Assystem : First-half 2019 results, Revenue: €246.5 million

(+14.1%)

First-half 2019 results

- Revenue: €246.5 million (+14.1%)

- Operating profit before non-recurring items (EBITA)(1): €15.6

million

- EBITA margin up 200 bp to 6.3%

Paris - La Défense, 5 September 2019, 5.35 p.m.

(CEST) – At its meeting held today, the Board of Directors of

Assystem S.A. (ISIN: FR0000074148 - ASY), an international

engineering group, reviewed the Group’s financial statements for

the first half of 2019 (i.e. the six months ended 30 June

2019).

First-time application of IFRS 16 and financial

indicators used by Assystem

Assystem adopted IFRS 16, “Leases” on 1 January

2019 using the modified retrospective approach. In accordance with

this approach, the financial statements for 2018 have not been

restated.

The first-time application of this new standard

had only a limited effect on EBITA and consolidated profit for the

period. However, it did have highly significant impacts on the

EBITDA and free cash flow indicators used by Assystem. All of these

impacts are disclosed in this press release together with the

related figures.

In view of these highly significant impacts, in

order to permit meaningful year-on-year comparisons of the above

indicators and maintain a method of calculating EBITDA and free

cash flow consistent with that used to calculate net debt, Assystem

will continue to use EBITDA and free cash flow indicators as

calculated excluding the impacts of IFRS 16.

In the consolidated statement of financial

position, the Group's adoption of IFRS 16 resulted in the

recognition of lease liabilities and right-of-use assets presented

on the liabilities and assets side respectively under “Lease

liabilities” and “Right-of-use assets”. The net debt indicator used

by Assystem does not include lease liabilities.

KEY FIGURES

|

In millions of euros (€m) |

H1 2018 |

H1 2019 |

Year-on-year change |

|

Revenue |

216.1 |

246.5 |

+14.1% |

|

Operating profit before non-recurring items –

EBITA(1) |

9.2 |

15.6 |

+69.5% |

|

% of revenue |

4.3% |

6.3% |

+ 200 bp |

|

Consolidated profit for the period(2) |

7.1 |

14.3 |

|

|

|

|

|

|

|

In millions of euros (€m) |

31 Dec. 2018 |

30 June 2019 |

|

|

Net debt(3) |

31.1 |

68.7 |

|

ANALYSIS OF THE FIRST-HALF 2019 INCOME

STATEMENT

Assystem’s consolidated revenue jumped 14.1%

year on year in the first half of 2019, breaking down as 13.2% in

like-for-like growth and a 0.9% positive currency effect. The lower

number of business days in the first six months of 2019 compared

with first-half 2018 trimmed an estimated 0.8% off like-for-like

growth.

Revenue from the Energy &

Infrastructure division advanced 16.3% to

€219.9 million, with 15.9% like-for-like growth and a 0.4%

positive currency effect.

At €22.7 million, revenue for the

Staffing division was up 2.0%, including a 5.0%

positive currency effect.

- Operating profit before non-recurring items (EBITA) and

EBITDA([4])

Consolidated EBITA surged 69.5%

to €15.6 million in the first six months of 2019 from €9.2 million

in the same period of 2018. The first-half 2019 figure includes a

€0.2 million positive impact from the first-time application of

IFRS 16, which solely affected the E&I division. EBITA margin

widened considerably year on year, to 6.3% from 4.3%.

EBITA for the Energy &

Infrastructure division totalled €16.4 million (including

the €0.2 million IFRS 16 impact) and EBITA margin was 7.5% (7.4%

excluding IFRS 16), versus €10.3 million and 5.4% respectively in

first-half 2018.

Staffing EBITA rose by €0.4

million to €0.8 million, representing an EBITA margin of 3.4%.

The Group’s “Holding company” expenses, net of

the EBITA of the activities classified in the “Other” category, had

a €1.6 million negative impact on consolidated EBITA in first-half

2019 versus a €1.5 million negative impact in the equivalent period

of 2018.

Consolidated EBITDA(4) came to

€17.4 million in the first six months of 2019, compared with €10.4

million in first-half 2018. Including the impact of IFRS 16, it

amounted to €22.0 million.

- Operating profit and other income statement

items

After taking into account €1.5 million in net

non-recurring expense for the period (including €0.3 million in

share-based payments), consolidated operating

profit came to €14.1 million, compared with €9.5 million

in the first six months of 2018.

