Pound Slides As Traders Look Forward To Rate Cut After BoE Policy Decision

June 20 2024 - 4:43AM

RTTF2

The British pound weakened against other major currencies in the

late European session on Thursday, as some traders bet on an August

rate-cut after the Bank of England retained its key policy rate for

the seventh straight policy session.

The Monetary Policy Committee, led by BoE Governor Andrew

Bailey, decided to hold the bank rate at 5.25 percent again in a

split vote. The current rate is the highest since early 2008.

Bailey and six other members voted to keep the rate unchanged,

while two members sought a reduction in the policy rate.

Swati Dhingra and Dave Ramsden again called for a 25 basis-point

cut as they said the interest rate needed to become less

restrictive now to enable a smooth and gradual transition in the

policy stance, and to account for lags in transmission.

Policymakers said they remained prepared to adjust monetary

policy as warranted by economic data to return inflation to the 2

percent target sustainably.

Consumer price inflation was expected to increase slightly in

the second half of this year, as declines in energy prices last

year fell out of the annual comparison. In the late European

trading today, the pound fell to 2-day lows of 0.8461 against the

euro and 1.2679 against the U.S. dollar, from early highs of 0.8435

and 1.2721, respectively. The EUR/GBP and GBP/USD pairs are likely

to find their support around 0.86 and 1.24 levels,

respectively.

Against the Swiss franc, the pound edged down to 1.1280 from an

early 3-day high of 1.1320. The franc had fell earlier to a two-day

low of 1.1221 against the pound. The GBP/CHF may test support near

the 1.11 region.

The franc slipped to 200.86 against the yen, from an early 6-day

high of 201.36. On the downside, 192.00 is seen as the next support

level for the CHF/JPY pair.

Earlier on Thursday, the Swiss National Bank lowered its key

policy rate by 25 basis points for the second consecutive meeting,

citing easing underlying inflationary pressures. The SNB policy

board, headed by Governor Thomas Jordan, decided to cut the policy

rate to 1.25 percent from 1.50 percent.

Looking ahead, Canada new housing price index for May, U.S.

building permits for May, housing starts for May, weekly jobless

claims, U.S. Philadelphia Fed manufacturing index for June and U.S.

EIA crude oil data are slated for release in the New York

session.

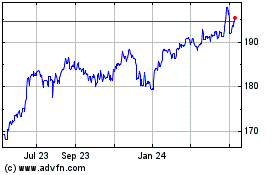

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From May 2024 to Jun 2024

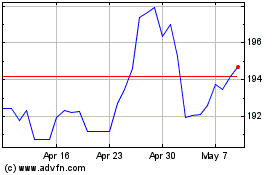

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jun 2023 to Jun 2024