HMA Matches Earnings, Misses Rev Est. - Analyst Blog

May 06 2013 - 9:20AM

Zacks

Health Management

Associates (HMA), a leading operator of general acute care

hospitals, reported first quarter 2013 adjusted (excluding one-time

expenses other than stock-based compensation expense) earnings per

share of 13 cents matching the Zacks Consensus Estimate. Adjusted

earnings in the first quarter exclude interest rate swap

calculation and mark-to-market modification.

Net income at Health Management

decreased 38.7% year over year to $23.1 million (or 9 cents per

share).

Revenues

Revenues (prior to provisioning for

doubtful clients) increased about 2.2% year over year to $1,723.8

million, missing the Zacks Consensus Estimate of $1,744 million.

Net revenues dropped marginally 0.2% year over year to $1,483

million. Net revenues from same hospital decreased 1% to $1,470

million.

Operational

Statistics

From a continuing operations

perspective, occupancy declined to 41.5% in the reported quarter

from 44.7% in the year-ago quarter. Admissions were down 7.6% while

adjusted admissions dropped 4.3% in the first quarter. Average

length of stay stood at 4.4 days compared with 4.3 days in the

year-ago quarter. Surgeries declined 4.6%, patient days dropped

5.4%, while emergency room visits rose 3.9%.

On a same hospital basis, occupancy

declined to 42.1% in the first quarter from 44.7% in the prior year

quarter. Same hospital admissions and adjusted admissions dipped

8.8% and 5.8%, respectively, while surgeries and emergency room

visits decreased 5.6% and increased 1%, respectively.

Margins

Same hospital adjusted EBITDA

margin dropped 90 basis points to 18.9% in the first quarter. Bad

debt expense, as a percentage of revenues, moved up to 14% compared

to 11.9% in the year-ago period.

The total of uninsured discounts, indigent/charity write-offs and

bad debt expense as a percentage of the sum of net sales before

provisioning, uninsured discounts and indigent/charity write-offs

rose to 28.6% in the quarter from 26.1% a year ago. This metric

indicates the aggregate extent of patient care for which Health

Management is not reimbursed.

Balance Sheet and Cash

Flow

Health Management exited the first

quarter with cash, cash equivalents and available-for-sale

securities of $37.4 million, down 36.9% year over year, with a

considerable long-term debt of about $3,411 million, marginally

down 0.6% year over year. The company generated cash flow (from

continuing operations) of $19.3 million in the reported

quarter.

Other

Information

A subsidiary of Health Management

undertook a joint venture to team with the Bayfront Health System

of St. Petersburg, Florida. As per the deal, Health Management took

an 80% stake in Bayfront Health System besides an affiliation with

ShandsHealthCare (belonging to UF&Shands, the Univ. of Florida,

Academic Health Care). The total consideration for the 80% stake

was about $162 million.

Outlook

Health Management is engaged in the

ownership and operation of general acute care hospitals in

non-urban communities across the U.S. The company is an active

acquirer of underperforming hospitals with a turnaround potential

in high-growth markets.

Health Management benefits from a

gradual growth in admissions largely due to improvements in

Emergency Room, sustained physician recruitment and service

development. Moreover, it is well placed to expand margins from

continuing operations and drive above industry average earnings

growth. The debt burden for the company remains sizeable.

We currently have a Zacks Rank #5

(Strong Sell) on Health Management. We are more positive

about Acadia Healthcare Company, Inc. (ACHC),

which carries a Zacks Rank #2 (Buy). We are also positive about

Abiomed, Inc. (ABMD) and Accuray

Incorporated (ARAY) which carry a Zacks Rank #1 (Strong

Buy) and Zacks Rank #2 (Buy), respectively.

ABIOMED INC (ABMD): Free Stock Analysis Report

ACADIA HEALTHCR (ACHC): Free Stock Analysis Report

ACCURAY INC (ARAY): Free Stock Analysis Report

HEALTH MGT ASSC (HMA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

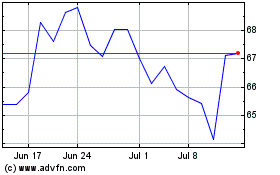

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

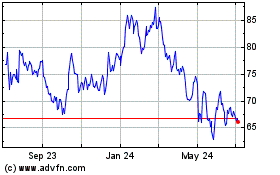

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jul 2023 to Jul 2024