Australian Dollar Declines As European Shares Drop Ahead Of Fed Meeting

January 30 2023 - 11:41PM

RTTF2

The Australian dollar fell against its major counterparts on

Tuesday, as investors became cautious ahead of key central bank

meetings, including the Federal Reserve.

The Fed begins its two-day meeting today and will announce the

policy decision on Wednesday.

Economists expect that the central bank will raise rates by 25

basis points to a range of 4.50 percent to 4.75 percent.

The European Central Bank and the Bank of England are expected

to raise interest rates by 50 basis points at their monetary policy

meetings on Thursday.

Oil prices fell on concerns that further interest rate increases

by major central banks could lead to a slowdown in global

growth.

The aussie depreciated to 1-week lows of 0.7013 against the

greenback and 91.35 against the yen, from its early highs of 0.7065

and 92.13, respectively. The next possible support for the aussie

is seen around 0.68 against the greenback and 87.00 against the

yen.

The aussie weakened to 6-day lows of 1.5438 against the euro and

0.9421 against the loonie, off its early highs of 1.5352 and

0.9454, respectively. The aussie is seen finding support around

1.57 against the euro and 0.92 against the loonie.

The aussie retreated to 1.0886 against the kiwi, heading to

pierce its Asian session's 6-day low of 1.0885. If the aussie

slides further, 1.06 is likely seen as its next support level.

Looking ahead, Eurozone GDP data for the fourth quarter is due

in the European session.

Canada GDP data for November, as well as U.S. consumer

confidence index for January and FHFA's house price index and

S&P/Case-Shiller home price index for November will be featured

in the New York session.

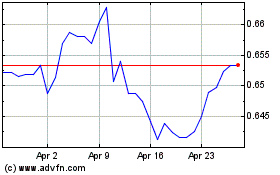

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2024 to May 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From May 2023 to May 2024