- As of September 30, 2023:

- Revenues of €248.6m, up 0.5% at constant exchange rates

- A difficult economic environment in Europe

- Launch of the TRANSFORM 2025 Plan to adapt organisations and

improve profitability

Regulatory News:

SergeFerrari Group (FR0011950682 - SEFER), a leading global

supplier of innovative flexible composite materials, listed on

Euronext Paris – Compartment C, today announced its revenues for Q3

2023 and as of September 30, 2023.

Revenue breakdown by region (unaudited)

(€ thousands)

Q3 2023

Q3 2022

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

At 30 Sep. 2023

At 30 Sep. 2022

Ch. at current scope and exchange

rates

Ch. at constant scope and

exchange rates

Europe

49,279

53,991

-8.7%

-17.5%

179,384

181,402

-1.1%

-9.9%

Americas

8,681

10,854

-20.0%

-18.0%

28,810

27,934

3.1%

3.0%

Asia - Africa - Pacific

15,077

14,831

1.7%

8.2%

40,391

40,380

0.0%

4.5%

Total revenues

73,036

79,676

-8.3%

-12.8%

248,584

249,716

-0.5%

-6.1%

Sébastien Baril, Chairman of the SergeFerrari Group Executive

Board, comments: " During the 3rd quarter of 2023, we note that

our markets in Europe remained under severe pressure, with a

negative impact on our historical businesses. On the other hand, we

are maintaining solid growth in our Solutions businesses, mainly

linked to Biogas, driven by dynamic markets and a positioning

strengthened by our latest acquisition, Markleen in 2023. The

success of this targeted acquisition policy confirms our growth

prospects in this segment. We have therefore decided to establish a

partnership in India through the creation of Biomembrane Systems

India Pvt Ltd, in order to gain a foothold in this fast-growing

market.”

Activity as of September 30, 2023: revenues of €248.6

million

In the first nine months of 2023, the Group posted revenues of

€248.6m, down 0.5% on a current scope and exchange rate basis and

down 6.1% on a constant scope and exchange rate basis.

This a constant scope and exchange rate revenues, which was

particularly sharp in Europe, was only partly offset by performance

in the rest of the world:

- The Europe region posted a slight

decline of -1.1% in sales compared with 2022 on a current scope and

exchange rate basis, and of -9.9% on a constant scope and exchange

rate basis. Conversely, the acquisitions of MSE/DCS and Baltijos

Tentas in 2022 and Markleen in 2023 contributed €16m to revenues

over the period. Europe was particularly affected by the decline in

revenues from the Furniture and Solar Protection segments.

- The Americas region achieved revenue

growth of 3.1% on a current scope and exchange rate basis, thanks

to good performances in the Modular Structures and Tensile

Architecture segments.

- The Asia-Pacific-Middle East-Africa

region reported stable revenues at current scope and exchange

rates, and growth of 4.5% at constant scope and exchange rates. The

negative currency effect recorded in this region concerns all

invoicing currencies (yen, yuan, rupee and Taiwanese dollar).

Over the first nine months of the year, the scope effect

contributed +6.6% to revenue growth, and the price mix effect

+4.9%. The currency effect was -0.9% and the volume effect

-11.1%.

3rd quarter 2023 activity: revenues of €73 million

Revenues for the 3rd quarter of 2023 amounted to €73.0m, down

8.3% on a current scope and exchange rate basis and down 12.8% on a

constant scope and exchange rate basis, compared with the 3rd

quarter of the 2022 financial year, which saw a strong commercial

performance.

The global trend in the 3rd quarter is the result of:

- A scope effect of +6.5% (+€5.1m), resulting from the targeted

external growth policy and the contribution of the Solutions

business (biogas, fish-farming and composite materials processing)

and Markleen;

- A slightly positive price-mix effect of +0.9%;

- A volume effect of -13.6%, mainly due to the economic situation

in the building, renovation and consumer equipment sectors;

- A currency effect of -2.0% and -1.6 million euros.

Outlook

The Company has updated its business and earnings outlook for

2023 and its business outlook for 2024. The Group is seeing a

faster-than-expected decline in new orders in the construction,

renovation, and home improvement sectors, which are being hit by

rising financing costs and a wait-and-see attitude on the part of

consumers in an unfavourable economic and geopolitical environment.

The sharp fall in building starts already seen in 2023 and the

outlook communicated by players in the sector, mainly in Europe,

point to a contraction in the Group's activities in these

sectors.

The Group, which in 2021 and 2022 experienced two years strongly

influenced by the rebound in post-Covid consumer spending, with

constant scope and exchange rate growth of +27% and +14%

respectively, has announced a further adjustment of its targets for

2023:

- Revenues in 2023 should be close to those

of 2022

- The current operating margin should be

close to 3% of revenue

The Group has launched its TRANSFORM 2025 Plan, which aims to

improve its profitability and the allocation of its resources to

its development projects:

- Adjusting staff numbers to current and

forecast business levels: by 2025, the reduction in fixed costs

should have an impact on operating profit equivalent to 2% of

revenues;

- Selective allocation of financial resources

and preservation of strategic investments ;

- Intensification of R&D initiatives,

particularly in the area of formulations, with the aim of reducing

the Group's dependence on high-cost raw materials;

- Reducing working capital to 35% of revenues

by 2025, in particular by improving and simplifying the Group's

supply chain footprint;

- Improving industrial efficiency through

successful transfers between the Group's industrial sites.

The Group will detail the measures taken under the TRANSFORM

2025 Plan when it publishes its 2023 annual results in March 2024.

The Group is confident in its ability to return to a recurring

operating margin in 2025 that is comparable to that seen in 2022,

and to pursue its development by relying on the launch of

innovative products for its traditional markets, as well as on the

dynamism of the markets addressed by the SOLUTIONS business,

particularly in the biogas sector.

Next financial communication

- Publication of 2023 full-year revenues,

on January 18, 2024, after market close

About SergeFerrari Group

The Serge Ferrari Group is a leading global supplier of

composite materials for Tensile Architecture, Modular Structures,

Solar Protection and Furniture/Marine, in a global market estimated

by the Company at around €6 billion. The unique characteristics of

these products enable applications that meet the major technical

and societal challenges: energy-efficient buildings, energy

management, performance and durability of materials, concern for

comfort and safety together, opening up of interior living spaces

etc. Its main competitive advantage is based on the implementation

of differentiating proprietary technologies and know-how. The Group

has manufacturing facilities in France, Switzerland, Germany, Italy

and Asia. Serge Ferrari operates in 80 countries via subsidiaries,

sales offices and a worldwide network of over 100 independent

distributors.

In 2022, Serge Ferrari posted consolidated revenues of €338.7

million, over 80% of which was generated outside France. The

SergeFerrari Group share is listed on Euronext Paris – Compartment

C (ISIN: FR0011950682). SergeFerrari Group shares are eligible for

the French PEA-PME and FCPI investment schemes.

www.sergeferrari.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231018575575/en/

Serge Ferrari Philippe Brun Executive Board

Member

Valentin Chefson Investor Relations

investor@sergeferrari.com

NewCap Investor Relations - Financial Communication

Théo Martin / Quentin Massé Tel.: 01 44 71 94 94

sferrari@newcap.eu

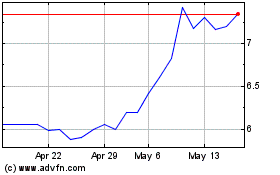

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Jan 2024 to Jan 2025