Uniswap Founder Says Banks Are Massive Scams

March 13 2023 - 1:30PM

NEWSBTC

Hayden Adams, the founder of Uniswap, is convinced that banks are

“massive scams” compared to decentralized finance (DeFi) protocols.

Hayden Adams Thinks Banks Are Scams In a recent tweet, Adams

criticized banks’ low collateral requirement, adding that they also

pay only a “tiny percent” of their revenue to depositors. The

founder was also concerned about banks’ ability to “rug” users

anytime. If you compare banks to DeFi protocols you realize what a

massive scam they are Only 10% collateral requirements? Only a tiny

fraction of returns paid out to users? Users can get rugged at any

time? Feeling bad for everyone negatively affected by degen banks 🙁

— hayden.eth 🦄 (@haydenzadams) March 11, 2023 Commercial banks are

regulated entities. In the United States, they can comply with

state or federal laws depending on their licenses. Related

Reading: Over 167 Million BAT Utilized In DeFi Mainly In Compound,

Aave And Uniswap But considering the fractional reserve system,

banks must maintain a certain percentage of user deposits as

collateral. Accordingly, deposits may have to wait longer in case

of a bank run, a spike in customers’ withdrawal which drains the

financial institution’s liquidity. The 10% collateral

requirement means only a small percentage of the total deposits are

available for withdrawal. Hayden believes this system is flawed. In

crypto and DeFi, the mechanism is different; for instance, they

must maintain 100% collateral at any point. Banks loan the

remaining 90% of deposits in this fractional reserve system at

higher interest rates. However, the yield distributed to holders of

saving accounts is relatively lower. While this is advantageous for

banks as they don’t have to hold a vast amount of capital while

also being open for regulation, the end user, the depositor, is

inconvenienced if these banks fail. Last week, Silicon Valley Bank

(SVB) experienced a bank run last week, and it was placed under

California regulators’ Federal Deposit Insurance Corporation (FDIC)

receivership. Many users and businesses, including Circle, the

issuer of the fiat-backed stablecoin, USDC, had exposure and

couldn’t access funds over the weekend. It is this

limitation, and the fragility of banks that Hayden thinks make the

very base layer of the global financial system a “massive scam.”

The United States Federal Reserve has since stated that it will

only bail out depositors, not the bank. Uniswap Drew Users After

USDC De-Pegging DeFi protocols are autonomous and guided by smart

contracts. Platforms like Uniswap operate every day of the week on

several blockchains, including Ethereum, facilitating swaps.

Related Reading: DeFiLlama Releases Special Uniswap v3 Router For

Optimism Over the years, Uniswap has emerged as one of the largest

decentralized exchanges in the world. UNI is its governance token.

Amid the de-pegging of USDC, Uniswap posted the highest daily

trading volume, reaching $11.41 billion. Yesterday had the highest

daily USD volume ever on the @Uniswap Protocol! $11.84b, almost

double the second place day.@DuneAnalytics: https://t.co/KMQxfmlIlo

pic.twitter.com/pn9X9yBNHq — Austin Adams (@AustinAdams10) March

12, 2023 As of writing on March 13, Uniswap had a total

value locked (TVL) of $3.56 billion, according to data from

DeFiLlama. Feature Image From Justin Sullivan/Getty Images,

Chart From TradingView

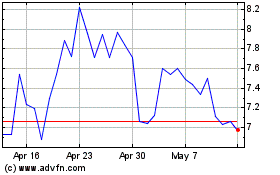

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025