SergeFerrari Group Posts H1 2023 Revenues of €175.5 Million, up 3.2%

July 18 2023 - 11:45AM

Business Wire

- Quarterly revenue of €90.7m, very close to the Q2 2022

historic record

- Strong growth in recent acquisitions in the field of

Solutions

- Cyclical impact of consumer equipment markets

- Adjusted revenue and profitability outlook for 2023

Regulatory News:

SergeFerrari Group (FR0011950682 - SEFER), a leading global

supplier of innovative flexible composite materials under the Serge

Ferrari and Verseidag brands and listed on Euronext Paris –

Compartment C, today announces its revenues for the first half of

2023.

Revenue breakdown by region (unaudited)

(in € thousands)

Q2 2023

Q2 2022

Ch. at

current scope and exchange

rates

Ch. at constant scope and

exchange rates

H1

2023

H1

2022

Ch. at

current scope and exchange

rates

Ch. at constant scope and

exchange rates

Europe

65,335

66,851

-2.3%

-10.6%

130,105

127,409

+2.1%

-6.6%

Americas

10,853

9,498

+14.3%

+16.0%

20,129

17,080

+17.9%

+16.3%

Asia - Africa - Pacific

14,537

14,629

-0.6%

+3.4%

25,314

25,551

-0.9%

+2.4%

Total revenues

90,725

90,978

-0.3%

-5.6%

175,548

170,040

+3.2%

-2.9%

Sébastien Baril, Chairman of the SergeFerrari Group Executive

Board, comments: "During the first half of 2023, business

levels increased despite the economic difficulties linked with the

downturn in consumer consumption, mainly in Europe. Revenues were

up by 3% on a record historic level. The Group was able to rely on

the strong momentum of its Solutions businesses, particularly in

the biogas sector. The acquisition of Markleen strengthens the

Group's capabilities in this promising sector, which enables us to

add value to the manufacture of our innovative membranes. Thanks to

our solid positioning in our historic markets and the dynamism of

our new activities, we remain firmly positive about the structural

dynamics of our markets".

Q2 2023 performance: revenues of €90.7m

Revenue for Q2 2023 amounted to €90.7 million, virtually

unchanged from Q2 2022 at current scope and exchange rates (down

0.3%) and down 5.6% at constant scope and exchange rates compared

with Q2 record.

This change of -0.3% is the result of:

- A scope effect of +6.1% (+€5.6m) resulting from last year's

acquisitions, Baltijos Tentas, MSE and DCS, consolidated from July

1st and August 1st, 2022, respectively, and Markleen, acquired in

the first half and consolidated from April 1st, 2023. The last 3

acquisitions make up the Solutions activities (biogas, fish-farming

and implementation of composite materials);

- A continuing positive price-mix effect of +2.8%;

- A volume effect of -8.4%, resulting in particular from lower

sales in the Solar Protection and Furniture segments. Particularly

well oriented in 2022, these two markets are impacted by the

slowdown in consumer consumption;

- A currency effect of -0.8%.

H1 2023 performance, up 3.2%

The Group generated cumulative revenue of €175.5 million in the

first half of 2023, up 3.2% at current scope and exchange rates and

down 2.9% at constant scope and exchanges rates.

Over the first half of 2023, revenue by geographic region is as

follows:

- In Europe, revenue increased by +2.1% to €130m, driven

in particular by acquisitions over the past 12 months.

- Revenue in Americas recorded strong growth of +17.9% at

current scope and exchange rates and +16.3% at constant scope and

exchange rates. This good performance is mainly due to the sales of

the Modular Structure and Tensile Architecture segments.

- In Asia - Africa - Pacific, revenue increased by +2.4%

at constant scope and exchange rates, following particularly

dynamic commercial activity in the first half of 2022. The

unfavourable impact of exchange rates (changes in the yuan, the

Turkish lira and the Taiwanese dollar against the euro) is

responsible for the -0.9% decline at current scope and exchange

rates.

Outlook

Given the uncertain economic environment, SergeFerrari Group is

adjusting its revenue expectations for 2023 and is now targeting

growth of +4% compared with 2022, below its previous assumption of

+7%.

The slowdown in sales growth in 2023 is the dual consequence of

a high base effect, with record sales recorded in 2021 and 2022,

and the priority given to destocking by customer-distributors in

the first half of 2023. This is a reflection of the importance of

indirect sales in our distribution strategy, it does not affect the

quality of the Group's fundamentals.

As a result, the 2023 current operating margin will be affected

by this lower-than-expected sales growth. At the same time, the

sharp rise in energy costs will not be fully offset by the initial

easing in prices for certain categories of raw materials. In these

circumstances, SergeFerrari Group is revising its guidance for

operating profit from ordinary activities in 2023 to between 5% and

5.5% of revenue in 2023, compared with 7.4% in 2022.

In the first half of the year, the Group noted the favourable

impact of the actions implemented by the new supply chain

organisation, which aims to improve working capital requirements

and adjust inventories to forecast business levels. In addition, on

July 13, 2023, the Group signed a €10 million financing agreement

under the "Prêts Participatifs Relance" scheme, which will

strengthen its financial structure.

Financial calendar

- Publication of the H1 2023 results on

September 14, 2023, after market close - Publication of the

Q3 2023 revenues on October 18, 2023, after market close

ABOUT SERGEFERRARI GROUP

Marketing its products under two brands, Serge Ferrari and

Verseidag, the Serge Ferrari Group is a leading global supplier of

composite materials for Tensile Architecture, Modular Structures,

Solar Protection and Furniture/Marine, in a global market estimated

by the Company at around €6 billion. The unique characteristics of

these products enable applications that meet the major technical

and societal challenges: energy-efficient buildings, energy

management, performance and durability of materials, concern for

comfort and safety together, opening up of interior living spaces

etc. Its main competitive advantage is based on the implementation

of differentiating proprietary technologies and know-how. The Group

has manufacturing facilities in France, Switzerland, Germany, Italy

and Asia. Serge Ferrari operates in 80 countries via subsidiaries,

sales offices and a worldwide network of over 100 independent

distributors. In 2022, Serge Ferrari posted consolidated revenues

of €338.7 million, over 80% of which was generated outside France.

The SergeFerrari Group share is listed on Euronext Paris –

Compartment C (ISIN: FR0011950682). SergeFerrari Group shares are

eligible for the French PEA-PME and FCPI investment schemes.

www.sergeferrari.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230718350717/en/

SergeFerrari Group Philippe Brun Executive Board

Member Valentin Chefson Investor Relations

investor@sergeferrari.com

NewCap Investor Relations – Financial

communication Théo Martin / Quentin Massé Tel: +33(0) 1 44 71

94 94 sferrari@newcap.eu

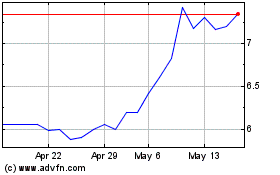

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sergeferrari (EU:SEFER)

Historical Stock Chart

From Jan 2024 to Jan 2025