The contribution to Assystem’s

consolidated profit by Expleo Group (“Expleo”) – in which

Assystem holds a 38.2% interest – was €6.7 million excluding the

impact of the non-recurring expenses recorded by Expleo for

first-half 2019 but including €4.4 million in coupons on Expleo

convertible bonds. Taking into account Assystem’s €2.6 million

share of Expleo’s non-recurring expenses, Expleo’s net contribution

to consolidated profit for first-half 2019 was €4.1 million

(comprising Assystem's €0.3 million share of Expleo’s loss for the

period and the €4.4 million in convertible bond coupons).

Assystem recorded net financial

income of €0.6 million in the six months ended 30 June

2019, including a €2.4 million dividend receivable by Assystem on

its 5% stake in Framatome.

After deducting €4.5 million in income tax

expense, consolidated profit for the period

totalled €14.3 million, compared with €7.1 million in

first-half 2018.

- Information on the revenue and EBITDA(4) generated in

first-half 2019 by Expleo Group

Revenue generated by Expleo Group came in at

€544.2 million in the first six months of 2019 versus

€511.4 million in first-half 2018. Overall year-on-year growth

was 6.4%, breaking down as a 6.6% positive impact from changes in

scope of consolidation (chiefly due to the inclusion for the full

six-month period of SQS, which has been consolidated since 1

February 2018), an estimated 0.7% negative impact from the

year-on-year decrease in the number of business days and a 0.4%

positive currency effect. Like-for-like growth based on constant

exchange rates and business days was 0.1%. This figure reflects the

adverse impact during the period of the one-off effect of losing a

contract in the aeronautics sector in the United Kingdom and a

change in SQS’s business mix. This change had an immediate positive

impact on operating profitability in terms of absolute value and

margin, but a short-term negative effect on business volumes.

Expleo Group’s EBITDA (excluding the IFRS 16

impact) amounted to €47.5 million for the period, representing 8.7%

of its consolidated revenue, versus €41.0 million and 8.0%

respectively in first-half 2018.

FREE CASH FLOW AND NET DEBT

At 30 June 2019, free cash flow

for the previous twelve months generated by Assystem’s fully

consolidated entities (excluding the IFRS 16 impact) totalled €27.1

million, representing 5.7% of revenue for that period. As expected,

working capital requirement related to the K.A.CARE contract

returned to a normal level in the first half of 2019. The down

payment received on this contract in late 2018 was used during

first-half 2019.

Assystem had net debt of €68.7 million

at 30 June 2019 versus €31.1 million at 31 December 2018.

The €37.6 million increase breaks down as follows:

- an €11.3 million negative effect on debt from the first-half

2019 free cash flow figure([5]) (excluding the IFRS 16

impact);

- a €15.0 million dividend payment made to Assystem's

shareholders;

- €9.3 million paid for acquisitions of shares (including €8.0

million in additional consideration for the acquisition of

Framatome shares) and purchased goodwill;

- €2.0 million in other movements.

In the second half of the year, the Group’s

stake in Framatome will further impact net debt as a result of (i)

a €4.5 million payment for the final instalment of additional

consideration, and (ii) the receipt of a €2.4 million dividend

for 2018. In addition, in July 2019, Assystem acquired ASCO for

€7.0 million.

OUTLOOK FOR FULL-YEAR 2019

On a consolidated basis, Assystem's targets for

full-year 2019 are now as follows:

- annual revenue of at least €500 million, including the impact

of consolidating ASCO as from 1 October 2019, but excluding

the effect of any other external growth transactions;

- EBITA margin of at least 6.8% (excluding the IFRS 16

impact);

- free cash flow (excluding the IFRS 16 impact) representing more

than 6% of revenue for the 24-month period covering the 2018 and

2019 financial years.

AVAILABILITY OF THE FIRST-HALF 2019 INTERIM FINANCIAL

REPORT

Assystem’s first-half 2019 interim financial

report has today been published and filed with the Autorité des

Marchés Financiers (AMF). This report, as well as the presentation

of the Group’s first-half 2019 results, can be viewed and

downloaded on Assystem’s website (www.assystem.com) in the

“Finance/Regulated Information” section.

