce

Land Scarcity

(Florida)

Florida is a major hub for Latin American and Caribbean trade

34% of all US exports between the countries

Trade

in South Florida is expected to continue to expand

Water on three sides and un-developable preserves,

including Everglades, in center of state

Coastal land is largely developed implies growth is likely to occur

in Central Florida

Source: John Burns Real Estate Consulting, US Census Bureau, Moody’s Analytics, NAHB /

MetLife study, Enterprise Florida, ESRI and Pew Research as of latest available data

HOMESTM

6

CONFIDENTIAL

Maximizing Consumer Experience and Value Proposition

Superior customer service is an integral part of AVHI’s corporate philosophy

Active Adult

Expertise in building lifestyle communities

Attuned to target consumer preferences

Quality of amenities is most important

Increased

community involvement drives sales

Offering a preview of living experience a differentiating factor at AVHI

Amenities create a high barrier to entry

Significant upfront capital investment

Primary Residential

History of building quality

single family homes for broad buyer profile

Multiple price points in substantially all of AVHI’s

communities

Location is the most important factor

Essential point of focus in recent land acquisition strategy

HOMESTM

7

CONFIDENTIAL

Investment Thesis

1 Experienced management team with M&A background

During his tenure as CFO of Pulte, Roger Cregg oversaw the $1.7bn merger with Del Webb in 2001 and $3.1bn merger of Centex in 2009, among the largest mergers in U.S. homebuilding industry

AVHI’s Division Presidents have significant industry experience with a track record of managing large

platforms

2 Positioned for growth through community count increases on primarily owned land

AVHI has a market-leading presence in some of the fastest growing housing markets in the country including Charlotte,

Orlando, Phoenix, Jacksonville and Raleigh

3 Significant momentum

Closings and homebuilding revenue have grown 281% and 326% respectively from 2012 through LTM 2015

New active adult communities opening in 2015 including Bethpage (650 lots), and Eastmark (905 lots)

4 Strong liquidity position and balance sheet

Conservative leverage ratios

Asset coverage of

1.9x1 and liquidity position of $243mm1 (includes $25mm of restricted cash)

1 Pre-acquisition of Bonterra

Builders

HOMESTM

8

CONFIDENTIAL

Q2 2015 Financial Highlights –

Does not include results of the Bonterra Builders acquisition July 1, 2015

AVHI increased its communities

with closings from 14 in Q2’14 to 32 in Q2’15

Net New Orders ($millions)

87% growth

$74

$138

Q2’14

Q2’15

Backlog ($millions)

83% growth

$124

$227

Q2’14

Q2’15

Homebuilding Revenue ($millions)

58% growth

$48

$76

Q2’14

Q2’15

Liquidity1 ($millions)

$289

$243

Q2’14

Q2’15

1 Includes cash, restricted cash (of $11mm and $25mm for Q2’14 and Q2’15, respectively), and availability under credit facility

HOMESTM

9

CONFIDENTIAL

Historical Financial Performance

Homebuilding Revenue ($millions)

326% growth

$70

$115

$243

$298

2012

2013

2014

LTM Q2’15

Total SG&A as a % of HB Revenue

31 percentage

points of improvement

51%

31%

21%

20%

2012

2013

2014

LTM Q2’15

Note: Includes division SG&A,

corporate G&A

Adjusted Homebuilding Gross Margin Performance1

Stable gross margins

18%

22%

20%

20%

2012

2013

2014

LTM Q2’15

Note: Excludes amortized interest

Adjusted EBITDA1 ($millions)

$0

$15

$17

2012

2013

2014

LTM Q2’15

($74)

1 Adjusted EBITDA and adjusted homebuilding gross margins as a percentage of revenue are non-GAAP numbers – see page 20 for a reconciliation to GAAP

HOMESTM

10

CONFIDENTIAL

AVHI 2015 Full Year Outlook

Reaffirmed1

Communities with closings to increase from 24 in 2014 to approximately 40 in 2015

Closings to increase approximately 68% from 953 units in 2014 to approximately 1,600 units in 2015

ASP on homes closed to increase approximately 6.5% to approximately $272,000 in 2015

Homebuilding Gross Margins to be approximately 17% in 2015 (18.2% in 2014)

Division SG&A to improve to approximately 11.5% of homebuilding revenue in 2015 (14.1% in 2014)

Corporate G&A to improve to approximately 3% of homebuilding revenue in 2015, from 6.6% in 2014

Land Sales to generate approximately $6 million of revenue and approximately $4 million of profit in 2015

Interest expense is expected to be approximately $10 million, after capitalization in 2015

Net income is expected to be approximately $4 million in 2015 compared to a loss of $2 million in 2014

1Guidance does not include impact of the acquisition of Bonterra and, as a result, may be considered non-GAAP because it

does not include future results of Bonterra

HOMESTM

11

CONFIDENTIAL

Bonterra Builders Acquisition

HOMESTM

CONFIDENTIAL

Bonterra Builders Overview

On July 1, 2015 AVHI acquired the assets of Bonterra Builders (“Bonterra”)

Bonterra, a Charlotte, NC based residential homebuilder, was founded in 2001

Bonterra is a recognized Homebuilding leader in the greater Charlotte market (Top 10 by closings)

Bonterra has over 30 active communities (25 with closings) in addition to scattered lot positions

