Press Release of SAS Shipping Agencies Services Sàrl1

March 21 2024 - 11:46AM

Business Wire

Agreement for the acquisition of 42.06% of

the share capital of Clasquin by SAS, at a price of €142.03 per

Clasquin share followed by a tender offer on the remaining shares

of Clasquin

8.5% of Clasquin’s share capital are already

committed into the offer, with the support of the key management

team members.

Regulatory News:

Following the announcement of 4 December 20232, SAS Shipping

Agencies Services Sàrl ("SAS"), a subsidiary of MSC Mediterranean

Shipping Company SA, confirms that it has entered into a put option

agreement for the acquisition of the shares held by Mr. Yves REVOL

and OLYMP in Clasquin SA, representing 42.06% of the share capital3

of Clasquin SA, at a price of EUR 142.03 per share4.

This price represents a premium of 13.17% to the last closing

price and 14.22% to the volume-weighted average over 60 trading

days before announcement of the offer, and of 59.94% to the last

closing price and 70.42% to the volume-weighted average over 60

trading days before the announcement of the entry into exclusive

negotiations between Mr. Yves REVOL and OLYMP, on the one hand, and

SAS, on the other hand dated 4 December 2023.

The final legal documentation relating to the acquisition of the

shares held by Mr. Yves REVOL and OLYMP will be concluded after

completion of the information and consultation procedures with the

relevant employee representative bodies of Clasquin.

Completion of the transaction, which will be subject to

obtaining clearances from the competent regulatory authorities5 ,

is expected to happen by year end.

SAS will thereafter file a tender offer with the Autorité des

Marchés Financiers(AMF) for the remaining shares in the capital of

Clasquin, at the same price of EUR 142.03 per share. SAS intends to

proceed with a squeeze-out should applicable conditions be met upon

closing of the offer.

The transaction is supported by the Chief Executive Officer of

Clasquin and other key management team members, who have committed

to tender all of their Clasquin shares into SAS’tender offer,

representing in aggregate c.8.5% of the share capital6.

1 11B, Boulevard Joseph II, L - 1840 Luxembourg. 2 See

Clasquin’s press release of 4 December 2023. 3 Currently

representing 55.93% of the voting rights based on a total number of

theoretical voting rights of 3,475,523. 4 The price of the block

will be subject to downward adjustment in the event of leakage

(including distribution), in particular before completion of the

block. 5 The transaction is subject to merger control clearances in

the European Union and in certain other jurisdictions as well as

foreign direct investment control in France; such regulatory

condition is to the benefit of all parties and can only be waived

by all parties. Other conditions precedent include the absence of

material adverse event and the obtaining of material third party

consents (both conditions being to the benefit of the purchaser,

which may waive them at its discretion) as well as other customary

conditions precedent. 6 The tender commitments will lapse in the

event of a competing offer made at a price higher than SAS’ tender

offer and cleared (déclarée conforme) by the AMF, unless SAS

decides to improve upon the terms of the competing offer under the

conditions set forth in the AMF General Regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240321138179/en/

SAS Shipping Agencies Services Sàrl

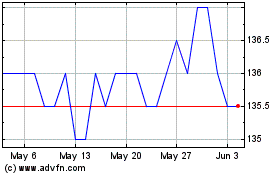

Clasquin (EU:ALCLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Clasquin (EU:ALCLA)

Historical Stock Chart

From Dec 2023 to Dec 2024