2019 FINANCIAL CALENDAR

- 30 October:

Third-quarter 2019 revenue release

Assystem is an international

engineering group. As a key participant in the industry for over 50

years, the Group supports its clients in managing their capital

expenditure throughout their asset life cycles. Assystem S.A. is

listed on Euronext Paris. For more information please visit

www.assystem.com / Follow Assystem on Twitter: @Assystem

|

CONTACTS Philippe

Chevallier CFO & Deputy CEOTel.: +33 (0)1 41 25 28 07

Anne-Charlotte DagornCommunications

Directoracdagorn@assystem.comTel.: +33 (0)6 83 83 70 29 |

Agnès VilleretInvestor

relations - Komodoagnes.villeret@agence-komodo.comTel.: +33 (0)6 83

28 04 15 |

APPENDICES

1/ Revenue and EBITA by

division

|

In millions of euros |

H1 2018 |

H1 2019 |

Total year-on-year change

|

Like-for-like change* |

|

Group |

216.1 |

246.5 |

+14.1% |

+13.2% |

| Energy & Infrastructure |

189.1 |

219.9 |

+16.3% |

+15.9% |

| Staffing |

22.3 |

22.7 |

+2.0% |

-3.0% |

|

Other |

4.7 |

3.9 |

- |

|

* Based on a comparable scope of consolidation and

constant exchange rates.

·EBITA(1)

|

In millions of euros |

H1 2018 |

% of revenue |

H1 2019 |

% of revenue |

|

Group |

9.2 |

4.3% |

15.6 |

6.3% |

| Energy & Infrastructure |

10.3 |

5.4% |

16.4 |

7.5% |

| Staffing |

0.4 |

1.8% |

0.8 |

3.4% |

| Holding

company and Other |

(1.5) |

- |

(1.6) |

- |

- Operating profit before non-recurring items (EBITA):

- including share of profit of equity accounted investees other

than Expleo Group (€0.6 million in first-half 2018 and €0.5

million in first-half 2019); and

- taking into account the €0.2 million positive impact of the

first-time application of IFRS 16, recognised under Energy &

Infrastructure

2/ Consolidated Financial Statements

- Consolidated statement of financial

position

| In millions of

euros |

31 Dec. 2018 |

30 June 2019 |

|

ASSETS |

|

|

| Goodwill |

82.8 |

83.0 |

| Intangible

assets |

4.7 |

8.2 |

| Property, plant

and equipment |

7.6 |

8.5 |

| Right-of-use

assets |

- |

36.9 |

| Investment

property |

1.4 |

1.4 |

|

Equity-accounted investees |

0.7 |

1.3 |

| Expleo

Group shares |

88.1 |

87.5 |

|

Expleo Group convertible bonds |

102.2 |

106.7 |

| Expleo Group

shares and convertible bonds |

190.3 |

194.2 |

| Other

non-current financial assets(1) |

129.1 |

137.5 |

| Deferred tax

assets |

4.7 |

3.5 |

|

Non-current assets |

421.3 |

474.5 |

| Trade

receivables |

150.8 |

177.9 |

| Other

receivables |

40.6 |

41.2 |

| Income tax

receivables |

1.1 |

1.0 |

| Other current

assets |

0.5 |

0.1 |

| Cash and cash

equivalents(2) |

32.4 |

18.9 |

|

Current assets |

225.4 |

239.1 |

|

|

|

|

|

TOTAL ASSETS |

646.7 |

713.6 |

| EQUITY

AND LIABILITIES |

31 Dec. 2018 |

30 June 2019 |

|

|

|

|

| Share

capital |

15.7 |

15.7 |

| Consolidated

reserves |

351.6 |

354.5 |

| Profit for the

period attributable to owners of the parent |

19.4 |

14.1 |

| Equity

attributable to owners of the parent |

386.7 |

384.3 |

|

Non-controlling interests |

0.1 |

(0.2) |

|

Total equity |

386.8 |

384.1 |

| Long-term debt

and non-current financial liabilities(2) |

63.1 |

87.2 |

| Lease

liabilities |

– |

29.5 |

| Pension and

other employee benefit obligations |

14.7 |

16.5 |

| Liabilities

related to share acquisitions |

4.6 |

4.6 |

| Long-term

provisions |

16.6 |

16.7 |

| Other

non-current liabilities |

1.3 |

0.7 |

| |

|

|

|

Non-current liabilities |

100.3 |

155.2 |

| Short-term

debt and current financial liabilities(2) |

0.4 |

0.4 |

| Lease

liabilities |

- |

7.6 |

| Trade

payables |

31.0 |

36.0 |

| Due to

suppliers of non-current assets |

0.8 |

2.0 |

| Accrued taxes

and payroll costs |

89.1 |

91.8 |

| Income tax

liabilities |

2.2 |

1.7 |

| Liabilities

related to share acquisitions |

1.1 |

1.0 |

| Short-term

provisions |

3.7 |

2.7 |

| Other current

liabilities |

31.3 |

31.1 |

|

Current liabilities |

159.6 |

174.3 |

| |

|

|

|

TOTAL EQUITY AND LIABILITIES |

646.7 |

713.6 |

- Including Framatome shares representing €132.3 million at 30

June 2019.

