U.S. Dollar Appreciates Ahead Of PCE Data

February 24 2023 - 12:18AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

European session on Friday, as investors awaited the release of

U.S. personal consumption expenditures price index, the Fed's

preferred gauge of inflation, due out later today.

Core PCE inflation is expected to rise to 0.4 percent in January

from 0.3 percent in December on a monthly basis.

On an annual basis, core PCE inflation is forecast to ease to

4.3 percent from 4.4 percent.

Initial jobless claims came in lower than expected at 192,000

last week, in a sign that labour market remained tight.

Investors expect the Fed to raise interest rates further as

recent data signalled a resilience in the economy.

The greenback rose to 0.6205 against the kiwi, 1.0580 against

the euro and 1.3578 against the loonie, from its prior lows of

0.6244, 1.0614 and 0.6244, respectively. The greenback may find

resistance around 0.61 against the kiwi, 1.04 against the euro and

1.37 against the loonie.

The greenback was up against the franc, at a 1-1/2-month high of

0.9365. Next key resistance for the dollar is seen around the 0.96

level.

The greenback approached 0.6778 against the aussie, its

strongest level since January 6. The greenback is seen facing

resistance around the 0.66 level.

The greenback rebounded to 135.20 versus the yen, from an early

4-day low of 134.05. On the upside, 137.00 is possibly seen as its

next resistance level.

In contrast, the greenback pulled back against the pound and was

trading at 1.2025. If the currency slides further, 1.22 is likely

seen as its next support level.

U.S. personal income and spending data and new home sales for

January and University of Michigan's final consumer sentiment index

for February will be featured in the New York session.

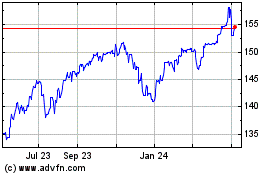

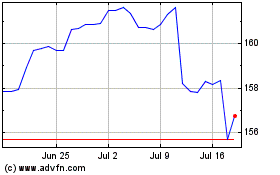

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024