- Allied Glass is a market leader in the UK premium glass

packaging segment, with 2022 Estimated Sales of over £150

million

- Verallia will expand its Northern European manufacturing

footprint with UK presence and reinforce its position in premium

glass bottles for the spirits’ market

Regulatory News:

Verallia (Paris:VRLA), the leading European and the world’s

third largest producer of glass containers for food and beverages,

has signed a binding agreement with an affiliate of Sun European

Partners LLP for the acquisition of Allied Glass, a market leader

in the UK premium glass packaging segment with a focus on the

premium spirits’ end market.

Expanding Verallia’s premium capabilities and geographic

footprint in Northern Europe

With more than 150 years of glass-making expertise each, both

groups share the same strong values – especially care for customers

and teamwork – that guide and inspire their behavior.

This acquisition will enable Verallia to benefit from Allied’s

expertise in premium glass bottles, specifically in the Scotch

Whisky and Gin sectors, and from its established position on the UK

market.

With this transaction, Allied Glass will integrate an

international group, European leader in the glass containers for

the food and beverage sector, which will allow it to take advantage

of its expertise and its long-term vision.

Allied Glass, an industry-leading premium glass

platform

Headquartered in Leeds, Allied Glass is a leading player in the

premium glass packaging market in the United Kingdom, where it

generates over 95% of its revenues, with 4 furnaces located in West

Yorkshire and around 600 employees.

Allied Glass designs, develops and manufactures glass packaging,

benefitting from state-of-the-art extra-white, bespoke color and

decoration capability, with a strong focus on sustainability, based

on an ESG policy with clear targets across all areas and a market

leading use of cullet across all products.

Allied Glass has strong relationships with a diversified

customer base covering blue chip, traditional and emerging brands,

based on a partnership approach to new product development. Allied

Glass is led by a strong management team with significant industry

experience who have successfully grown the Group’s profitability

over the last years.

Allied Glass generated revenue of £138 million in the fiscal

year ended December 2021 and over £150 million of revenues are

estimated for 2022.

Verallia expects the transaction to have an accretive impact on

its Adjusted EBITDA margin reflecting Allied’s strong performance

as well as significant synergy potential between both

businesses.

Commenting on the acquisition, Patrice Lucas, CEO of Verallia,

declared:

“This acquisition of Allied Glass is fully in line with our

strategy which is to accelerate our investments in key markets

while leveraging our industrial, technological and management

expertise to generate synergies. I am convinced that Verallia and

Allied Glass have an outstanding fit as we share common vision and

values. This is a great milestone too, as the Group will be present

on the UK market, I am confident that this combination will create

sustainable value for customers, employees and shareholders.

Finally, I am delighted to welcome Alan Henderson in the Executive

Committee team of Verallia.”

Alan Henderson, CEO of Allied Glass, added:

“Integrating Allied into an international Group, one of the main

world leaders in glass manufacturing for food and beverage, is a

thrilling challenge for Allied. Based on our respective strengths,

the two companies will benefit from strong synergies. Whilst our

customers in the UK market will continue to benefit from the same

level of quality of service locally, we believe we can further

improve our market offering through the support and knowledge of

the wider Verallia group.”

Transaction details

Verallia will acquire 100% of the capital of Allied Glass. The

transaction is valued at approximately £315 million (enterprise

value) and will be financed by Verallia’s existing cash, whilst

maintaining the Verallia Group’s leverage below 2x net

debt/adjusted EBITDA.

Verallia expects to complete the acquisition by

mid-November.

Advisors

Legal: White & Case LLP Financial and Tax: Ernst & Young

Environmental: ERM

About Verallia

At Verallia, our purpose is to re-imagine glass for a

sustainable future. We want to redefine how glass is produced,

reused and recycled, to make it the world’s most sustainable

packaging material. We work in common cause with our customers,

suppliers and other partners across the value chain to develop new

healthy and sustainable solutions for all. With around 10,000

people and 32 glass production facilities in 11 countries, we are

the leading European and the third largest producer globally of

glass containers for food and beverages, providing innovative,

customized and environmentally friendly solutions to more than

10,000 businesses around the world. Verallia produced more than 16

billion bottles and jars and achieved revenues of €2.7 billion in

2021. Verallia is listed on compartment A of the Euronext Paris

stock exchange (Ticker: VRLA – ISIN: FR0013447729) and belongs to

the SBF 120, CAC Mid 60, CAC Mid & Small et CAC All-Tradable

indexes. For more information: www.verallia.com.

Disclaimer

Certain information included in this press release does not

constitute historical data but constitutes forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding present and future business

strategies (including the successful integration of Allied Glass

within the Group) and the environment in which Verallia operates,

and involve known and unknown risks, uncertainties and other

factors, which may cause actual results, performance or

achievements, or industry results or other events, to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include those discussed

or identified under Chapter 3 "Risk Factors" in the Universal

Registration Document filed with the AMF on 29 March 2022 under

number D.22-0188 and available on the Company's website

(www.verallia.com) and the AMF's website. These forward-looking

information and statements are not guarantees of future

performances.

This press release includes only summary information and does

not purport to be comprehensive. No reliance should be placed on

the accuracy or completeness of the information or opinions

contained in this press release.

Information related to Allied Glass included in this press

release were furnished by Allied Glass to Verallia in connection

with the acquisition described herein. Financial information

related to Allied Glass have been neither audited nor reviewed by

Verallia's auditors.

This press release does not contain or constitute an offer of

securities for sale or an invitation or inducement to invest in

securities in France, the United States or any other

jurisdiction.

Personal data protection

You can unsubscribe from our press release distribution list at

any time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available to

access via the website https://www.verallia.com/en/investors.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise one of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to CNIL (Commission nationale de

l'informatique et des libertés - French regulatory body).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101006236/en/

Verallia Press Office Annabel Fuder & Rachel

Hounsinou verallia@wellcom.fr – +33 (0)1 46 34 60 60

Verallia Investor Relations contact Alexandra Baubigeat

Boucheron – alexandra.baubigeat-boucheron@verallia.com

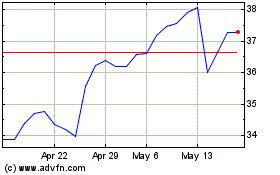

VERALLIA (EU:VRLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

VERALLIA (EU:VRLA)

Historical Stock Chart

From Jan 2024 to Jan 2025