Thermo Fisher Remains at Neutral - Analyst Blog

February 13 2013 - 12:44PM

Zacks

We recently reiterated our Neutral recommendation on

Thermo Fisher Scientific (TMO), a major scientific

instrument maker. While we hold a favorable view regarding the

company’s huge potential in the emerging markets, cost reduction

initiatives and value added acquisitions, concerns linger around

the overall soft industry trends with headwinds in the government

and academic markets. The stock currently carries a Zacks Rank #3

(Hold).

Why at Neutral?

Thermo Fisher posted encouraging fourth-quarter 2012 results

with adjusted earnings per share (EPS) of $1.36, surging past both

the Zacks Consensus Estimate of $1.28 and the adjusted EPS of $1.19

in the year-ago period. Revenues increased 6% year over year based

on 4% organic growth.

Given the huge potential in the emerging markets, the company

has been focusing on these regions, which paid off with their

robust performance during the quarter. We are also optimistic about

the company’s persistent acquisition spree including the recent One

Lambda, Dionex and Phadia acquisitions, which are expected to

strengthen the company’s product portfolio and provide better

access to regions with strong potential.

Moreover, Thermo Fisher continued to benefit from the successful

execution of its $100 million and $75 million of restructuring

actions initiated in 2011 and 2012, respectively.

However, over the past several years, Thermo Fisher has been

witnessing headwinds in the government and academic markets.

Moreover, many countries in Europe are also going through a tough

time that might impact their academic budgets. We remain cautious

since growth could moderate if the economic scenario

worsens.

Over the past 30 days, 3 of the 13 firms covering the stock made

positive estimate revisions for the current quarter, with 2 moved

in the opposite direction, implying that they still hold similar

views on the stock.

Other Stocks to Consider

While we prefer to remain on the sidelines on Thermo Fisher,

other medical device stocks worth a look are Cyberonics

Inc. (CYBX), Acadia Healthcare Company,

Inc. (ACHC) and ResMed Inc. (RMD). All

these stocks carry a Zacks Rank #1 (Strong Buy).

ACADIA HEALTHCR (ACHC): Free Stock Analysis Report

CYBERONICS INC (CYBX): Free Stock Analysis Report

RESMED INC (RMD): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

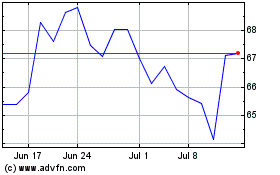

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

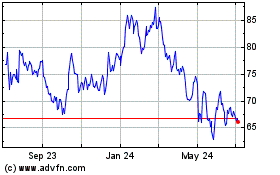

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jul 2023 to Jul 2024