2nd UPDATE: Switzerland's Adecco Buys MPS Group For $1.3 Billion

October 20 2009 - 7:14AM

Dow Jones News

Switzerland-based staffing company Adecco SA (ADEN.VX) Tuesday

said it has acquired U.S.-based MPS Group Inc. (MPS), a specialist

in placing professional staff, for $1.3 billion, extending its lead

as the world's biggest staffing company by revenue and giving it

more resilience to the economic downturn that has hammered

recruitment markets.

The move marks a new phase in the consolidation of the

fragmented staffing market and gives Adecco a greater presence in

the U.S., the home market of closest rival Manpower Inc. (MAN).

However, the company said it would also be its last major

acquisition for a while as it seeks to preserve cash and its

investment grade rating.

MPS reported $2.2 billion of revenue in 2008, adding to the

EUR20 billion that Adecco generated. Manpower generated $22 billion

in revenue last year.

Global staffing markets have contracted sharply in the past year

as companies have cut back on hiring or laid off staff in response

to the economic downturn. Staffing companies like Manpower and

Adecco have seen revenues fall sharply and have cut costs and some

of their own staff. However, the downturn hasn't stopped big

staffing companies acquiring smaller rivals as they seek to take

advantage of cheap asset prices, position themselves for a recovery

and buy operations that are more resilient to the downturn.

Adecco this year also acquired Spring Group Ltd (SRG.LN) of the

U.K. for GPB108 million, and that followed last year's multibillion

dollar acquisition of Dutch recruiter Vedior by peer Randstand

Holding NV (RAND.AE).

The acquisition of MPS gives Adecco bigger professional staffing

operations - a high margin business that places highly-educated

personnel like medical staff and is worth about one third of the

EUR200 billion annual global recruitment industry. Adecco expects

the sector to grow in coming years.

Before the economic downturn, the professional staffing industry

grew at a rate of about 9% annually, while the placement of

blue-collar workers rose about 3%, according to estimates by

industry experts.

"With this takeover, we are strengthening our professional

staffing business and profitability," said Chief Executive Officer

Patrick de Maeseneire, who joined the world's largest recruiter

earlier this year. "The ratio of the professional staffing business

will move up to 25% from 17% at the moment."

Jacksonville, Florida-based MPS generates the bulk of its sales

by placing specialized staff from the information technology,

finance, and engineering industry in the U.S. and U.K. Adecco will

move its U.S. headquarters to Jacksonville once the agreed deal is

completed - the companies expect completion in the first quarter of

2010.

Adecco will pay $13.8 per common MPS share, representing a 24%

premium to the U.S. company's closing price Monday, which Vontobel

analyst Michael Foeth considered to be fair. To finance the

acquisition, Adecco will launch a 900 million Swiss franc ($891

million) convertible bond.

Standard & Poor's put Adecco's Triple-B rating on negative

watch and warned it could cut the rating to Triple-B-minus as the

"proposed acquisition presents increased operational risks in light

of the potential continued deterioration of market conditions."

Adecco's shares, which have gained more than 50% this year so

far, were under pressure as a result, and at 1035 GMT, the stock

was down CHF2.30, or 4.2%, at CHF52.30. Shares of Dutch recruiter

USG People NV (USG.AE) also fell sharply because markets had

speculated it could be a possible Adecco target and that now looks

unlikely for the time being. The stock was down 4.6% in

Amsterdam.

"This takeover will be the last big acquisition for the time

being," Adecco CEO de Maeseneire said. "The focus will lie now on

organic growth and the integration of MPS and Spring. With the

takeover of MPS we have the basis to grow our professional staffing

business organically."

However, De Maeseneire didn't exclude small, bolt-on

acquisitions.

Analysts welcomed the acquisition, which will boost Adecco's

annual revenue by about 10%, be profit accretive one year after the

deal closes and help generate synergies of about EUR25 million over

the next two years.

Furthermore, analysts said, the deal will help the Swiss firm

stem against the steep drop in demand for recruitment services amid

the economic downturn.

Even as leading economies such as the U.S. and Germany are

moving out of recession, jobless rates are expected to rise over

the next few months, according to economists. As a result, analysts

expect more merger and acquisition deals in the industry as

takeover prices are still deemed to be attractive.

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

(Katharina Bart contributed to this article.)

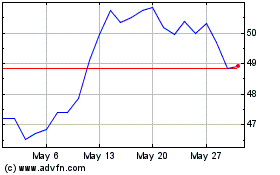

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024