Analyst’s Crystal Ball: Bitcoin Price Targets $600,000 After ETF Approval

January 11 2024 - 10:00AM

NEWSBTC

Bullish tremors shook the cryptocurrency world today as Bitcoin,

fueled by the historic approval of spot ETFs and a bold prediction

by analyst Michaël van de Poppe, appears poised for a potential

moonshot. Van de Poppe, whose pronouncements carry weight in the

digital realm, envisions an ascent of the world’s leading

cryptocurrency to staggering heights – a price range of $300-$600K

within the current cycle. Related Reading: Bitcoin ETF: Navigating

The Promise And Pitfalls Of Mainstream Adoption ETF Excitement

Sparks Bitcoin Trading Surge This electrifying forecast sent a

ripple of excitement through the crypto community, reflected in the

top coin’s vibrant trading volume. Up a whopping 35%, the $51.7

billion figure paints a vivid picture of investor interest piqued

by the ETF developments. Range is defined. $48K has been reached,

perhaps we’ll go there again with the dealflow on the ETF approval

today for #Bitcoin. Dips at $36-40K are amazing to get. Perhaps

we’ll go to $300-600K this cycle. pic.twitter.com/C0SSroiYGa —

Michaël van de Poppe (@CryptoMichNL) January 11, 2024 Traders were

quick to capitalize on the bullish sentiment, driving substantial

price movements and creating a dynamic market atmosphere. The surge

in trading activity not only underscores the immediate impact of

the ETF forecast but also highlights the growing influence of

institutional and retail investors alike. While Bitcoin’s current

price of $46,286 shows a modest daily gain, its 9.72% monthly surge

hints at an underlying anticipation. BTCUSD currently trading at

$47,075 on the daily chart: TradingView.com The catalyst for this

optimism lies in the January 10th SEC decision to greenlight

several spot Bitcoin ETFs. This long-awaited move removes a barrier

for many mainstream investors, allowing them to participate in the

Bitcoin story without directly holding the digital asset. It’s akin

to opening a new door, inviting a fresh wave of potential capital

into the crypto ecosystem. However, amidst the celebratory mood, a

note of caution resonates from SEC Chair Gary Gensler. While

acknowledging the ETF approval, he reminds investors of the

crypto’s inherent risks and the need for careful consideration

before diving into the volatile cryptocurrency waters. 2⃣

Investments in crypto assets also can be exceptionally risky &

are often volatile. A number of major platforms & crypto assets

have become insolvent and/or lost value. Investments in crypto

assets continue to be subject to significant risk. — Gary Gensler

(@GaryGensler) January 8, 2024 ETF Milestone: Bitcoin’s Symbolic

Validation Unfolds This serves as a crucial reminder for all,

seasoned veterans and newcomers alike, to approach their

investments with prudent risk management. The ETF launch isn’t just

about new access. It’s a symbolic validation, with industry giants

like Grayscale BTC Trust, Hashdex BTC ETF, and Bitwise ETF

receiving the SEC’s nod. This marks a significant milestone,

solidifying cryptocurrency’s place in the wider financial

landscape. Related Reading: Is Peter Schiff Right? Bitcoin ETF

Approval Hype May Lead To Market Disappointment Featured image from

iStock

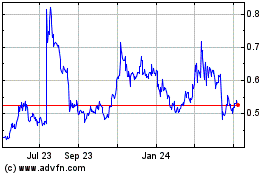

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

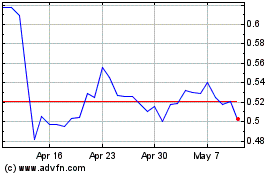

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025