Canadian Dollar Falls On Risk Aversion, BoC Rate Cut Worries

January 19 2017 - 12:38AM

RTTF2

The Canadian dollar declined against its key counterparts in the

early European session on Thursday, in response to the Bank of

Canada Governor Stephen Poloz's warning over an interest rate cut,

citing considerable uncertainty surrounding the protectionist

policies proposed by the U.S. President-elect Donald Trump.

Speaking to reporters in Ottawa post-BoC decision on Wednesday,

Poloz said that an interest rate cut "remains on the table," as the

economy is bracing a "protectionist tilt" in the U.S., which would

have "material consequences for Canadian investment and

exports."

Poloz said the bank is "particularly concerned about the

ramifications of U.S. trade policy, because it is so fundamental to

the Canadian economy."

"Should any of those downside risks materialize and put our

inflation target at risk, then we would have the room to

manoeuvre," he added.

Further undermining the currency was risk aversion, with

investors turning cautious ahead of the European Central Bank

monetary policy decision later in the day and the inauguration of

Donald Trump as President on Friday.

Caution prevailed over the fiscal policies proposed by Trump and

the potential difficulties in its implementation when he takes

charge.

The loonie showed mixed trading in the Asian session. While the

loonie held steady against the greenback and the euro, it rose

against the yen. Against the aussie, it declined.

The loonie fell to an 8-day low of 1.3287 against the greenback,

compared to Wednesday's closing value of 1.3269. The loonie is seen

finding support around the 1.335 region.

The loonie that closed Wednesday's trading at 1.4104 against the

euro and 0.9958 against the aussie fell to near a 3-week low of

1.4165 and near a 2-month low of 1.0046, respectively. The next

possible support for the loonie may be found around 1.43 against

the euro and 1.01 against the aussie.

The loonie pared gains to 86.16 against the Japanese yen, from a

high of 86.62 hit at 8:15 pm ET. If the loonie extends slide, 85.00

is likely seen as its next support level.

Looking ahead, the European Central bank will announce its

interest rate decision at 7:45 am ET. The economists expect the

central bank's deposit rate and refinancing rate to remain stable

at -0.4 percent and 0 Percent, respectively.

Following the announcement, European Central Bank President

Mario Draghi will hold the customary post-meeting press conference

at 8:30 am ET.

In the New York session, U.S. building permits and housing

starts for December, U.S. weekly jobless claims for the week ended

January 14, Federal Reserve Bank of Philadelphia manufacturing

index for January, U.S. crude oil inventories data and Canada

manufacturing sales data for November are set to be published.

At 3:45 pm ET, San Francisco Fed President John Williams is

expected to speak before the Solano Economic Development

Corporation Annual Luncheon Meeting, Fairfield, United States.

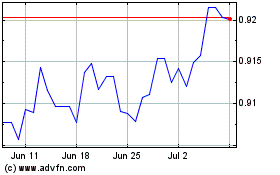

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Apr 2023 to Apr 2024