Adecco 3Q Net Profit -46%; US Staffing Market Shows Improvement

November 05 2009 - 1:54AM

Dow Jones News

Adecco SA (ADEN.VX) Thursday reported a better-than-expected 46%

drop in third quarter profit and said that staffing markets in the

U.S., which have been hard hit during the recession, have started

to improve.

The Zurich-based employment firm said net profit for the

three-month period to the end of September fell to EUR90 million

from EUR168 million a year ago. That beat analyst calls for EUR50

million, as the company benefitted from cost-cutting and an

unexpected improvement in market conditions in the U.S. and

France.

While sales still fell 27% to $3.72 billion from EUR5.10 billion

during the third quarter, the decline was less steep than in

previous quarters, when revenues dropped more than 30% as weak job

markets in the U.S. and France hit Adecco's top line.

"Market conditions have improved during the third quarter,

especially in general staffing, and we have seen a gradual

improvement of the revenue trend," said Chief Executive Patrick De

Maeseneire.

The company, which recently bough U.S.-based peer MPS Group Inc

for $1.3 billion, said it would continue to reduce costs as pricing

still remained under pressure as many companies are still trying to

avoid hiring staff.

Adecco's competitors, such as Manpower Inc (MAN) and Randstad

Holding NV (RAND.AE), have already warned that margins would stay

depressed.

Despite the market improvement in France and the U.S., the

company's key market, employment trends in Germany remained weak,

with sales falling more than 30%. Likewise, hiring activity in the

U.K., which is still mired in recession, was weak.

Company Web Site: http://www.adecco.com

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

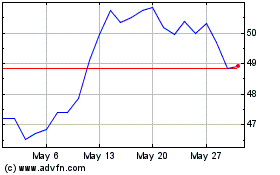

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024