KBC Group: Third-quarter result of 868 million euros

November 07 2024 - 1:00AM

UK Regulatory

KBC Group: Third-quarter result of 868 million euros

KBC Group – overview (consolidated,

IFRS) |

3Q2024 |

2Q2024 |

3Q2023 |

9M2024 |

9M2023 |

|

Net result (in millions of EUR) |

868 |

925 |

877 |

2 300 |

2 725 |

|

Basic earnings per share (in EUR) |

2.14 |

2.25 |

2.07 |

5.58 |

6.44 |

|

Breakdown of the net result by business unit (in millions of

EUR) |

|

|

|

|

|

|

Belgium |

598 |

519 |

517 |

1 359 |

1 392 |

|

Czech Republic |

179 |

244 |

200 |

620 |

661 |

|

International Markets |

205 |

224 |

200 |

576 |

498 |

|

Group Centre |

-114 |

-61 |

-41 |

-255 |

174 |

|

Parent shareholders’ equity per share (in EUR, end of period) |

54.1 |

53.2 |

52.2 |

54.1 |

52.2 |

We recorded a net profit of 868 million euros in the third

quarter of 2024. Compared to the result for the previous quarter,

our total income benefited from several factors, including higher

net interest income (despite significantly lower income on

inflation-linked bonds), increased insurance revenues supported by

commercial actions, and higher net fee and commission income driven

by excellent business performance. These items were offset by a

decrease in trading & fair value income and the drop in

dividend income following its seasonal peak in the second

quarter.

Our loan portfolio continued to expand, increasing by 1%

quarter-on-quarter and by 5% year-on-year. Customer deposits –

excluding volatile, low-margin short-term deposits at KBC Bank’s

foreign branches – were up 3% quarter-on-quarter and 5%

year-on-year. As regards Belgium, deposits grew by as much as 5%

quarter-on-quarter and 8% year-on-year, owing to the successful

recuperation of customer funds following the maturity of the

Belgian state note issued a year earlier. In fact, thanks to our

proactive, multi-phased and multi-product customer offering, the

total inflow of core customer money after the state note matured

amounted to 6.5 billion euros, outpacing last year’s

5.7-billion-euro outflow to the state note by 0.8 billion

euros.

Operational expenses were up in the quarter under review but

remained perfectly within our full-year 2024 guidance. Insurance

service expenses were higher, partly as a result of the storms and

floods in Central Europe, especially Storm Boris. To date, we are

helping some 10 000 customers alleviate the impact of the floods

caused by this storm. Next to that, we established a donation fund.

Loan loss impairment charges, excluding the reserve for

geopolitical and macroeconomic uncertainties, were up on the level

recorded in the previous quarter, leading to a credit cost ratio of

16 basis points for the first nine months of 2024, substantially

below the guidance. Including the reserve for geopolitical and

macroeconomic uncertainties, the credit cost ratio stood at 10

basis points for the first nine months of 2024. In the quarter

under review, we also booked a one-off 79-million-euros gain, under

‘share in results of associated companies & joint

ventures’.

Our solvency position remained strong, with a fully loaded

common equity ratio of 15.2% at the end of September 2024. Our

liquidity position remained very solid too, as illustrated by an

LCR of 159% and NSFR of 142%. As already announced earlier, we will

– in line with our general dividend policy – pay an interim

dividend of 1 euro per share on 14 November 2024 as an advance on

the total dividend for financial year 2024.

The share of bank and insurance products sold digitally has

continued to rise: based on a selection of core products, around

55% of our banking and 29% of our insurance products were sold

through a digital channel, up from 51% and 26% a year ago. And

Kate, our personal digital assistant, is making good progress too:

to date, over 5 million customers have already used Kate, an

increase of no less than 37% on the year-earlier figure, while the

proportion of cases resolved fully autonomously by Kate continues

to improve and now stands at 67% in Belgium and 69% in the Czech

Republic. I’m also delighted to add that our successful

digitalisation and innovation journey regularly receives

recognition from external parties. I am particularly proud that,

just a few weeks ago, the independent international research agency

Sia Partners honoured us by naming KBC Mobile the best mobile

banking app in the world.

Our ultimate aim is to be the reference bank-insurer in all our

core markets. This ambition is fuelled by our customer-centric

business model and, most importantly, by the trust our customers,

employees, shareholders, and other stakeholders place in us. We

appreciate and are deeply grateful for this continued trust.

Johan Thijs

Chief Executive Officer

- 3q2024-pb-en

- 3q2024-quarterly-report-en

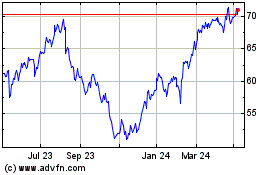

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Dec 2024 to Jan 2025

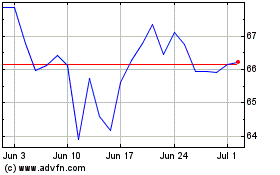

KBC Groep NV (EU:KBC)

Historical Stock Chart

From Jan 2024 to Jan 2025