- Net debt totalled €68.7 million at 30 June 2019, breaking down

as:

- Short- and long-term debt and current and non-current financial

liabilities: €87.6 million

- Cash and cash equivalents: €18.9 million

|

- Consolidated income statement

|

In millions of euros |

Six months ended 30 June 2018 |

Six months ended 30 June 2019 |

| |

|

|

|

|

Revenue |

216.1 |

246.5 |

|

| Payroll

costs |

(158.5) |

(177.0) |

|

| Other operating

income and expenses |

(47.2) |

(47.6) |

|

| Taxes other

than on income |

(0.6) |

(0.4) |

|

| Depreciation,

amortisation and provisions for recurring operating items, net |

(1.2) |

(6.4) |

|

|

|

|

|

|

|

Operating profit before non-recurring items

(EBITA) |

8.6 |

15.1 |

|

| Share of profit

of equity-accounted investees |

0.6 |

0.5 |

|

|

|

|

|

|

|

EBITA including share of profit of equity-accounted

investees |

9.2 |

15.6 |

|

| Non-recurring

income and expenses |

0.4 |

(1.2) |

|

|

Share-based payments |

(0.1) |

(0.3) |

|

|

|

|

|

|

|

Operating profit |

9.5 |

14.1 |

|

| Share of

profit/(loss) of Expleo Group |

(2.9) |

(0.3) |

|

| Income from

Expleo Group convertible bonds |

3.9 |

4.4 |

|

| Net financial

expense on cash and debt |

(0.3) |

(1.0) |

|

| Other financial

income and expenses |

0.1 |

1.6 |

|

| |

|

|

|

|

Profit from continuing operations before tax |

10.3 |

18.8 |

|

| |

|

|

|

| Income tax

expense |

(3.1) |

(4.5) |

|

| |

|

|

|

|

Profit from continuing operations |

7.2 |

14.3 |

|

| |

|

|

|

| Profit/(loss)

