Australian, NZ Dollars Strengthen As China PMI Hits 5-month High

May 21 2014 - 11:58PM

RTTF2

The Australian and NZ dollars climbed against the other major

currencies in early Asian deals on Thursday, as the China's HSBC

PMI topped forecasts in May, reaching a 5-month high.

The latest survey from HSBC and Markit Economics revealed today

that an index measuring manufacturing activity in China came in

with a score of 49.7 in May

That topped forecasts for a score of 48.3 and was up sharply

from 48.1 in April -and while it does remain below the line of 50

that separates expansion from contraction.

Consumer inflationary expectations in Australia rose by 0.2

percentage points to 4.4 percent in May from 4.2 percent in April,

survey by Melbourne Institute showed today.

The Federal Reserve discussed plans to exit stimulus but gave no

indication that a rate hike is imminent, the minutes of the most

recent Federal Reserve meeting showed Wednesday.

In April, the Fed kept its benchmark rate unchanged at historic

low levels near zero and it tapered quantitative easing (QE3) by

another $10 billion.

The aussie climbed to 2-day highs of 0.9268 against the

greenback, 1.0109 against the loonie and 1.4761 against the euro.

The aussie may face resistance around 0.93 against the greenback,

1.02 against the loonie and 1.47 against the euro.

The aussie that ended yesterday's deals at 1.0787 against the

kiwi and 93.78 against the yen advanced to 2-day highs of 1.0806

and 94.12, respectively. The next possible upside target for the

aussie is seen at 1.09 against the kiwi and 94.5 against the yen.

The kiwi hit a 2-day high of 87.17 against the yen, after having

touched more than 2-month low of 86.37 yesterday. The next possible

upside target for the kiwi lies around 88.00 area.

The kiwi advanced to a 2-day high of 1.5928 against the euro,

recovering from an early low of 1.5992. If the kiwi extends its

uptrend, it is likely to find resistance around the 1.585 area.

The kiwi rose back to 0.8585 against the greenback, from an

early low of 0.8554. The next possible upside target for the kiwi

lies around 0.90 area.

Looking ahead, Japan monthly economic report is due at 1:00 am

ET.

The PMIs from major European economies are due in the early

European session.

In the New York session, the Canadian retail sales data for

March and U.S weekly jobless for the week ended May 17,

manufacturing PMI for May, existing home sales data and leading

indicators for April are set to be released.

At 12:00 pm ET, Bundesbank Chief Jens Weidmann's speech in

Frankfurt is due.

The Federal Reserve bank of San Francisco President John

Williams speech in San Francisco is due at 4:00 pm ET.

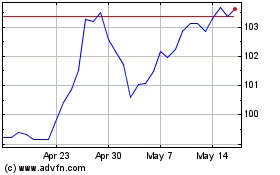

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Jun 2024 to Jul 2024

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Jul 2023 to Jul 2024