Air France-KLM Plans Capital Increase After EU Approves EUR4 Billion in French State Aid -- Update

April 06 2021 - 6:00AM

Dow Jones News

--Air France-KLM to raise capital of up to EUR1 billion for

French arm, with participation from France's government and China

Eastern Airlines

--The plan follows the European Commission's approval of up to

EUR4 billion in state aid to recapitalize Air France, with certain

conditions attached, including that the airline surrender up to 18

slots at Paris-Orly airport

--Air France-KLM expects to book a hefty loss in its first

quarter due to the coronavirus crisis

By Olivia Bugault

Air France-KLM said Tuesday that it plans to launch a capital

increase of up to 1 billion euros ($1.18 billion) for its French

arm after the European Commission approved up to EUR4 billion in

French state aid to recapitalize Air France.

The French government--which currently holds roughly 14.3% of

Air France-KLM's capital--will participate in the capital raise,

and would be the company's largest shareholder, though it has

committed to keeping its stake below 30%. China Eastern Airlines

also plans to subscribe but will maintain its share capital under

10%. The Chinese airline already owns approximately 8.8% of the

carrier's share capital, according to FactSet.

The Dutch state, which currently holds a 14% stake, said it

won't participate in the capital raise, but has approved the latest

set of actions and indicated that it is continuing discussions with

the European Commission on potential capital-strengthening measures

for KLM, the group said.

Air France's recapitalizing measures also include the conversion

of the EUR3 billion French state loan granted last May into a

"perpetual hybrid bonds instrument."

The European Commission's approval of the recapitalization plan

came with certain conditions, however, of which one is that Air

France will have to surrender "up to 18 take-off and landing rights

(slots) at Paris-Orly airport to a competing carrier in order to

create or develop an existing base at that airport," the company

said.

Air France-KLM said additional measures are likely to be

implemented ahead of its general meeting next year as the decisions

announced today won't be enough for the group's net equity to

return to positive. This could include the issuance of new equity

that would help reduce net debt, it said.

A resurgence in Covid-19 cases in several European countries has

seen travel restrictions upheld across the continent, hurting the

airline's activities in the first quarter, the company said. Air

France-KLM expects an operating loss of around EUR1.3 billion in

the first three months of the year, and forecasts a loss before

interest, taxes, depreciation, and amortization of around EUR750

million.

"Over the coming months, and in particular at the beginning of

the summer, the Group still expects a significant recovery in

demand, assuming the positive effects of the accelerated

vaccination campaigns in several countries could trigger less

stringent restrictions on passenger travel across those countries,"

it said.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

April 06, 2021 05:45 ET (09:45 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

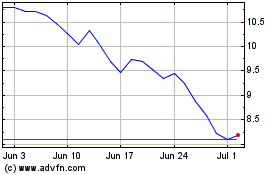

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

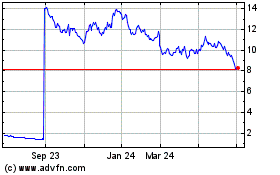

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024