Antipodean Currencies Rise Amid Risk Appetite

July 02 2024 - 11:16PM

RTTF2

Antipodean currencies such as the Australia and the New Zealand

dollars strengthened against their major currencies in the Asian

session on Wednesday amid risk appetite, as investors are digesting

U.S. Fed Chair Jerome Powell's speech at the ECB Forum in Portugal,

where he expressed satisfaction with the progress on inflation but

said he wants to see more before being confident enough to start

cutting interest rates.

Powell said that policy makers want to understand whether recent

weaker inflation readings indicate a true picture of underlying

price pressures.

Traders also look ahead to the closely watched monthly U.S. jobs

report on Friday for more clarity about the outlook for Fed

interest rates.

Gains in technology and mining stocks also led to the upturn of

investor sentiment.

The Australian dollar started rising against its major rivals

after the release of retail sales data for May.

Data from Australian Bureau of Statistics showed that

Australia's retail trade rose 0.6 percent in May, followed by a 0.1

percent rise in April. The economists had expected only a rise of

0.3 percent.

In economic news, data from Judo Bank showed that the services

sector in Australia continued to expand in June, albeit at a slower

pace, with a services PMI score of 51.2. That's down from 52.5 in

May, although it remains above the boom-or-bust line of 50.

In the Asian trading today, the Australian dollar appreciated to

a 33-year high of 108.01 against the yen, from yesterday's closing

value of 107.62. The AUD/JPY pair may test resistance near the

109.00 region.

Against the U.S. dollar and the euro, the aussie advanced to

2-day highs of 0.6682 and 1.6082 from Tuesday's closing quotes of

0.6666 and 1.6113, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 0.68 against the greenback

and 1.59 against the euro.

Against the Canada and the New Zealand dollars, the aussie edged

up to 0.9137 and 1.0987 from yesterday's closing quotes of 0.9116

and 1.0966, respectively. On the upside, 0.92 against the loonie

and 1.10 against the kiwi are seen as the next resistance levels

for the aussie.

The NZ dollar rose to 2-day highs of 0.6086 against the U.S.

dollar and 98.33 against the yen, from yesterday's closing quotes

of 0.6078 and 98.12, respectively. The NZD/USD and NZD/JPY pairs

may test resistance around 0.61 and 99.00, respectively.

Against the euro, the kiwi advanced to 1.7664 from Tuesday's

closing value of 1.7674. If the kiwi extends its uptrend, it is

likely to find resistance around 1.74 against the euro.

Meanwhile, the safe-haven yen weakened against other major

currencies in the Asian session, as Asian stock market rose and

also traders looked out for signs of Japanese authorities to

intervene in the currency market to prop up the currency.

Data from Jibun Bank showed the services sector in Japan slipped

into contraction territory in June, with a services PMI score of

49.4. That's down from 53.8 in May, and it falls beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

The yen declined to a 38-year low of 161.88 against the U.S.

dollar and a 16-year low of 205.24 against the pound, from

yesterday's closing quotes of 161.44 and 204.77, respectively. The

yen may test support near 162.00 against the greenback and 206.00

against the pound.

Against the Canadian dollar and the euro, the yen slipped to a

17-year low of 118.30 and a 2-day low of 173.79 from Tuesday's

closing quotes of 118.00 and 173.45, respectively. On the downside,

119.00 against the loonie and 175.00 against the euro are seen as

the next support levels for the yen.

The yen edged down to 178.95 against the Swiss franc, from

yesterday's closing value of 178.56. If the yen extends its

downtrend, the CHF/JPY pair is likely to find support around the

180.00 area.

Looking ahead, Services PMI reports from various European

economies and U.K. for June are due to be released in the European

session.

In the New York session, U.S. mortgage approvals data, U.S.

weekly jobless claims data, U.S. and Canada trade data for May,

U.S. factory orders for May and U.S. EIA weekly crude oil data are

slated for release.

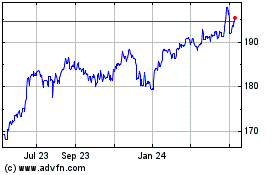

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jun 2024 to Jul 2024

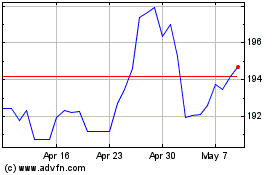

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jul 2023 to Jul 2024