Prosus 1st Half Net Profit Jumps Amid Ecommerce Strength, Tencent Holdings Performance

November 23 2020 - 5:05AM

Dow Jones News

By Alexandra Wexler

JOHANNESBURG--Internet conglomerate Prosus NV reported a 21%

jump in first-half net profit on Monday, thanks to growing revenue

in its ecommerce businesses and a strong performance from Chinese

internet and gaming colossus Tencent Holdings Ltd., in which it

holds a 31% stake.

Amsterdam-listed Prosus said net profit was $3.02 billion for

the six months ended Sept. 30, compared to $2.5 billion a year

earlier. Prosus is a 72.7%-owned subsidiary of Naspers Ltd., a

South African newspaper-publisher-turned-technology-giant and

Africa's most valuable listed company.

Prosus, which holds Naspers' international assets, attributed

the better performance to increased revenue from its ecommerce

businesses, which include U.S. online marketplace Letgo, German

food-delivery business Delivery Hero and BYJU's, an

educational-technology company in India. In addition, Tencent

reported an 89% jump in net profit for its third quarter earlier

this month, thanks to strong gaming revenue and better cost

efficiencies.

Parent Naspers, meanwhile, reported a drop in earnings for the

six months ended Sept. 30, as the flotation of Prosus last year

resulted in a smaller contribution to the group. Naspers recorded a

profit of $2.14 billion for the first half of its 2021 fiscal year,

down 5.2% from the same period a year earlier--in line with

guidance provided last week. The company said it recognized 72.7%

of Prosus's earnings in the period, compared with 100% a year

earlier.

Revenue at Prosus for the first half of fiscal 2021 jumped 53%

to $2.17 billion, while Naspers' revenue increased 44% to $2.5

billion over the same period, the company said.

"We believe our businesses today are fundamentally stronger than

when we went into the pandemic," Basil Sgourdos, chief financial

officer at both Naspers and Prosus, said on a media call.

Last month, Prosus said it planned to buy back up to $5 billion

of its own shares and those of parent Naspers, the latest attempt

to narrow a persistent gap between the company's market value and

that of its stake in Tencent. Naspers said the buyback plan was a

vote of confidence in its assets and would help its investors

capitalize on the discount.

Analysts have attributed this persistent gulf to a

dividend-withholding tax that Naspers would need to pay should it

sell its stake in Tencent and distribute the proceeds to investors,

as well as the fact that holding companies generally trade at a

discount. Tech and internet stocks have also been on a tear this

year, because of pandemic-fueled demand, further boosting the share

prices of companies like Tencent.

"We are investing in very exciting assets that are doing

exceptionally well," Naspers and Prosus Chief Executive Bob van

Dijk said. "We believe that over time that's the most important

component to us narrowing the discount."

Prosus has recently lost out on two high-profile acquisitions.

In July, it lost a bidding war for eBay Inc.'s classified-ads

business to Norway's Adevinta AS. Earlier this year, U.K. food

delivery business Just Eat PLC snubbed a 4.9 billion pounds ($6.35

billion) offer from Prosus and instead merged with Dutch rival

Takeaway.com NV.

Prosus shares in Amsterdam were trading 1.9% higher at 92.72

euros ($110.04) on Monday morning. Naspers shares in Johannesburg

were up 2.6% at 3,201.99 South African rand ($209.04).

Founded in South Africa in 1915, Naspers was originally De

Nationale Pers Beperkt, or the National Press Ltd., which produced

a Dutch-language newspaper for the country's Afrikaner population.

In the 1980s, the company began expanding beyond its publishing

roots, including into video entertainment.

Naspers paid $34 million for its original Tencent stake in 2001,

and Tencent is now one of the world's most valuable companies. Much

of Naspers' growth in recent years can be attributed to the rise in

value of its stake in Tencent, best known in China for its WeChat

messaging app.

--Jaime Llinares Taboada contributed to this article

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

November 23, 2020 04:50 ET (09:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

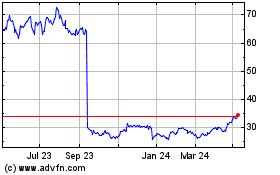

Prosus NV (EU:PRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

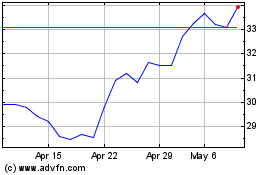

Prosus NV (EU:PRX)

Historical Stock Chart

From Jan 2024 to Jan 2025