from discontinued operations |

(0.1) |

- |

|

|

|

|

|

|

|

Consolidated profit for the period |

7.1 |

14.3 |

|

|

Attributable to: |

|

|

|

| Owners of the

parent |

7.1 |

14.1 |

|

| Non-controlling

interests |

- |

0.2 |

|

- Consolidated statement of cash flows

|

In millions of euros |

Six months ended 30 June 2018 |

Six months ended 30 June 2019 |

| CASH

FLOWS FROM OPERATING ACTIVITIES |

|

|

| EBITA including

share of profit of equity-accounted investees |

9.2 |

15.6 |

| Depreciation,

amortisation and provisions for recurring operating items, net |

1.2 |

6.4 |

|

EBITDA |

10.4 |

22.0 |

| Change in

operating working capital requirement |

5.7 |

(18.2) |

| Income tax

paid |

(4.5) |

(3.2) |

| Other cash

flows |

(3.2) |

(1.9) |

|

Net cash generated from/(used in) operating

activities |

8.4 |

(1.3) |

| O/w related to

continuing operations |

8.4 |

(1.3) |

| O/w related to

discontinued operations |

- |

- |

| CASH

FLOWS FROM INVESTING ACTIVITIES |

|

|

| Acquisitions of

property, plant and intangible assets, net of disposals, o/w: |

(3.0) |

(5.4) |

| Acquisitions of

property, plant and equipment and intangible assets |

(3.1) |

(5.4) |

| Proceeds from

disposals of property, plant and equipment and intangible

assets |

0.1 |

- |

| Free

cash flow |

5.4 |

(6.7) |

| O/w related to

continuing operations |

5.4 |

(6.7) |

| O/w related to

discontinued operations |

- |

- |

| Acquisitions of

shares, net of proceeds from sales |

- |

(9.3) |

| Investment in

Expleo Group |

(60.7) |

- |

| Other

movements, net |

(9.8) |

- |

| |

|

|

|

Net cash generated from/(used in) investing

activities |

(73.5) |

(14.7) |

| O/w related to

continuing operations |

(66.3) |

(14.7) |

| O/w related to

discontinued operations |

(7.2) |

|

| CASH

FLOWS FROM FINANCING ACTIVITIES |

|

|

| Net financial

income received/(expenses paid) |

0.1 |

(0.9) |

| Proceeds from

new borrowings |

59.7 |

24.0 |

| Repayments of

borrowings and movements in other financial liabilities |

7.4 |

- |

| Repayments of

lease liabilities* |

- |

(4.6) |

| Dividends

paid |

(15.7) |

(16.3) |

| Other movements

in equity of the parent company |

(3.8) |

0.5 |

| |

|

|

|

Net cash generated from/(used in) financing

activities |

47.7 |

2.7 |

| |

|

|

|

Net decrease in cash and cash equivalents |

(17.4) |

(13.3) |

| |

|

|

|

Net cash and cash equivalents at beginning of

period |

27.3 |

32.1 |

| Effect of

non-monetary items and changes in exchange rates |

(0.8) |

(0.2) |

| Net decrease in

cash and cash equivalents |

(17.4) |

(13.3) |

|

Net cash and cash equivalents at beginning of

period |

9.1 |

18.6 |

* Including €0.4 million in interest paid.

3/ Changes in net debt

|

In millions of euros |

|

|

| Net debt at 31 Dec.

2018 |

31.1 |

|

|

Free cash flow from continuing operations |

11.3 |

Excluding impact

of first-time application of IFRS 16 |

| Acquisitions of

shares and purchased goodwill |

9.3 |

|

| Dividends paid to

shareholders of Assystem |

15.0 |

|

| Other

movements |

2.0 |

|

|

Net debt at 30 June 2019 |

68.7 |

|

4/ Information about the Company's

capital

|

Number of shares |

At 31 Dec. 2018 |

At 31 Aug. 2019 |

| Ordinary shares outstanding |

15,668,216 |

15,668,216 |

| Treasury shares |

667,336 |

658,205 |

| Free shares and performance shares

outstanding |

256,380 |

304,555 |

| Weighted average number of shares

outstanding |

15,089,319 |

15,002,279 |

| Weighted

average number of diluted shares |

15,345,699 |

15,306,834 |

Ownership structure at 31 August

2019

|

In % |

Shares |

Exercisable voting rights |

| HDL Development(1) |

61.34% |

77.45% |

| Free float(2) |

34.46% |

22.55% |

|

Treasury shares |

4.20% |

- |

- HDL Development is a holding company controlled by Dominique

Louis (Assystem's Chairman and Chief Executive Officer), notably

through HDL, which itself holds 0.35% of Assystem's capital.

- Including 0.35% held by HDL.

([1]) Operating profit before

non-recurring items (EBITA) including share of profit of

equity-accounted investees other than Expleo Group

(€0.6 million in first-half 2018 and €0.5 million in

first-half 2019). The Group’s first-time application of IFRS 16 had

a €0.2 million positive impact on EBITA in first-half 2019.

([2]) Including profit

attributable to non-controlling interests: a nil amount in

first-half 2018 and €0.2 million in first-half 2019. Profit for the

period attributable to owners of the parent therefore totalled €7.1

million in first-half 2018 and €14.1 million in first-half 2019.

The Group’s first-time application of IFRS 16 had a €0.1 million

negative impact on consolidated profit for the period in first-half

2019.

([3]) Debt less cash and cash equivalents and

after taking into account the fair value of hedging

instruments.

([4]) EBITA before net depreciation expense and

net additions to provisions for recurring operating items,

excluding the impact of IFRS 16 on EBITA and depreciation

expense

([5]) Free cash flow including the impact of

IFRS 16 was a negative €6.7 million.

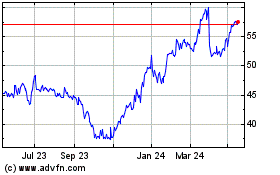

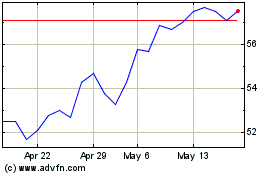

- Assystem First-half 2019 results

Assystem (EU:ASY)

Historical Stock Chart

From Sep 2024 to Oct 2024

Assystem (EU:ASY)

Historical Stock Chart

From Oct 2023 to Oct 2024