Current committed lot inventory of approximately 1,700 lots

The Bonterra team has over 50 employees including President Darren Sutton

Operating statistics

2013A 2014A 2015E

Home closings 294 303 400-430

ASP ($000s) $336 $368 $364

Revenues ($mm) $99 $112 $145-$155

Gross margin

19% 19% --

Property map

321

29

52

Iredell

Rowan

77

Lincoln

Mecklenburg

21

85

Cabarrus

NC

Gaston

Charlotte

29

485

85

321

29

74

Stanly

485

77

485

601

21

485

York

74

77

SC

321

Lancaster

Union

BB

BONTERRA BUILDERS

HOMESTM

13

CONFIDENTIAL

Strategic Rationale

1 High quality, diversified portfolio

2 Achieve scale in Charlotte (target growth market)

3 Execution of M&A strategy

4 Highly accretive transaction

5 Adds to

AVHI’s experienced management team

The acquisition of Bonterra advances AVHI’s strategic goal to

expand in its core markets

HOMESTM

14

CONFIDENTIAL

Pro Forma Count of Communities With

Closings

Florida

Arizona

Carolinas

Bonterra

60

50

40

30

20

10

0

56

25

4

24

2

6

5

7

7

17

21

3

2

4

5

2012

2013

2014 1

Pro forma 2

Q2 2015

1 Includes 12 communities from the Royal Oak Homes Acquisition

2 Pro forma for Bonterra Acquisition

HOMESTM

15

CONFIDENTIAL

Charlotte Market Overview

In October 2013, AVHI entered the Carolinas market and had 4 communities with closings in Q2 ‘15

AVHI will become a top 10 builder in Charlotte with the acquisition of Bonterra and expects to have 29 active

communities with closings as of Q3 ‘15

Market Snapshot

Charlotte National

Wage and Salary Employment (1 year change) 3.4% 2.2%

Unemployment (%) 5.1% 5.5%

Population Growth (1

year change) 1.4% 0.7%

Home Ownership (%) 59.0% 64.2%

Months Supply of Unsold Homes 5.7 5.3

Burns Home Value Index (YoY % change)1 4.8% 3.9%

Permits vs. Home Value Index Growth

30,000

25,000

20,000

15,000

10,000

5,000

0

8.0%

6.0%

4.0%

2.0%

0.0%

(2.0%)

(4.0%)

(6.0%)

(8.0%)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015E

2016E

2017E

2018E

Total Permits

Home Value Index

Months Supply of Unsold Homes

20

16

12

8

4

0

Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11

Feb-12 Apr-12 Jun-12 Aug-12

Oct-12 Dec-12 Feb-13 Apr-13 Jun-13 Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14

Aug-14 Oct-14 Dec-14 Feb-15 Apr-15

Source: Source: John Burns Real Estate Consulting, U.S. Census Bureau,

Bureau of Labor, DataQuick, M.O.R.E and Moody’s Analytics as of latest available data

1 Index developed

by JBREC that tracks current home price trends across 137 markets in the U.S.

HOMESTM

16

CONFIDENTIAL

Execution of M&A Strategy

Builder

NEXT

100

THE

FASTEST-GROWING

BULDER 2014 *

By Builder Magazine

1 Royal Oak Homes 176% Closed March 2014

2

Bonterra Builders, LLC 99% Closed July 2015

3 Anglia Homes, LP 86%

4 Streetman Homes, Ltd. LLP 79%

AVHI has acquired two of the fastest growing homebuilders within an 18 month time frame

Charlotte, North Carolina Homebuilder Acquisition

BB

BONTERRA BUILDERS

Central Florida Homebuilder

Acquisition

ROYAL

OAK

HOMES

* Builders Magazine’s “Next 100 List” ranks the Country’s top 101 to 200 building firms by sales

volume. This ranking was based on year over year closing growth from 2012 to 2013.

HOMESTM

17

CONFIDENTIAL

Conclusion

AVHI is among the fastest growing homebuilders in US

Positioned for further growth and profitability

Attractive markets

Commitment to quality product

and service

Experienced management team

We believe the acquisition of Bonterra

Increases our scale and market share in Charlotte

Improves our geographic and customer segment diversification

Increases exposure to primary residential market

Accelerates potential monetization of deferred tax assets

Solidifies AVHI’s position as a leading homebuilder

HOMESTM

18

Non-GAAP reconciliations

HOMESTM

CONFIDENTIAL

Homebuilding Gross Margin, Adjusted

Homebuilding Gross

Margin and Adjusted EBITDA Reconciliation

Homebuilding Gross Margin Reconciliation

($ mm) 2012A 2013A 2014A LTM Q2’15

Homebuilding revenue $70 $115 $243 $298

Less: Homebuilding expenses (58) (92) (199) (246)

Homebuilding gross margin $12 $23 $44 $52

Homebuilding gross margin % 17% 20% 18% 17%

Plus:

Interest amortized to homebuilding expenses 1 2 5 6

Adjusted Homebuilding gross margin $13 $25 $49 $58

Adjusted Homebuilding gross margin % 18% 22% 20% 20%

EBITDA Reconciliation

($ mm) 2012A 2013A 2014A LTM Q2’15

Net

income (loss) ($90) ($9) ($2) ($7)

Add: Depreciation and amortization 4 3 3 3

Add: Amortization of stock based compensation 3 2 3 3

Add: Capitalized interest expense in cost of sales 1 2 5 6

Add: Interest expense 8 3 6 11

Add: Income Tax expense (benefit) - - - -

EBITDA

($74) $0 $15 $17

HOMESTM

20

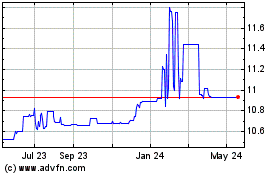

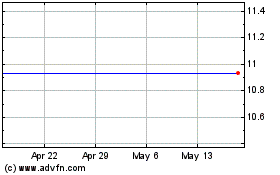

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Nov 2023 to Nov 2024