Capgemini successfully prices a €3.5 billion bond issue

April 08 2020 - 1:30PM

Capgemini successfully prices a €3.5 billion bond issue

This press

release may not be distributed directly or indirectly

in the United States, Canada, Australia or

Japan

Investor Relations:Vincent

BiraudTel: +33 (0)1 47 54 50 87Email:

vincent.biraud@capgemini.com

Capgemini successfully prices a €3.5

billion bond issue

Paris, 8 April 2020 - Capgemini

announces that it successfully priced on April 8, 2020, a total of

€3.5 billion bonds comprising four tranches:

- €500 million 2-year notes (the 2022 tranche), with a coupon of

1.250% (issue price 99.794%),

- €800 million 6-year notes (the 2026 tranche), with a coupon of

1.625% (issue price 99.412%),

- €1 billion 9-year notes (the 2029 tranche), with a coupon of

2.000% (issue price 99.163%) and

- €1.2 billion 12-year notes (the 2032 tranche), with a coupon of

2.375% (issue price 99.003%).

This bond offering was a great success with an

oversubscription of about 4.5 times.

Carole Ferrand, Chief Financial Officer of

Capgemini, said: “The strong interest of the financial markets

generated by this bond issue, in the current market context marked

by the Covid‑19 crisis, demonstrates investors' confidence in the

quality of Capgemini's financial profile. It is also an

illustration of the support for the strategy that led the Group to

acquire Altran in order to position itself as a leader in the

digital transformation of industrial and technology companies.

Lastly, this refinancing transaction does extend the average

maturity of our indebtedness without increasing its overall

amount”.

The proceeds of this bond issue will be used to

refinance the bridge loan entered into in the context of the

acquisition of Altran Technologies and for general corporate

purposes of the Group, including the redemption of the €676 million

principal amount outstanding under the bonds maturing on July 1,

2020 (ISIN FR0012821932). Capgemini can redeem such latter bonds at

par at any time since April 1 and until July 1, 2020.

The newly issued bonds will be rated BBB by

Standard & Poor's, in line with the BBB/stable outlook rating

recently assigned to Capgemini.

This transaction fully complies with the

financing strategy of the Altran acquisition as announced in June

2019. Capgemini is thus taking advantage of attractive conditions

prevailing in bond markets, in spite of the Covid-19 sanitary

crisis, to refinance the Altran acquisition and extend the average

maturity of its debt.

Disclaimer

This press release and the information contained

herein do not constitute a public offer or an offer to subscribe or

a solicitation of an order to purchase or subscribe for the

securities in the United States or in any other country, or an

invitation to accept the public offer mentioned in this press

release. This press release and the information contained therein

do not constitute a public offer or an offer to subscribe or a

solicitation of an order to purchase or subscribe for the

securities in the United States or in any other country, or an

invitation to accept the public offer mentioned in this press

release. The publication, broadcasting or distribution of this

press release in certain countries may be subject to legal or

regulatory restrictions and the persons in possession of this press

release must inform themselves about and comply with such

restrictions.

This press release does not constitute an offer

to sell the bonds of Capgemini SE in the United States or any other

country. The bonds of Capgemini SE may not be offered or sold in

the United States absent registration or an exemption from

registration under the U.S. Securities Act of 1933, as amended.

Capgemini SE has not registered and does not intend to register the

offer referred to in this press release or any part thereof in the

United States or to make any public offer of its bonds in the

United States. The public offer referred to in this press release

is being made solely by the offeror referred to in this press

release. The public offer is not being made to (and no offer of

securities will be accepted from) bondholders established in any

jurisdiction (including the United States, Canada, Japan or

Australia) in which the launch of such an offer or its acceptance

would not comply with the provisions of the laws relating to

financial markets.

This press release may contain information that

may be deemed to be forward-looking statements concerning Capgemini

SE's financial condition, results of operations, business, strategy

and plans. Although Capgemini SE believes that such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, most of which are outside of

Capgemini SE's control, including risks relating to competition and

regulatory approvals, as well as the risks described in the

documents filed by Capgemini SE with the Autorité des Marchés

Financiers and available in English or French on Capgemini SE's

website (www.capgemini.com). Investors and security holders may

obtain a free copy of the documents filed by Capgemini SE with the

Autorité des Marchés Financiers at www.amf-france.org or directly

on Capgemini SE's website. The forward-looking statements contained

in this document are made as of the date hereof and Capgemini SE

reserves the right to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

About CapgeminiCapgemini is a

global leader in consulting, digital transformation, technology,

and engineering services. The Group is at the forefront of

innovation to address the entire breadth of clients’ opportunities

in the evolving world of cloud, digital and platforms. Building on

its strong 50-year+ heritage and deep industry-specific expertise,

Capgemini enables organizations to realize their business ambitions

through an array of services from strategy to operations. Capgemini

is driven by the conviction that the business value of technology

comes from and through people. Today, it is a multicultural company

of 270,000 team members in almost 50 countries. With Altran, the

Group reported 2019 combined revenues of €17 billion.Visit us at

www.capgemini.com. People matter, results count.

- Capgemini_-_2020-04-08_-_Successful_bond_issuance

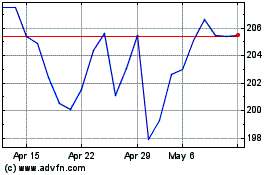

Capgemini (EU:CAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

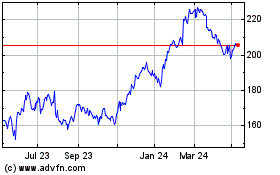

Capgemini (EU:CAP)

Historical Stock Chart

From Nov 2023 to Nov 2024