Mawson Infrastructure Group Inc. Announces April

2022 Bitcoin Self-Mining, Hosting Co-location and Operational

Update

Mawson

produced record 171 Self-Mined Bitcoin in April, +384% vs April

2021

Mawson

Self-Mining and Hosting Co-location operating at approximately 2.4

Exahash as at end April, expected to rise to approximately 3.3

Exahash by end May 2022, +37.5% month on

month

Mawson now

has over 36,000 ASIC Bitcoin Miners deployed at its facilities

across the USA and Australia across its Self-Mining and Hosting

Co-location businesses, +63% vs March

2022

Self-Mining

expected to be operating at approximately 1.8 Exahash end of May,

producing approximately 8.0 Bitcoin per day

1

630 Bitcoin

produced in FY 2022 to end of

April

Sydney,

Australia and New York City, USA -- May 12, 2022 -- InvestorsHub

NewsWire -- Mawson

Infrastructure Group Inc. (NASDAQ:MIGI) ("Mawson"), a digital

infrastructure provider, announces unaudited Bitcoin production and

operational update for April

2022.

Mawson

Self-Mining and Hosting Co-location operating at approximately 2.4

Exahash as at end of April, expected to rise to approximately 3.3

Exahash by end of May 2022.

Bitcoin

Self-Mining Update:

-

In April

Mawson produced 171 Bitcoin, +384% vs April

2021

-

April average

hash rate at approximately 1.3 Exahash, +583% vs April

2021

-

April end of

month hash rate at approximately 1.4 Exahash, +679% vs April

2021

-

May end of

month hash rate expected to be approximately 1.8 Exahash, producing

approximately 8.0 Bitcoin per

day

Hosting

Co-location Update:

-

Mawson

Hosting Co-location at 28 megawatts online end of April (+75% vs

March 2022), expected to rise to approximately 52 megawatts online

by end of May (+85% vs April 2022), as Mawson customers Celsius

Mining LLC (100 megawatts) and Foundry Digital LLC (12 megawatts)

deployments are scaled up

Operational

Update:

In April

Mawson continued to build out and expand its existing and new

facilities in the USA and Australia. ASIC Bitcoin miners continue

to be delivered on a monthly basis, with a batch of Canaan A1246

miners delivered during the month. April was characterized by a

rise in network difficulty. Despite this, monthly Bitcoin

production was up +1% vs March 2022, and up +384% vs April 2021.

Mawson now has over 36,000 ASIC Bitcoin Miners deployed at its

facilities across the USA and Australia across its Self-Mining and

Hosting Co-location businesses, up from 22,000 in March

2022.

Midland,

Pennsylvania facility

– Modular

Data Centers (MDCs) now being rolled out progressively, site

expected to have approximately 52 megawatts of mining hardware

online by the end of May

2022.

Sandersville,

Georgia facility: 38

Modular Data Centers (MDCs) online, site now fully operational at

approximately 80 megawatts. Stage 3 expansion approved to 230

megawatts (capable of accommodating up to 7.5 Exahash) with

development planning for 150 megawatt expansion commencing in June

2022.

New South

Wales, Australia facility:

site commissioning ongoing, with operational

ramp up expected to occur steadily throughout May and June, with

approximately 0.1 Exahash online by the end of May. The facility is

expected to be fully operational with approximately 0.4 EH online

by June 2022.

Expected Hash

Rate Growth:

Mawson

expects Bitcoin Self-Mining to be at 4.0 EH by Q3, 2022, and target

of 5.5 EH online by early Q1 2023

reiterated.

Aerial view

of Midland, Pennsylvania facility development (April

2022)

USA Modular

Data Center (MDC) fabrication

facility

Aerial view

of Midland, Pennsylvania facility development (May

2022)

James Manning, CEO and Founder of

Mawson, said, "April was

operationally solid for the business, with a particularly pleasing

result in our hosting co-location business ramp up, where we

expanded from 16 megawatts online in March, to 28 megawatts online

in April. We expect this to rise to 52 megawatts online by the end

of May, as we progressively roll out and expand our second major

Bitcoin mining facility in the town of Midland, Pennsylvania. The

Mawson team continued to expand over the month with more

high-quality individuals joining the Mawson family. We anticipate a

meaningful step up in our Bitcoin Self-Mining operations in May, to

1.8 Exahash, and expect further solid growth on this front in May

and June."

About Mawson

Infrastructure

Mawson

Infrastructure Group (NASDAQ: MIGI) is a digital infrastructure

provider, with multiple operations throughout the USA and

Australia. Mawson's vertically integrated model is based on a

long-term strategy to promote the global transition to the new

digital economy. Mawson matches sustainable energy infrastructure

with next-generation Mobile Data Center (MDC) solutions, enabling

low-cost Bitcoin production and on-demand deployment of

infrastructure assets. With a strong focus on shareholder returns

and an aligned board and management, Mawson Infrastructure Group is

emerging as a global leader in ESG focused Bitcoin mining and

digital infrastructure.

For more

information, visit: www.mawsoninc.com

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Mawson cautions that statements in this press

release that are not a description of historical fact are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words referencing future

events or circumstances such as "expect," "intend," "plan,"

"anticipate," "believe," and "will," among others. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. These forward-looking statements are

based upon Mawson's current expectations and involve assumptions

that may never materialize or may prove to be incorrect. Actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of

various risks and uncertainties, which include, without limitation,

the possibility that Mawson's need and ability to raise additional

capital, the development and acceptance of digital asset networks

and digital assets and their protocols and software, the reduction

in incentives to mine digital assets over time, the costs

associated with digital asset mining, the volatility in the value

and prices of cryptocurrencies and further or new regulation of

digital assets. More detailed information about the risks and

uncertainties affecting Mawson is contained under the heading "Risk

Factors" included in Mawson's Annual Report on Form 10-K filed with

the SEC on March 21, 2022 and Mawson's Quarterly Report on Form

10-Q filed with the SEC on November 15, 2021, and in other filings

Mawson has made and may make with the SEC in the future. One should

not place undue reliance on these forward-looking statements, which

speak only as of the date on which they were made. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Mawson undertakes no obligation to

update such statements to reflect events that occur or

circumstances that exist after the date on which they were made,

except as may be required by law.

Investor Contact:

Brett Maas

646-536-7331

brett@haydenir.com

www.haydenir.com

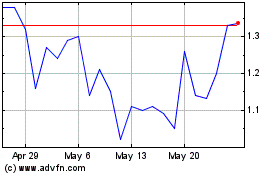

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Apr 2023 to Apr 2024